Sector Detector: A 3-pronged approach to boost the economy and roll back debt under Trump 2.0

by Scott Martindale

by Scott Martindale

President & CEO, Sabrient Systems LLC

Monthly commentary on the economy, inflation, Fed policy, stock valuations, global events, Sabrient’s SectorCast rankings, sector rotation model positioning, and top-ranked ETF ideas.

Summary:

-

I remain skeptical of the official, government reports on jobs, GDP, and inflation, which are not passing my “smell test” and what I consider to be the illusion of a robust economy and jobs market, as GDP and jobs growth have been overly reliant on government deficit spending and hiring, which is both unhealthy and unsustainable.

-

Rising asset prices have been largely driven by a strong dollar, rising global liquidity, and capital flight into the US (most of which does not show up in M2 money supply), which comes at the expense of the rest of the world’s growth. It also creates a “wealth effect” here that lifts US consumer price inflation even though global supply chain pressures are low.

-

Somewhat elevated inflation in the 2-3% range can be desirable to help address our enormous federal debt as part of a 3-pronged attack: inflate away the debt, cut government waste and spending, and grow our way out of debt by stimulating organic private-sector-led productivity and economic growth with business-friendly Trump 2.0 fiscal policy and deregulation.

-

Overall, Trump 2.0 policies combined with a dovish Fed should be good for stocks, but bond prices will be more stagnant, in my view, with yields staying around current levels. I continue to suggest investors buy stocks in high-quality businesses at reasonable prices, hold inflation and dollar hedges like gold and bitcoin, and be prepared to exploit any market correction for further gains through 2025 and beyond, fueled by massive capex in blockchain and AI applications, infrastructure, and energy.

-

Sabrient’s latest fundamental-based SectorCast quantitative rankings of the ten U.S. business sectors is topped by Technology, Financials, and Consumer Discretionary. I also discuss the current positioning of our sector rotation model and several top-ranked ETF ideas.

-

Sabrient is best known for our “Baker’s Dozen” portfolio franchise and our process-driven, growth-at-a-reasonable-price methodology, which Sabrient founder David Brown describes in his latest book, How to Build High Performance Stock Portfolios, along with his value, dividend, and small cap portfolio strategies.

Each Baker’s Dozen is designed to be held for 15 months as a unit investment trust. Notably, although the mega-cap-dominated S&P 500 has been so tough to beat, the next Baker’s Dozens to terminate will be the Q4 2023 portfolio on 1/21, which is up about +49% (vs. +47% for SPY), and the Q1 2024 portfolio on 4/21, which is up about +95% (vs. +27% for SPY), as of 12/6.

To learn more about both the book and the companion subscription product we offer (which does most of the stock evaluation work for you), please visit: https://DavidBrownInvestingBook.com

Click HERE to continue reading my full commentary online or to sign up for email delivery of this monthly market letter. Also, here is a link to this post in printable PDF format. I invite you to share it as appropriate (to the extent your compliance allows).

Market Commentary:

I continue to be dismayed by our bloated and ever-expanding federal government and its staggering $36.2 trillion debt and $1.9 trillion budget deficit (of which $1.2 trillion is for debt service alone). In addition, I continue to be skeptical of the official government reports on jobs, GDP, and inflation, which are not passing my “smell test” and what I consider to be the illusion of a robust economy and jobs market, as GDP and jobs growth have been overly reliant on government deficit spending and hiring, not to mention its inefficient capital allocation—like a politburo picking winners and losers rather than incentivizing organic growth within a vibrant private sector. Moreover, the rosy jobs reports have seen consistent and substantial downward revisions to private sector jobs, which adds cynicism to my skepticism about the potentially political nature of the initial overstated numbers.

