Sector Detector: October washout serves up compelling buying opportunity at lower forward valuations

by Scott Martindale

by Scott Martindale

President, Sabrient Systems LLC

The escalating trade standoff with China, an increasingly hawkish Federal Reserve, and the impending mid-term elections finally took a toll on investor psyche, creating a rush to the exits in October as concern rises about the sustainability of the ultra-strong corporate earnings given China’s key role in global supply chains. Even some sell-side analysts have seen fit to slightly trim Q4’s strong earnings estimates. Nonetheless, the month ended with an encouraging rally from deeply oversold technical conditions. Overall, Sabrient’s model continues to suggest that little has changed with the positive fundamental outlook characterized by solid global economic growth, strong US corporate earnings, modest inflation, low real interest rates (despite incremental rate hikes), a stable global banking system, and historic fiscal stimulus in the US (especially corporate tax cuts and deregulation) that is only starting to have an impact on all-important capital spending. Also worth mentioning are the Consumer Confidence Index, which rose to its highest level in 18 years, and the Small Business Optimism Index, which continues with the longest streak of sustained optimism in its 45-year history.

Although the S&P 500 managed to plod its way upward during the summer and hit new highs well into September, a dramatic risk-off defensive rotation commenced in mid-June reflecting cautious investor sentiment, which disproportionately impacted Sabrient’s cyclicals-heavy portfolios. But this was not a healthy rotation. In fact, I wrote during the summer that the market wouldn’t be able to move much higher without renewed breadth and leadership from cyclicals. But instead of a risk-on rotation to recharge bullish conviction, we got a big market sell-off in October. Notably, such a pullback is normal in mid-term election years, but what is also normal is a strongly positive market move over the course of the 12 months following the mid-terms.

Last week’s fledgling recovery rally from severely oversold technical conditions showed promising risk-on action – and some relative performance catch-up in Sabrient’s portfolios. Thus, while the aggregate earnings outlooks for companies in the cyclical sectors and smaller caps have held steady or in many cases improved, shares prices have fallen dramatically, making the forward P/Es in these market segments much more attractive, while forward P/Es in the defensive sectors have become quite pricey.

Getting the uncertainty of the mid-term elections behind us should be good for investor sentiment. So, I think the correction lows are in – barring a massive “blue wave” in which Democrats take over both houses of Congress or a total breakdown in the China trade talks. Also, companies are coming out of their reporting-season blackout windows so that they can resume their massive share buybacks, further goosing stock prices. All told, I anticipate a risk-on rotation spurring a year-end rally that should treat our portfolios well.

In this periodic update, I provide a market commentary, offer my technical analysis of the S&P 500, review Sabrient’s latest fundamentals-based SectorCast rankings of the ten US business sectors, and serve up some actionable ETF trading ideas. In summary, our sector rankings remain bullish, while the sector rotation model has been forced into a defensive posture due to the recent correction. Read on...

Market Commentary:

For the month of October, the SPDR S&P 500 ETF (SPY) registered a loss of -7% while the SPDR S&P SmallCap 600 ETF (SLY) fell more than -10%, and total peak-to-trough drawdowns from the recent all-time highs were about -10% for the S&P 500 (from September 20) and -13% for the Nasdaq Composite (from August 29). Notably, defensive sectors Consumer Staples and Utilities were both up about 2% in October, and low-volatility and dividend-oriented funds generally outperformed. Moreover, momentum and high-beta strategies that have driven this market for so long were the worst performers, down -10% and -13%, respectively, while international markets (both developed and emerging) also took heavy losses, in a broad risk-off rotation. Even long/short equity strategies lost an estimated -8% during the month, making one wonder how a contrarian can make money these days.

The CBOE Volatility Index (VIX) only spiked as high as 29 intraday during the October correction (compared with an intraday high of 50 in February) before closing the month at 21.23. It closed Friday trading at 19.51. When you consider the magnitude of the October selloff, it’s interesting that the same level of panic didn’t manifest.

