Sector Detector: Prognosis for inflation, Fed policy, and the 60/40 portfolio

by Scott Martindale

by Scott Martindale

President & CEO, Sabrient Systems LLC

Investors found optimism and “green shoots” in the latest CPI and PPI prints. As a result, both stocks and bonds have rallied hard and interest rates have fallen on the hope that inflation will continue to subside and the Fed will soon ease up on its monetary tightening. Still, there is a lot of cash on the sidelines, many investors have given up on stocks (and the longstanding 60/40 stock/bond allocation model), and many of those who are the buying the rally fear that they might be getting sucked into another deceptive bear market rally. I discuss in today’s post my view that inflation will continue to recede, stocks and bonds both will gain traction, and what might be causing the breakdown of the classic 60/40 allocation model—and whether stocks and bonds might revert back to more “normal” relative behavior.

Like me, you might be hearing highly compelling and reasoned arguments from both bulls and bears about why stocks are destined to either: 1) surge into a new bull market as inflation falls and the Fed pivots to neutral or dovish…or 2) resume the bearish downtrend as a deep recession sets in and corporate margins and earnings fall. Ultimately, whether this rally is short-lived or the start of a new bull market will depend upon the direction of inflation, interest rates, and corporate earnings growth.

The biggest driver of financial market volatility has been uncertainty about the terminal fed funds rate. DataTrek observed that the latest rally off the October lows closely matches the rally off the 12/24/2018 bottom, which was turbocharged when Fed Chair Jerome Powell backed down from his hawkish stance, which of course has not yet happened this time around. Instead, Powell continues to actively talk up interest rates (until they are “sufficiently restrictive”) while trying to scare businesses, consumers, and investors away from spending, with the goals of: 1) demand destruction to push the economy near or into recession and raise unemployment, and 2) perpetuate the bear market in risk assets (to diminish the “wealth effect” on our collective psyche and spending habits). Powell said following the November FOMC meeting that it is “very premature” to talk about a pause in rate hikes.

Indeed, the Fed has been more aggressive in raising interest rates than I anticipated. And although some FOMC members, like Lael Brainard, have started opining that the pace of rate hikes might need to slow, others—most notably Chair Powell—have stuck unflinchingly with the hawkish inflation-fighting jawboning. However, I think it is possible that Powell has tried to maintain consistency in his narrative for two reasons: 1) to reduce the terminal fed funds rate (so he won’t have to cut as much when the time comes for a pivot), and 2) to not unduly impact the midterm election with a policy change. But now that the election has passed and momentum is growing to slow the pace given the lag effect of monetary policy, his tune might start to change.

As the Fed induces demand destruction and a likely recession, earnings will be challenged. I believe interest rates will continue to pull back but will likely remain elevated (even if hikes are paused or ended) unless we enter a deep recession and/or inflation falls off a cliff. Although the money supply growth will remain low, shrinking the Fed balance sheet may prove challenging due to our massive federal budget deficit and a global economy that is dependent upon the liquidity and availability of US dollars (for forex transactions, reserves, and cross-border loans)—not to mention the reality that a rising dollar exacerbates inflationary pressures for our trading partners and anyone with dollar-denominated debt.

Thus, the most important catalyst for achieving both falling inflation and global economic growth is improving supply chains—which include manufacturing, transportation, logistics, energy, and labor. Indeed, compared to prior inflationary periods in history, it seems to me that there is a lot more potential on the supply side of the equation to bring supply and demand into better balance and alleviate inflation, rather than relying primarily on Fed policy to depress the demand side (and perhaps induce a recession). The good news is that disrupted supply chains are rapidly mending, and China has announced plans to relax its zero-tolerance COVID restrictions, which will be helpful. Even better news would be an end to Russia’s war on Ukraine, which would have a significant impact on supply chains.

In any case, it appears likely that better opportunities can be found outside of the passive, cap-weighted market indexes like the S&P 500 and Nasdaq 100, and the time may be ripe for active strategies that can exploit the performance dispersion among individual stocks. Quality and value are back in vogue (and the value factor has greatly outperformed the growth factor this year), which means active selection is poised to beat passive indexing—a climate in which Sabrient's GARP (growth at a reasonable price) approach tends to thrive. Our latest portfolios—including Q4 2022 Baker’s Dozen, Forward Looking Value 10, Small Cap Growth 36, and Dividend 41 (which sports a 4.8% current yield as of 11/15)—leverages our enhanced model-driven selection approach (which combines Quality, Value, and Growth factors) to provide exposure to both: 1) the longer-term secular growth trends and 2) the shorter-term cyclical growth and value-based opportunities.