Distortions in jobs and economic growth:

Following a disastrous October jobs report from the BLS—which was only positive because of government hiring while manufacturing jobs, private payrolls overall, and civilian employment all collapsed—the November jobs report showed recovery from a lot of those job losses as the impacts of strikes and hurricanes subsided, and for once the revisions to prior months were positive. Nevertheless, all is not so rosy. Civilian employment (which includes small business start-ups) fell by -355,000 and is down by -715,000 jobs since November 2023. Looking back over those past 12 months, half of all jobs growth has been in government directly (averaging +41,000/month) plus private-sector jobs that are essentially paid for by government programs and new spending bills (mostly healthcare, social assistance, education, and some manufacturing). According to The Kobeissi Letter, the hiring rate (ratio of new hires to total employment) has fallen precipitously over the past three years to 3.3% in November, making it the 14th straight month below the pre-pandemic average of 3.8% and the lowest since 2013.

So, it should come as no surprise that the ISM Manufacturing index has remained below 50 (which indicates contraction) for 24 out of the last 25 months. Even in the more robust services sector, rather than lamenting labor shortages as they had been, companies are now reporting hiring freezes or non-replacement of quits and retires, and the ISM Services Index fell precipitously in November, although it’s still above 50 (indicating continued expansion).

And as for GDP, the BEA’s second estimate of Q3 GDP is just 2.8%, despite those big government spending bills, which contributed 85 bps, or about 30% of the total, not to mention government entitlements also contributed covertly to household consumption. Private investment rose only 30 bps. Not a good sign. This implies that real GDP from the private sector was around 2%. Also, the trade deficit report for October showed that exports fell $4.3 billion, and imports fell a whopping $14.3 billion.

Looking ahead, the latest GDPNow forecast for Q4 from the Atlanta Fed has risen to 3.3% as of 12/9, but the estimate for growth in real gross private domestic investment (GPDI) is only 1.8%. Ideally, GPDI growth should be slightly higher than GDP growth, which would indicate active, prospective investment in technology, equipment, and infrastructure leading to better productivity, increased productive capacity, and economic expansion. But that does not appear to be the case. The next GDPNow estimate for Q4 comes out on 12/17.

Also notable is Gross Domestic Income (GDI). Theoretically, GDP and GDI should be equal, as the first measures spending and the second measures income, which should balance each other—and indeed they historically show 97% correlation. But GDI has been lagging GDP, with the BEA’s preliminary estimate for Q3 at 2.2% (vs. 2.8% for GDP). Recall that final Q2 GDP was 3.0% (of which private sector growth was just 1.3%), while Q2 GDI was 1.3%. Up until Q4 2022, the two metrics tracked similarly, as they should, but for the past two years the growth rate of real GDP has been quite a bit higher than the growth rate of GDI. (More evidence of a failed “smell test”?) So, which one should we believe? Well, when they diverge like this, many economists believe GDI is the more accurate gauge, as advanced estimates have tended to track closer to the final metric.

And then we can look at Gross Output (GO), which is a metric created by economist/professor Mark Skousen (and published quarterly by the BEA since 2014) to measure the total value of economic activity throughout the supply chain rather than just the final output measured by GDP—i.e., it equals GDP plus “intermediate consumption.” The Q3 reading comes out 12/19. But looking back at Q2 (when real GDP was 3.0%), real GO came in at a lethargic 1.8%, hindered primarily by sluggish B2B spending. Moreover, Skousen also computes an adjusted version of GO that uses gross wholesale and retail figures as opposed to the BEA’s headline version that uses only net figures, and his adjusted GO for Q2 was just 1.2%.

All told, the data suggests to me an overreliance on Big Government deficit spending and hiring and inefficient capital allocation rather than fostering organic growth by unleashing a vibrant private sector to efficiently allocate capital to where it provides the greatest ROI. So, of course, this is unsustainable. Debt is growing faster than GDP, with the total federal debt at 122% of GDP (versus about 60% at the start of the Global Financial Crisis in 2008) and a budget deficit of approximately 7% of GDP.

Some market observers fear a so-called “Liz Truss moment,” which means a massive structural budget deficit, with large tax cuts and increased spending, despite an already massive debt, leading investors to protest by selling off the currency and capital markets. As you recall, Liz Truss ended up the shortest tenured Prime Minister in UK history at just 50 days in office after proposing such fiscal policy.

