by Scott Martindale

by Scott Martindale

President & CEO, Sabrient Systems LLC

It would be an understatement to say that last week was particularly eventful, what with the elections and FOMC policy decision, plus some impressive earnings announcements. Election Day is finally behind us, and the results sent investors into a fit of stock market FOMO—in one of the greatest post-election rallies ever—while dumping their bonds. Much like the day after President Trump’s win in 2016, the leading sectors were cyclicals: Industrials, Energy, Financials. And then on Fed Day, markets got their locked-in 25-bp rate cut, and the rally kept going across all risk assets, including strengthening the US dollar on the expectation of accelerating capital flight into the US as Trump’s policies, particularly with support from a Republican-led congress, should be quite business-friendly, with lower tax rates and red tape and much less focus on anti-trust lawfare.

So, there was a lot for investors to absorb last week, and this week brings the October CPI and PPI reports. Indeed, the whole world has been pining for clarity from the US—and they got it. And I’m sure no one misses the barrage of political ads and bitter electioneering. Hopefully, it marks the peak in election divisiveness our society will ever see again. Notably, inflation hedges gold and bitcoin have suddenly diverged, with gold pulling back from its all-time high while bitcoin—which can be considered both a dollar hedge and a risk asset for its utility—has continued its surge to new highs (now over $85k as I write!) on the added optimism around Trump’s crypto-friendly stance.

Besides expectations of a highly aggressive 15% earnings growth in the S&P 500 over the next couple of years, venture capital could be entering a boom following four years of difficulty in raising capital. In an interview with Yahoo Finance, Silicon Valley VC Shervin Pishevar opined, “I think there’s going to be a renaissance of innovation in America…It’s going to be exciting to see… AI is going to accelerate so fast we’re going to reach AGI [Artificial General Intelligence, or human-like thinking] within the next 2-3 years. I think there will be ‘Manhattan Projects’ for AI, quantum computing, biotech.”

It all sounds quite appealing, but there’s always a Wall of Worry for investors, and the worry now is whether Trump’s pro-growth policies like reducing tax rates, deregulation, rooting out government waste and inefficiency (i.e., “drain the swamp”) combined with his more controversial intentions like tariffs, mass deportations of cheap migrant labor, and threats to Big Pharma, the food industry, and key trading partners (including Mexico)—in concert with a dovish Fed—will create a resurgence in inflation and unemployment and push the federal debt and budget deficit to new heights before the economy is ready to stand on its own—i.e., without the massive federal deficit spending and hiring we saw under Biden—thus creating a period of stagflation and perhaps a credit crisis. Rising interest rates and a stronger dollar are creating tighter financial conditions and what Michael Howell of CrossBorder Capital calls “a fast-approaching debt maturity wall” that adds to his concerns that 2025 might prove tougher for investors if the Global Liquidity cycle peaks and starts to decline.

But in my view, the end goals of shrinking the size and scope of our federal government and restoring a free, private-sector-driven economy are worthy, and we can weather any short-term pain along the way and perhaps fend off that looming “debt maturity wall.” Nevertheless, given the current speculative fervor (“animal spirits”) and multiple expansion in the face of surging bond yields (i.e., the risk-free discount rate on earnings streams), it might be time to exercise some caution and perhaps put on some downside hedges. Remember the old adage, “Stocks take the stairs up and the elevator down” (be sure to read my recent post with 55 timeless investing proverbs to live by).

In any case, at the moment, I believe the stock market has gotten a bit ahead of itself with frothy valuations and extremely overbought technical conditions (with the major indexes at more than two standard deviations above their 50-day moving averages). But I think any significant pullback or technical consolidation to allow the moving averages to catch up would be a buying opportunity into year-end and through 2025, and perhaps well into 2026—assuming the new administration’s policies go according to plan. As DataTrek Research pointed out, there is plenty of dry powder to buy stocks as cash balances are high (an average of 19.2% of institutional portfolios vs.10-15% during the bull market of the 2010’s).

