Sector Detector: Will earnings season provide the next catalyst for stocks?

More unnerving conflicts around the globe have flared up, but as usual, U.S. equity investors have given it nary a yawn as they seem to have become pretty much numb to the steady stream of unwelcome news, particularly out of the Middle East. Now we enter the summer version of earnings season. Although sell-side expectations have been reduced from the previous lofty forecasts coming out of the dismal Q1 numbers, we’ll see if earnings reports can catalyze a renewed bullish march higher, or a long-feared bearish correction, or perhaps a resumption of the sideways-to-upward summer consolidation that we have seen so far.

More unnerving conflicts around the globe have flared up, but as usual, U.S. equity investors have given it nary a yawn as they seem to have become pretty much numb to the steady stream of unwelcome news, particularly out of the Middle East. Now we enter the summer version of earnings season. Although sell-side expectations have been reduced from the previous lofty forecasts coming out of the dismal Q1 numbers, we’ll see if earnings reports can catalyze a renewed bullish march higher, or a long-feared bearish correction, or perhaps a resumption of the sideways-to-upward summer consolidation that we have seen so far.

Going into Q2 earnings season, projections are for the strongest in several years due to resurgent GDP growth, the highest level of stock buybacks since 2007, and a weak U.S. dollar (while helps multinationals and commodity-oriented companies. Last week, Alcoa (AA) kicked off things with a strong report, which bodes well for the Industrial sector. This week, some of the biggest Technology sector companies will report, including Intel (INTC), Yahoo (YHOO), eBay (EBAY), and Google (GOOGL).

The other week, a patriotic pre-Independence Day holiday push took the Dow Jones Industrials Index above 17,000, the Wilshire 5000 Total Market Index above 21,000, and the S&P 500 to slightly above the upper trend line of its long-standing bullish ascending channel that has been in place for nearly three years. However, as I predicted last week, stocks lost their momentum in the post-holiday summer trading, and I still think there may be more downside in store before summer is over.

The Federal Reserve has signaled that October is likely to mark the end of their quant easing program, and eventually they will need to begin raising short-term rates and shrinking their balance sheet of those bonds they’ve accumulated. Nevertheless, the 10-year Treasury bond continues to remain strong with a low yield of 2.54%, which is back down to where it was a couple of weeks ago before a brief inflation scare nudged it up a smidge last week. Persistently low yields continue to push investors into equities in their search for both yield and total return. As unemployment drops, there eventually will be wage inflation pressures, which is a first step toward long-anticipated price inflation. So, it seems to many observers that there is greater risk in holding bonds at their current levels than stocks.

The CBOE Market Volatility Index (VIX), a.k.a. fear gauge, is still quite low, even after the minor pullback, closing last Friday at 12.08. Obviously, with such low volatility, short-selling clearly has not been working, and indeed after rising for a time, short interest is now at its lowest level since just before the financial crisis -- about 2% of float in S&P 500 companies. In fact, short covering was a likely driver of the pre-holiday push to new highs, but now that bullish fuel has nearly dried up. These signs of investor complacency are troubling to many market commentators and investment officers.

I still expect the market to pullback during the summer to test some support levels before heading to new highs this fall. However, we will need to see some top-line revenue growth soon, since P/E multiples are running out of room to grow without interest rates going even lower. In fact, ConvergEx has offered up a contrarian potential scenario in which weak consumer spending and hiring lead to a shallow recession here in the U.S. early next year, perhaps in addition to a worsening geopolitical crisis, that sends investors running for cover. Just one cautionary alternative to consider.

By the way, I have been traveling quite a bit over the past several weeks in support of the launch of our new Forward Looking Value Portfolio on June 19 (which is offered for investment as a unit trust through First Trust Portfolios). I have met some terrific folks in the financial advisory community during the road show, many of whom have become subscribers to this weekly Sector Detector newsletter. To all of you new followers, I say welcome!

The Forward Looking Value portfolio comprises 35 stocks based on a selection process that is very similar to our renowned Baker’s Dozen annual portfolio, which combines a quantitative GARP (Growth At Reasonable Price) screening model with a qualitative final review and selection overlay that enlists the forensic accounting expertise of Sabrient subsidiary Gradient Analytics to evaluate the quality and sustainability of each company’s accounting practices, reported earnings, and regulatory filings.

In fact, 8 of the 13 Baker’s Dozen holdings also are included in the Forward Looking Value portfolio, including top performers like NXP Semiconductors NV (NXPI), Southwest Airlines (LUV), Arris Enterprises (ARRS), and Actavis PLC (ACT). Notably, the Energy sector has strong representation in the portfolio, reflecting the sector’s recent rise in our fundamentals-based sector rankings.

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed last Friday at 196.61, after recently hitting a new 52-week high of 198.29. The upper line of the long-standing bullish rising channel proved once again to be extremely tough resistance. Last week, I predicted a failed breakout and a cycling back down to test major support levels -- starting at least with the 50-day simple moving average (around 193). So far, however, the 20-day SMA has offered strong support, and I also see a mini rising channel forming within the larger rising channel. Oscillators RSI, MACD, and Slow Stochastic have all worked off some of their overbought conditions but still have a ways to go to make a healthy return to oversold territory, from which to launch a new leg up and a run at 200, which should offer some stout resistance.

