Sector Detector: While stocks enjoy a post-election rally, the economy and jobs stare into the abyss

by Scott Martindale

by Scott Martindale

President & CEO, Sabrient Systems LLC

It would be an understatement to say that last week was particularly eventful, what with the elections and FOMC policy decision, plus some impressive earnings announcements. Election Day is finally behind us, and the results sent investors into a fit of stock market FOMO—in one of the greatest post-election rallies ever—while dumping their bonds. Much like the day after President Trump’s win in 2016, the leading sectors were cyclicals: Industrials, Energy, Financials. And then on Fed Day, markets got their locked-in 25-bp rate cut, and the rally kept going across all risk assets, including strengthening the US dollar on the expectation of accelerating capital flight into the US as Trump’s policies, particularly with support from a Republican-led congress, should be quite business-friendly, with lower tax rates and red tape and much less focus on anti-trust lawfare.

So, there was a lot for investors to absorb last week, and this week brings the October CPI and PPI reports. Indeed, the whole world has been pining for clarity from the US—and they got it. And I’m sure no one misses the barrage of political ads and bitter electioneering. Hopefully, it marks the peak in election divisiveness our society will ever see again. Notably, inflation hedges gold and bitcoin have suddenly diverged, with gold pulling back from its all-time high while bitcoin—which can be considered both a dollar hedge and a risk asset for its utility—has continued its surge to new highs (now over $85k as I write!) on the added optimism around Trump’s crypto-friendly stance.

Besides expectations of a highly aggressive 15% earnings growth in the S&P 500 over the next couple of years, venture capital could be entering a boom following four years of difficulty in raising capital. In an interview with Yahoo Finance, Silicon Valley VC Shervin Pishevar opined, “I think there’s going to be a renaissance of innovation in America…It’s going to be exciting to see… AI is going to accelerate so fast we’re going to reach AGI [Artificial General Intelligence, or human-like thinking] within the next 2-3 years. I think there will be ‘Manhattan Projects’ for AI, quantum computing, biotech.”

It all sounds quite appealing, but there’s always a Wall of Worry for investors, and the worry now is whether Trump’s pro-growth policies like reducing tax rates, deregulation, rooting out government waste and inefficiency (i.e., “drain the swamp”) combined with his more controversial intentions like tariffs, mass deportations of cheap migrant labor, and threats to Big Pharma, the food industry, and key trading partners (including Mexico)—in concert with a dovish Fed—will create a resurgence in inflation and unemployment and push the federal debt and budget deficit to new heights before the economy is ready to stand on its own—i.e., without the massive federal deficit spending and hiring we saw under Biden—thus creating a period of stagflation and perhaps a credit crisis. Rising interest rates and a stronger dollar are creating tighter financial conditions and what Michael Howell of CrossBorder Capital calls “a fast-approaching debt maturity wall” that adds to his concerns that 2025 might prove tougher for investors if the Global Liquidity cycle peaks and starts to decline.

But in my view, the end goals of shrinking the size and scope of our federal government and restoring a free, private-sector-driven economy are worthy, and we can weather any short-term pain along the way and perhaps fend off that looming “debt maturity wall.” Nevertheless, given the current speculative fervor (“animal spirits”) and multiple expansion in the face of surging bond yields (i.e., the risk-free discount rate on earnings streams), it might be time to exercise some caution and perhaps put on some downside hedges. Remember the old adage, “Stocks take the stairs up and the elevator down” (be sure to read my recent post with 55 timeless investing proverbs to live by).

In any case, at the moment, I believe the stock market has gotten a bit ahead of itself with frothy valuations and extremely overbought technical conditions (with the major indexes at more than two standard deviations above their 50-day moving averages). But I think any significant pullback or technical consolidation to allow the moving averages to catch up would be a buying opportunity into year-end and through 2025, and perhaps well into 2026—assuming the new administration’s policies go according to plan. As DataTrek Research pointed out, there is plenty of dry powder to buy stocks as cash balances are high (an average of 19.2% of institutional portfolios vs.10-15% during the bull market of the 2010’s).

This presumes that the proverbial “Fed Put” is indeed back in play. Also, I continue to believe that rate normalization means the FOMC ultimately taking the fed funds rate down to a terminal rate of about 3.0-3.5%—although I’m now leaning toward the higher side of that range as new fiscal policy from the “red wave” recharges private-sector growth (so that GDP and jobs are no longer reliant on government deficit spending and hiring) and potentially reignites some inflationary pressures.

This is not necessarily a bad thing. Although inflation combined with stagnant growth creates the dreaded “stagflation,” moderate inflation with robust growth (again, driven by the private sector rather than the government) can be healthy for the economy, business, and workers while also helping to “inflate away” our massive debt. Already, although supply chain pressures remain low, inflation has perked up a bit recently, likely due to rising global liquidity and government spending, as I discuss in detail in today’s post.

So, my suggestions remain: Buy high-quality businesses at reasonable prices, hold inflation hedges like gold and bitcoin, and be prepared to exploit any market correction—both as stocks sell off (such as by buying out-of-the-money put options, while VIX is low) and as they begin to rebound (by buying stocks and options when share prices are down). A high-quality company is one that is fundamentally strong (across any market cap) in that it displays consistent, reliable, and accelerating sales and earnings growth, positive revisions to Wall Street analysts’ consensus estimates, rising profit margins and free cash flow, solid earnings quality, and low debt burden. These are the factors Sabrient employs in selecting the growth-oriented Baker’s Dozen (our “Top 13” stocks), the value-oriented Forward Looking Value, the growth & income-oriented Dividend portfolio, and Small Cap Growth. We also use many of those factors in our SectorCast ETF ranking model. And notably, our Earnings Quality Rank (EQR) is a key factor in each of these models, and it is also licensed to the actively managed, absolute-return-oriented First Trust Long-Short ETF (FTLS).