By the way, if you like to invest through a TAMP or ETF, you might be interested in learning about Sabrient’s new index strategies. I provide more detail below on some indexes that might be the timeliest for today’s market.

Here is a link to a printable version of this post. In this periodic update, I provide a comprehensive market commentary (including constraints on hawkish Fed actions and causes of—and prognosis for—the breakdown of the classic 60/40 portfolio), discuss the performance of Sabrient’s live portfolios, offer my technical analysis of the S&P 500 chart, review Sabrient’s latest fundamentals based SectorCast quant rankings of the ten U.S. business sectors, and serve up some actionable ETF trading ideas. To summarize, our SectorCast rankings reflect a modestly bullish bias, the technical picture looks short-term overbought but mid-term bullish, and our sector rotation model has moved from a defensive to neutral posture. Read on...

Market commentary:

Investors continue to be frustrated with the high correlation among asset classes, and many are calling the traditional 60/40 stock/bond portfolio “dead.” (They said the same about Value not long ago.) Indeed, in today’s world in which broad market indexes are dominated by growth stocks, rising rates (and falling bond prices) tend to depress valuations (from a discounted cash flow standpoint). Back when the broad indexes were largely dominated by industrial conglomerates, cyclical sectors, value stocks, and dividend payers, the stock/bond correlations were low and usually inversely related. But as money flowed into growth stocks—particularly starting in 2015 when the market became quite narrowly focused on mega-cap Tech and the “FAANG” acronym was born—it ultimately became so imbalanced that in 2021, the Nasdaq index return would have been 35 pps lower without the five biggest tech stocks, according to DataTrek. Stocks and bonds became gradually more correlated—but never more than this year’s correlation spike.

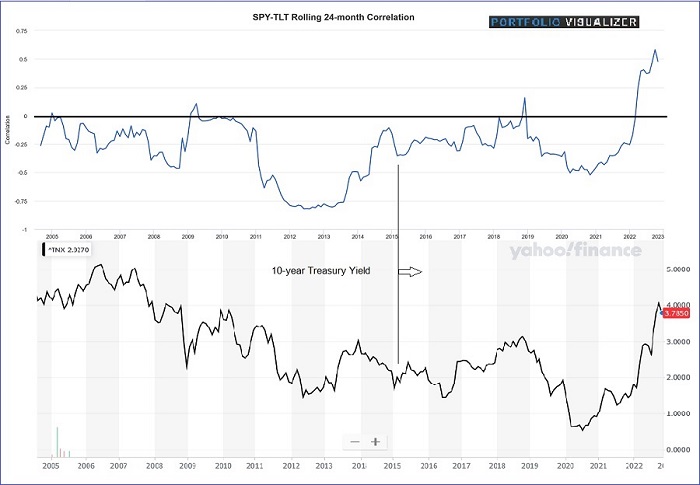

As shown in the upper chart below, stocks and bonds—as represented by the SPDR S&P 500 (SPY) and iShares 20+ Year Treasury Bond ETF (TLT)—have been mostly uncorrelated or inversely correlated until this year. The lower chart shows the 10-year Treasury note yield over the same timeframe (mid-2004 through current). Although there wasn’t a discernable correlation between the 10-year yield and stock/bond correlation prior to 2015, my observation is that there has been a visible correlation between rising (or falling) yields and rising (or falling) stock/bond correlation. Again, I would attribute this to the predominance of growth stocks (whose valuations are so sensitive to interest rates on a discounted cash flow basis) on the broad cap-weighted market indexes. This might imply that as 1) value stocks re-emerge in importance and popularity and 2) interest rates fall, the correlation between stocks and bonds may fall…and the 60/40 model just might regain its luster. From the chart, it appears that 3% might be the magic number (particularly if value/cyclical sectors like Energy, Materials, and Industrials can regain at least a little of their past prominence in the major indexes). I think this is achievable so long as the Fed can refrain from pumping up the money supply well beyond the rate of GDP growth, which tends to induce speculative growth investing.