The 100-day SMA is near 190 (which is also psychological round-number support), and the critical 200-day SMA is all the way down around 184, just below the bottom line of the larger rising bullish channel. Some technicians have suggested that a full 50% Fibonacci retracement of its move from the May low to the July high is on the horizon, which would take the SPY down to a test of support at the 50-day SMA (near 193).

Notably, after the Russell 2000 small cap index rallied from a May double-bottom formation to back above the 1200 level, it has suddenly sold off quite hard before finally finding some support at its 50-day simple moving average. It appears that the bearish double-top formation was accurate.

Latest sector rankings:

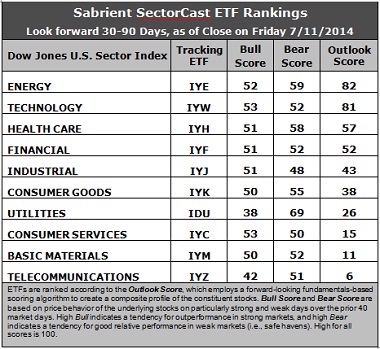

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. Energy has suddenly emerged at the top of the Outlook scores this week, with a 82, while Technology remains is technically in second place but really in a virtual tie at 81. Although Technology continues to display generally solid factor scores across the board, with a strong forward long-term growth rate, a reasonable forward P/E, and the highest return ratios, sentiment among Wall Street analysts (upward revisions to earnings estimates) has been falling a bit. On the other hand, Energy has enjoyed strong and increasing upward revisions from Wall Street, as well as the second lowest forward P/E, and the strongest insider sentiment (open market buying) this week. Healthcare remains in third place, scoring 57, with solid sell-side sentiment and a strong forward long-term growth rate. Financial and Industrial round out the top five.

2. Telecom returns to the cellar this week with an Outlook score of 6, as it displays generally poor factor scores across the board. Basic Materials remains in the bottom two with a score of 11, as sentiment among both sell-side analysts and insiders is quite weak.

3. Looking at the Bull scores, Technology and Consumer Services are the leaders with a relatively low score of 53, while Utilities is the clear laggard at 38. The top-bottom spread is 15 points, reflecting moderately high sector correlations on particularly strong market days. It is generally desirable in a healthy market to see lower correlations and a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold, rather than the all-boats-lifted-in-a-rising-tide mentality that dominated 2013.

4. Looking at the Bear scores, Utilities is the clear leader with a 69, which means that stocks within this sector have been the preferred safe havens on weak market days. Industrial displays the lowest score of 48, which is the only sector scoring below 50. The top-bottom spread is 21 points, reflecting low sector correlations on particularly weak market days. Again, it is generally desirable in a healthy market to see low correlations and a top-bottom spread of at least 20 points, so this is promising.

5. Energy displays the best all-weather combination of Outlook/Bull/Bear scores, while Telecom is by far the worst. Looking at just the Bull/Bear combination, Energy is the leader, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish). Telecom scores by far the lowest, indicating general investor avoidance during extreme conditions.

6. Overall, this week’s fundamentals-based Outlook rankings still look neutral. On the one hand, economically-sensitive sectors Technology, Financial, and Industrial are all in the top five, while defensive sector Utilities continues to fall. But on the other hand, the top three include Energy and Healthcare, which display particularly strong Bear scores (i.e., mostly defensive), and none of the ten sectors are showing high Bull scores.

These Outlook scores represent the view that the Energy and Technology sectors are relatively undervalued, while Telecom and Basic Materials may be relatively overvalued based on our 1-3 month forward look.

Stock and ETF Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or bearish), suggests continuing to hold Energy, Technology, and Healthcare (in that order) in the prevailing bullish climate. (Note: In this model, we consider the bias to be bullish from a rules-based standpoint because SPY is still above its 50-day simple moving average while also remaining above its 200-day SMA.)

Other highly-ranked ETFs from the Energy, Technology, and Healthcare sectors include PowerShares Dynamic Semiconductors Portfolio (PSI), SPDR S&P Oil & Gas Exploration & Production ETF (XOP), and Market Vectors Biotech ETF (BBH).

For an enhanced sector portfolio that enlists top-ranked stocks (instead of ETFs) from within Energy, Technology, and Healthcare, some long ideas include Phillips 66 (PSX), Exxon Mobil Corp (XOM), Skyworks Solutions (SWKS), Cirrus Logic (CRUS), Jazz Pharmaceuticals (JAZZ), and Questcor Pharmaceuticals (QCOR). All are highly ranked in the Sabrient Ratings Algorithm and also score in the top quintile (lowest accounting-related risk) of our Earnings Quality Rank (EQR), a pure accounting-based risk assessment signal based on the forensic accounting expertise of our subsidiary Gradient Analytics. We have found it quite valuable for helping to avoid performance-offsetting meltdowns in our model portfolios.

If you are more comfortable with a neutral bias, the model still suggests holding Energy, Technology, and Healthcare (in that order). But if you have a bearish outlook on the market, the model suggests holding Utilities, Energy, and Healthcare (in that order).

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.