Each of our key alpha factors and their usage within Sabrient’s Growth, Value, Dividend, and Small Cap investing strategies (which underly those aforementioned portfolios) is discussed in detail in Sabrient founder David Brown’s new book, How to Build High Performance Stock Portfolios, which is now available to buy in both paperback and eBook formats on Amazon.com.

And in conjunction with David’s new book, we are also offering a subscription to our next-generation Sabrient Scorecard for Stocks, which is a downloadable spreadsheet displaying our Top 30 highest-ranked stock picks for each of those 4 investing strategies. And as a bonus, we also provide our Scorecard for ETFs that scores and ranks roughly 1,400 US-listed equity ETFs. Both Scorecards are posted weekly in Excel format and allow you to see how your stocks and ETFs rank in our system…or for identifying the top-ranked stocks and ETFs (or for weighted combinations of our alpha factors). You can learn more about both the book and the next-gen Scorecards (and download a free sample scorecard) at http://DavidBrownInvestingBook.com.

In today’s post, I dissect in greater detail GDP, jobs, federal debt, inflation, corporate earnings, stock valuations, technological trends, and what might lie ahead for the stock market with the incoming administration. I also discuss Sabrient’s latest fundamental-based SectorCast quantitative rankings of the ten U.S. business sectors, current positioning of our sector rotation model, and several top-ranked ETF ideas. And be sure to check out my Final Thoughts section in which I offer my post-mortem on the election.

Click HERE to continue reading my full commentary or to sign up for email delivery of this monthly market letter. Also, here is a to this post in printable PDF format. I invite you to share it as appropriate (to the extent your compliance allows).

Market Commentary

US stocks are up in 2024 YTD more than any election year since 1936, and they continue to hold up near their all-time highs in the face of a towering Wall of Worry. Despite rising bond yields (which more severely discount future earnings streams), investors continue to bid up stock valuation multiples in what has become quite apparent is an extreme case of FOMO (“fear of missing out”). And it was never more apparent than 11/6 in the wake of the election results, which pushed multiples to even loftier levels, with the S&P 500 and Nasdaq 100 now at forward P/Es of 22.4x and 27.0x, respectively. Meanwhile, the 10-year yield has been on a rapid rise (having recently eclipsed 4.4% before pulling back), which historically tends to hold down valuation multiples. Indeed, many of the most prominent investors are wary, including the likes of Warren Buffett, Jamie Dimon, and Jeff Bezos, while corporate insider buying has slowed.

Berkshire Hathaway's (BRK.B) cash pile now exceeds $300 billion ($325.5B) as Buffett sold about $36 billion in stocks into the rally during Q3—including about 1/4 of its huge Apple stake and a good chunk of his Bank of America (BAC) holdings—while freezing share buybacks (after buying back $2.9 billion in H12024 and $9.2 billion in 2023).

Sir John Templeton once said, “The four most dangerous words in investing are: ‘This time it’s different,’” but in many ways it is, as the major stock indexes are far more dominated by the fast-growing, cash-flush Big Tech titans that can enjoy the higher interest on their cash balances, with little to no financing costs, and sales and earnings growth rates well above the discount rate (much less the inflation rate) that mostly justifies their rising multiples. This lies in stark contrast to decades past in which the largest companies were stodgy industrial conglomerates and vertically integrated oil companies, which were considered value stocks with their slow, steady growth and fat dividends.

In the wake of this post-election spurt of FOMO, there are now 8 companies with market caps of $1 trillion or more—established “club” members NVIDIA (NVDA), Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon.com (AMZN), and Meta Platforms (META), and newcomers Tesla (TSLA) and Buffett’s Berkshire Hathaway, which is straddling the threshold. Thus, today the ratio of US stock market capitalization to the global stock market has risen from about 30% in 2009 (following the GFC) to 50% today.

Actually, all risk assets rallied hard, including bitcoin—with the iShares Bitcoin ETF (IBIT) trading $4 billion in volume the day after the election and now holding over $30 billion in assets. Also strong were the US dollar and Japanese stocks, while Chinese and European stocks fell. The huge drop in volatility triggered automatic buy signals among the large systematic/algorithmic trading funds (aka “algos” or “quants”), which added a lot of fuel to the fire. Goldman Sachs cited unwinding of election hedges, re-leveraging of risk assets, and a resumption in share buyback programs as additional sources of demand. According to Nomura Securities, volatility-controlled funds are expected to buy $110 billion in US stocks through January.

Looking at sectors, much like the day after Trump's win back in 2016, the rally was led by cyclical sectors, specifically Industrials, Energy, Financials, and Consumer Discretionary. The lagging sectors were the bond proxies Real Estate, Staples, and Utilities, as bonds tanked (since mid-September, the 10-year Treasury yield surged more than 80 bps, from trough to peak.) And yet gold has also held up for many reasons, including as a hedge against inflation and currency devaluation, central banks fearing US sanctions, and a potential credit crisis down the road. Notably, as Meb Faber observed, there has never been a calendar year in which both the S&P 500 and gold were both up 25%.

Unfortunately, as bonds sold off and yields spiked following the election (despite fed funds rate cuts), the average 30-year fixed rate mortgage surged to 7.13%, which was its highest level since July and up by nearly a full percentage point since the FOMC cut 50 bps in mid-September. It closed last week at 6.92%.

Fed chair Jay Powell insists the FOMC is in no rush to cut rates unless the economy weakens and sees little evidence now of any weakening. But I disagree (and perhaps he does, too). As I have opined consistently in prior posts, GDP and jobs growth has been overly reliant upon government hiring and spending—which is all expected to change soon under the new administration. And the impressive S&P 500 earnings growth has been overly reliant on the Big Tech mega-cap titans. Perhaps this underlying weakness is why Fed chair Powell insists the FOMC remains committed to cutting rates in spite of his public statements about the “strength” reflected in the GDP readings.

