Sector Detector: Bulls may be getting ready to push stocks higher

After a brief pullback to retest support levels, it appears that bulls may be preparing to take the market higher. Although retail investors are still hesitant, risk-taking among institutions is apparent. Cheap cash from abundant global liquidity is hungry for higher returns. Margin debt is high. Credit spreads are low. Subprime loans are back in vogue. Small caps and the banking sector in particular look ready to resume a leadership role.

In this weekly update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review our weekly fundamentals-based SectorCast rankings of the ten U.S. business sectors, and then offer up some actionable trading ideas, including a sector rotation strategy using ETFs and an enhanced version using top-ranked stocks from the top-ranked sectors.

Market overview:

After last week’s strong jobs report (coming in 25% above expectations), Treasury yields spiked, the dollar strengthened, and dividend stocks took a hit while growth stocks held up, particularly the NASDAQ, mid caps, and small caps. Market commentators of course have expressed a wide range of views ranging from cautious optimism to outright collapse. For example, Goldman Sachs’s chief U.S. equity strategist David Kostin just announced a prediction that the S&P 500 will finish the year around current levels as the market simply treads water and relies upon dividends for further returns.

Some of the dominant concerns include the fact that total margin debt is at record levels, hitting $507 billion in mid-April, and while the major indexes have been hitting record highs, breadth is narrow (NYSE Composite has not challenged its high), GDP growth has shrunk, unit labor costs have surged, and corporate profits have struggled.

Of course, the strong dollar has been blamed as a prime culprit for hindering profits. However, the U.S. economy overall has enjoyed a net benefit from the strong dollar, with low oil and gasoline prices, affordable imports and overseas travel, and foreign investors flocking to the safety, yield, and bullish trend of the dollar. Nevertheless, although companies appear to be doing some hiring, they continue to be reluctant to make much in the way of new capital investment in PP&E.

As a result, 95% of profits at S&P 500 stocks last year were used for stock buybacks or dividends. In April, $133 billion of new stock buyback programs were announced, the highest level ever for a single month. In fact, buybacks have been the biggest source of accumulation. At the current rate, the overall market is on track to hit over $1 trillion in buybacks.

We keep hearing that it has been three years since the market pulled back at least 10%, and although investors are worried that any of a variety of potential triggers could start a massive correction, stocks continue to hold up pretty well -- even though the former resistance-turned-support thresholds of Dow at 18,000 and S&P 500 at 2100 failed as support. Learned observers insist that we desperately need a 10% correction soon in order to stave off a 20% debacle later. But few traders are willing to let it happen in this low volatility environment. The CBOE Market Volatility Index (VIX), a.k.a. fear gauge, closed Friday at 14.21, and the 15 threshold has held as resistance.

The 10-year Treasury yield closed Friday at 2.40%. This is a 7-month high and represents a breakthrough of resistance from the December high and 200-day moving average. Greece’s decision to delay an IMF payment weighed on bullish sentiment, and the IMF urged the Federal Reserve not to raise interest rates until 2016. And with the Fed conceding that economic growth is progressing more slowly than expected, that is a distinct possibility.

Worth noting are falling sector correlations. ConvergEx reported that average sector correlations to the S&P 500 has fallen to below 80%, which gives portfolio managers a better shot at outperforming an index, while also allowing for effective asset allocation.

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed Friday at 209.77, displaying a spinning top (or doji) candlestick pattern that reflects uncertainty about direction. It broke below its 50-day simple moving average on Friday, but I usually like to see a second day of confirmation before pronouncing an official break (and Monday appears to be providing it). But with plenty of solid support nearby, it could be setting up as a good launch point for the next bullish move.

The long-standing uptrend line has been providing reliable support for quite a while, and it is now around 209. As I said two weeks ago when SPY made a tepid breakout above resistance at 212, oscillators RSI, MACD, and Slow Stochastic had all either flattened out or were pointing down bearishly. And indeed a pullback has occurred. But now the oscillators have worked off most of their overbought conditions and could reverse soon. Next major support is at the convergence of the uptrend line and 100-day SMA (around 209), and the critical 200-day SMA (near 205), followed by earlier-in-year support at 204, then round-number support at the 200 price level. But I think the uptrend line will hold (even if there is a temporary breach).

