Sector Detector: Inflation and the economy slow, real rates rise, and the Fed is behind the curve

by Scott Martindale

by Scott Martindale

President & CEO, Sabrient Systems LLC

The first half of 2024 looked a lot like the first half of 2023. As you recall, H1 2023 saw a strong stock market despite only modest GDP growth as inflation metrics fell, and H2 2023 continued on the same upward path for stocks despite a slowdown in inflation’s retreat, buoyed by robust GDP growth. Similarly, for H1 2024, stocks have surged despite a marked slowdown in GDP growth (from 4.1% in the second half of 2023 to an estimated 1.5% in the first half of 2024) and continued “stickiness” in inflation—causing rate-cut expectations to fall from 7 quarter-point cuts at the start of the year to just 2 at most.

And yet stocks have continued to surge, with 33 record highs this year for the S&P 500 through last Friday, 7/5. Of course, it is no secret that the primary driver of persistent market strength, low volatility (VIX in the mid-12’s), and an extreme low in the CBOE put/call ratio (around 0.50) has been the narrow leadership of a handful of dominant, innovative, mega-cap Tech titans and the promise of (and massive capital expenditures on) artificial intelligence. But while the S&P 500 is up +17.4% YTD and Nasdaq 100 +21.5% (both at all-time highs), the small cap indexes are flat to negative, with the Russell 2000 languishing -14% below its June 2021 all-time high.

Furthermore, recessionary signals abound. GDP and jobs growth are slowing. Various ISM indexes have fallen into economic contraction territory (below 50). Q2 earnings season kicks off in mid-July amid more cuts to EPS estimates from the analyst community. Given a slowing economy and falling estimates, it’s entirely possible we will see some high-profile misses and reduced forward guidance. So, investors evidently believe that an increasingly dovish Fed will be able to revive growth without revving up inflation.

But is this all we have to show for the rampant deficit spending that has put us at a World War II-level ratio of 120% debt (nearly $35 trillion) to GDP (nearly $29 trillion)? And that doesn’t account for estimated total unfunded liabilities—comprising the federal debt and guaranteed programs like Social Security, Medicare, employee pensions, and veterans’ benefits—estimated to be around $212 trillion and growing fast, not to mention failing banks, municipal pension liabilities, and bankrupt state budgets that might eventually need federal bailouts.

Moreover, the federal government “buying” jobs and GDP in favored industries is not the same as private sector organic growth and job creation. Although the massive deficit spending might at least partly turn out to be a shrewd strategic investment in our national and economic security, it is not the same as incentivizing organic growth via tax policies, deregulation, and a lean government. Instead, we have a “big government” politburo picking and choosing winners and losers, not to mention funding multiple foreign wars, and putting it all on a credit card to be paid by future generations. I have more to say on this—including some encouraging words—in my Final Comments section below.

As for inflation, the Fed’s preferred gauge, Core Personal Consumption Expenditures (PCE, aka Consumer Spending), for May was released on 6/28 showing a continued downward trend (albeit slower than we all want to see). Core PCE came in at just +0.08% month-over-month (MoM) from April and +2.57% YoY. But Core PCE ex-shelter is already below 2.5%, so as the lengthy lag in shelter cost metrics passes, Core PCE should fall below 2.5% as well, perhaps as soon as the update for June on 7/26, which could give the Fed the data it needs to cut. By the way, the latest real-time, blockchain-based Truflation rate (which historically presages CPI) hit a 52-week low the other day at just 1.83% YoY.

In any case, as I stated in my June post, I am convinced the Fed would like to starting cutting soon—and it may happen sooner than most observers are currently predicting. Notably, ever since the final days of June—marked by the presidential debate, PCE release, various jobs reports, and the surprising results in Europe and UK elections, the dollar and the 10-year yield have both pulled back—perhaps on the view that rate cuts are indeed imminent. On the other hand, the FOMC might try to push it out as much as possible to avoid any appearance of trying to impact the November election. However, Fed chair Powell stated last week that the committee stands ready to cut rates more aggressively if the US labor market weakens significantly (and unemployment just rose above the magic 4-handle to 4.1%)—so it appears the investor-friendly “Fed put” is back in play, which has helped keep traders bullishly optimistic. The June readings for PPI and CPI come out later this week on 7/11-12, and July FOMC policy announcement comes out on 7/31.