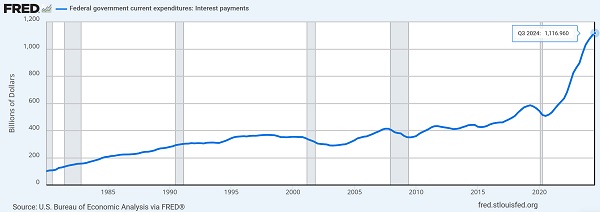

I have talked in prior posts about a debt-and-deficit-reduction approach that includes cutting wasteful and profligate spending (“smart austerity,” including foreign wars and malinvestment in politburo-style picking of industry winners and losers), stimulating stronger economic growth (“grow our way out of it” through lower taxes and deregulation), and maintaining somewhat elevated inflation of 2-3% (to “inflate away” the debt through a weaker dollar—so keep buying gold!). However, what is happening under the current administration is none of those things, and in fact is counterproductive and worsening the debt at an alarming rate. Total federal debt has hit $36 trillion after adding $384 billion last month alone (as the growth rate of debt has gone parabolic), and the debt service on that debt now exceeds $3 billion/day.

Besides the AI frenzy and associated capex, it has been government spending and hiring that has buoyed the jobs and GDP figures, which is why I have advocated for the Fed to immediately cut the fed funds rate by a full percentage point from its peak. As the inflation rate falls and the Fed policy remains unchanged, the real effective Fed fund rate actually rises. So even without the Fed raising rates after July 2023, the real effective funds rate continued to increase to a peak of 2.8%. This suggests that the Fed must continue to cut rates to ensure policy is truly easing. With the 25-bps rate cut in November, the real effective funds rate is 2.14%.

Best bet for market winners in the wake of this red wave are value stocks, small caps, and cyclical sectors like Industrials (including Defense and Transports), Energy and Basic Materials (which have lagged badly), and Financials. I’m not upbeat on China and other emerging markets, and I think defensive sectors may have had their run for now. Moreover, Real Estate stopped its short-lived outperformance once interest rates began to rise again in mid-September but remains arguably the most undervalued sector in the stock market. Keep in mind, REITs typically can adjust rents in line with inflation.

Growth stocks can continue to do well—despite the impact on valuation multiples (e.g., P/E) from the elevated discount rate—as long as the earnings growth rate is well above the discount rate (typically the risk-free 10-year yield, not the inflation rate). In fact, many of the Big Tech growth stocks benefit from higher interest rates because they hold little to no debt while earning higher yields on their huge cash balances.

While Elon Musk’s Tesla (TSLA) surged +30% following the election, there were also many under-the-radar, small/mid-cap firms that are successfully leveraging new technologies have surged this year. They include interesting names that caught my eye like genomics diagnostics firm GeneDx (WGS), which is up an astounding 2,800% YTD, with growth driven primarily by its AI-powered health intelligence platform Centrellis; payments fintech Sezzle (SEZL), +2,000% YTD, quantum computing firm IonQ (IONQ), +100% YTD, small modular nuclear reactor maker SMR Inc. (SMR), +600% YTD, and online gaming and advertising firm AppLovin (APP), +600% YTD, with growth driven primarily by its AI-powered Axon tool that provides targeted advertising in gaming apps [note: APP is a holding in Sabrient’s Q1 2024 Baker’s Dozen].

Other notable outperformers include bitcoin-proxy MicroStrategy (MSTR), +330%, which besides holding lots of bitcoin also provides AI-powered decision-making software, and electric power producer Vistra (VST), +260% YTD, which is riding the wave of enthusiasm around using nuclear capacity to power energy-hungry AI. Several Big Techs have announced plans to build or restart nuclear reactors for AI datacenters. It’s hard to believe it’s been less than two years since the first version of ChatGPT was released for public use. The speed of development and adoption is impressive. Capex across Microsoft, Meta Platforms, Alphabet, and Amazon during Q3 hit a combined $60 billion—and they asserted that such spending levels would continue.

I wrote in my October post how Europe, given its increasingly socialist welfare statehood, is increasingly becoming irrelevant in the global economy and especially in the Technology sector, which of course is the main driver of disruptive innovation and productivity growth across all industries. Take its main Big Tech company, ASML Holding (ASML), a semiconductor equipment maker based in Holland. While others in the industry are excelling, ASML has severely underperformed. Its CEO sees weak demand into 2025, while companies like NVIDIA (NVDA), Taiwan Semiconductor (TSM), and others are extremely upbeat, citing “insane” demand for chips. TSM, which was selected to be in Sabrient’s latest Q4 Baker’s Dozen portfolio, raised its target for 2024 revenue growth after quarterly results beat estimates, fending off concerns about global chip demand and the AI hardware boom. Indeed, not only does a YTD chart of TSM vs. ASML reflect a near-perfect “pairs trade” (long TSM, short ASML), but the same could be said for the US vs. Europe in general.

As for the Energy sector, Trump’s “Drill, baby, drill” directive may further increase record US oil production. As the low-cost producer (particularly regarding shale oil), the US has been the sole driver of growth in what has been otherwise falling global oil production, which has kept total production flat. Of course, increased production tends to hold down prices. So, for oil & gas companies to do well and be incentivized to invest in additional production, sales volumes and margins must both increase. As The Crude Chronicles wrote on Substack, “…[historically,] both red and blue sweeps tend to create the best backdrop for energy equities. They set the stage for expansionary fiscal policies and excessive money creation which is the foundation on which every commodity cycle is built….” This should be good for oil & gas producers and services companies.

Healthcare as a sector hasn’t shown much election reaction, but Big Pharma executives are apparently in a panic with the imminent “new sheriff in town” RFK Jr. preparing to crack the whip, address health agency corruption (and collusion with Big Pharma), and perhaps ban TV ads (I never understood them anyway—isn’t your doctor supposed to know this stuff?

GDP, jobs, debt, and inflation:

As for GDP, the BEA reported Q3 GDP in the US at just 2.8%, despite profligate government spending, which contributed 85 bps, or about 30% of the total, which of course is unsustainable—not to mention government entitlements also contributed covertly to household consumption. Private investment rose only 0.3%. Not a good sign. All told, it implies that real GDP from the private sector was below 2%. Looking ahead, the latest Atlanta Fed GDPNow forecast for Q4 is predicting even lower growth at just 2.5% (as of 11/7). The US electorate recognized that something had to change drastically.