This presumes that the proverbial “Fed Put” is indeed back in play. Also, I continue to believe that rate normalization means the FOMC ultimately taking the fed funds rate down to a terminal rate of about 3.0-3.5%—although I’m now leaning toward the higher side of that range as new fiscal policy from the “red wave” recharges private-sector growth (so that GDP and jobs are no longer reliant on government deficit spending and hiring) and potentially reignites some inflationary pressures.

This is not necessarily a bad thing. Although inflation combined with stagnant growth creates the dreaded “stagflation,” moderate inflation with robust growth (again, driven by the private sector rather than the government) can be healthy for the economy, business, and workers while also helping to “inflate away” our massive debt. Already, although supply chain pressures remain low, inflation has perked up a bit recently, likely due to rising global liquidity and government spending, as I discuss in detail in today’s post.

So, my suggestions remain: Buy high-quality businesses at reasonable prices, hold inflation hedges like gold and bitcoin, and be prepared to exploit any market correction—both as stocks sell off (such as by buying out-of-the-money put options, while VIX is low) and as they begin to rebound (by buying stocks and options when share prices are down). A high-quality company is one that is fundamentally strong (across any market cap) in that it displays consistent, reliable, and accelerating sales and earnings growth, positive revisions to Wall Street analysts’ consensus estimates, rising profit margins and free cash flow, solid earnings quality, and low debt burden. These are the factors Sabrient employs in selecting the growth-oriented Baker’s Dozen (our “Top 13” stocks), the value-oriented Forward Looking Value, the growth & income-oriented Dividend portfolio, and Small Cap Growth. We also use many of those factors in our SectorCast ETF ranking model. And notably, our Earnings Quality Rank (EQR) is a key factor in each of these models, and it is also licensed to the actively managed, absolute-return-oriented First Trust Long-Short ETF (FTLS).

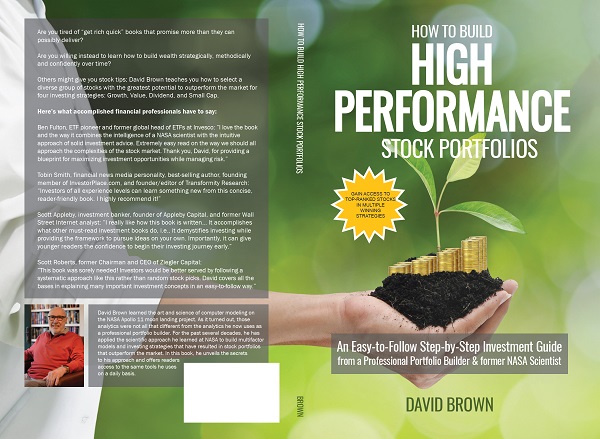

Each of our key alpha factors and their usage within Sabrient’s Growth, Value, Dividend, and Small Cap investing strategies (which underly those aforementioned portfolios) is discussed in detail in Sabrient founder David Brown’s new book, How to Build High Performance Stock Portfolios, which is now available to buy in both paperback and eBook formats on Amazon.com.

And in conjunction with David’s new book, we are also offering a subscription to our next-generation Sabrient Scorecard for Stocks, which is a downloadable spreadsheet displaying our Top 30 highest-ranked stock picks for each of those 4 investing strategies. And as a bonus, we also provide our Scorecard for ETFs that scores and ranks roughly 1,400 US-listed equity ETFs. Both Scorecards are posted weekly in Excel format and allow you to see how your stocks and ETFs rank in our system…or for identifying the top-ranked stocks and ETFs (or for weighted combinations of our alpha factors). You can learn more about both the book and the next-gen Scorecards (and download a free sample scorecard) at http://DavidBrownInvestingBook.com.

In today’s post, I dissect in greater detail GDP, jobs, federal debt, inflation, corporate earnings, stock valuations, technological trends, and what might lie ahead for the stock market with the incoming administration. I also discuss Sabrient’s latest fundamental-based SectorCast quantitative rankings of the ten U.S. business sectors, current positioning of our sector rotation model, and several top-ranked ETF ideas. And be sure to check out my Final Thoughts section in which I offer my post-mortem on the election.

Click HERE to continue reading my full commentary or to sign up for email delivery of this monthly market letter. Also, here is a to this post in printable PDF format. I invite you to share it as appropriate (to the extent your compliance allows).