Friday’s big peak-to-trough intraday drawdown was driven partly by Apple’s disappointing holiday sales outlook, but no doubt there also was some trader position-squaring and investor de-risking going on ahead of the mid-term elections. However, let’s not forget that the 12 months following mid-term elections tend to be quite bullish. According to the Wells Fargo Investment Institute, looking back to 1962 (14 midterm cycles), the S&P 500 sees an average -19% pullback heading into the elections followed by an average +31% gain in the 12 months after. Notably, 100% of those 14 12-month timeframes generated positive returns and only 3 were negative from election day until year-end.

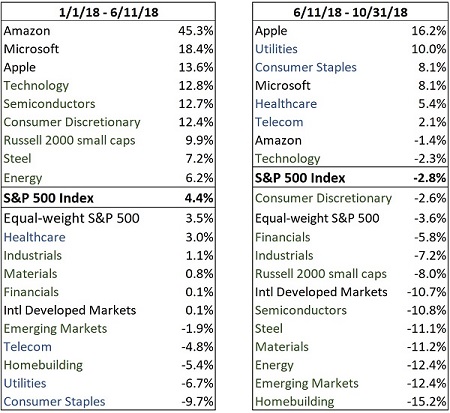

June 11 brought about an abrupt shift from risk-on to risk-off investor sentiment, after the trade war with China escalated, as illustrated in the tables below. Capital moved out of small caps, emerging markets, international developed markets, and cyclical sectors (like Materials, Steel, Homebuilding, Energy, Industrials, Financials, and Semiconductors) and into US large-cap defensive sectors like Utilities, Healthcare, Telecom, and Consumer Staples, as well as the mega-cap Technology names like Apple (AAPL) and Microsoft (MSFT) that dominate the cap-weighted market indexes. Despite this defensive rotation, the major cap-weighted market indexes continued to hit new highs into late-September (before the October correction).

For example, you can see that prior to June 11, Technology sector and Semiconductors industry (a component of the broad Tech sector) were performing very similar, up +12.8% and +12.7%, respectively. But after June 11, the broad Technology sector held up pretty well, down only -4.8% at the depths of the selloff on October 24, while the highly-cyclical Semiconductors industry sold off much harder, down -16.9% between 6/11 and 10/24, before both recovered some ground by month-end. I wrote during the summer that the market assuredly would not continue to hit new highs on the backs of defensive sectors and that a rotation back into cyclicals would be necessary, with participation from small-mid caps and improved breadth demonstrated by falling sector correlations. But instead of such a risk-on rotation to recharge bullish conviction, we got a full-blown washout.

Furthermore, year-to-date, Growth (SPYG) and Momentum (SPMO) are still greatly outperforming Value (SPYV), while Low-volatility (SPLV) is performing in-line with the broad S&P 500 (SPY). But since the defensive rotation commenced on June 11, the relative performance among SPY, SPYV, and SPYG have converged together with roughly equal performance, while SPMO has trailed and SPLV has greatly outperformed.

But there is no doubting the current strength in the US economy. Final Q2 GDP was a robust annual rate of 4.2%, and the BEA’s advance estimate for Q3 came in at 3.5%. Looking ahead, the Atlanta Fed’s GDPNow model as of November 2 forecasts Q4 real GDP of 2.9%, while the New York Fed’s Nowcast model forecasts 2.6%. Moreover, Gross Output (GO) – a measure of total economic activity that includes transactions within the supply chain and not just final products – is showing real growth of 4.6%. Historically, when GO grows faster than GDP, it foreshadows continued strong growth. US Manufacturing PMI was the highest in the world in October at 57.7. The October nonfarm payrolls report blew away estimates with over 250,000 new jobs and unemployment remained at an ultra-low 3.7% (lowest since 1969), while the labor participation rate ticked up to 62.9% and average hourly wages rose +3.1% YOY (highest growth since 2009 Great Recession). Overall, the Trump administration can tout the best economy going into the first mid-term election of any administration in 60 years.