As for jobs, the latest jobless claims data (both initial and continuing) suggest a moribund labor market. Although layoffs haven’t been increasing, those who have lost jobs are having difficulty finding a new job, as continuing claims have risen above the pre-pandemic levels of 2019. Non-farm payrolls for October were only 12,000, and previous reports were (one again!) revised downward significantly, this time by 112,000 jobs. Even more distressing, the top-line number was only positive because of—you guessed it—government hiring, with 40,000 new government jobs offset by 46,000 lost jobs in manufacturing, and most upsettingly, private payrolls fell by -28,000, which is the first month of a net loss in private sector jobs since the pandemic lockdowns.

Moreover, the civilian employment metric, which includes small business start-ups, fell by 368,000. And although the unemployment rate miraculously remained at 4.1%, it was because there were 220,000 fewer people counted in the “civilian labor force,” i.e., working or seeking work. Combine that number with the 209,000 additional work-eligible people, there was a month-over-month (October vs. September) increase of 428,000 work-eligible people (16 years old or older and not in active military or institutions like prisons, mental health facilities, nursing homes) who are not in the labor force.

So, the persistent weakness in private payrolls, low quit rates, fewer hours worked, the trend toward fewer full-time and more part-time jobs (with those holding multiple jobs hitting an all-time high), an 80% rate of downward revisions to initial jobs reports, and continued compounding of its impact, has become worrisome. Private sector employers have not been hiring, particularly in manufacturing. Indeed, ISM manufacturing remains deeply in contraction territory, with weakness in both demand (new orders) and production and with order backlogs dwindling. Manufacturing companies have adjusted their hiring efforts with this revelation, as the employment index came in at a very weak 44.4 and hovers close to the lowest level since the COVID lockdown months. In addition, residential construction jobs may be at risk as housing starts now lag completions by the most since 2008.

This is why Elon Musk has warned us that slashing federal government waste will create some short-term pain on the citizenry, as cutting many of these unnecessary government jobs and profligate spending that has ballooned the deficit and debt may temporarily increase unemployment and GDP until the private sector gets revved up through tax cuts and deregulation. Musk is aiming to help Trump cut fat from the federal budget (i.e., “drain the swamp”) by up to $2 trillion through a new agency in the administration that Musk wants to call the Department of Government Efficiency (DOGE)—which of course deliberately uses the same acronym as the ticker of his favorite cryptocurrency, Dogecoin. Cute.

Simply put, the economy (i.e., GDP) must grow faster than the budget (i.e., spending). Unleashing the private sector via lower taxes and regulation suggests faster and more sustainable organic GDP growth than government-directed “investment," i.e., boondoggles, cronyism, and spending bills written by politicians and their donors/lobbyists. It also equates to rising earnings and taxable income—and rising tax receipts. So, rather than raising tax rates on corporations and “the rich” to fund government deficit spending and monetary inflation to stimulate the economy (a la China), it is more effective to cut red tape and put working capital back in the hands of businesses, while keeping money supply growing at a rate in line with the resulting organic economic growth rate. My regular readers know I have been pounding the table on this relentlessly.

Moreover, MacroStrategy UK points out that the US potential GDP growth rate (real GDP growth + net national savings rate) and the world real GDP growth rate both have been in a long-term downtrend since the 1970’s (which, by the way, corresponds with the US removing the dollar’s gold standard). This downtrend must be staunched.

As discussed earlier, I continue to harp on the misleading jobs and GDP reports that underreport the overreliance on government deficit spending, with national debt approaching $36 trillion and rising $2 trillion/year, and with debt carrying costs alone having eclipsed $1.1 trillion/year, as shown in the chart below.

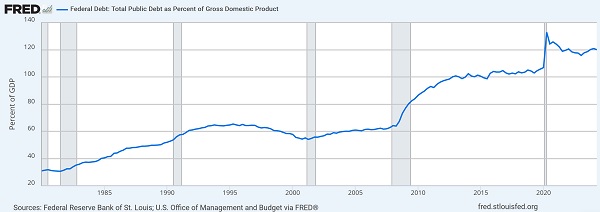

The federal government spent a lot to absorb most of the economic pain of the pandemic, as reflected by the ratio of federal debt to GDP of 120%, as shown in the chart below.

But I think it is possible if not likely that Trump’s deregulation and Musk’s reducing of bureaucracy will eventually lead to lower (or at least flat) spending while GDP growth improves. And although it may initially result in significant job losses among all that low-ROI government hiring that has propped up the jobs report, private-sector hiring will soon kick in (in supply-side fashion). And although there may be an initial spike in the budget deficit when lower tax rates are first implemented to spur growth, it eventually will be offset by stronger GDP growth (recall the DataTrek Research observation I often cite that federal tax receipts have averaged about 17% of GDP since 1960, no matter the tax regime).

The trick will be in preventing a resurgence in inflation, and that must come from supply-driven growth rather than demand-driven growth (too many dollars chasing too few goods). As the “bond vigilantes” see that this is possible, the rise in bond yields should stop as bonds once again catch a bid (particularly at these elevated levels).