Alternative inflation metrics suggest an uptick:

And as for inflation, besides the headline YoY numbers, I like to look at alternative inflation metrics to get a better sense of the current trend rather than where the given price index was 12 months ago, and I talk about this regularly in my blog posts. They include annualized 3-month rolling averages of PPI, CPI, CPI, PCE, and the Harmonized Index of Consumer Prices (HICP), which is a European methodology. The general trends in these metrics were looking quite promising during the summer, with many of the alternative metrics I watch falling below the Fed’s 2% target. But it has reared its ugly head over the past few months to move closer to 3% as of October, with this week kicking off the November readings.

As shown in the upper chart below, the BLS’s 12-month PPI, CPI, Core CPI, Core PCE, and the Harmonized Index of Consumer Prices (HICP, a European methodology) for October all posted roughly in the 2-3% range, with HICP the lowest at +1.94% and Core CPI the highest at +3.30%. Other inflation indicators are the BEA’s quarterly GDP Price Index and Price Deflator, which both came in at +1.9% YoY for Q3.

Also shown in the lower chart below are other metrics I follow that give a better sense of the current trend rather than comparing today’s price index against where it was 12 months ago. They include the annualized 3-month rolling averages of PPI, CPI, Core CPI, Core PCE, and HICP. Earlier this year, the annualized 3-month metrics were suggesting much more subdued inflation than the headline numbers, but lately it has reversed, with the short-term inflation trend rising (at least for the moment).

The PCE report for October showed that consumers increased spending on essentials like healthcare, housing & utilities, financial services & insurance (mostly from the big YoY resets in premiums), while cutting back on gasoline, nondurables, clothing, furnishings and household durables.

Another valuable metric is the real-time, blockchain-based “Truflation,” which is published daily and reflects YoY comparisons for 30 million price points, with 3 price feeds for every price point. It has risen quite a bit over the past few months. After falling to about +1.01% on 9/13, it has surged back up to +2.85% versus the price index 12 months ago—its highest level of the year—as of 12/9

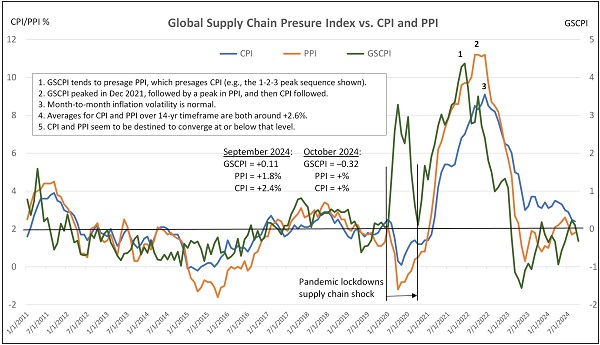

And by the way, this resurgence in inflation is not due to supply chain disruptions, as the New York Fed’s Global Supply Chain Pressure Index (GSCPI) is actually negative, or below its long-term average. The chart below illustrates the strong correlation between GSCPI and inflation metrics (outside of the anomalous pandemic shock). So, by this metric, inflation is likely not destined for continued resurgence. In fact, hedge fund manager and new Treasury Secretary nominee Scott Bessent has opined that the “reordering of supply chains from optimal to secure/strategic” since the pandemic and the sudden move toward onshoring/friendshoring of manufacturing and logistics created an inflationary impulse, but going forward he believes the resulting “duplicative excess capacity…will depress global capital goods pricing” and lead to disinflation rather than deflation—in other words, price stability rather than lower prices.

