by Bradley Cipriano, CPA

by Bradley Cipriano, CPA

Equity Analyst, Gradient Analytics LLC (a Sabrient Systems company)

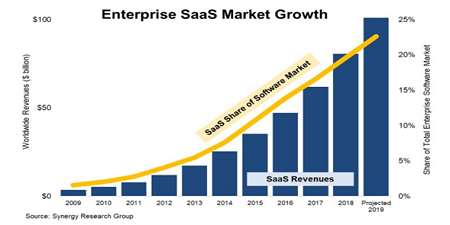

The software industry is rapidly adopting a Software-as-a-Service (SaaS) subscription model, which tends to drive higher lifetime customer values, and lower volatility in revenue and earnings growth compared to the traditional software licensing model. SaaS companies, which provide their software on a subscription basis via the cloud, have grown at a rapid pace in recent years. Moreover, they are poised to continue their strong growth trajectory as more enterprises adopt cloud-based services. And yet according to Synergy Research Group, SaaS revenue accounted for only about 23% of the total software market in 2019 despite growing 39% YOY and eclipsing $100 billion in annual sales, as shown below in Chart 1.

Chart 1. Enterprise SaaS Market Growth

The relatively low penetration rate of SaaS models implies that there is plenty of runway left for increased adoption. Unfortunately, when companies migrate toward a subscription billing model, financial transparency diminishes as the financial statements are impacted by the change. For example, sales growth tends to decelerate and cashflows tend to decline. These trends can be misconstrued as a sign of a financial distress when instead the company is rapidly growing while transitioning its billing model. However, sometimes the distress is real.

Given the benefits and the relatively low penetration rate of SaaS models, we believe that software providers will increasingly migrate towards a subscription model going forward. Therefore, we likely will continue to observe software companies reporting decelerating growth and deteriorating cashflows during the migration. However, we also must be on the lookout for companies that are under fundamental pressure and are using the SaaS migration explanation to disguise growth and cashflow headwinds.

In this article, I attempt to discern between these two possibilities. First, I describe how transitioning from a licensing sales model to a subscription billing model can impact a software company’s financial statements. Then, I examine two different companies that have undergone a SaaS billing model transition – Adobe Inc. (ADBE) and MicroStrategy Inc. (MSTR) – and point out key differences between them that can help investors differentiate between an apparent slowdown in sales caused by a successful SaaS transition and an actual slowdown caused by fundamental headwinds. In my view, ADBE is an example of a successful SaaS transition, while MSTR is an example of a company that was struggling to grow sales all along but temporarily disguised these issues as a “normal” transition. I conclude by applying the same analysis to Splunk (SPLK), which is in the midst of its own transition to a SaaS billing model. Read on...