As an interesting side note, the Energy sector allocation in the S&P 500 today has risen from about 2.3% to 5.4% over the past couple of years. However, we surely won’t again see anything like 1980, when the Energy sector represented a third of the S&P 500, and the largest companies in the world were industrial conglomerates or vertically integrated oil companies. In fact, 6 of the 10 largest companies in the S&P 500 were oil companies (Exxon, Standard Oil of Indiana, Schlumberger, Mobil, Standard Oil of California, Atlantic Richfield). Even as recently as 2013, Exxon-Mobil (XOM) was generating more profits than Apple (AAPL) and competing with it for the top spot as the largest publicly traded company. Remarkably, even given Energy’s recent resurgence, AAPL (5.9%) and Microsoft (MSFT, 5.6%) individually are larger than the aggregate market cap of the entire Energy sector within the S&P 500 (5.4%).

Notably, as oil demand grows while oil companies slash capex on exploration, their free cash flow and earnings are surging. According to Rystad Energy, the world's oil companies are spending half a trillion dollars per year less on exploration than in 2014.

Inflation and Fed policy:

Inflation is showing encouraging signs of retreating due to both demand destruction and mending supply chains. Although the midterm election results (and lack of the expected “red wave”) mean we are unlikely to see greater support for domestic oil & gas exploration & production, there may be sufficient gridlock to prevent new profligate spending bills. Longer term, productivity-enhancing technologies continue to proliferate along with other disinflationary structural trends, which I believe will reverse the troublesome recent trend in labor productivity and help to contain costs and boost profitability—leading to rising corporate earnings and real wages, which together would suggest a healthy and sustainable economy and stock market.

After peaking at +9.1% YoY in June, the Consumer Price Index (CPI) rose +0.4% MoM in October (below the expected +0.6%) and +7.7% from a year ago. The core CPI, which excludes food and energy, rose +0.3% (below the expected +0.5%) and +6.3% YoY. In addition, real average hourly earnings declined -0.1% MoM in October and -2.8% YoY, while average weekly earnings are down -3.7% YoY. According to Capital Economics, “The clearest evidence of disinflation was the 0.4% m/m fall in core goods prices, which we expect has much further to run – as easing shortages and the stronger dollar feed through. That echoes the message from the October NFIB survey, released earlier this week, which showed that markedly fewer firms are planning price rises…the fading of price pressures in the goods sector alone is set to drive core inflation much lower from here…”, given their strong historical correlation.

In response to the lower-than-expected CPI print last Thursday, the speculative ARK Innovation ETF (ARKK) soared 15% and then added another 8% on Friday, which were its largest single-day and 2-day gains ever. Moreover, bond prices soared (and yields cratered), while bond volatility cratered and credit spreads tightened, which are positive signs for both bonds and stocks.

Then earlier this week, the Producer Price Index (PPI) report showed a +0.2% MoM increase in October (below the expected +0.4%) and +8.0% YoY, lifted by energy and food prices. Excluding food and energy, it was unchanged MoM in October and up +6.7% YoY. Although the trends are certainly encouraging—as evidenced by the strong market reaction to CPI and PPI—producer price inflation remains at a slightly higher pace than consumer prices, which suggests profit margins are being crimped. However, final demand services PPI saw its first decline since November 2020.

After the November FOMC meeting (before the latest CPI/PPI numbers were released), the formal statement said the committee would take into consideration its “cumulative tightening” as well as “lags with which monetary policy affects economic activity and inflation.” Scott Minerd of Guggenheim opined that their statement was an “articulate way of being dovish without being [explicitly] dovish.” But during the Q&A session, Powell said, “It is very premature to be thinking about pausing…We think we have a ways to go.” And he concluded with, “The last thing I’ll say is that I would want people to understand our commitment to getting this done and to not making the mistake of not doing enough or the mistake of withdrawing our strong policy and doing that too soon.”

