Despite uncertainties from war, oil, inflation, and interest rates, have stocks put in a bottom?

by Scott Martindale

by Scott Martindale

President & CEO, Sabrient Systems LLC

As the economy has emerged from the pandemic and some sense of normalcy has returned around the world, investors had returned to wrestling with the potential impacts of unwinding 13 years of unprecedented monetary stimulus (QE and ZIRP). But then new uncertainties piled on with the onset of Russian’s invasion of Ukraine, Ukraine’s impressive resistance, and the resulting refugee crisis, not to mention new COVID mutations and some renewed lockdowns – all of which has led to historic inflationary pressures on energy, commodities, and food prices, as well as elevated market volatility.

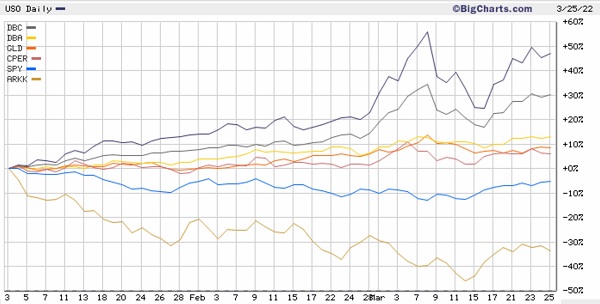

After a solid post-FOMC rally, the CBOE Volatility Index (VIX) fell from a panicky high near 37 – which is more than two sigma above its long-term average of 20 – to close last week at 20.81. At their lows, the S&P 500 had corrected by -13.1% and the Nasdaq Comp by -21.7% (from their all-time high closing prices last November to their lowest close on Monday 3/14/22). But the price action in the SPDR S&P 500 and Tech-heavy Nasdaq 100 over the past few weeks looks very much like a bottoming process going into the FOMC meeting, culminating in a bullish “W” technical formation that broke out strongly to the upside, with recoveries of +9.2% for the S&P 500 and +12.9% for Nasdaq through last Friday. The rally has seen a resurgence in the more speculative growth stocks that had become severely oversold, as illustrated by the ARK Innovation ETF (ARKK), which has risen nearly 25%.

Except for some gyrations in the immediate aftermath of the FOMC announcement, price essentially went straight up. I believe the rocket fuel came from a combination of the Fed providing greater clarity (and not hiking by 50 bps), China’s soothing words (including assurances to global investors and distancing itself from Russia’s aggression), as well as a general fear of missing out (FOMO) among investors on an oversold rally.

Notably, commodities and crude oil have been strong from the start of the year, with oil at one point (March 7) touching $130/bbl after starting the year at $75 (that’s a 73% spike!). For now, oil seems to have stabilized in a trading range, although the future is uncertain and summer driving season is on the horizon. It seems that President Putin finally acting out his goal of restoring historical Russian lands (similar to the jihadist dream of redrawing an Islamic caliphate) may be shaking up our leftists’ utopian vision of a Great Reset and “stakeholder capitalism” and into realizing (at least for the moment) the pitfalls of rapid decarbonization, denuclearization, the embracing of green/renewable energy before the technologies are ready for the role of primary energy source, and the outsourcing of critical energy supplies (the very lifeblood of a modern economy) to mercurial/adversarial dictators. I talk at length about oil production and supply dynamics in today’s post.

So, have we seen the lows for the year in stocks? Is this merely an oversold bounce and end-of-quarter “window dressing” for mutual funds that will soon reverse, or is it a sustainable recovery? Well, my view is that we may have indeed seen the lows, depending upon how the war develops from here, how aggressive the Fed’s actions (not just its language) actually turn out, and how economic growth and corporate earnings are impacted. But I also think there is too much uncertainty – including a possible recessionary dip for one quarter – for there to be new highs in the broad indexes anytime soon. Instead, I think we are in a trader’s market. Although I think stocks will end the year in positive territory, they are unlikely to reach new highs given the vast new disruptions to supply chains and the less-speculative nature of current investor sentiment – meaning that valuations will depend more on earnings growth rather than multiple expansion. In any case, I believe there are many high-quality stocks to be found outside of the mega-cap Tech darlings offering better opportunities.