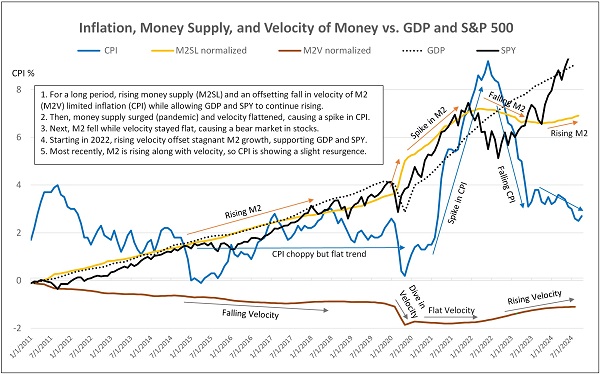

Indeed, the current inflationary pressures instead seem to have more to do with rising global liquidity and capital flight into the US, which adds to rising US money supply (M2SL) in tandem with rising velocity of money supply (M2V).. The surge in foreign capital flows is due to our strong dollar, innovative public companies and start-ups, relatively higher bond yields, desirable real estate, property rights, and Trump 2.0 business- and crypto-friendly policies (including the threat of tariffs on those other countries). As illustrated in the chart below, falling velocity (the number of transactions per dollar in a unit of time) can offset rising money supply, but when they rise together it can lead to rising prices in consumer goods and services.

Much of this capital flight into the US stays outside our banking system and therefore is not captured by M2. But it has helped lift asset prices (notably risk assets like stocks and crypto) and likely has created excess consumer demand (due to the “wealth effect”). Investors certainly don’t seem to mind today’s high valuation multiples in the US equity market, with the forward (next 12 months earnings) P/E for the S&P 500 at 22.7x and for the Nasdaq 100 at 27.2x, and with bitcoin at $100k and ether at $4k.

As I discussed in greater depth in my November post, the ominous downside to this capital flight is that it has come at the expense of growth in the rest of the world, and especially Europe. Capital is king, the veritable lifeblood of a growth economy. Moreover, the strong dollar not only hinders sales of US exporters and multinationals but also is deflationary for other countries (especially those who carry dollar-denominated debt) by tightening financial conditions and suppressing consumer spending and commodity prices in those countries while inducing capital outflows. Cutting interest rates to stimulate their struggling economies only serves to further weaken their currencies for international trade. And because oil and commodities are typically priced in dollars (e.g., the “petrodollar”), critical energy and materials become even more expensive for those countries and raises the potential for a global credit crisis. It also encourages leveraged carry trades (in which traders sell short the weakening local currency and buy the rising US dollar)—the rapid unwinding of which can spark a currency crisis all on its own.

Lastly, forward expectations of future US inflation over the next 5 years have risen from as low as 1.86% in September to 2.33% today, at least partly due to a perception that protective tariffs and business-friendly fiscal policies while the Fed is enacting dovish monetary policy will be an inflationary mix. However, the 5-year, 5-year forward expectation rate (i.e., the rate expected 5-10 years out from today) has fallen to 2.21%. These numbers make sense to me. In fact, I think maintaining somewhat elevated inflation in the 2-3% range not only might be hard to avoid (particularly given rising global liquidity and capital flows into the US) but actually may be desirable to help “inflate away” the enormous federal debt.

How to boost the economy and roll back debt:

In my view, there are three ways to address the debt: 1) we can inflate it away, 2) we can cut government waste and deficit spending, and 3) we can grow our way out of debt by stimulating organic private-sector-led productivity and economic growth with business-friendly Trump 2.0 fiscal policy and deregulation. And my view is that we should do all three. Tolerating somewhat elevated inflation while simultaneously incentivizing growth through monetary policy (modest interest rates and supportive money supply growth) and fiscal policy (lower tax rates and less red tape) and slashing our bloated federal government would return precious capital to consumers and the private sector and incentivize wise investments in projects that increase productivity and create robust organic growth in GDP, jobs, wages, free cash flow, earnings…and by extension, tax receipts.

And as a reminder, DataTrek Research has observed, “Regardless of individual and corporate tax rates, Federal receipts have averaged 17% of GDP since 1960. Economic growth is the only reliable way to increase government revenues.” This means that raising taxes stunts GDP growth while cutting taxes boosts GDP growth. Most short-sighted commentators who insist tax cuts must be “paid for” by commensurate spending cuts (and project massive increases in debt over the ensuing decade) fail to account for this dynamic.