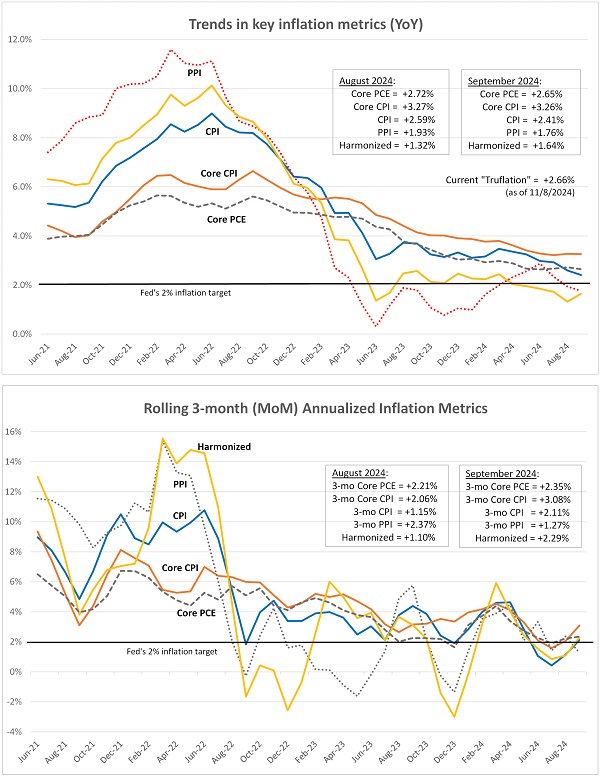

As for inflation, this week will reveal October CPI and PPI reports on 11/13-14, followed by the Harmonized Index of Consumer Prices (HICP) on 11/19, and then Personal Consumption Expenditures (PCE) on 11/27. For now, let’s compare the September readings.

In the graphic below, the upper chart compares the year-over-year (YoY) trends in PPI, CPI, Core CPI, and Core PCE (“core” excludes the volatile food & energy components), along with HICP, which is an alternative European method of accounting for inflation across countries in the EU includes rural populations and replaces owner’s equivalent rent (OER) with the true cost of owner-occupied housing. All metrics suggest inflationary pressures remain in a downtrend, with HICP notably at just +1.64%. In addition, real-time, blockchain-based “Truflation” is another alternative metric I follow. It is updated daily for YoY changes, and historically presages CPI by several months. After holding below the Fed’s 2% target for much of the past several months, Truflation has recently indicated a slight uptick in inflationary pressures.

So, let’s examine the lower chart, which shows annualized 3-month rolling averages to better reflect current inflation trends (without the effects of the large first-of-year resets on many services costs. Like Truflation, all these annualized 3-month metrics (except for PPI) suggest the current inflation trend has perked up a bit, with PPI at +1.27%, CPI at +2.11%, Core CPI at +3.08%, Core PCE (the Fed’s preferred gauge) at +2.35%, and HICP at just +2.29%—although nothing looks overly worrisome.

In fact, slightly elevated inflation in an environment of robust economic growth might be desirable. As I discussed last month, there are three ways to dig our way out of this enormous deficit and debt pile: 1) “inflate away” the debt with 2-3% inflation, 2) cut spending and red tape, and 3) foster strong, sustained, organic economic growth, led by the private sector and supported by low tax rates for all. In fact, a combination of all three would spur innovation, R&D, and capital investment; foster robust commerce, competition, and efficient use of capital; and generate rising productivity and wages, higher profit margins, robust corporate earnings, faster GDP growth, and higher tax receipts (remember: 17% of GDP, on average).

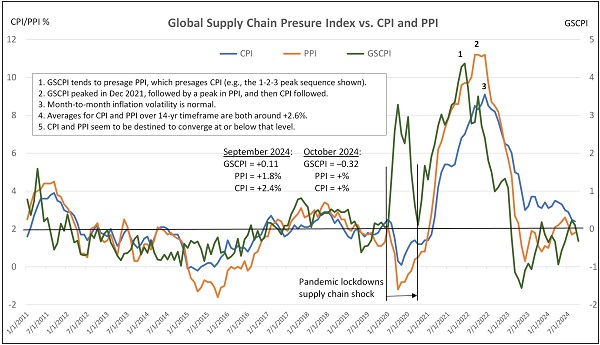

The next chart below compares CPI and PPI with the New York Fed’s Global Supply Chain Pressure Index (GSCPI), which measures the number of standard deviations from the historical average value (aka Z-score) and generally foreshadows movements in inflation metrics. Supply chain pressures remain subdued, as GSCPI fell in October to -0.32. As shown, GSCPI is a precursor to producer prices, which has kept the PPI so low. And because PPI flows into consumer prices, it tends to presage CPI, thus suggesting that CPI also should resume its gradual retreat (leaving only sticky shelter costs as the main concern, as I discussed earlier). We will see what this week’s CPI/PPI readings for October have in store, but GSCPI would suggest moderation.

By the way, I mentioned at the start of this post about the existing capital flows of global investment capital into the US, which has boosted our economy and capital markets, is expected to accelerate given Trump’s business-friendly policies. But there is a looming dark side to this regarding its impact on the rest of the world and especially Europe. As MacroStrategy UK explains, “It has been at the expense of world growth, which has continued to trend lower, meaning it is not a sustainable position. The cost to the rest of the world, particularly Europe, is becoming unbearable. German industrial production is down 14% from its high, its GDP has gone nowhere since 2017, and with its population growing from the flood of immigrants, its GDP per capita has been falling. Things are getting so bad that even German Chancellor Olaf Scholz said Germany must forge new policy if it is to be saved… [Capital flows into the US will] need a sufficient relative return to continue. If that return is only from the flow of funds itself, then in a typical Ponzi scheme fashion, it will eventually run out of funds and collapse of its own weight.”

Separately, MacroStrategy UK also wrote of further European woes, “Europe (and U.K) pays by far the most for electricity in the industrialised world. Its renewable electricity is about 5 times the cost of conventional electricity. As its renewable electricity has grown, its overall energy consumption has collapsed, down 17.47% since peaking in 2006... the resultant demand destruction [is] enormous… [and GDP] will decline until the cost of energy is back into line with what the economy can afford.”

So, is it any wonder—particularly in the wake of our red-wave election—that European and other G-7 leaders appear to be seeing the writing on the wall about the “black hole” of spending on climate policies, as several top leaders are choosing not to attend this year’s UN Climate Change Conference (COP29) taking place this week in Azerbaijan, including German Chancellor Scholz, French President Macron, EC President von der Leyen, Australian Prime Minister Albanese, and Canadian Prime Minister Trudeau, not to mention or own President Biden.