And as inflation recedes, real interest rates rise. As it stands today, I think the real yield is too high—great for savers but bad for borrowers, which would suggest the Fed is behind the curve. The current fed funds rate is roughly 3% above the CPI inflation forecast, which means we have the tightest Fed interest rate policy since before the 2008 Global Financial Crisis (aka Great Recession). This tells me that the Fed has plenty of room to cut rates and still maintain restrictive monetary policy.

As I have said many times, I believe a terminal fed funds rate of 3.0-3.5% would be the appropriate level so that borrowers can handle the debt burden while fixed income investors can receive a reasonable real yield.

Nevertheless, even with rates still elevated today, I believe any significant pullback in stocks (which I still think is coming before the November election, particularly in light of the extraordinarily poor market breadth) would be a buying opportunity. It’s all about investor expectations. As I’ve heard several commentators opine, the US, warts and all, is the “best house in a lousy [global] neighborhood.” I see US stocks and bonds (including TIPS) as good bets, particularly as the Fed and other central banks inject liquidity. But rather than chasing the high-flyers, I suggest sticking with high-quality, fundamentally strong stocks, displaying accelerating sales and earnings and positive revisions to Wall Street analysts’ consensus estimates.

By “high quality,” I mean fundamentally strong companies with a history of, and continued expectations for, consistent and reliable sales and earnings growth, upward EPS revisions from the analyst community, rising profit margins and free cash flow, solid earnings quality, and low debt burden. These are the factors Sabrient employs in selecting our growth-oriented Baker’s Dozen (primary market for the Q2 portfolio ends on 7/18), value-oriented Forward Looking Value portfolio, growth & income-oriented Dividend portfolio, and our Small Cap Growth portfolio (an alpha-seeking alternative to a passive position in the Russell 2000), as well as in our SectorCast ETF ranking model. Notably, our Earnings Quality Rank (EQR) is a key factor in each of these models, and it is also licensed to the actively managed, absolute-return-oriented First Trust Long-Short ETF (FTLS) as an initial screen.

Each of these alpha factors and how they are used within Sabrient’s Growth, Value, Dividend income, and Small Cap investing strategies is discussed in detail in David Brown’s new book, How to Build High Performance Stock Portfolios, which will be out shortly (I will send out a notification soon!).

In today’s post, I provide a detailed commentary on the economy, inflation, valuations, Fed policy expectations, and Sabrient’s latest fundamentals based SectorCast quantitative rankings of the ten U.S. business sectors, current positioning of our sector rotation model heading into earnings season, and several top-ranked ETF ideas.

Click here to continue reading my full commentary. Or if you prefer, here is a link to this post in printable PDF format. I invite you to share it with your friends, colleagues, and clients (to the extent compliance allows). You also can sign up for email delivery of this periodic newsletter at Sabrient.com.

Market commentary:

Q1 real GDP was a paltry 1.4%, and the Atlanta Fed’s GDPNow model has cut its Q2 estimate once again, down to just 1.5% (from as high as 4.3% expectation back in early May). Also, Friday’s jobs report shows the unemployment rate has ticked up to 4.1% as the mirage of strong jobs growth has been propped up by government deficit spending and hiring rather than true organic growth. The housing market (which is important for the “wealth effect” in our society) continues to weaken, with growing inventory and slowing sales amid persistently high mortgage rates. And although corporate bond spreads remain quite low, they have begun to drift higher, particularly on the lower quality (high yield) end. All of this reflect a slow underlying deterioration from the lag effects of tight Fed monetary policy coupled with a lack of effective and sustainable fiscal stimulus.