Notably, after his nomination as Treasury Secretary, Scott Bessent immediately released his “3-3-3” plan, which quickly mollified the flailing Treasury market, as a strong bid came in like a hurricane to snap up the elevated yields. His three goals of “3” are: 1) cut the budget deficit to 3% of GDP (from 7% today) by 2028, 2) push annual real GDP growth to 3%, and 3) increase oil production by 3 million bbls/day. He believes we are in something of a Roaring ‘20s redux, much like Calvin Coolidge’s 1920s economy.

Similarly, economist Ed Yardeni also sees this as a new Roaring ‘20s decade. In a recent article, Yardeni essentially argued that the evolving nature of our economy, smart fiscal policy, and rapid productivity growth have invalidated many of the traditional macroeconomic warning signals. He concludes, “Perhaps monetary policy is not the most important factor for economic growth. Productivity attributable to the efforts of the private sector may be more important, in our opinion. Furthermore, fiscal policy may quicken money velocity and encourage more consumer spending and business investment.” This argument is similar to my earlier discussion about velocity of money stock rising or falling to offset minor monetary policy mistakes (such as too much or too little growth in M2 money supply), which I have written about numerous times in past posts.

As Brian Wesbury of First Trust says, “Government is a ball & chain on the economy; it’s a wet blanket on the fire of innovation,” which he asserts is why GDP growth has been sluggish despite so many incredible, productivity-enhancing technological breakthroughs. Economist Timothy Taylor has opined on the compounded benefits of strong productivity growth, “The gap between the good and the bad periods of US productivity is about 1.0–1.5% per year, each year. Over a decade, the higher productivity would mean that GDP was 10–15% higher.”

As government programs and agencies proliferate, they never go away, even if they were intended to be temporary. So, the whole bloated monolith just grows like a malignant tumor. But this year, the US electorate seems to have recognized that something had to change dramatically, which led to Trump’s “red wave.” Trump has said, “No mas.” Rather than the threat to democracy, Trump has emerged as a threat to bureaucracy. And by the way, following the election, the Conference Board’s Consumer Confidence Index shot up to 111.7 in November, and the latest University of Michigan Consumer Sentiment Index jumped to 74.

Indeed, it appears the cavalry have arrived to save the day. After a tumultuous first term (with internal and external obstructionists), Trump’s team is riding in with a strong mandate, clarity as to what personnel are ready to help rather than impede, and a viable plan to take a swing at cutting profligate spending. And that includes not only Elon Musk’s DOGE initiative to take on the scourge of Big Government, but also what I call “smart austerity,” including ending our funding of foreign wars and malinvestment in the picking of industry winners and losers like a socialist politburo. As those dollars are freed up, they reduce deficit spending and total debt while unleashing organic growth in the private sector, which means much more sustainable economic growth and hiring. Notably, Truflation just published an open letter to Elon Musk’s DOGE (Dept. of Government Efficiency) proposing that the BLS can be shut down and outsourced to the Truflation team as an independent, fast, and technology-driven solution.

But cutting spending is hard to do. As an electorate, we reap what we sow, and politicians have learned the hard way that cutting entitlements or earmarks is a sure way to lose the next election—voters say, “Yes, cut spending…just don’t touch the stuff that benefits me!” As Alexis de Tocqueville opined, circa 1850, “The American Republic will endure until the day Congress discovers that it can bribe the public with the public's money.” Likewise, Scottish judge and historian Alexander Tytler, circa 1800, observed about the Cycle of Democracy, “A democracy…can only exist until the voters discover they can vote themselves largess from the public treasury. From that moment on, the majority always votes for the candidates promising them the most benefits from the public treasury….”

A good example is the Grace Commission under Ronald Reagan in 1982, which proposed sweeping reforms to “eliminate waste and inefficiency in the federal government,” but saw little in the way of uptake. Perhaps a stern and peremptory Trump will prove a stronger taskmaster/dealmaker-in-chief (or “Lord of the Swamp”) than the more amiable and gentlemanly Reagan. And of course, today’s federal government is more bloated, wasteful, intrusive, and corrupt than ever, and as they say, sunlight is the best disinfectant.

In any case, during this period of government overhaul, I expect we will also see elevated market volatility as mixed signals emerge around GDP, jobs, inflation, earnings, and deficits.