In addition, Q3 corporate earnings season has been quite strong. Consensus estimates for S&P 500 earnings in Q3 were for a robust +19.2% year-over-year growth, while actuals entering November have come in even better at roughly 3% above estimates (+22.5% growth!), and revenues have slightly beat expectations. In fact, aggregate consensus estimates for S&P 500 earnings in 2019 were raised during October, even while the market was selling off. As BofA’s Savita Subramanian wrote in a recent note, “It may not feel like it, but guidance is above consensus.” So, it is evident that companies and the sell-side analysts who cover them have displayed a completely different view of the likely impacts of trade wars and rising interest rates – at least for the near-term.

The latest market outlook from Loomis Sayles noted that indeed, consensus earnings estimates for 2018 and 2019 have been revised higher, suggesting justification for rising global equity prices. The report observes that emerging markets is the only major asset class with negative earnings revisions year to date (based on US dollars), mostly due to foreign currency weakness. But most other regions are doing just fine, even considering that in October the IMF reduced its projection for global growth this year and next to 3.7% from 3.9%. For example, Japan has seen upward earnings revisions and improving valuations, and Europe also displays historically attractive valuations, although the political risks have been holding it back (of note: S&P has maintained its investment-grade credit rating on Italian debt). Here at home, the S&P 500 is expected to provide full calendar year 2018 earnings growth of over +20%, with less than half of that attributable to lower tax rates, and even without the same one-time boost from lower taxes next year, strong US fundamentals still suggest double-digit organic earnings growth (not to mention the impact of massive share buyback programs on EPS).

Corporate confidence and optimism is best displayed by capital spending and R&D, which are longer-term investments in future growth. So, it is encouraging that S&P 500 companies spent $341 billion on capital expenditures in the first half of the year, with capex rising at the fastest pace in 25 years. Also, R&D spending is up 14%. Furthermore, there is favorable supply/demand dynamic when you consider the active M&A that has shrunk the number of public companies and the massive share buyback programs that have shrunk the outstanding float of those companies that remain.

Nevertheless, despite all these encouraging indicators, the prevailing market narrative seems to be that the economy is late-cycle, which generally implies that an overheating economy with rising inflationary pressures will compel the Fed to raise rates and ultimately push the economy into a corrective recession to “wring out the excesses.” While stocks indeed have been in a long bull market and investors are getting nervous about peak earnings, a tight labor market, and an overheated economy, the missing link in this narrative is inflation. The core CPI (less food and energy) was up 2.2% YOY in September and has been falling on a YOY basis over the past few months, while core Personal Consumption Expenditures (PCE), which is the Fed’s preferred metric, is holding around 2%. Moreover, the expected “breakeven” inflation indicated by the 10-year Treasury Inflation Protected Securities (TIPS) versus the 10-year T-note actually declined to 2.02% as of November 1, which is the lowest reading since May and well below the 2.09% long-term average. So, by all indications, inflation is quite tame.

But for now, the Fed seems determined to put their proverbial bullets back in the holster and bring the fed funds rate up to (or beyond) the elusive “neutral rate” (i.e., the rate that neither aids nor hinders the economy). Although a gradual rise, especially at these historically low levels, should not be a problem for equities, a bond selloff that spikes longer-term yields (e.g., the 10-year suddenly spiking above 3.5%) would definitely spook equity investors. However, we are a long way from a level that would suggest current equity valuations are too high.

The 10-year T-note fell to as low as 3.06% last week during the stock selloff before closing the week at 3.21%, while the 2-year T-note closed Friday at 2.90%. So, the closely-watched 2-10 spread is only 31 bps, which continues to generate talk of a potential “Fed inversion” if the Fed keeps raising rates. But I think it’s important to realize that the 2-10 spread has been holding at around this level with each Fed rate hike, which seems to indicate that the October stock selloff was less about investor worries of an impending recession and more about rising rates overall suppressing equity valuations. Guggenheim CIO Scott Minerd estimated that the October stock selloff is indicative of a 10-year Treasury yield of 5.5%, not the current yield in the low-3% range. Indeed, stock investors seem more concerned with the bond market’s implied discount rate of future earnings than with the earnings growth estimates.