The ISM Services Index for June fell into contraction at 48.8, its lowest level since July 2009 (outside of the pandemic lockdowns). The ISM Manufacturing Index declined to 48.5, missing expectations yet again and in contraction (below 50) for 19 of the last 20 months. Prices Paid for both indexes fell, which is disinflationary). For manufacturing, the New Orders component has been in contraction for 20 or the last 22 months. Order Backlogs fell to a dismal 41.7 and has been contracting for 21 straight months, leading to worker furloughs.

So, manufacturing activity is falling, services activity is falling, home sales are falling, and bank credit conditions remain tight. Furthermore, although personal income is still rising, wage growth is slowing, consumer spending has been weakening, and consumer loan and credit card delinquencies have been rising. And then of course, we have the rising federal debt (at nearly $35 trillion), debt/GDP ratio (now 120%, which equates to World War II levels), and debt service (now well over $1 trillion/year), which hinders economic growth. And with sluggish growth overseas and dovish policy actions by foreign central banks, the US dollar has strengthened all year in the forex market—with the Japanese yen in particular continuing to plunge, as the BoJ resists raising rates on its highly indebted economy (which is on the cusp of recession already) in hopes the Fed will soon cut US rates instead. The yen recently hit its weakest level against the dollar since 1986, as it seems to have firmly broken through the 160 USD/JPY level despite valiant intervention from the BoJ to support it. Dollar strength likely was also one of the reasons Saudi Arabia chose to end its 50-year petrodollar arrangement (the other reason being cooperation with BRICS to “de-dollarize” and counter US weaponization of the dollar).

Heading into Q2 earnings season, the bottom-up sell-side analysts’ consensus EPS estimate for the S&P 500 was cut further to just $193.45, which is about 10% lower than last year’s initial forward-looking estimate for Q2 2024 of $214.03. And yet many of the investment banks are still raising their year-end price estimates for the index—which implies further multiple expansion based on an expectation of lower interest rates.

Moreover, high interest rates are harder on small cap companies, which tend to carry more short-term debt (which upon maturity must be rolled over into higher interest rates) than large caps (who tend to hold either little debt or long-term debt at lower rates). On the other hand, many of those same large caps receive a high percentage of revenue from overseas sales and thus face the double-whammy of cash-strapped customers and lower sales totals after the foreign currency is converted back into dollars. I believe the Fed is well aware of all these issues and actually wants to cut rates sooner than later.

Falling inflation and Fed policy prediction:

The Fed’s preferred inflation gauge of Core PCE for May was released on 6/28, and it showed a continued downward trend (albeit still slower than everyone wants to see). It came in at just +0.08% month-over-month (MoM) from April (versus +0.26% in April versus March), and +2.57% YoY (down from +2.78% in April), which mirrors the downtrend we saw earlier for Core CPI (which fell to 3.41% in May from 3.62% in April).

As a reminder, CPI measures the price changes on a fixed basket of goods and services while PCE measures what consumers are actually buying, reflecting behavior shifts like substituting cheaper products. CPI has been consistently higher than PCE mainly due to the difference in impact of Shelter cost, which has a severe lag in the metrics, but real-time rents show a flattening out. While Shelter is 33% of CPI and 42% of Core CPI, it is only about 16% of PCE and 18% of Core PCE. Besides Shelter cost, the main component that has been propping up inflation metrics is Motor Vehicle Insurance, which saw an unusually large, one-time, first-of-year adjustment, which will continue to show up in YoY prints for several more months—but not in the MoM prints.