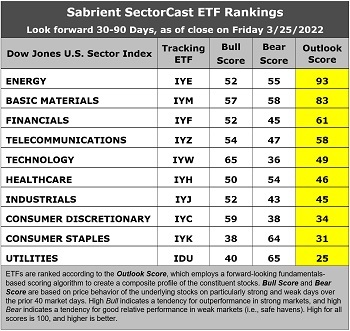

In this periodic update, I provide a comprehensive market commentary, offer my technical analysis of the S&P 500 chart, review Sabrient’s latest fundamentals based SectorCast quant rankings of the ten US business sectors, and serve up some actionable ETF trading ideas. To summarize, our SectorCast rankings reflect a bullish bias, with 4 of the top 5 scorers being cyclical sectors, Energy, Basic Materials, Financials, and Technology. In addition, the near-term technical picture looks weak, but the mid-to-long-term looks like a bottom is in, and our sector rotation model is back in a bullish posture.

Regardless, Sabrient’s Baker’s Dozen, Dividend, and Small Cap Growth portfolios leverage our enhanced Growth at a Reasonable Price (GARP) selection approach (which combines quality, value, and growth factors) to provide exposure to both the longer-term secular growth trends and the shorter-term cyclical growth and value-based opportunities – without sacrificing strong performance potential. Sabrient’s latest Q1 2022 Baker’s Dozen launched on 1/20/2022 and is off to a good start versus the benchmark, led by an oil & gas firm. In addition, the live Dividend and Small Cap Growth portfolios are performing quite well relative to their benchmarks. Read on....

Commentary:

Inflation and interest rates:

Ukraine’s inspiring patriotism, determination, ability to defend itself, and willingness to fight to the death for freedom, along with the crippling sanctions the Western world has placed upon Russia, have led to added pressures on energy and food prices, which of course were already rising due to the combination of immediate recovery in pent-up demand with slow recovery in supply chains (encompassing manufacturing, transportation, logistics, energy, and labor). Wheat prices hit all-time highs, as Ukraine and Russia account for 29% of global exports. Although China is the world’s biggest producer, adverse weather has hurt this year’s crop, contributing to the supply issues. In addition, fresh lockdowns in China due to new outbreaks of COVID mutations (including major Apple supplier/assembler Foxconn) only added to the renewed disruptions.

As a result, the US saw a CPI print of 7.9% last month, the highest level in the last 40 years. Even excluding food and energy, core inflation still gained 6.4% in a month. Moreover, rising wages have not kept pace with the rise in CPI, leading to falling household savings and fears of a dreaded stagflation scenario, which is generally considered to be the worst possible outcome for an economy.

At first, Fed chairman Jerome Powell spooked investors (sending both stocks and bonds down – and rates higher) when he said the Fed would "adjust policy as needed" to bring down inflation, including possibly accelerating rate hikes. This led to fears of a 50-bp hike and an acceleration in the pace of QT (selling off its balance sheet of Treasuries). But when the announcement came in at only 25 bps and Powell asserted that the economy is strong enough to "flourish in the face of less accommodative monetary policy,” it ignited a global rotation of capital from bonds into stocks. This technical selloff in bonds also may have some roots in outlying fears that freezing assets and shutting out the ruble from global markets could lead to “work-arounds” that weaken trust in the dollar-based financial system (as in, who might be canceled next?). But ultimately, I think the bond selloff will prove short-lived, as the high yields will prove too juicy for global investors to ignore, particularly as the global economy slows, supply chains gradually repair, inventories rise, and the dollar continues to show strength. But it won’t be without continued volatility.