Fed policy expectations:

Beginning with the Fed’s first 50-bps rate cut in mid-September, the dollar began its latest surge along with longer-dated Treasury yields. I have spoken in the past about how the yield curve was being manipulated by the Treasury by having virtually all new issuances in short-dated T-bills, which kept supply low on the long end, thus driving down bond yields and creating a maturity mismatch. Going forward, the yield curve may steepen further, driven by lower short-term rates and a slight rise in term premium (reflective of investor concerns about high debt and deficits and perhaps some “bond vigilantism”). The stimulative policies will be both supportive of economic growth and “reflationary,” offset by deflationary impulses from China (desperate to maintain some semblance of growth) and blockchain and AI-driven productivity growth.

I think the Fed should target a terminal fed funds rate of around 3.5%, versus today’s 4.5%, and it should get us there soon because, as Jerome Powell admits, current monetary policy remains restrictive (even after the 75 bps of cuts already implemented) and the labor markets are cooling. Moreover, our trading partners are struggling with the strong dollar, as they need to cut rates to support their struggling or recessionary economies, which would further weaken their currencies. And then of course, President-elect Trump favors a weak-dollar policy to support US companies’ overseas sales and reduce our trade deficit—but he can’t decree its exchange rate (the global forex market decides it), and as the US economy strengthens, it attracts capital and strengthens the dollar.

The December FOMC policy announcement comes on 12/18. Fed funds futures currently indicate an 86% chance of a 25-bp rate cut. As for longer duration bond yields, I think they will settle in right around where they stand today, with the 10-year in the low 4% range, which would suggest a term premium of 50 bps or so.

Once that terminal (“neutral”) rate is achieved, perhaps the Fed can go back into the shadows where it was always intended to be, and let fiscal, trade, and tax policies from Congress and the President dominate the news cycle. No more sitting on pins-and-needles at every FOMC meeting or Fed governor speaking engagement.

Final comments:

Let’s not ignore the defensive signals that are showing up in various corners, including narrowing market breadth among US stocks despite continuing to hit new all-time highs (on the backs of the mega-caps), and from the bond market as US Treasuries are getting bought again (with the 10-year yield closing last week at 4.15%), and Chinese yields have fallen precipitously to near historic lows (with the 10-year yield below 2%), which reflects deep concern about its struggling economy, deflation, and the potential for new US tariffs, and its consumers are focused more on savings than consumption—which of course would have serious global impact given the size of China’s economy. The ratio of PCE to GDP in the US is 68% but only 39% in China, and Chinese consumers today are further reducing discretionary spending and major purchases in a defensive posture.

Furthermore, the consumer is getting more and more stretched. Both household credit card debt and credit card interest rates are at record highs. So, it should be no surprise that 11% of credit-card balances are more than 90 days delinquent, which is the highest delinquency rate since 2012 (coming out of the Global Financial Crisis). On the other hand, according to the St. Louis Fed, household debt service payments as a percentage of disposable personal income remains below pre-pandemic levels at 11.5% (which is the highest post-pandemic reading but stable over the past 3 quarters).

Regardless, I think any significant pullback or technical consolidation to allow the moving averages to catch up would be a buying opportunity into year-end and through 2025, and perhaps well into 2026—assuming the new administration’s policies go according to plan. Adding exposure to cyclical sectors and small caps may be prudent. Yes, the broad indexes are already highly valued, with the mega-cap-dominated S&P 500 and Nasdaq 100 at 22.7x and 27.2X, respectively, but the equal-weighted indexes are more attractively valued, with the equal-weight S&P 500 (RSP) and Nasdaq 100 (QQQE) at 18.0x and 24.0x, and the S&P 600 SmallCap (SPSM) at 16.5x.