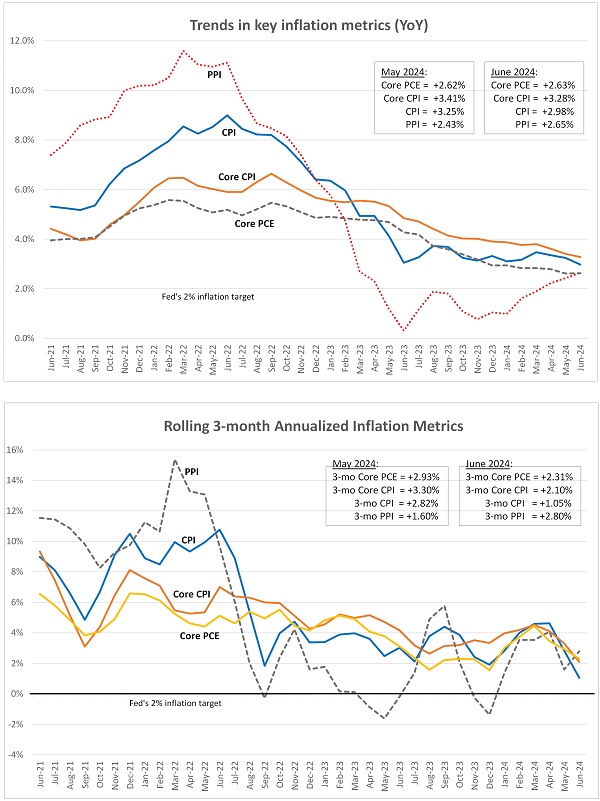

The upper chart below compares the trends since June 2021 in CPI, Core CPI, and Core PCE. It shows that PPI cratered to nearly zero in June 2023 but has been chopping around on a gradual upward path since then. Similarly, headline CPI has gone essentially sideways since June 2023. However, the Core CPI and Core PCE (excluding the volatile food & energy components) have maintained a consistent downward trend from their September 2022 highs.

Furthermore, I also like to examine current inflation trends by computing a rolling 3-month annualized average of MoM readings, as shown in the lower chart below. 3-month Core PCE fell to 2.74% in May from 3.45% in April, and 3-month Core CPI fell to 3.30% in May from 4.11% in April.

So, however you measure it, Core PCE seems well on its way to sub-2.5%. Moreover, Core PCE ex-shelter is already below 2.5%, so as the lag passes, it seems Core PCE will also fall below 2.5%—perhaps as soon as the June release on 7/26. And as I mentioned earlier, the latest real-time, blockchain-based Truflation rate (which historically presages CPI), came in the other day at a 52-week low of just 1.83%. Thus, the Fed may soon have all the data it needs to justify a rate cut. The June readings for PPI and CPI come out later this week on 7/11-12, and the July FOMC policy announcement comes out on 7/31.

Even though the Fed has kept rates “higher for longer” throughout this waiting game on inflation, it has also kept liquidity in the financial system, which of course is the lifeblood of economic growth and risk assets. And corporate credit spreads remain near historic lows even as the economy has slowed and credit pressures have grown (slightly pushing up the high-yield segment as of late).

Inflation erodes purchasing power. Of course, war is inherently inflationary, and no one (except of course the defense industry) benefits from the resulting death, destruction, and wide-ranging, long-term repercussions. Moreover, war is mostly financed through deficit spending, and as it escalates or spreads, it can disrupt supply chains and create outsized demand for scarce resources leading to supply shortages, as well as induce moments of panic in the capital markets.

And massive deficit spending is inherently inflationary as well, particularly on fiscal pet projects, earmarks, boondoggles, student debt forgiveness, and other efforts to “buy votes.” Government wages rose 0.5% MoM and are up 8.5% YoY, which is the largest YoY increase in over 30 years (driven of course by deficit spending). As MacroStrategy Partnership has opined, “More government, especially when deficit-funded, doesn’t solve problems, it is the problem… The empirical evidence is clear, chronic deficits severely erode economic growth.”

I wrote at length in my June post about the inefficacy, destructiveness, and economic death spiral of unfettered deficit spending, and I would encourage you to go back and read it if you haven’t already—particularly my Final Comments section.