Looking at the yield curve, the 2-year T-note is up 214 bps over the past 12 months to 2.28% as of last Friday, while the 10-year is up only 78 bps to 2.49%, so the yield curve has flattened quite a bit, with the 2-10 spread at only 21 bps. Longer term, I do not believe the Fed will be able to “normalize” interest rates over the next couple of years without causing severe pain to the economy and to the stock and bond markets, despite Powell’s assertion that the economy is strong enough to “flourish” under tighter policy. In my view, our economy is simply too levered and “financialized” to absorb a “normalized” level of interest rates. Moreover, raising rates when they are already among the highest (not to mention safest) across developed nations just makes the dollar stronger by attracting global capital. For example, the euro has fallen from a high of $1.23 just 10 months ago to $1.10 today, while the yen has fallen from about 103 per USD at the beginning of 2021 to 122 per USD today. This hurts US multinationals and emerging market debtors (whose debts are typically denominated in dollars).

My regular readers know that I have been expecting supply-driven inflationary pressures to taper off later this year. Consumer demand quickly returned to pre-COVID levels while supply chains have been slow to recover, leading to a spike in excess demand and elevated CPI inflation until supply chains (factories, transport, logistics, energy, labor) fully mend. But although recent events may have delayed that process, I still think the supply-side recovery will get back on track and accelerate as the year progresses, with CPI readings moderating as YoY comps get easier, the dollar remains strong, supply chains continue to repair, velocity of money supply remains low, the global economy cools, and disinflationary structural trends resume. Also worth mentioning, the dollar historically is negatively correlated with CPI, i.e., rising inflation implies a falling dollar; however, during this current episode of supply-driven inflation, the dollar has continued to strengthen, which is perhaps a message about the direction of inflation. Meanwhile, all the Fed can do with its monetary tools is depress demand, spending, and economic growth; it can’t fix supply chains.

For now, industrial production continues to strengthen as inventories are lean, backlogs are elevated, and demand outstrips supply. But resolving rising inflation is a delicate task, especially when interest rates are your only tool. If the Fed attacks inflation by increasing the cost of capital for both businesses and consumers, it is intended to slow the pace of economic growth, and by extension, capital investment, hiring, wage growth, and spending. For individuals with less money, it only takes the slightest rate increase for them to feel the impact. But for those with greater means, it could take multiple increases over a longer time frame before things start to hurt.

In any case, rising oil prices and higher borrowing costs create a de facto tax on consumers’ disposable incomes, and of course, raising taxes is an established fiscal policy tool to reduce excess demand and fight inflation. Furthermore, history shows that stocks tend to thrive during slow, gradual rate hike cycles while the economy is strong, but they don’t fare as well when rates rise rapidly. I expect the former from this Fed chief. Sure, Powell wants to tame inflation, but he also wants to maintain positive economic growth, so, as I have opined in prior posts, I believe he is “talking up” rates for now but likely won’t end up going that far.

Keep an eye on BBB US corporate bond spreads. DataTrek examined them going back to 1997 and found, “…when BBB spreads were over 200 bp, the Fed either lowered the Fed Funds rate, kept it at zero, or paused the rate cycle. Only when BBB spreads have been consistently below 200 bps does the Fed even consider raising rates.” After remaining below 1.20 for most of last year, the spread briefly spiked to a worrisome 185 bps on 3/15/22 but has since pulled back to 164 bps.

Oil and commodity prices:

Let’s talk about the global impact of sanctions on Russian commodity exports, since it is a major exporter of oil, natural gas, coal, potash (for fertilizers), wheat, gold, platinum, palladium (in catalytic converters for cars), nickel (for steel, rechargeable batteries), lumber, iron, steel, aluminum, and copper (the best commercial conductor among non-precious metals). No doubt you have noticed the impact in your community on prices and supply of so many things, ranging from food to gasoline to housing.

Commodities were already on a wild ride even before the Russian invasion. As of Monday, oil is at $112/bbl after touching the $130 mark earlier in March and falling into the mid-90’s mid-Month. Gold is around $1,960/ounce after hitting $2,070 earlier in the month. Copper is at $4.72/lb after touching $5 earlier in the month. The chart below compares United State Oil Fund (USO), Invesco DB Commodity Index Tracking Fund (DBC), Invesco DB Agriculture Fund (DBA), SPDR Gold Trust (GLD), and United State Copper Index Fund (CPER) versus the SPDR S&P 500 Trust (SPY) and the aggressive-growth ARK Innovation ETF (ARKK), illustrating the startling outperformance of oil and commodities.