Overall, my suggestion to investors in this optimistic Trump 2.0 climate is to not chase the highflyers and instead focus on high-quality businesses at reasonable prices, hold inflation and dollar hedges like gold and bitcoin (both of which are at or near all-time highs), and be prepared to exploit any market correction (such as by buying out-of-the-money put options in advance of a potential pullback while VIX is low) and then buy those high-quality stocks as they begin to rebound for further gains through 2025 and beyond, fueled by massive capex in blockchain and AI applications, infrastructure, and energy leading to better productivity, increased productive capacity, and economic expansion.

When I say, “high-quality company,” I mean one that is fundamentally strong by displaying a history of consistent, reliable, and accelerating sales and earnings growth, positive revisions to Wall Street analysts’ consensus forward estimates, rising profit margins and free cash flow, solid earnings quality, and low debt burden. These are the factors Sabrient employs in selecting our portfolios. We also use many of those factors in our SectorCast ETF ranking model. And notably, our Earnings Quality Rank (EQR) is a key factor in each of these models, and it is also licensed to the actively managed, absolute-return-oriented First Trust Long-Short ETF (FTLS).

Sabrient is best known for our “Baker’s Dozen” portfolio franchise (and offshoot portfolios) based on our process-driven, growth-at-a-reasonable-price methodology, which Sabrient founder David Brown describes in his new book, How to Build High Performance Stock Portfolios. It is available in both paperback and eBook formats on Amazon for investors of all experience levels. It teaches how to methodically and strategically build wealth in the stock market—and it makes a great holiday gift idea. David describes his path from NASA engineer on the Apollo 11 moon landing project to creating quant models for ranking stocks and building stock portfolios in 4 distinct investing styles—growth, value, dividend, or small cap growth. To learn more about David's book and the companion subscription product we offer that does most of the stock evaluation work for you, visit: https://DavidBrownInvestingBook.com

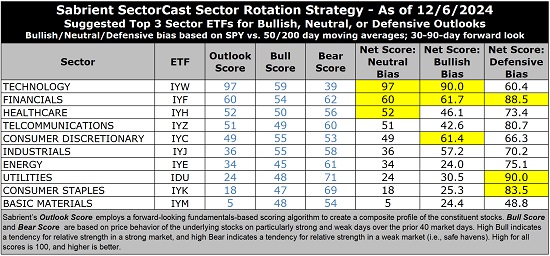

Relative sector rankings are based on Sabrient’s proprietary SectorCast model, which builds a composite profile of each of over 1,400 equity ETFs based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score is a Growth at a Reasonable Price (GARP) model that employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings, and various return ratios. It helps us predict relative performance over the next 3-6 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. A high Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak. Outlook score is forward-looking while Bull and Bear are backward-looking.

As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financials (IYF), Technology (IYW), Industrials (IYJ), Healthcare (IYH), Consumer Staples (IYK), Consumer Discretionary (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500 large cap index, I prefer the iShares for their larger universe and broader diversity.

The table below shows the latest fundamentals-based Outlook rankings and my full sector rotation model. I would call the rankings neutral given that secular growth, cyclicals, and defensives are mixed throughout. Bullish rankings would entail cyclical and economically sensitive sectors dominating the top half of the rankings with scores well above 50 and defensive sectors in the lower half. In the immediate wake of the Fed rate cut and dovish pivot, the rankings were more bullish, but with the market’s renewed strength and broad reductions to earnings estimates, valuation multiples are back to extremes once again as prices have gotten ahead of earnings growth forecasts but boosted by lower interest rates.

Technology (dominated by the mega-cap MAG-7) remains at the top with a near-perfect Outlook score of 97, despite having by far the highest forward P/E (29.7x). However, because of its strong EPS growth estimates (19.1%), its forward PEG (ratio of P/E to EPS growth) is a relatively modest 1.56, which is second lowest only to Financials’ 1.38, so investors are happy to “pay up” for strong growth. Tech also displays strong Wall Street analyst earnings revisions, by far the highest return ratios, and the most insider buying. Rounding out the top 5 are Financials, Healthcare, Telecom, and Consumer Discretionary, followed by Industrials and Energy. Notably, 6 of the 10 sectors have seen net negative revisions to EPS estimates from the analyst community, with only Telecom, Technology, Financials, and Consumer Discretionary positive.