Market breadth remains disappointing:

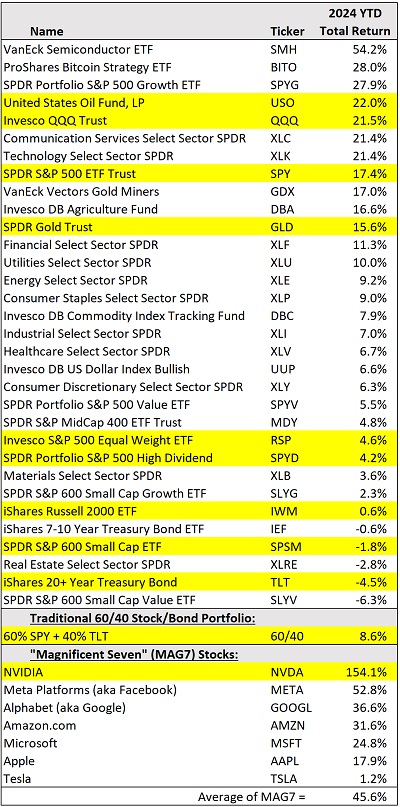

The table below compares YTD performances (through 7/5) of a variety of asset class ETFs, as well as a generic 60/40 portfolio and the MAG-7 stocks. I have highlighted several for discussion purposes. Oil (USO) is up +22.0% and Gold (GLD) is up +15.6%. The Nasdaq 100 (QQQ) is up +21.5%, and SPY is up +17.4%, but the equal-weight S&P 500 (RSP) is up only +4.6%, followed closely by the S&P 500 High Dividend (SPYD) at +4.2%, as the market-leading Tech names typically don’t pay much in the way of dividends and thus don’t qualify for the portfolio. And languishing at the bottom with flat or negative returns are the small cap and Treasury Bond ETFs. Notably, the quality-oriented (stocks must be profitable for admission) S&P 600 (SPSM) at -1.8% is performing worse than the Russell 2000 (IWM) in which roughly 30% of the stocks are unprofitable. And despite the poor showing of the 20+ Treasury ETF (TLT), the generic 60/40 portfolio is up a respectable +8.6%.

Solid market breadth is a sign of confident investors and a healthy stock market. Today, however, the percentage of S&P 500 stocks outperforming index has hit a 50-year record low at about 24%, following last year’s record low. The only previous occurrence of two consecutive years of bad market breadth was 1998-1999. Moreover, although there are plenty of names in the S&P 500 other than NVIDIA (NVDA, +154% YTD) that are up more than 30% YTD, the harsh reality is the historic divergences between SPY:RSP and SPY:IWM, as I discussed in detail in my June post.

The 10 largest stocks by market cap now make up 34% of the S&P 500’s total market cap, and they are responsible for about 75% of the 17.4% YTD total return of the index. As shown in the table, the average gain of the MAG-7 stocks is 45.6%, but the median stock in the index is up only a little over 3%. Furthermore, the S&P 500 InfoTech and Comm Services sectors today make up as large a percentage of the index as they did during the dot-com bubble—but of course, today they also generate a much larger percentage of the S&P 500’s total earnings than they did back then. This is also the reason the S&P 500’s dividend yield is historically low, at about 1.26%, as growth stocks tend not to pay as much in the way of dividends.

The large vs small cap relative performance divergence has continued to worsen since late 2021. The largest firms have huge cash balances and R&D budgets that allow them to lead development of new technologies (like AI) and widen their business “moats.” The largest firms also typically have low debt or cash positions created by issuing long-term bonds during the ZIRP days, and that cash has been earning juicy 5% interest rates in money market funds while awaiting deployment for R&D or capex. On the other hand, small firms (and especially small private companies that are not publicly traded) typically have lower cash balances and shorter-term debt that must be rolled over at today’s higher interest rates.

However, not all the largest companies are participating in the bull market. While some value-oriented titans like Walmart (WMT) and Costco (COST) are performing quite well, popular brands like McDonald’s (MCD), Lululemon (LULU), Starbucks (SBUX), Disney (DIS), and Home Depot (HD) have been struggling…and Nike (NKE) just had the rug pulled out from under it in a big way.

Bespoke Investment Group observed, “In the first half of this year, 23% of trading days saw the S&P's price move in the opposite direction of breadth,” based on net advancers/decliners in the S&P 500. This is another indicator of narrow leadership. Market strength in H1 2024 was characterized by poor breadth (i.e., more stocks down than up, but the biggest stocks were the ones that rose), while market weakness was characterized by greater breadth (i.e., more stocks up than down, but the biggest stocks were the ones that fell). That’s simply not the kind of behavior that characterizes a healthy market. Historically, the strongest bull markets have been characterized by strong breadth and “all boats lifted” behavior.

