Sector Detector: Strong earnings and optimism about resolving trade wars

by Scott Martindale

by Scott Martindale

President, Sabrient Systems LLC

Market conditions remain strong for equities, in my view, with stocks being held back only by the (likely transient) trade war uncertainty. The US economy appears to be hitting on all cylinders, with the new fiscal stimulus (tax reform, deregulation) providing the long-missing ingredient for a real economic “boom cycle” to finally get some traction. For too long, the US economy had to rely solely on Federal Reserve monetary stimulus (ZIRP and QE), which served mainly to create asset inflation to support the economy (aka “Ponzi financing”), while the bulk of our working population had to endure de facto recessions in corporate profits, capital investment, and hiring. But with fiscal stimulus, corporate earnings growth is on fire, underpinned by solid revenue growth and record levels of profitability.

So far, 2Q18 earnings reporting season has come in even better than expected, with year-over-year EPS growth for S&P 500 companies approaching 24%. Even when taking out the favorable impact of lower tax rates, organic earnings growth for full-year 2018 still looks as though it will come in around the low to mid-teens.

Cautious investors are seeing the fledgling trade war as a game of brinksmanship, with positions becoming ever more entrenched. But I actually see President Trump as a free-trade advocate who is only using tariffs to force our trading partners to the bargaining table, which they have long avoided doing (and given the advantages they enjoy, why wouldn’t they avoid it?). China is the biggest bogeyman in this game, and given the challenges it faces in deleveraging its enormous debt without upsetting growth targets, not to mention shoring up its bear market in stocks, its leaders are loath to address their rampant use of state ownership, subsidy, overcapacity, tariffs, forced technology transfer, and outright theft of intellectual property to give their own businesses an unfair advantage in the global marketplace. But a trade war couldn’t come at a worse time for China.

In this periodic update, I provide a market commentary, offer my technical analysis of the S&P 500, review Sabrient’s latest fundamentals-based SectorCast rankings of the ten US business sectors, and serve up some actionable ETF trading ideas. In summary, our sector rankings still look moderately bullish, while the sector rotation model retains its bullish posture. Read on....

Market Commentary:

I have a lot to talk about this month, so I’m breaking it up into sections. I will start with market performance, economic reports, and corporate earnings, then follow up with equity valuations and interest rates, then get a bit into the trade wars, and then finish up with some closing thoughts.

Performance, economic reports, and corporate earnings:

Year to date through Friday August 3, the S&P 500 large cap index is +6.3%, while the S&P 600 small cap index is +12.8% and the Russell 2000 is +9.1%. Stocks continue to be led by the Momentum factor. Looking at the iShares Edge MSCI USA single-factor ETFs, Momentum is far-and-away the leader at +9.6%, with Quality at +5.0%, Low-volatility at +4.7%, and Value at 3.5%. However, since the market swooned in early June (in response to tariff threats going into effect and rhetoric escalating), the Low-volatility factor has been the leader in a defensive rotation. Still, growth stocks have significantly outperformed value stocks year-to-date and over the past 12 months. The SPDR S&P 500 Growth (SPYG) is +11.8% YTD through Friday, while SPDR S&P 500 Value (SPYV) is essentially flat at 0.6%. Notably SPYG has its highest sector weighting in Technology at 37%, while SPYV is heaviest in Financials at 24% (and has less than 7% in Technology) – and Technology Select Sector SPDR (XLK) is +13.7% YTD while Financial Select Sector SPDR (XLF) is +0.75%.

Goldman Sachs recently opined, “Unlike past episodes of narrow market breadth, the earnings environment today appears healthy and broad-based.” Indeed, I think market breadth in accumulation has been good, as evidenced by strength in small caps. Although I prefer to see the S&P 500 Equal-Weight index (+4.2% YTD) outperforming the cap-weighted version (+6.3%), the aforementioned Momentum factor and some high-flying mega-caps have made that race difficult to win for the equal-weight index. So, I would call the relative performance “close enough.” In addition, the Advance/Decline line remains in an uptrend, indicating a broad level of participation and points to a stock market that is consolidating within a secular uptrend. I also like to look at sector correlations to the benchmark, which are about 75% for the year so far, but for the past month they are around 50%, which means investors are picking their spots for investment – including suddenly avoiding the market segments and companies deemed most vulnerable to import tariffs. Some of these suddenly shunned companies are Sabrient GARP (growth at a reasonable price) favorites, but they are showing even better forward valuations for strong growth projections today than they did when we picked them – so we fully expect them to rise once again.