By my calculation, the current forward P/E on the SPY is 15.5x, implying an earnings yield of 6.5%, which is double the 10-year Treasury yield and easily supports higher stock prices, in my view. Alternatively, when you combine the 1.7% dividend yield with the 4% share buyback yield (based on estimated $1 trillion on $25 trillion market cap), the SPY displays a composite yield to the shareholder of 5.7%. So, either way, Treasury yields would have to escalate fast and high to rationalize a market top. I still expect new highs by year end, perhaps even achieving my beginning-of-year prediction of 3,000 on the S&P 500 – provided the elections, trade wars, growing federal deficit, or FOMC rate hikes don’t screw up the great economic outlook.

After the latest September rate hike, fed funds now sit in the 2.00-2.25% range (let’s call it 2.25%). CME Group fed funds futures currently place the odds of another rate hike in December at 77.5%, but interestingly, there is a 75% chance of only two or fewer rate hikes by the end of 2019 (i.e., a fed funds rate of 3.00% or less). Increasingly, the market is telling the Fed that the neutral rate is no higher than 3.0%. As a reminder, every recession and bear market over the past 50 years has been preceded by high real interest rates (nominal rate minus inflation). So, with the fed funds rate at 2.25% and expected to be no higher than 3.0% by the end of next year, and with inflation at only about 2.0-2.2%, real rates remain quite low (and far from a recessionary threat).

Another place to look for clues is the high-yield (“junk”) bond market. It is notable that junk bonds didn’t sell off nearly as bad as equities did. Typically, junk bonds trade in tandem with small cap stocks because, much more so than other types of corporate bonds, they are driven by company fundamentals. If junk bonds had sold off with small caps in October, it would be a worrisome sign of investors losing confidence in corporate fundamentals. But given that they held up well with persistent demand from yield-hungry investors, it is a good sign for small cap stocks and the broader market overall.

I won’t spend too much time talking about China today. However, I have said many times before that our trade war couldn’t have come at a worse time for China, as the country is burdened with a highly-leveraged and fragile financial system. S&P Global just called attention to the “debt iceberg with titanic credit risks,” particularly the “shadow banking system” [unregulated lending kept off-balance sheet such as local government financing vehicles (LGFVs)], which has been estimated at nearly $10 trillion. Instead of deleveraging its massive debt load, encouraging domestic consumption, and loosening up its capital markets and currency exchanges in order to attract foreign capital, the Chinese government has reversed its deleveraging and is once again injecting massive liquidity back into the system, cutting taxes, redoubling infrastructure investment, cutting the required reserve ratio, loosening restrictions on corporate share buybacks, and pledging further economic stimulus measures.

China has found that it must offer a bond yield that is competitive with US treasuries to attract foreign capital, so its leaders can either hike interest rates or devalue the renminbi to a level that investors no longer feel a need to hedge against a weakening currency. But higher rates would hurt its highly-leveraged economy, so that leaves them with little choice but to manage further devaluation of the currency so that investors can avoid hedging costs and bet on a recovery in the renminbi. This is why they recently announced a government bond offering denominated in US dollars. We’ll see if President Xi is willing to make some progress on resolving the standoff with President Trump at the G-20 Summit in Argentina later this month. The clock is ticking on China.

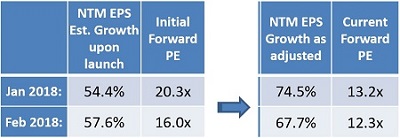

I will close by asking the question, has anything really changed from a fundamental standpoint? I would say, no. Despite the defensive risk-off rotation since June 11, our quantitative model still suggests solid global economic growth, robust US corporate earnings, modest inflation, and low real interest rates. Moreover, it appears to me that equities in the risk-on market segments are severely oversold such that now is a good time to be accumulating high-quality stocks with attractive forward valuations from the cyclical sectors and small caps. For example, the graphic below illustrates the improved forward valuations when we replace the original estimates for Q1 and Q2 with actual reported Next Twelve Months (NTM) EPS numbers for Sabrient’s January 2018 Baker’s Dozen stocks along with recent prices. Unless guidance suddenly weakens significantly and the analyst community slashes forward estimates, we fully expect these stocks to recover, as their numbers are just too good.