Focusing on crude oil for a moment, price is historically boom/bust cyclical relative the global economy (not just the US), and it impacts both producers’ cost of production and consumers’ cost of living. The top five producing nations (in order) are the US, Saudi Arabia, Russia, Canada, and China. The US became the world's top crude oil producer in 2018. Due to proximity, Europe has become dependent on Russian energy imports. Also, total trade between Russia and China reached a record $146.9 billion last year. China gets 15% of its imported oil from Russia, making it Russia’s biggest customer, and China depends upon Russia for much of its natural gas and coal supplies as well. Indeed, China may actually benefit from sanctions on Russia by, for example, buying sanctioned products and materials at discounted prices.

According to the International Energy Agency, 3 million bbls/day of Russian oil output will be removed from Western imports due to sanctions beginning in April. Russia is the third-largest oil producer, but it is the largest exporter of oil and refined products. Several of the major multinational oil companies, including Exxon, BP, Shell, and Equinor, have announced they are pulling out of Russia, more recently the big oilfield services companies are doing the same, including Halliburton, Schlumberger, and Baker Hughes. Although Russia can keep the wells flowing on its own, such a loss of expertise will have a significant impact on production over time.

By the way, when a large source of crude oil is removed from the system, it roils the established trades and transport. It is not a simple matter to replace it with another source by asking another country to increase production and reroute transportation lines. Moreover, there are more than 100 different crude oils globally ranging across the spectrum of grades from light/sweet/low-acidity to heavy/sour/high-acidity. Light/heavy refers to the density, sweet/sour refers to the sulfur content, and low/high acidity refers to the corrosiveness. Refinery facilities built to process a given oil can’t necessarily be easily switched around to a substitute, and a different crude oil yields a different refined product mix.

The Organization of Petroleum Exporting Countries (OPEC) is essentially a price-setting cartel. It comprises 13 countries: Algeria, Angola, Congo, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, Saudi Arabia, United Arab Emirates, and Venezuela. The 23-country “OPEC+ alliance” (which includes an additional 10 non-OPEC countries: Azerbaijan, Bahrain, Brunei, Kazakhstan, Malaysia, Mexico, Oman, Russia, South Sudan, and Sudan) controls about half of global oil production, so it has a real influence on market pricing – and you will notice that all are developing countries, and most are non-democratic, authoritarian, or otherwise adversarial with the West. In the face of international pressure to increase production to make up for the shortfall from sanctions on Russia, the OPEC+ alliance has held firm with only nominal pre-planned increases while enjoying the windfall from surging prices. And why not? Most of these nations’ leaders are more than happy to watch the developed world flounder while they enjoy the windfall of surging prices.

In response, the Biden Administration is negotiating with the hostile mullahs in Iran to resurrect the nuclear deal that would drop sanctions and put more Iranian oil into the global market. In addition, it has reached out directly to the authoritarian/despotic leadership of Venezuela to increase exports to us. Venezuela has the largest oil reserves in the world, but its production is not even in the top 20 due to mismanagement and underinvestment in the nationalized oil industry. Notably, Chevron has had a long relationship with the country and has been lobbying our federal government to reduce sanctions so they can help Venezuela boost production (by as much as 100%, it claims).

However, instead of schmoozing the despots in Venezuela and Iran, perhaps they also should consider US economic stability and national security by incentivizing domestic production and restoring energy independence, which is well within our grasp. Instead, the Biden Administration continues to discourage domestic hydrocarbon production in the name of climate activism.

To be fair, it’s not just our federal government. Oil companies themselves have become shy to ramp up production given the history of boom-bust cycles, and the last experience with overproduction culminated in the COVID lockdowns, with oil prices literally falling below zero for a brief time leading to many bankruptcies and debt defaults. In addition, many of the shareholders and board members of the large oil companies have pressured management to stop throwing capital at new drilling, as they would rather enjoy the greater earnings and dividends from high oil prices, not to mention the rise in social consciousness in the boardroom (as activist investors have won board seats).