Because a broad expectation for 20+% year-over-year EPS growth rate for the S&P 500 was largely baked into expectations, investor focus has been on forward guidance and how much the trade war rhetoric would impact plans for new capital investment. As expected, corporations have been using much of their huge stores of cash and new cash generation for share buybacks, dividend increases, and M&A, but capital spending (on new factories, onshoring operations, equipment upgrades, and capital goods) is the best indicator of corporate optimism in the future. Recall the extended period of anemic capex before the 2016 elections, as businesses were reluctant to invest given all the uncertainty. But for Q1, capital spending by S&P 500 companies totaled about $167 billion, representing a year-over-year growth rate of 32.7%. For Q2, year-over-year growth was still a solid 15.7%. This is good stuff. Notably, the CBOE Market Volatility Index (VIX), aka “fear gauge,” has fallen precipitously to close Monday at 11.27, as volatility has subsided.

As for recent economic reports, unemployment fell back below the 4% level to 3.9%, with wage growth at +2.7% year-over-year. The U-6 unemployment rate (including discouraged workers and those settling for part-time jobs) fell to an ultra-low 7.5%. Chicago PMI was described as “torrid.” Railcar utilization (Warren Buffett’s favorite indicator) has risen to a robust 86%. Redbook same-store retail sales numbers were stronger, and the PCE Index rose nicely, with analysts noting an easing in inflationary pressure and a healthy consumer. Although New, Existing, and Pending Home Sales were slightly down year-over-year, the S&P Corelogic Case-Shiller Home Price Index was up. Both Consumer Confidence and the State Street Investor Confidence Index rose. These suggest both a healthy consumer and accumulation of equities by global institutional investors.

For US real GDP growth in 2Q18, domestic economists’ consensus estimate was for annualized growth to be at least 4%, and they were right, with the BEA’s advance estimate coming in at an annualized rate of 4.1%, the fastest since 2014 (note: the second estimate will be out on 8/29/18). In addition, Q1 GDP growth was revised upward to 2.2%. Of course, there were those analysts who tried to put a wet blanket on it, noting a spike in Q2 exports likely intended to skirt the imminent tariffs, which essentially borrowed from Q3 growth. But the reality is that inventories are also included in the GDP computation, so most of those extra exports came out of inventories (in fact, it was the largest drop in inventories since 2009). So, it was basically a wash, with increased exports adding 1.06 to GDP and decreased inventories subtracting 1.0. In other words, the GDP growth was for real.

Looking ahead, the Atlanta Fed’s GDPNow model as of August 3 forecasts 3Q18 GDP annualized growth of 4.4%, while the New York Fed’s Nowcast model forecasts 2.6%. Both the IMF and the OECD have lifted their estimates for full-year 2018 global growth to 3.9%, which would represent the highest pace since 2011 if it comes to fruition. The IMF also upgraded US expectations from 2.7% to 2.9% and China from 6.5% to 6.6%. For full-year 2018, forecasting firm IHS Markit is predicting real US GDP growth of 3.0%, then falling to 2.7% in 2019 and 1.7% in 2020 as unresolved trade wars, tightening of monetary stimulus, high oil prices, and geopolitical risks persist and take a toll. However, I believe trade wars will subside, as discussed below.