So, with the robust economic climate and fiscal stimulus powering strong corporate earnings, capital spending, share buybacks, M&A, and dividend increases, and with small business and consumer optimism persisting near all-time highs, it sure seems to me that the October price correction has presented investors with a terrific buying opportunity.

SPY Chart Review:

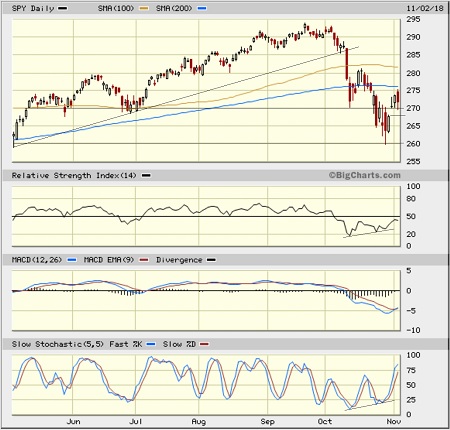

The SPDR S&P 500 ETF (SPY) closed Friday at 271.89 after a strong recovery rally from the second 10% correction this year, which served to successfully retest the early-May low around 260. In mid-October, I wrote that it appeared the retest of the summer low of 270 was successful, but after a tepid bounce, a deeper correction transpired – which is typical in mid-term elections years. In retrospect, the June defensive rotation was indeed a warning sign of vulnerability and despite the test of support at 270, the correction simply had not yet run its course. Oscillators RSI and Slow Stochastic have recovered nicely from extreme oversold levels and both have set higher lows during that second leg down, which is further indication that the bottom is in, although both look like they may need to cycle back down briefly as price consolidates gains. MACD looks a little more bullish, including a bullish crossover. There is a bullish gap from 268 that probably will be filled this week, but I don’t anticipate a retest of the 260 level. The important 200-day simple moving average is overhead near 276, and it may put up some temporary resistance in the course of a rally.

It appears to me that the correction lows are in, and barring a massive “blue wave” in which Democrats take over both houses of Congress or an ugly escalation in the China trade war, I think there will be a risk-on rotation back into cyclicals with strong breadth, including participation from small-mid caps. And if we get some sort of an olive branch from China to address Trump’s major beefs on trade, there is a good chance that the SPY hits new highs by year end – and possibly my expected year-end target of 300 on the SPY.

Latest Sector Rankings:

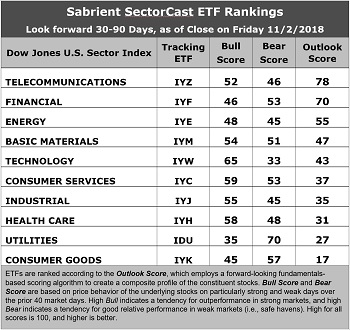

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each of over 600 equity ETFs based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings, and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. A high Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500 large cap index, I prefer the iShares for their larger universe and broader diversity.

Here are some of my observations on this week’s scores:

1. Defensive sector Telecom continues to hold the top spot with an Outlook score of 78. Telecom displays an attractive forward P/E of 13.9x and the best sell-side analyst sentiment (net positive revisions to EPS estimates). However, its pure GARP metrics are average, with projected year-over-year EPS growth rate of only 9.8% and a forward PEG (ratio of forward P/E to forward EPS growth rate) of 1.42, which ranks it only 7th out of 10 sectors (this is why we don’t see many Telecoms as candidates for Sabrient’s GARP portfolios). Financial takes second with an Outlook score of 70, as it displays an attractive forward P/E of 14.0x and decent sell-side analyst sentiment. Energy moves to third and displays a low forward P/E of 14.5x, by far the highest projected YOY EPS growth rate of 51.1%, and by far the lowest forward PEG of 0.28 (this is why we see a lot of Energy candidates for Sabrient’s GARP portfolios). Materials, Technology, Consumer Services (Discretionary/Cyclicals), and Industrials round out the top seven.