However, in my view, a mild recession is one thing, but our elected politicians (unlike the unelected FOMC members) are not likely to stand idly by if the economy (and especially the working class) gets crushed, so I expect a pause (or neutral pivot) sometime after the December meeting, in early 2023, to at least allow the tightening enacted thus far some time to take full effect, which typically takes 9-12 months for each action to show its impact. What would force the Fed’s hand to pause, in my view, would be the combination of a falling housing market, irate bond vigilantes, and overseas sovereign debt crises stemming from an ultra-strong dollar (which creates widespread dumping of US Treasuries by our trading partners so they can bolster their own currencies and debt—for example, the Japanese yen has fallen more than 20% versus the dollar this year).

When the Fed is ready to pivot, it will have to be carefully choreographed. The way I see it, first the hawkish language will soften. Then, rate hikes will slow and then pause. As inflation readings retreat and/or recession sets in, the cuts will start (likely slowly at first). But of course, Powell can’t start telegraphing a pivot now (like Lael Brainard seems to be doing) or he upends his carefully crafted and unwavering rhetoric that has been meant to “talk up” interest rates and demand destruction without having to actually implement overt actions that later must be reversed.

As an interesting aside, let’s hear from Warren Mosler, affectionately known as the father of (the questionable) post-Keynesian Modern Monetary Theory. He said, “Lifting interest rates is the opposite of what [the Fed] should do…And raising rates pays interest only to the people in society who already have assets. It is the equivalent of Universal Basic Income for rich people…The government currently increases the deficit to pay interest on its debt, so higher interest rates increase the deficit and money in the system, and this lifts inflation…If a government wants to reduce demand…it should cut interest rates to 0% (keep them there forever), raise taxes, and/or cut federal spending.”

Jeff Brown of Brownstone Research opined, “If we wanted to get inflation down, we’d make sure companies had access to the capital they needed to secure and increase supply. That added production would push down prices and lower the CPI. But with raising interest rates, it will be more difficult for these companies to access the funds needed to expand production. And this will likely exacerbate the supply chain problems.”

Goldman Sachs economists expect core PCE to decline to 2.9% by December 2023 from 5.1% currently, reflecting weaker commodity prices, improving supply chains, falling shelter inflation, and slowing wage growth. They expect the supply-constrained goods categories will swing negative, which would account for nearly half of their expected slowdown in overall core inflation. Already, inventories have recovered substantially, ranging from cars and consumer goods to semiconductors.

Finally, from Alpine Macro, “Compared with Eurasia, America’s inflation problem seems cyclical rather than secular, and the momentum behind rising prices is reversing. This is important because disinflation, if it persists, usually leads to a virtuous cycle of falling bond yields, strengthening growth, and rising asset prices… any news of a weakening economy is good for capital markets, and there is increasing evidence of a rapid loss of economic momentum, contraction in manufacturing activity and capital investment, a weakening housing market, and softening in the labor market in the US…Assuming June was the peak in CPI inflation, history shows that inflation cycles are symmetric in their rise and fall, so the rapid rise should by followed by a rapid fall, putting inflation back to the 2% level by the end of 2023 or early 2024…Thus, being long both stocks and bonds should be profitable over the next 12-18 months.”

As I discussed in my blog post last month, hawkish U.S. monetary policy severely impacts the rest of the world. As a recent Bloomberg headline said, “The US is Exporting Inflation, and Fed Hikes Will Make It Worse.” With near 4% yields on short-duration Treasury bonds, stronger economic growth than most countries, and stable capital markets, the dollar (although slightly down from its recent peak) remains near a 20-year high relative to other currencies, while the combined impact of supply shortages and currency devaluation for most of our trading partners and emerging markets has been devastating, often leading to capital flight (mostly to the U.S.), hyperinflation, dissension, and emigration. Hyper-financialization of the global economy also means that rising rates cripple housing markets and debt-addicted businesses and governments, including our own sky-high federal debt ($31 trillion, of which $25 trillion is public debt on which interest payments must be made).

Thus, I believe the Fed will not only be willing to live with inflation somewhat above its 2% goal, but it may become an intentional tactic within a coordinated global monetary policy (a la the 1985 “Plaza Accord”) that seeks to weaken the dollar and gradually “inflate away” the massive debt loads across the world.

Final thoughts:

A compelling bearish thesis is that the long-running bull market was driven by low inflation, low interest rates, QE, world peace, and globalization. However, as those favorable variables have reversed, valuation multiples (P/E) must ultimately revert to the lower levels of yore. However, I do not believe these variables have permanently reversed. I think inflation and interest rates will moderate, and onshoring and other forms of “deglobalization” will turn out to be simply some “deconcentration” of manufacturing away from China (and Taiwan, for semiconductors)—and the secular disinflationary and productivity-enhancing macro trends will resume.