However, it wreaks of hypocrisy when we end up burning the hydrocarbons anyway – especially at economy-crippling prices and sourced from faraway places via environmentally unfriendly seagoing tankers, no less. The economy is nowhere close to being ready to run fully green/renewable, much less in an efficient, economical, and reliable manner. So, if we need more oil than we are currently producing domestically, why not produce the reserves we already have here, embrace the energy independence we need for economic stability and national security during these dangerous and uncertain times, and reduce the need for massive imports that enrich corrupt/adversarial dictators.

Meanwhile, oil rig activity posted only a small 0.1% gain in February, and according to Baker Hughes, the total number of oil and gas rigs in operation in the US is still about 16% below pre-pandemic levels. In fact, according to Rystad Energy, global investment in oil & gas exploration and production peaked eight years ago and has since fallen roughly 65%. Many of the small independent and private domestic oil firms can’t believe their good fortune, as they can confidently invest capex in new drilling to boost production into these high prices (and get insanely rich) without fear that competition from the big guys will bring prices back down. But although these small players are getting rich, their increased production won’t make much of a dent in the undersupply or high prices.

With the Europe Union forsaking Russian gas, it will soon surpass China and Japan as the biggest LNG importer. The timing couldn’t be more perfect for US exporters of shale gas who have recently completed export facility projects on the Gulf Coast. The US will become the world’s largest exporter of natural gas. Why not ramp up domestic oil as well?

Outlook:

Many pundits are claiming that “the Fed put is kaput,” meaning that the Federal Reserve will no longer prop up stocks by reacting dovishly to any sign of market weakness. However, I wouldn’t bet on the Fed sitting idly by during a market panic, as the wealth effect of lofty asset prices has been so important to economic growth. Regardless, I don’t think we are done with volatility. So, my advice is, be prepared for it with hedges and/or mental stops…and avoid panic selling…but staying invested in quality stocks.

Q4 2021 real GDP expanded at an annualized rate of 7.0%, according the BEA’s second estimate, versus 2.3% in Q3. It was the strongest expansion since the record of 33.8% in Q3 2020. The Conference Board’s Leading Economic Index (LEI) increased to a strong 119.9 in February (versus the baseline of 100 in 2016), and the U.S. economy has never entered a recession when LEI is high and rising. Still, the Conference Board expects US economic growth to fall to a still-robust 3.5% rate for full-year 2022, although the Atlanta Fed’s GDPNow model is showing a Q1 slowdown to 0.9% before getting back on track in Q2.

As for Q4 2021 corporate earnings, S&P 500 companies in aggregate reported EPS growth of 31% (the fourth straight quarter above 30%, with 76% of the companies exceeding estimates), as well as strong free cash flow and a robust net margin of 12.4%, which is up from 11.0% from 12 months ago. Yes, it was another strong quarter for both GDP and earnings growth. However, growth is going to be more difficult going forward as YoY comps get harder and supply-driven inflation pressures will likely boost production costs and depress consumer spending. On that latter note, US consumer sentiment fell to the lowest level since 2011 and pending home sales declined given tight housing inventory (as surging prices have failed to free up sufficient supply).

As for valuations, the -4.4% YTD decline in the S&P 500 is explained primarily by multiple contraction, given that 2022 EPS estimates are expected to rise. The next-12-months (NTM) forward P/E ratio for the S&P 500 (SPY) is 19.2x, which is -11.5% lower than the 21.7x level at the start of the year. Nonetheless, small and mid-cap valuations have also fallen, and they display far lower valuations than their larger cousins – perhaps offering more compelling investment opportunities. For example, the Russell 2000 small caps (IWM) displays a forward P/E of 14.6x, while the S&P 600 small caps (SLY) is 13.6x, which is about 20% below its 5-year average. Notably, SLY has an inherent quality bias (versus the Russell 2000) due to its requirement of positive reported earnings for both the most recent quarter and for the sum of its trailing four consecutive quarters). Similarly, the quality-biased S&P 400 mid-caps (MDY) has a forward P/E of 14.7x.