As for the valuation disparity in the wake of these performance divergences, the forward P/E for the SPDR S&P 500 Technology (XLK) is 29.9x, QQQ 28.0x, and SPY 21.9x; while the equal-weight RSP is 16.4x, SPYD 13.9x, IWM 15.3x, and SPSM is only 14.0x. So, the imbalance is obvious.

Still, many investors believe it is worth it. As Morgan Stanley’s Michael Wilson has opined, “It is paying up for quality, and it’s paying up for growth that is idiosyncratic from the economy, and maybe some defensive properties... I think the market totally makes perfect sense… I think if you get a perfect soft landing, it’s going to be fine. But if you get any aberration from that, it's going to be a problem.” Also, Michael Howell of CrossBorder Capital has opined that investors must take into account the macro backdrop, particularly regarding liquidity, top-down asset allocation, macro-valuation shifts, and aggregate investor behavior as well as central bank policies and how they influence aggregate savings and spending.

Final comments:

I continue to believe there is more of a stock market correction in store this summer (of perhaps 10%)—even if for no other reason than mean reversion and the fact that stocks simply can’t go up in a straight line forever. Okay, it hasn’t been a “straight line” per se, but other than the 5% pullback in April, we have seen little more than late-month consolidation periods from which to launch the next leg up. And the longer it goes on like this, the greater the correction that might ultimately ensue. Certainly, the technicals have become extremely overbought, especially on the monthly charts, which has become quite stretched beyond its 20-month moving average (i.e., the “rubber band effect”). Investors are bound to start suffering from acrophobia (fear of heights).

Regardless, as I said last month, it would be a buying opportunity, in my view. I expect higher prices by year end (no matter who wins the election) and into 2025 as interest rates come down. Central banks around the world are already starting to cut rates and inject liquidity—perhaps as much as $2 trillion to the global economy by some estimates—which should find its way into stocks and bonds. Crossborder Capital reminds us that the best time for investors is when policymakers are trying to stimulate sluggish economies.

So, my view is that the relative safety, big cash positions, low interest-rate exposure, wide protective moats, and reliability/consistency of earnings growth of large caps in general and large-cap Tech in particular means these names should continue to have a prominent place within a diversified equity portfolio. However, the extreme performance and valuation divergences (leading to today’s ultra-low 1.3% yield on the S&P 500) suggests an investor also should hold a broader set of high-quality stocks across market caps and sectors in anticipation of improving market breadth.

Besides stocks and bonds, I also like agency mortgage-back securities (MBS), which are the second largest segment of the US bond market after Treasuries and offer higher yields. They are considered risk-free (or essentially so) given they are issued by either a government agency (GNMA) or a government-sponsored enterprise (FNMA, FHLMC). Commodities also may be a good bet in this environment, including gold and crypto (as hedges against financial disruption or currency devaluation), silver, and copper (which is a primary industrial metal due to its electricity conductivity and the growing demand to power data centers for AI).

Those “Baby Boomers” who are more concerned with return of capital than return on capital have plenty of global macro worries to keep their grand stashes of cash (trillions of dollars) in money market funds. But FOMO can infect anyone, and it will be hard to watch stocks take off while MMF rates fall. The rising price of gold may be foreshadowing a global dovish pivot and massive liquidity support.

Indeed, if interest rates begin to come down toward my 3.0-3.5% target, today’s high valuations can be largely justified given still-solid corporate earnings growth, a high ratio of corporate profits to GDP, and the promise of continued margin growth across all industries due to tremendous improvements in productivity, efficiency, and product development speed from Generative AI, Large Language Models (LLMs), and Big Data.

And regarding our massive federal debt, will we ultimately have to “inflate it away”? Or will unparalleled economic growth ultimately get us out of it? Capital, labor, and productivity are the key inputs to economic growth. So, perhaps it will be massive capital investment leading to historic technological breakthroughs and radical productivity enhancements from artificial intelligence that remakes our lives, economy, and workplace, much like prior gamechangers like the printing press, steam engine, electrical grid, telephone, automobile, personal computer, semiconductors, cellular network, and Internet.