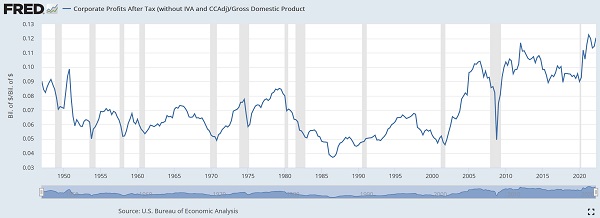

As DataTrek recently observed, multiple compression occurs when “investors lose faith in either corporate earnings power or the predictability of Fed monetary policy…neither is currently an outsized factor in setting daily stock prices. We are, after all, trading at 21x likely recession-level earnings rather than 15-16x.” Furthermore, they point out that U.S. corporate profits as a percentage of GDP are near an historic high (around 12%), as shown in the chart below (as of Q2 2022).

Of course, the future direction of equities hinges on the trajectory of corporate earnings and interest rates, both of which are largely at the mercy of the trajectory of inflation, Fed monetary policy decisions, and the state of the economy (e.g., recession). I have opined for months that inflation and bond yields have been in volatile topping patterns (which finally may be starting to recede), including the recent "blow-off top" in the 10-year Treasury yield (which spiked as high as 4.33% on 10/20 before falling below 3.8% following the October CPI print).

Furthermore, it seems that rather than investing in the broad passive indexes, the time may be ripe for active strategies that can exploit the performance dispersion among individual stocks. On that note, Sabrient’s new portfolios—including the new Q4 2022 Baker’s Dozen, Forward Looking Value 10, Small Cap Growth 35, and Dividend 41—leverage our enhanced model-driven selection approach (which combines Quality, Value, and Growth factors) to provide exposure to both the longer-term secular growth trends and the shorter-term cyclical growth and value-based opportunities.

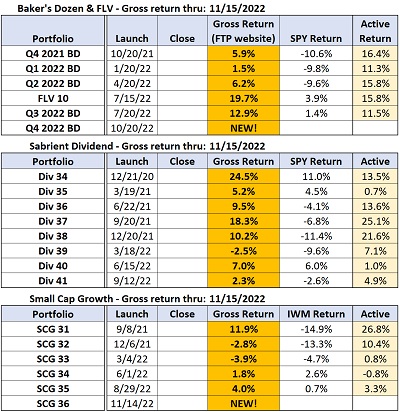

You can see in the table below that all 18 of 18 live portfolios are outperforming (or staying within 1% of) their benchmarks from inception thru Tuesday 11/15 (based on gross total returns as shown on the ftportfolios.com website for portfolios with at least one month of history)—many by significant margins. Note that all the live Baker's Dozen and Forward Looking Value portfolios (other than Q4 2022, which just launched) are outperforming by double digits:

All portfolios that launched after mid-2021 are overweight (relative to the benchmark) the Energy sector, which continues to score strongly in our SectorCast ETF rankings (as discussed below). In fact, the new Q4 2022 Baker’s Dozen holds 4 Energy names among its 13 positions.

Also of note, our Sabrient Dividend portfolio is different from most high-yielding dividend products in that it seeks both capital appreciation and reliable income by identifying quality companies selling at an attractive price with a solid growth forecast, a history of raising dividends, a good coverage ratio, and a target dividend yield in of 4% or more. Dividend 41 has a current yield of 4.8% as of 11/15.

And for those seeking small cap exposure, which many observers think will lead the market recovery, Sabrient Small Cap Growth 36 launched with 28% Financials and 22% Energy sector allocations. It provides an alpha-seeking alternative to the Russell 2000 ETF.