At the bottom of the rankings are Materials and Consumer Staples, mainly due to large negative revisions to earnings estimates, low projected EPS growth rates, mediocre return ratios, and high PEG ratios. Notably, Energy, Telecom, and Financials display the lowest (most attractive) forward P/Es at 14.6x, 14.8x, and 15.8x, respectively.

Keep in mind, the Outlook Rank does not include timing, momentum, or relative strength factors, but rather reflects the consensus fundamental expectations at a given point in time for individual stocks, aggregated by sector.

Sector Rotation Model and ETF Trading Ideas:

Our rules-based Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), has maintained a bullish bias since 9/12, based on the SPY remaining above both its 50-day and 200-day moving averages. (Note: In this model, we consider the bias to be bullish from a rules-based trend-following standpoint when SPY is above both its 50-day and 200-day simple moving averages, but neutral if it is between those SMAs while searching for direction, and defensive if below both SMAs.)

Thus, it suggests holding Technology (IYW), Financials (IYF), and Consumer Discretionary (IYC), in that order. However, if you prefer a neutral stance, the Sector Rotation model still suggests holding the same sectors Technology, Financials, and Healthcare (IYH), in that order. Or, if you prefer to take a defensive stance, it suggests holding Utilities (IDU), Financials, and Consumer Staples (IYK), in that order.

An assortment of other interesting ETFs that are scoring well in our latest rankings include: US Global GO Gold and Precious Metals Miners (GOAU), AXS Esoterica NextG Economy (WUGI), Goldman Sachs Future Consumer Equity (GBUY), US Global Jets (JETS), Invesco Next Gen Media & Gaming (GGME), Hartford Large Cap Growth (HFGO), BNY Mellon Innovators (BKIV), Global X Social Media (SOCL), American Century Focused Dynamic Growth (FDG), iShares ESG Aware MSCI USA Growth (EGUS), Kurv Technology Titans Select (KQQQ), First Trust Active Factor Small Cap (AFSM), Invesco Biotechnology & Genome (PBE), ERShares Private-Public Crossover (XOVR), The Future Fund Active (FFND), iShares Technology Opportunities Active (TEK), Invesco Dorsey Wright Healthcare Momentum (PTH), Zacks Small/Mid Cap (SMIZ), VictoryShares Small Cap Free Cash Flow (SFLO), Invesco Building & Construction (PKB), and TCW Artificial Intelligence (AIFD). All score in the top decile (90-100) of Outlook scores.

As always, I welcome your thoughts on this article! Please email me anytime. Any and all feedback is appreciated. Also, please let me know of your interest in any of Sabrient’s new indexes for ETF investing, such as High-Quality Growth (similar to our Baker’s Dozen model), Quality Growth & Income, SMID-Cap Quality Plus Momentum, High-Quality Technology, High-Quality Energy, Quality Legacy & Green Energy, or Defensive Equity.

IMPORTANT NOTE: I post this information periodically as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I do not update the information on a regular schedule or on technical triggers. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted, but not necessarily on the days that I happen to post this article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ideas mentioned here as a managed portfolio.

Disclosure: At the time of this writing, of the securities mentioned, the author held positions in SPY, QQQ, FTLS, GOAU, bitcoin, and ether.

Disclaimer: Opinions expressed are the author’s alone and do not necessarily reflect the views of Sabrient. This newsletter is published solely for informational purposes only. It is neither a solicitation to buy nor an offer to sell securities. It is not intended as investment advice and should not be used as the basis for any investment decision. Individuals should consider their personal financial circumstances in acting on any opinions, commentary, rankings, or stock selections provided by Sabrient Systems. Sabrient makes no representations that the techniques used in its rankings or analyses will result in profits. Trading involves risk, including possible loss of principal and other losses, and past performance is no guarantee of future results. Investment returns will fluctuate, and principal value may either rise or fall. Sabrient disclaims liability for damages of any sort (including lost profits) arising from the use of or inability to use its rankings or analyses. Information contained herein reflects our judgment or interpretation at the time of publication and is subject to change without notice.