And beyond the near-term promise of Gen AI, LLMs, Big Data, hyperscale data centers, small modular nuclear reactors, and blockchain technology, we can look out further on the horizon to emerging technologies like Artificial General Intelligence (AGI), superconductive graphene, quantum computing…and perhaps the elusive holy grail—the zero-emission, perpetual energy technology of nuclear fusion. But until then, let’s try to stay solvent.

Sabrient Scorecards:

As a reminder, we have a new version of our quantitative Sabrient Scorecards due out shortly based on the investing strategies described in David Brown’s (soon to be launched) new book. The new Scorecard for Stocks is intended to help investors and advisors with stock search, fundamental screening, idea generation, risk monitoring, and confirmation, as well as portfolio construction for four specific investing styles: Growth, Value, Dividend Income, and Small Cap investing. The Scorecard for ETFs will continue in its current form. Both sheets will be posted weekly in Excel format and allow you to see how your stocks and ETFs rank in our system…or for identifying the top-ranked stocks and ETFs (or for weighted combinations of our alpha factors). I will be sending you a formal announcement on the launch of David’s book and the new Scorecards later this month!

For now, the current versions of our Scorecards for stocks and ETFs are still free:

Latest Sector Rankings:

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each of over 1,400 equity ETFs based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score is a Growth at a Reasonable Price (GARP) model that employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings, and various return ratios. It helps us predict relative performance over the next 3-6 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. A high Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak. Outlook score is forward-looking while Bull and Bear are backward-looking.

As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financials (IYF), Technology (IYW), Industrials (IYJ), Healthcare (IYH), Consumer Staples (IYK), Consumer Discretionary (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500 large cap index, I prefer the iShares for their larger universe and broader diversity.

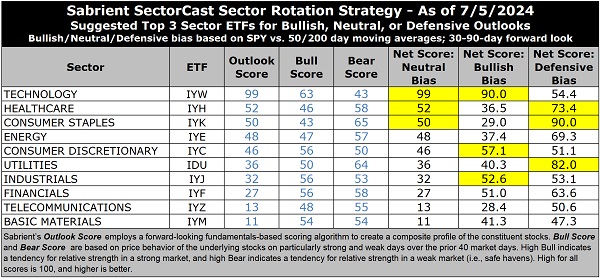

The table above shows the latest fundamentals-based Outlook rankings and my full sector rotation table. The rankings are very similar to last month’s. I would call it a neutral-to-defensive bias given that all-weather, secular-growth Technology stands alone at the top with a near-perfect Outlook score of 99, and everything else is right at the neutral 50 level or lower, with a mix of cyclicals and non-cyclicals throughout. Typically, the most bullish rankings would have cyclical sectors dominating the top of the rankings with scores well above 50. Despite having by far the highest forward P/E at an extreme of 31.3x, Technology (IYW) scores at the top in every other factor with strong forward EPS growth estimates (18.2%), a reasonable forward PEG (ratio of forward P/E to EPS growth) of 1.72, consistently positive earnings revisions from the Wall Street analyst community (while all other sectors are seeing flat or downward revisions to EPS estimates), by far the best return ratios, and by far the best insider sentiment (open market buying).

Then, there’s a big drop-off to the next 4 who are bunched together: Healthcare (IYH) with an Outlook score of 52, Consumer Staples (IYK) at 50, Energy (IYE) at 48, and Consumer Discretionary (IYC) at 46. You can see that 3 of them have the lowest Bull scores well below 50 and solid Bear scores well above 50, which suggests they do better when the markets are weak or stagnant.

Notably, Energy and Telecom (IYZ) display the lowest forward P/Es at 12.4x and 12.5x, respectively, and Financials has the lowest forward PEG of 1.18 (forward P/E of 13.6x and EPS growth estimate of 11.5%). At the bottom remains Basic Materials (IYM) with negative earnings revisions, a relatively high forward P/E (19.4x), and a modest projected growth rate of 9.1%.