Sabrient’s new indexes:

For those who like to invest through a TAMP (like SMArtX or AssetMark or Envestnet, for example) or an ETF, you might be interested in learning about Sabrient’s new index strategies. Here are some that we think might be the most timely:

1. Sabrient Armageddon Index was designed to address a growing investor desire for an alternative defensive, low-beta, all-equity portfolio that can minimize losses during economic distress, market dislocation, and tumultuous/volatile conditions (like we have now!) while also offering reasonable upside during normal or bullish market conditions. The rules-based model searches a narrow universe of defensive/all-weather industries like Food/Tobacco, Gold/Mining, Household/Personal, Pharma, Telecom, and Utilities. YTD through 10/31, the 50-stock portfolio shows an active return of +14.4% versus the S&P 500 while also outperforming comparable defensive ETFs.

2. Sabrient Quality Growth Plus Income Index is one of our 10-index Sabrient Quality Index Series that seems particularly timely given the Fed’s evolving policies and the market income-paying strategies. We think of it as an “all-weather” hybrid product that combines capital appreciation potential with a robust dividend yield. YTD through 10/31, the 25-stock portfolio shows an active return of +29.2% versus the S&P 500, while also outperforming various comparable dividend-paying ETFs. The current yield as of the 8/15 rebalance is a robust 5.2%.

3. Sabrient Space Exploration & Sustainability Index leverages our founder’s NASA Apollo 11 background). Our reasoning for combining space with sustainability is based upon putting human settlements on space stations, the moon, or other planets, which would require advances in both technologies. YTD through 10/31, the 30-stock portfolio shows an active return of +14.0% versus the S&P 500 while also outperforming comparable space-themed ETFs.

Each has performed quite well during the market turbulence. Others that might be of current interest include our Insider Sentiment, Earnings Quality Leaders (based on our subsidiary Gradient Analytics’ forensic accounting expertise), SMID Quality Growth, or Legacy Plus Green Energy, among others. Again, let me know if you would like to learn more about accessing any of these themes through a TAMP or an ETF.

SPY Chart Review:

The SPDR S&P 500 Trust (SPY) closed Wednesday at 395.45. In my post last month, I showed on the weekly chart that the 200-week simple moving average (SMA) again provide solid support as it has done for the past decade (other than a very brief moment during the pandemic selloff when it was violated, but quickly recovered). And SPY has been in recovery mode ever since. However, it was struggling for several days with resistance at the 50-day SMA until last Thursday-Friday’s post-CPI rally, which took it above both the 50-day and 100-day SMAs. Now some consolidation is underway, as oscillators RSI, MACD, and Slow Stochastic are all rolling over in tandem with bearish candlestick patterns. Nevertheless, I think the medium-term pattern looks bullish for the next few months.

Latest Sector Rankings:

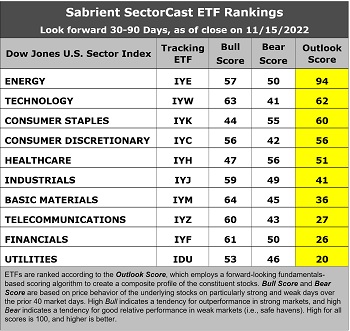

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each of over 900 equity ETFs based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings, and various return ratios. It helps us predict relative performance over the next 2-6 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. A high Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financials (IYF), Technology (IYW), Industrials (IYJ), Healthcare (IYH), Consumer Staples (IYK), Consumer Discretionary (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500 large cap index, I prefer the iShares for their larger universe and broader diversity.

Here are some of my observations on this week’s scores:

1. The rankings are once again led by Energy, with an Outlook score of 94. The sector scores extraordinarily well in the model as it tops the factor rankings for analyst sentiment (recent net revisions to EPS estimates), forward P/E (the lowest and only single digit at 9.5x), and return ratios, while also having a good YoY projected EPS growth rate of 12.5% and the lowest forward PEG (forward P/E divided by projected EPS growth rate) of 0.76. Technology comes in a distant second, with relatively good analyst sentiment, a solid YoY projected EPS growth of 14.4%, a forward PEG of 1.56, and good insider sentiment. Rounding out the top six are Consumer Staples (which has seen a nice pullback in forward P/E), Consumer Discretionary, Healthcare, and Industrials.

2. At the bottom are Utilities, Financials, and Telecom with Outlook scores of 20, 26, and 27, respectively. Utilities has a low (but stable) projected EPS growth rate of only 7.4%, yet it has been bid up to a high forward P/E of 19.3x by income-seeking investors for its dividend yield, which makes it popular as a bond alternative. Financials and Telecom both have forward P/Es below 12x, but otherwise score poorly.