2. At the bottom of the rankings we find two defensive sectors: Consumer Goods (Staples/Noncyclical) and Utilities, both of which have been holding up relatively well during the defensive rotation in the market. Consumer Goods in particular has been burdened by significant net downward revisions to EPS estimates and modest expectations for projected YOY EPS growth (9.4%), while Utilities has by far the highest forward PEG of 3.04.

3. Looking at the Bull scores, Technology enjoys the top score of 65, followed by Consumer Services (Discretionary/Cyclicals), as stocks within these sectors have displayed relative strength on strong market days. Utilities scores the lowest at 35, followed by Consumer Goods (Staples/Noncyclicals) at 45. The top-bottom spread is 30 points, which reflects quite low sector correlations on strong market days. It is desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the market segments and stocks they want to hold (rather than broad risk-on behavior).

4. Looking at the Bear scores, as usual we find Utilities alone in the top spot with a score of 70, which means that stocks within this defensive sector have been the preferred safe havens lately on weak market days. Technology has by far the lowest score of 33, as investors have fled during recent market weakness, largely due to a massive repricing among the mega-cap Tech names. The top-bottom spread is 37 points, which reflects quite low sector correlations on weak market days. Ideally, certain sectors will hold up relatively well while others are selling off (rather than broad risk-off behavior), so it is desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points.

5. Telecom displays the best all-around combination of Outlook/Bull/Bear scores, followed by Financial, while Consumer Goods (Staples/Noncyclicals) is the worst. Looking at just the Bull/Bear combination, Consumer Services (Discretionary/Cyclicals) is the best, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish), while Energy is the worst.

6. This week’s fundamentals-based Outlook rankings still reflect a bullish bias, given that six of the top seven sectors are economically-sensitive (cyclical). It remains a bit concerning that Telecom has remained at the top, when I expected it to be a temporary phenomenon. And it’s also worth a note of caution that only three sectors display Outlook scores above 50. Keep in mind, the Outlook Rank does not include timing, momentum, or relative strength factors, but rather reflects the consensus fundamental expectations at a given point in time for individual stocks, aggregated by sector.

ETF Trading Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), now displays a defensive bias and suggests holding Utilities (IDU), Financial (IYF), and Telecom (IYZ), in that order. (Note: In this model, we consider the bias to be defensive from a rules-based trend-following standpoint when SPY moves below both its 50-day and 200-day simple moving averages.)

Besides iShares’ IDU, IYF, and IYZ, other highly-ranked ETFs in our SectorCast model (which scores nearly 500 US-listed equity ETFs) from the Utilities, Financial, and Telecom sectors include First Trust Utilities AlphaDEX Fund (FXU), Oppenheimer S&P Financials Revenue (RWW), and Fidelity MSCI Telecommunications Services (FCOM).

If you prefer a bullish bias (which might be warranted by the extremely oversold conditions and solid fundamentals), the Sector Rotation model suggests holding Technology, Telecom, and Consumer Services (Discretionary/Cyclicals), in that order. On the other hand, if you are more comfortable with a neutral stance on the market, the model suggests holding Telecom, Financial, and Energy, in that order.

An assortment of other interesting ETFs that are scoring well in our latest rankings include iShares US Insurance (IAK), VanEck Vectors Mortgage REIT Income (MORT), VanEck Vectors Unconventional Oil & Gas (FRAK), VanEck Vectors BDC Income (BIZD), SPDR S&P 500 Buyback (SPYB), Alpha Architect US Quantitative Value (QVAL), First Trust Value Line 100 (FVL), iShares US Broker-Dealer & Securities (IAI), WBI BullBear Rising Income 2000 (WBIA), ALPS Alerian Energy Infrastructure (ENFR), and Direxion All-Cap Insider Sentiment (KNOW, which tracks a Sabrient index).

IMPORTANT NOTE: I post this information periodically as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I do not update the information on a regular schedule or on technical triggers. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted, but not necessarily on the days that I happen to post this article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ideas mentioned here as a managed portfolio.

Disclosure: The author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any opinions, commentary, rankings, or stock selections provided by Sabrient Systems or its wholly-owned subsidiary Gradient Analytics. Sabrient makes no representations that the techniques used in its rankings or analysis will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.