Earnings and valuations:

Both the cap-weighted and equal-weighted S&P 500 (SPY and RSP, respectively) have been hitting new all-time highs—which suggests solid market breadth and a healthy market. Moreover, although equal-weight RSP still trails SPY on YTD basis, they have performed in lockstep over the past 3 months as the market rallied from its shallow August “head-fake” correction.

Although I have spoken at length about our government’s massive deficit spending and skyrocketing debt, this is not a problem for the largest US corporations. After taking on plenty of cheap debt during the pandemic lockdowns, corporations have been steadily deleveraging, and in fact their net interest expense has plummeted toward record lows, as they earn much more on their huge cash balances than they pay on any remaining debt. Of course, given that about 1/3 of total market capitalization is in the Big Tech titans, those cash-rich companies make the cap-weighted indexes look quite good.

This aggregation effect also applies to earnings growth metrics. According to FactSet, “In aggregate, the ‘Magnificent 7’ companies are expected to report year-over-year earnings growth of 18.1% for the third quarter. Excluding these seven companies, the blended (combines actual and estimated results) earnings growth rate for the remaining 493 companies in the S&P 500 would be 0.1% for Q3 2024. Overall, the blended earnings growth rate for the entire S&P 500 for Q3 2024 is 3.4%.”

Today, forward P/E ratios on the major indexes continue to be elevated on investor optimism (and complacency). The Nasdaq 100 (QQQ) is now 27.3x with a forward P/E-to-Growth ratio (PEG) of 1.65x, and the S&P 500 (SPY) is at 22.7x and 1.68x, as of 11/8. But looking beyond cap-weighted, broad market indexes, we find more palatable valuations, with the equal-weight Nasdaq 100 (QQQE) at a forward P/E of 23.6x and forward PEG of 1.61x, and the equal-weight S&P 500 (RSP) at 17.9x and 1.71x. The lower the forward P/E and PEG, the better, so while the forward PEG ratios for the equal-weight indexes are similar to their more popular cap-weight versions, the forward P/Es for the equal weights are much more attractive—which of course suggests that investors are willing to “pay up” for stronger growth.

But when you look at the subset of fundamentally sound small caps, they continue to be a relatively undervalued asset class. For example, the quality-oriented S&P 600 SmallCap (SPSM), which requires consistent profitability for index eligibility, has a forward P/E of just 16.4x, while the “zombie-laden” Russell 2000 (IWM), in which about 40% of the stocks are not profitable, is at 17.2x.

Nevertheless, rather than a passive investment in any of these broad market indexes, I continue to advocate for an active selection approach that identifies high-quality companies with the best fundamentals and growth prospects—which is what Sabrient seeks to do with our various portfolios. In fact, our next-generation Scorecard for Stocks (which just launched as a new research subscription) provides our Top 30 stocks on a weekly basis for each of four rules-based quantitative investing strategies—Growth, Value, Dividend, and Small Cap—described in Sabrient founder David Brown’s new investing book.

Final thoughts:

Here’s a brief post-mortem on the presidential election. I felt all along that it was critically important for the avoidance of lawsuits and violence that there be a decisive win (for whichever side). It was the only way for the losing side to accept the result. It’s also important that the winner have a diverse coalition—and indeed many blacks, Mexicans, Jews, and even some Muslims voted for Trump. He has changed the Republican Party from a declining corporate/rich-guy club to a populist/patriotic coalition. Some would say God chose this unusual but fearless non-politician to “save” the country, and perhaps Western civilization, from wokeism and a Soros/WEF-led “Great Reset” toward socialist authoritarianism.

Turns out Americans of all walks of life and ethnicities have more in common than the MSM (aka legacy media) wants us to know. Most of us just want government to leave us alone, leave tax money in our pockets, and incentivize a robust economy that creates plenty of opportunity to prosper without rampant inflation that erodes away our gains. And most of us are not driven by petty identity politics. Maybe the US electorate has come to the realization that what the Left has been accusing the Right of intending do if they take office are the very things the Left is actually doing today—like censorship, propaganda/disinformation, lawfare, weaponizing the justice system (through the DOJ and blue state AGs) with selective prosecutions, and proliferating foreign wars. Maybe the electorate is recognizing the corruption of career politicians and entrenched media and rejecting the siren song and ruinous creep of “big government” socialist authoritarianism.

Charlie Munger once said, “Show me the incentives, and I’ll show you the outcome.” And there have been far too many incentives for bad behavior. As examples, illegal immigration, petty larceny, claiming victimhood, race-baiting, reverse discrimination, human trafficking, drug abuse, anti-Semitism, and malinvestment/speculation—and indeed the “seven deadly sins” of pride, greed, wrath, envy, lust, gluttony, and sloth—all have been not only tolerated but encouraged and rewarded in today’s society and political climate. “Your failure is not your fault,” they are told.

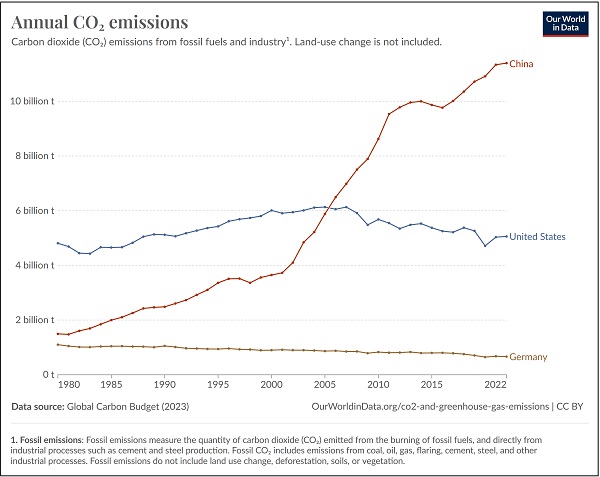

Moreover, as investment advisor/writer Bryan Perry pointed out, we continue to essentially tolerate (and thus incentivize) the “seven deadly sins” of China’s trade tactics, which include: 1) IP theft, 2) forcing technology transfer, 3) hacking, 4) “dumping” of products on the global markets, 5) massive government subsidies, 6) exporting of fentanyl, and 7) currency manipulation—not to mention its human rights abuses and use of slave labor, as well as the game it plays with the West’s green energy obsession by cheering on our carbon footprint goals and massive spending on renewables while China burns as much coal and oil as it can get its hands on, with its attendant carbon emissions skyrocketing (as shown in the chart below). China does not need a “hand up” like it did when it was first allowed in the WTO, so it is fair game for punitive tariffs.