I keep hearing commentators lament that the economic cycle and bull market are getting long in the tooth, but I just don’t see it, other than on the calendar. But you have often heard that bull markets don’t die of old age, nor do economic cycles. With annual GDP growth over the past nine years barely averaging 2%, this post-Financial Crisis recovery has barely caught any traction compared to the recoveries in the 1980’s and 1990’s that averaged in the 3.9% to 4.5% range. As such, I continue to believe there is plenty of fuel in the tank from tax reform, deregulation, and new corporate and government spending plans, providing potential for strong growth for at least the next few years. Notably, Reuters’ monthly asset allocation poll of 50 global wealth managers and CEOs showed an increase in their US equity allocations to roughly 42%, which is the highest since June 2015.

Moreover, the quality of earnings appears to be improving, which of course is the area of expertise of Sabrient’s wholly-owned subsidiary Gradient Analytics. First and foremost, “cash is king,” and whereas prior years have seen earnings growth driven more by cost-cutting and creative accounting, today we are seeing earnings growth driven by revenue growth. For 2Q18, S&P 500 companies are on course to hit 9% revenue growth, which would be the highest since 2011. Furthermore, corporate profitability is stronger than ever – and importantly, it encompasses all sectors (yet another indicator of market breadth). For Q1, net profit margin for S&P 500 companies hit a record high of 11.4%, and the 12-month forward profit margin at that time was estimated to be 12.3%. Such strong profitability serves to magnify top-line growth as it flows down to the bottom line, allowing earnings to grow at much faster rate than revenues, which is favorable for equity prices. So far in Q2, with 81% of the S&P 500 companies having reported, FactSet says that 74% of the reporting companies have beaten consensus revenue estimates and 80% have beaten EPS estimates, and the overall year-over-year earnings growth rate is expected to be 24%, with a net profit margin of 11.8% (another record).

As for the lofty levels of non-financial corporate debt, which is now at 45% of GDP, I have read commentaries expressing grave concern that defaults will be rising as interest rates creep up. But I think this a situation in which you must look at other key variables relevant to today’s economy to put this in the proper context. The real question is whether this level of debt is as burdensome today as it might have been in the past. So, you should consider the cash positions of corporate borrowers by netting out cash and cash equivalents from the debt. Given the tax cuts and strong corporate earnings and cash flows that have led to high levels of cash in the corporate coffers, net corporate debt to GDP is about 33%, which is right in-line with historical averages for net debt levels – and it is even less concerning than other times in history given today’s superior profitability and low interest rates.

Equity valuations:

Some gloomy commentators are lamenting the 2.02% 3-month T-bill yield having eclipsed the 1.82% dividend yield of the S&P 500, calling it a warning sign of impending recession. But this is another case of taking a situation out of context. Shareholders are enjoying record levels of share buybacks, which reduces public float and improves valuations. When you add in the yield from buybacks, the composite yield to an investor actually might be around 5.2%, based on BofA’s estimate that S&P 500 companies will execute buybacks totaling $850 billion this year (3.4% of the S&P 500 market cap of about $25 trillion).

Moreover, the S&P 500’s dividend growth over the last five years has averaged 13.4%, and with the tax cuts putting more cash into corporate coffers, I would expect that growth rate to rise. Increases in dividends are a signal from corporate leadership that the future is bright such that higher dividends are sustainable, as opposed to share buyback programs that are often ad hoc. In addition, Thomson Reuters has reported that global M&A activity totaled $2.5 trillion during 1Q18, which was 64% higher than 1Q17.

Let’s talk a bit about stock valuations. The S&P 500 has a forward P/E of about 16.4x, implying an earnings yield of 6.1%. The S&P 600 small cap index has a forward P/E of about 17.6x (5.7% earnings yield). In addition, S&P 500 Growth (SPYG) is at 20.1x (5.0% earnings yield) and S&P 500 Value (SPYV) is at 14.2x (7.0% earnings yield). Using the “Fed Model” to compare these to a 10-year Treasury yield under 3%, stocks still look pretty good to me.

Moreover, Sabrient continues to find intriguing stocks with low forward P/E and forward PEG (forward P/E to next 12 months year-over-year estimated EPS growth). Our July Baker’s Dozen portfolio displayed upon launch an average forward P/E of 13.2x for over 100% average EPS growth, or a forward PEG of 0.13, which is extraordinarily low.