As for the Russell 2000 small caps, the index formed a bullish engulfing pattern on Friday and might be ready to lead the overall market higher. In addition, the VIX formed a bearish engulfing pattern on Friday, which is bullish for stocks. On the bearish side, the iShares Dow Jones Transportation Average ETF (IYT) got a little bounce last week but has a lot of work to break that series of which was displaying a series of lower highs and lower lows since November.

Latest sector rankings:

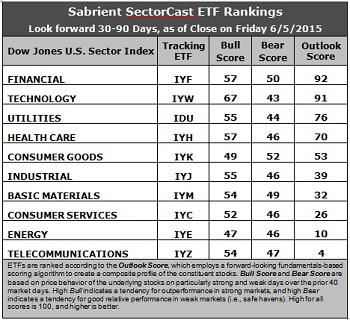

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. Financial again takes first place with a strong Outlook score of 92. Financial displays the lowest (i.e., best) forward P/E, and good sell-side analyst sentiment, forward long-term growth rate, and insider sentiment (buying activity). Technology has moved back up to take second place with a score of 91, primarily due to the best Wall Street sentiment, the best return ratios, and solid insider sentiment. Utilities falls to third this week.

2. Telecom stays in the cellar with a feeble Outlook score of 4. Other than a strong forward long-term growth rate, the sector scores poorly in most factors in the model, and in fact, stocks within Telecom continue to be hit the hardest by net downward revisions to Wall Street earnings estimates. Energy remains in the bottom two with a score of 10. Even though the sell-side community has eased up on the cuts to forward estimates, it still reflects a flat forward long-term growth rate and poor return ratios.

3. Looking at the Bull scores, Technology displays the top score of 67. Energy shows the lowest Bull score of 47, which is the only one below 50. The top-bottom spread is 20 points, reflecting low sector correlations on particularly strong market days. It is generally desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold. So this is good.

4. Looking at the Bear scores, Consumer Goods (Staples/Noncyclical) displays the highest (i.e., best) score of 52, followed by Financial and Materials, which means that stocks within these sectors have been the preferred safe havens (relatively speaking) on weak market days. Technology scores the lowest at 43. The top-bottom spread is about 9 points, which reflects elevated sector correlations on particularly weak market days (i.e., broad risk-off selling). Ideally, certain sectors will hold up relatively well while others are selling off, so it is generally desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points.

5. Technology displays the best all-around combination of Outlook/Bull/Bear scores, followed closely by Financial, while Energy is the worst. Looking at just the Bull/Bear combination, Technology is the best, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish), while Energy is the worst.

6. Overall, this week’s fundamentals-based Outlook rankings are still mostly neutral, but are actually starting to move in a bullish direction with Financial and Technology looking quite solid and all-weather Healthcare holding up well. On the other hand, Utilities and Consumer Goods (Staples/Noncyclical) remain in the top five, while Industrial and Consumer Services (Discretionary/Cyclical) are in the bottom five. Keep in mind, the Outlook Rank does not include timing or momentum factors, but rather is a reflection of the fundamental expectations of individual stocks aggregated by sector.

Stock and ETF Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), retains its bullish bias and suggests holding Technology, Financial, and Healthcare, in that order. (Note: In this model, we consider the bias to be bullish from a rules-based trend-following standpoint when SPY is above both its 50-day and 200-day simple moving averages.) Because SPY is right on reliable support levels (despite closing below its 50-day SMA), I am maintaining a bullish bias for the moment.

Other highly-ranked ETFs in SectorCast from the Technology, Financial, and Healthcare sectors include iShares Global Tech ETF (IXN), PowerShares KBW Bank Portfolio (KBWB), Market Vectors Pharmaceutical ETF (PPH).

For an enhanced sector portfolio that enlists some top-ranked stocks (instead of ETFs) from within the top-ranked sectors, some long ideas from Technology, Financial, and Healthcare sectors include Intuit (INTU), Lam Research (LRCX), East West Bancorp (EWBC), Voya Financial (VOYA), Mylan (MYL), and Zoetis (ZTS). All are highly ranked in the Sabrient Ratings Algorithm.

If you prefer to maintain a neutral bias, the Sector Rotation model suggests holding Financial, Technology, and Utilities, in that order. But if you prefer a defensive stance on the market, the model suggests holding Financial, Consumer Goods (Staples/Noncyclical), and Basic Materials, in that order.

IMPORTANT NOTE: I post this information each week as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I may or may not update the information each week. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted -- but not necessarily on the days that I happen to post this weekly article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ETF and stock ideas mentioned here as a managed portfolio.

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.