An inspiring and instructive X post comes from British satirist/podcaster Konstantin Kisin who describes “10 reasons his European friends didn’t see Trump’s victory coming.” My synopsis of his list: “Unlike Europeans, Americans have not accepted managed decline... [They are optimistic and aspirational and] do not believe in socialism. They believe in meritocracy… [They] are the most pro-[legal] immigration people in the world… [and] know that they live in a country where [prosperity] is available to anyone with the talent and drive to make it. They don't resent success, they celebrate it… [They resist] government overreach [and] understand that freedom comes with the price of self-reliance and they pay it gladly.”

There’s a reason why the world’s migrants risk life and limb to come here—it’s called the American Dream, where industriousness and fortitude can bring you the opportunity (not the guarantee) to achieve and prosper within a free capitalist meritocracy, rather than a forced Marxist redistribution model of, “from each according to his capability, to each according to his needs” (from which most of the migrants fled). I’m not talking about an anarchic, Wild-West system of exploitation or crony capitalism or win/lose, “to the victor goes the spoils,” but rather an ethical system of free-market business (some might say, “conscious capitalism”), as in the Bible’s admonition, “to whom much is given, much is expected,” backed by a supportive government and the Rule of Law. As such, all the government needs to do is maintain the system. Instead, Leftist politicians aspire to radically remake our society and economy toward some sort of anti-business, socialist utopia of equal outcomes.

As economist/investor Mark Skousen said, “What do the American people want? A return to normalcy: the end of price inflation… good job opportunities… higher standards of living for all… lower crime… balanced budgets… fewer regulations… control of the border… and return to traditional values… Americans want to go about their business without being overregulated, harassed, audited and taxed to death.” And as Scottish economist Adam Smith (author of The Wealth of Nations) once said, “Little else is required to carry a state to the highest degree of opulence but peace, easy taxes and a tolerable administration of justice.” Instead, as the econ team at First Trust wrote, “The US has spent trillions on welfare, and all we are left with are collapsing inner-cities and dependent people. Government has become too large. It’s nearly impossible to find a nook or cranny of human activity not impacted by government money, taxes and regulations.”

So, the jig is up. Most average, churchgoing, working-class citizens are not buying the gaslighting anymore. Celebrity endorsements (especially from actors, pro athletes, and musicians who live in a bubble of wealth, safety, and entitlement) no longer carry weight. Statistics on voting by income level showed that Harris won the majority of those making under $25k/yr (the poor) and over $100k/yr (the affluent), while Trump won every income group in between (the vast middle class). Even the dogged socialist Senator Bernie Sanders lamented on X, “It should come as no great surprise that a Democratic Party which has abandoned working class people would find that the working class has abandoned them. First, it was the white working class, and now it is Latino and Black workers as well. While the Democratic leadership defends the status quo, the American people are angry and want change. And they’re right.” Indeed, his party appeared to be more interested in pursuing global agendas (like social justice, mass migration, climate change, foreign wars) than helping its aspirant and struggling citizens.

As a result, it seems the only audience left for the likes of Scarborough, Maddow, Wallace, The View, Clooney, Oprah, and Kimmel are Ivy League professors, affluent white women, DEI hucksters, and what I call the “aggrievement coalition” (comprising the self-ordained “oppressed” and their gaslit allies) Turns out such a team steeped in negativity is doomed to fail in an optimistic and aspirant country like ours, particularly as each identity group begins to compete over who is the most oppressed and thus deserving of the greatest entitlements—it becomes like crabs in a barrel, climbing over each other but getting nowhere.

This no longer plays well with the broad populace of common-sense working people of all races who simply want to pursue the American Dream. They were continually told of a right-wing threat to democracy, but they knew the real threat to democracy was not what Trump might do in the future but what the Democrats, MSM, and Big Tech have already done in suppressing relevant news, promoting their own false narratives, weaponizing the justice system against political opponents and their associates, and even removing their own duly elected candidate and anointing a younger, multi-racial replacement, unburdened by the rigors of an open, democratic primary campaign.

Lastly, this X post from blogger Tim Denning summarizes the pro-capitalism, small government philosophy of entrepreneur/VC Naval Ravikant in 17 short bullet points. As a teaser, here is Naval’s Reagan-esque bullet #8: "It’s a race between technology-driven abundance and government-driven poverty. Governments rarely make things better. They're terrible at spending. And they go into huge debt. The government isn't going to save you. Save yourself.”

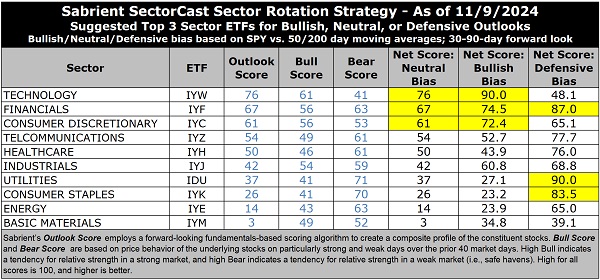

Latest Sector RankingsRelative sector rankings are based on Sabrient’s proprietary SectorCast model, which builds a composite profile of each of over 1,400 equity ETFs based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score is a Growth at a Reasonable Price (GARP) model that employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings, and various return ratios. It helps us predict relative performance over the next 3-6 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. A high Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak. Outlook score is forward-looking while Bull and Bear are backward-looking.