3. Looking at the Bull scores, Basic Materials has the top score of 64, followed by Technology at 63, as stocks within these sectors have displayed relative strength on strong market days. Consumer Staples scores the lowest at 44. The top-bottom spread is 22 points, which reflects low sector correlations on strong market days. It is desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the market segments and stocks they want to hold.

4. Looking at the Bear scores, Healthcare scores the highest at 56, followed by Consumer Staples at 55, as stocks within these sectors have been the preferred safe havens on weak market days. Technology displays the lowest score of 41, as investors have fled the sector during market weakness. The top-bottom spread is 15 points, which reflects somewhat low sector correlations on weak market days. Ideally, certain sectors will hold up relatively well while others are selling off (rather than broad risk-off behavior), so it is desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points.

5. Energy displays by far the best all-around combination of Outlook/Bull/Bear scores, while Utilities is the worst. Looking at just the Bull/Bear combination (investor sentiment indicator), Financials has the highest score, indicating superior and consistent relative performance (on average) in extreme market conditions whether bullish or bearish, while Consumer Discretionary is the worst.

6. This week’s fundamentals-based Outlook rankings display a modestly bullish bias given that 3 of the top 4 sectors are economically sensitive, cyclical, or “all weather,” while defensive sectors Utilities and Telecom are in the bottom 3. The low score for Financials and the high score for Consumer Staples are the main “flies in the ointment.” Keep in mind, the Outlook Rank does not include timing, momentum, or relative strength factors, but rather reflects the consensus fundamental expectations at a given point in time for individual stocks, aggregated by sector.

ETF Trading Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), is in a neutral posture. This suggests holding Energy (IYE), Technology (IYW), and Consumer Staples (IYK), in that order. (Note: In this model, we consider the bias to be neutral from a rules-based trend-following standpoint when SPY is between its 50-day and 200-day simple moving averages.)

If you prefer a defensive bias, the Sector Rotation model suggests holding Healthcare (IYH), Consumer Staples, and Energy, in that order. Or, if you are more aggressively pursuing a bullish stance, the model suggests holding Technology, Energy, and Basic Materials (IYM), in that order. You can see that Energy is suggested in all 3 scenarios.

An assortment of other interesting ETFs that are scoring well in our latest rankings include: Innovator IBD 50 (FFTY), Invesco DWA Energy Momentum (PXI), Invesco S&P 500 Equal Weight Energy (RYE), Invesco S&P SmallCap Energy (PSCE), QRAFT AI-Enhanced US Large Cap Momentum (AMOM), First Trust Energy AlphaDEX (FXN), Alpha Architect US Quantitative Momentum (QMOM), Pacer US Small Cap Cash Cows 100 (CALF), First Trust Natural Gas (FCG), Cambria Value and Momentum (VAMO), Alpha Architect US Quantitative Value (QVAL), Invesco Dynamic Networking (PXQ), WBI BullBear Value 3000 (WBIF), AdvisorShares Dorsey Wright Micro-Cap (DWMC), AdvisorShares Hotel (BEDZ), Kelly Hotel & Lodging Sector (HOTL), Putnam BDC Income (PBDC), First Trust Lunt US Factor Rotation (FCTR), iShares US Home Construction (ITB), and First Trust Indxx Global Agriculture (FTAG). All score in the top decile (90-100) of Outlook scores.

As always, I welcome your thoughts on this article! Please email me anytime. Any and all feedback is appreciated! In particular, please tell me what sections you find the most valuable—commentary, chart analysis, SectorCast scores, or ETF trading ideas / sector rotation model. And please let me know of your interest in a Sabrient index for TAMP or ETF investing!

IMPORTANT NOTE: I post this information periodically as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I do not update the information on a regular schedule or on technical triggers. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted, but not necessarily on the days that I happen to post this article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ideas mentioned here as a managed portfolio.

Disclosure: At the time of this writing, of the securities mentioned, the author held positions in SPY and PSCE.

Disclaimer: Opinions expressed are the author’s alone and do not necessarily reflect the views of Sabrient. This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any opinions, commentary, rankings, or stock selections provided by Sabrient Systems or its wholly owned subsidiary, Gradient Analytics. Sabrient makes no representations that the techniques used in its rankings or analysis will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.