Regarding growth stocks in general, the Technology sector represents nearly 40% of them by market cap, so let’s examine some of the big players. Following recent disappointing reports from FANG stalwarts Facebook (FB) and Netflix (NFLX), last week Apple (AAPL) bolstered the Tech sector with a strong earnings report and became the first company ever to hit $1 trillion in market cap – and Alphabet (GOOG), Amazon (AMZN), and Microsoft (MSFT) are all inching closer to that mark, as well. So Tech is overvalued, right? This has become another Tech bubble like in 2000, right? Well, not so fast. The reality is that these market leaders can be considered relatively cheap today compared to 2000. Most of the Tech juggernauts not only dominate their space but are also cash machines with superb profitability and cash flow generation. Also, the cost of capital is much lower today. Thus, Tech sector profitability, cash flow generation, and cash balances are much higher while the cost of capital is much lower, all of which bolster valuations. So, making simple comparisons of P/E and P/S today versus in 2000 is yet another example of comparing numbers out of context.

Sell-side analysts continue to raise consensus revenue and earnings estimates for 2019. As of July 19, economist Ed Yardeni calculates the consensus year-over-year EPS growth for 2018 to be 21.3%, with earnings rising so fast, he thinks the market deserves a P/E ratio in the high teens (e.g., 17-18x). So, with the S&P 500 reflecting 2019 earnings expectations of $177.34 per share, and assuming a forward P/E of 17x at year-end, the S&P 500 would close the 2018 at 3,015. This view aligns with what I have been forecasting all year.

Interest rates:

At last year’s Jackson Hole conference at the end of August, Fed chair Jay Powell cited low inflation as a reason to remain patient on further rate increases, so this year’s conference likely will provide some important guidance. So far this year, the Fed has expressed confidence that the economy is sufficiently strong to shoulder higher rates, and the futures market has been pricing in a hawkish tone. After two rate hikes this year, the current target fed funds rate is 1.75-2.00% (which, by the way, with inflation subtracted is still a slightly negative real rate). CME fed funds futures currently place the odds of 2018’s next rate hike coming at the September meeting at 94%. By the December meeting, there is a 70% probability of another quarter-point rate hike, including a remote 1.8% chance of a fifth hike, but also 30% odds of no action (i.e., a total of only three rate hikes this year).

The 10-year Treasury yield rose quickly in late July, briefly hitting the magic 3% level (in response to a surprise debt issuance by the US Treasury), but it has since pulled back, closing Monday at 2.94%. With the 2-year T-bill at 2.65%, the closely-watched 2-10 spread sits at only 29 bps (a little more than one Fed 25-bp rate hike). The 2-10 spread continues to compress, which has many market participants worried about an imminent inversion of the yield curve, which typically precedes a recession. However, in many ways we are in uncharted waters, given divergent central bank policies creating global imbalances in demand for government bonds that the Fed thinks may have reduced the term premium on our 10-year Treasury yield by as much as a 100 bps. The good news is that modest Treasury yields help support higher equity valuations in various ways (e.g., lower cost of debt and lower discount rate in valuation models).

The rising 2-year yield suggests a consensus view that a full-blown trade war will be averted and the Fed will likely continue to raise rates through 2019, as planned. But with the long end struggling to rise above 3.0%, the flattening yield curve – according to the Fed chair himself – is essentially the marketplace telling the FOMC that it is getting close to “neutral rate” and may not need to raise much further.

On the other hand, some market commentators have opined that the 10-year yield must get to a level that offers an attractive real return. Round numbers, if you add the latest 2.9% CPI to a 4.1% GDP, they would say the 10-year should be serving up a 7% yield. But that simply doesn’t take into account supply/demand and macro forces, including geopolitical turmoil, aging demographics seeking safe yield, divergent monetary policies and the much higher rates offered in the US (and the resulting “carry trade” from other countries), plus the structure of fixed income indexes (i.e., new issuance of Treasuries has natural buyers in fixed-income portfolio managers and ETFs whose mandate is to track bond indexes, so when more Treasuries enter the market while various asset-backed bonds are reduced, the weighting of Treasuries in the indexes increases.) Accordingly, ETF inflows in July were strong (following net outflows in June), and fixed income funds continue to see strong growth (10% YTD), with July marking the 36th straight month of inflows. Thus, I continue to believe that a selloff in Treasuries leading to a sustained breakout in yield much above 3.0% in the 10-year is unlikely this year.