As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financials (IYF), Technology (IYW), Industrials (IYJ), Healthcare (IYH), Consumer Staples (IYK), Consumer Discretionary (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500 large cap index, I prefer the iShares for their larger universe and broader diversity.

The table below shows the latest fundamentals-based Outlook rankings and my full sector rotation model. I would call the rankings neutral given that secular growth, cyclicals, and defensives are mixed throughout. Bullish rankings would entail cyclical and economically sensitive sectors dominating the top half of the rankings with scores well above 50 and defensive sectors in the lower half. In the immediate wake of the Fed rate cut and dovish pivot, the rankings were more bullish, but with the market’s renewed strength and broad reductions to earnings estimates, valuation multiples are back to extremes once again as prices have gotten ahead of earnings growth forecasts but boosted by lower interest rates.

Although down from its lofty Outlook Score (in the 90s), Technology (dominated by the mega-cap MAG-7) remains at the top with an Outlook score of 76, despite having by far the highest forward P/E (29.7x). However, because of its strong EPS growth estimates (18.1%), its forward PEG (ratio of P/E to EPS growth) is a relatively modest 1.65, which is second lowest only to Financials’ 1.23. Tech also displays strong Wall Street analyst earnings revisions, by far the highest return ratios, and the most insider buying. Rounding out the top 6 are Financials, Consumer Discretionary, Telecom, Healthcare, and Industrials. Notably, 7 of the 10 sectors have seen net negative revisions to EPS estimates from the analyst community, with only Financials, Telecom, and Tech positive.

Still at the bottom of the rankings are Energy and Materials, mainly due to large negative revisions to earnings estimates, low projected EPS growth rates, poor return ratios, and high PEG ratios. Notably, Telecom, Financials, and Energy display the lowest (most attractive) forward P/Es at 14.4x, 15.2x and 14.9x, respectively.

Keep in mind, the Outlook Rank does not include timing, momentum, or relative strength factors, but rather reflects the consensus fundamental expectations at a given point in time for individual stocks, aggregated by sector.

Sector Rotation Model and Other ETF Trading IdeasOur rules-based Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), has retained a bullish bias since 9/12, based on the SPY close firmly above its 50-day moving average and also remaining above its 200-day. (Note: In this model, we consider the bias to be bullish from a rules-based trend-following standpoint when SPY is above both its 50-day and 200-day simple moving averages, but neutral if it is between those SMAs while searching for direction, and defensive if below both SMAs.)

Thus, it suggests holding Technology (IYW), Financials (IYF), and Consumer Discretionary (IYC), in that order. However, if you prefer a neutral stance, the Sector Rotation model still suggests holding the same sectors Technology, Financials, and Consumer Discretionary, in that order. Or, if you prefer to take a defensive stance on the market (given lofty valuations and stretched technicals), it suggests holding Utilities (IDU), Financials, and Consumer Staples (IYK), in that order.

An assortment of other interesting ETFs that are scoring well in our latest rankings include: US Global GO Gold and Precious Metals Miners (GOAU), Global X Social, Global X Social Media (SOCL), Fidelity Disruptive Communications (FDCF), US Global Jets (JETS), Invesco Next Gen Media and Gaming (GGME), Goldman Sachs Future Consumer Equity (GBUY), Kurv Technology Titans Select (KQQQ), Invesco Biotechnology & Genome (PBE), Vanguard Communication Services (VOX), American Century Focused Dynamic Growth (FDG), Alger 35 (ATFV), Invesco Dorsey Wright Technology Momentum (PTF), PGIM Jennison Focused Growth (PJFG), CastleArk Large Growth (CARK), First Trust Active Factor Small Cap (AFSM), Cambria Cannabis (TOKE), iShares Global Comm Services (IXP), First Trust Bloomberg R&D Leaders (RND), iShares MSCI Global Gold Miners (RING), American Century US Quality Growth (QGRO), BNY Mellon Innovators (BKIV), iShares MSCI Global Silver and Metals Miners (SLVP), AXS Esoterica NextG Economy (WUGI), Counterpoint Quantitative Equity (CPAI), and Zacks Small/Mid Cap (SMIZ). All score in the top decile (90-100) of Outlook scores.

As always, I welcome your thoughts on this article! Please email me anytime. Any and all feedback is appreciated! In particular, please tell me what sections you find the most valuable—commentary, SectorCast scores, ETF trading ideas, or the sector rotation model. Also, please let me know of your interest in any of Sabrient’s new indexes for ETF investing, such as High-Quality Growth (similar to our Baker’s Dozen model), Quality Growth & Income, SMID-Cap Quality Plus Momentum, High-Quality Technology, High-Quality Energy, Quality Legacy & Green Energy, or Defensive Equity.

IMPORTANT NOTE: I post this information periodically as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I do not update the information on a regular schedule or on technical triggers. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted, but not necessarily on the days that I happen to post this article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ideas mentioned here as a managed portfolio.

Disclosure: At the time of this writing, of the securities mentioned, the author held positions in SPY, QQQ, FTLS, IONQ, SMR, GOAU, and bitcoin.

Disclaimer: {C}{C}{C}{C}{C}

{C}{C}{C}{C}{C} {C}{C}{C}{C}{C} {C}{C}{C}{C}{C} Opinions expressed are the author’s alone and do not necessarily reflect the views of Sabrient. This newsletter is published solely for informational purposes only. It is neither a solicitation to buy nor an offer to sell securities. It is not intended as investment advice and should not be used as the basis for any investment decision. Individuals should consider their personal financial circumstances in acting on any opinions, commentary, rankings, or stock selections provided by Sabrient Systems. Sabrient makes no representations that the techniques used in its rankings or analyses will result in profits. Trading involves risk, including possible loss of principal and other losses, and past performance is no guarantee of future results. Investment returns will fluctuate, and principal value may either rise or fall. Sabrient disclaims liability for damages of any sort (including lost profits) arising from the use of or inability to use its rankings or analyses. Information contained herein reflects our judgment or interpretation at the time of publication and is subject to change without notice.