Thus, let me reiterate from prior posts that rather than investing in the major cap-weighted indexes, I think investors can find better opportunities this year among high-quality stocks outside of the Big Tech favorites that dominate the cap-weighted S&P 500 and Nasdaq 100, namely FANGMAT – Facebook, Apple, NVIDIA, Google, Microsoft, Amazon, Tesla. I’m talking about well-positioned stocks with lower valuations and/or higher growth rates, including both value/cyclicals and high-quality, digital, secular-growth names that enjoy high gross margins and pricing power, with many coming from the small-mid (aka SMID) capitalizations.

In that vein, when Sabrient creates new Baker’s Dozen, Dividend, and Small Cap Growth portfolios, our quantitative growth-at-a-reasonable-price (GARP) model tells us where to find (often “under the radar”) stocks displaying attractive valuations for strong and reliable earnings growth estimates. We employ a similar model for our ETFCast rankings of over 1,000 equity ETFs. And in today’s environment, Energy and Materials stocks and ETFs continue to score at or near the top, so you will find exposure to these sectors in our portfolios. In addition, I reveal some of the higher--scoring ETFs in the Sector Rankings section below.

SPY Chart Review:

The SPDR S&P 500 Trust (SPY) closed Friday at 452.69. We got a nice technical washout that retested the 2022 lows, culminating in a “W” pattern on the daily chart that broke out strongly to the upside, with the SPY up +9.2% from its 3/14/22 low. Positive divergences in oscillators RSI and MACD foreshadowed the potential rally, and price is back above both its 50-day and 200-day simple moving averages (SMA). However, on the negative side, we see Bollinger Bands are stretched wide and ready to reverse, the ”death cross” of the 50-day cutting down through the 200-day occurred mid-month, the 100-day SMA is providing resistance, volume has tapered off as the rally has progressed, oscillators RSI, MACD, and Slow Stochastic all look ready to roll over, and Friday’s trading ended with a something close to a bearish hanging man candlestick pattern.

So, net-net, the daily chart looks bearish for at least a mild pullback. If you pull up weekly and monthly charts, it appears to me that the weekly is bullish and the monthly may be putting in a bottom. So, I’m optimistic that the bottom is in, even if we have more volatility in store for the next several months.

Latest Sector Rankings:

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each of over 1,000 equity ETFs based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings, and various return ratios. It helps us predict relative performance over the next 2-6 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. A high Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financials (IYF), Technology (IYW), Industrials (IYJ), Healthcare (IYH), Consumer Staples (IYK), Consumer Discretionary (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500 large cap index, I prefer the iShares for their larger universe and broader diversity.

Here are some of my observations on this week’s scores:

1. The rankings continue to look bullish, topped by deep cyclicals Basic Materials, Energy, and Financials with impressive Outlook scores of 93, 83, and 61, respectively, which is largely unchanged. You would expect strength in these cyclical sectors given their high earnings leverage within an expansionary economy and solid oil and commodity prices. Basic Materials displays strong analyst sentiment (recent positive net revisions to EPS estimates), a low forward P/E of 12.0x, strong projected EPS growth of 23.4%, and an ultra-low forward PEG of just 0.51. Energy also enjoys strong analyst sentiment, the lowest forward P/E of 11.6x, good projected EPS growth of 12.0%, and an attractive forward PEG (forward P/E divided by projected EPS growth rate) of 0.97, and strong insider sentiment. After dwelling in or near the cellar for much of the past few years, Energy has remained as firmly entrenched at the top as it was previously entrenched at the bottom – helped of course by strong oil prices. Rounding out the top six are Telecom, Technology, Healthcare, and Industrials, which is a solidly bullish group.

2. At the bottom are defensive sectors Utilities and Consumer Staples with Outlook scores of 25 and 31, respectively. Both are low (but stable) growth sectors that should be expected to score lowest in a surging, inflationary economy. They display high forward P/Es, the lowest projected EPS growth rates, and thus the highest forward PEGs of 3.34 and 2.52, respectively.