Keep in mind, the Outlook Rank does not include timing, momentum, or relative strength factors, but rather reflects the consensus fundamental expectations at a given point in time for individual stocks, aggregated by sector.

ETF Trading Ideas:

Our rules-based Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), retains its bullish bias as the market rally continues (despite the neutral-to-defensive turn in the SectorCast rankings). It was bullish from early November until the market pullback in mid-April when it shifted to neutral (for about 3 weeks) on the S&P 500’s confirmed close below its 50-day moving average. But the model moved back to bullish in early May on the strong close back above the 50-day and remained there ever since. (Note: In this model, we consider the bias to be bullish from a rules-based trend-following standpoint when SPY is above both its 50-day and 200-day simple moving averages, but neutral if it is between those SMAs while searching for direction, and defensive if below both SMAs.)

It continues to suggest holding Technology (IYW), Consumer Discretionary (IYC), and Industrials (IYJ), in that order. However, if you prefer a neutral bias (given the overbought technicals and neutral bias of our quant rankings), the Sector Rotation model suggests holding Technology, Healthcare (IYH), and Consumer Staples (IYK). Or, if you prefer to take a defensive stance on the market, it suggests holding Consumer Staples, Utilities (IDU), and Healthcare, in that order.

An assortment of other interesting ETFs that are scoring well in our latest rankings include: First Trust Natural Gas (FCG), Innovator IBD 50 (FFTY), Invesco Dorsey Wright Consumer Cyclicals Momentum (PEZ), Invesco Next Gen Media and Gaming (GGME), Fidelity Disruptive Communications (FDCF), Invesco Dorsey Wright Healthcare Momentum (PTH), iShares Global Tech (IXN), Global X Social Media (SOCL), AdvisorShares Gerber Kawasaki (GK), PBIM Jennison Better Future (PJBF), iShares Expanded Tech Sector (IGM), Nuveen Growth Opportunities (NUGO), Roundhill Generative AI & Technology (CHAT), Pacer US Small Cap Cash Cows Growth Leaders (CAFG), Global X MLP (MLPA), iShares S&P 500 Growth (IVW), ERShares Entrepreneurs (ENTR), Simplify Volt RoboCar Disruption and Tech (VCAR), Counterpoint Quantitative Equity (CPAI), Invesco S&P 500 Pure Growth (RPG), First Trust Innovation Leaders (ILDR), Amplify Emerging Markets FinTech (EMFQ), ETC 6 Meridian Small Cap Equity (SIXS), and Global X MSCI Argentina (ARGT). All score in the top decile (90-100) of Outlook scores.

As always, I welcome your thoughts on this article! Please email me anytime. Any and all feedback is appreciated! In particular, please tell me what sections you find the most valuable—commentary, SectorCast scores, or ETF trading ideas / sector rotation model. Also, please let me know of your interest in:

1. One of Sabrient’s new indexes for ETF investing, such as High-Quality Growth (similar to our Baker’s Dozen model), Quality Growth & Income, SMID-Cap Quality Plus Momentum, High-Quality Technology, High-Quality Energy, Quality Legacy & Green Energy, or Defensive Equity

2. Sabrient Scorecards with our full rankings of stocks and ETFs and Top 30 names for several of our proprietary alpha factors

3. Having me speak at your event (topics include the economy and stock market, the energy sector, China’s economic situation, and career success secrets for new grads and young professionals).

IMPORTANT NOTE: I post this information periodically as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I do not update the information on a regular schedule or on technical triggers. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted, but not necessarily on the days that I happen to post this article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ideas mentioned here as a managed portfolio.

Disclosure: At the time of this writing, of the securities mentioned, the author held positions in SPY, QQQ, FTLS, gold, and cryptocurrencies.

Disclaimer: Opinions expressed are the author’s alone and do not necessarily reflect the views of Sabrient. This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any opinions, commentary, rankings, or stock selections provided by Sabrient Systems. Sabrient makes no representations that the techniques used in its rankings or analysis will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.