3. Looking at the Bull scores, Technology has the top score of 65 as stocks within the sector have displayed relative strength on strong market days. Consumer Staples scores the lowest at 38. The top-bottom spread is 27 points, which reflects quite low sector correlations on strong market days. It is desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the market segments and stocks they want to hold.

4. Looking at the Bear scores, Consumer Staples scores the highest of 65 followed closely by Utilities at 64, as stocks within these defensive sectors have been the preferred safe havens on weak market days. Technology displays the lowest score of 36, as investors have fled the sector during market weakness. The top-bottom spread is 29 points, which reflects quite low sector correlations on weak market days. Ideally, certain sectors will hold up relatively well while others are selling off (rather than broad risk-off behavior), so it is desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points.

5. Basic Materials displays the best all-around combination of Outlook/Bull/Bear scores, while Utilities is the worst. Looking at just the Bull/Bear combination, Energy is the best, indicating superior and consistent relative performance (on average) in extreme market conditions whether bullish or bearish, while Industrials is the worst.

6. This week’s fundamentals-based Outlook rankings display a highly bullish bias given that 4 of the top 5 sectors are economically-sensitive or cyclical (Energy, Materials, Financials, Technology), while the more defensive sectors (Utilities and Staples) are relegated to the bottom. Keep in mind, the Outlook Rank does not include timing, momentum, or relative strength factors, but rather reflects the consensus fundamental expectations at a given point in time for individual stocks, aggregated by sector.

ETF Trading Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), has moved back to a bullish bias with two consecutive daily closes above both the 50-day and 200-day moving averages, even though the 50/200 death cross is still in play. Nevertheless, I’m going to call it bullish, which suggests holding Technology (IYW), Basic Materials (IYM), and Energy (IYE), in that order, even though we have likely entered a range-bound trader’s market rather than a trending market. (Note: In this model, we consider the bias to be bullish from a rules-based trend-following standpoint when SPY is above both its 50-day and 200-day simple moving averages.)

If you prefer a neutral bias, the Sector Rotation model suggests holding Energy, Basic Materials, and Financials (IYF), in that order. Or, if you are more comfortable with a defensive stance, the model suggests holding Basic Materials, Energy, and Consumer Staples, in that order. So, in all three cases, the model suggests holding Energy and Materials.

An assortment of other interesting ETFs that are scoring well in our latest rankings include: Van Eck Vectors Steel (SLX), First Trust Indxx Natural Resources Income (FTRI), Pacer US Cash Cows Growth (BUL), WBI BullBear Yield 3000 (WBIG), First Trust Dorsey Wright Momentum & Value (VDLU), Invesco Dynamic Energy Exploration & Production (PXE), iShares MSCI Global Energy Producers (FILL), Avantis US Small Cap Value (AVUV), SPDR S&P Metals & Mining (XME), First Trust Natural Gas (FCG), SPDR S&P North American Natural Resources (NANR), Virtus Private Credit Strategy (VPC), WBI BullBear Quality 3000 (WBIL), Fidelity Stocks for Inflation (FCPI), First Trust Morningstar Dividend Leaders (FDL), Invesco S&P SmallCap Energy (PSCE), ETFMG Treatments Testing and Advancements (GERM), AdvisorShares Alpha DNA Equity Sentiment (SENT), and Vanguard US Multifactor (VFMF).

As always, I welcome your thoughts on this article! Please email me anytime. Any and all feedback is appreciated!

IMPORTANT NOTE: I post this information periodically as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I do not update the information on a regular schedule or on technical triggers. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted, but not necessarily on the days that I happen to post this article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ideas mentioned here as a managed portfolio.

Disclosure: At the time of this writing, the author held no positions in the securities mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any opinions, commentary, rankings, or stock selections provided by Sabrient Systems or its wholly owned subsidiary, Gradient Analytics. Sabrient makes no representations that the techniques used in its rankings or analysis will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.