Trade Wars:

The surge in economic activity and corporate earnings also has provided an opportunity for President Trump to force our trading partners to the bargaining table and aggressively tackle those long-festering and lopsided trade agreements that were designed (in quite a different time in history) to give struggling countries a leg up at our expense. He has stated that “tariffs are great,” but I think saying this in a public forum is just a negotiating tactic for our various trade partners to hear, because he has also stated a desire to eventually get to free trade with no tariffs at all. Critics have called him protectionist, but I think he is simply using tariffs as a way to call out our overseas trading partners who variously use state ownership, subsidy, overcapacity, and tariffs to give their businesses an advantage in the global marketplace.

But moving us closer toward truly free trade and an un-tariffed flow of goods is only the start. More important for the long-term is to confront the patent violations, forced technology transfer, and appropriation of Western intellectual property (IP) by China, which no longer needs a helping hand to emerge from poverty and diversify from its focus on cheaply-made consumer products. The US and the EU seem to be mending fences so as to work cooperatively to face the enormous challenge posed by China.

On the one hand, China can ill-afford a trade war at this point in time, but on the other hand, giving up the advantages it enjoys in our trade deals and business contracts would also hurt it. So, it’s a bit of a Catch-22. But on balance, I think it would be better for China to end this trade “skirmish” now, given that its economy might be slowing more than its official government reports on GDP growth are indicating and given that its stock market has been mired in a bear market.

No doubt, China is highly-levered with some estimates that total debt-to-GDP has risen over the past 10 years from roughly 140% to about 300%. While a free economy might be in crisis in such a situation, because of its rigid internal controls, China actually has a chance to navigate its way through the deleveraging process while maintaining reasonable growth through capital controls and tighter regulation, allowing its currency to gradually depreciate while restricting capital flight and redoubling infrastructure investment. For example, its government recently instituted new monetary easing measures by injecting $74 billion into its banking system and cutting local corporate taxes by about $1 billion.

We shall see whether Trump can get some resolution on the trade war front in advance of the November’s mid-term elections.

I will stop here, but I will have much more to say about China in my commentary next month.

Summary:

Let me wrap up this extra-long market commentary by saying this. I expect strong and sustainable economic fundamentals to continue to drive robust corporate earnings, which combined with modest inflation and interest rates and a continued flow of foreign capital into the US, should drive stocks higher into year-end and beyond, perhaps for the next few years, as a true “boom cycle” finally gains traction. There remains plenty of global liquidity seeking the best investment opportunities.

Of course, risks abound, including the high levels of global debt (led by China) and divergent central bank monetary policies (with some easing while others tighten). The gradual withdrawal of massive liquidity from the global economy is an unprecedented challenge loaded with uncertainty. And finally, we have US government dysfunction and the prospects for a federal government shutdown in September (primarily over immigration), followed by the mid-term elections that could possibly lead to Democrats gaining enough power to derail some of Trump’s fiscal stimulus and regulatory reforms.

Nevertheless, my belief is that the positives far outweigh the negatives, and the runway remains clear for take-off for US equities, especially fundamentally-strong companies from cyclical market segments sporting attractive forward valuations.

SPY Chart Review:

The SPDR S&P 500 ETF (SPY) closed Monday August 6 at 284.64. After setting an all-time high of 286.63 in January, it experienced its worst correction in two years, and then traded essentially sideways, bounded by 280 at the top. After forming a double-bottom around 255, SPY made a series of higher lows in forming a 4-month bullish ascending triangle pattern, and then broke out in late-July through 280 resistance. It then spent pulled back for a few days to retest resistance-turned-support at 280 before forming a bullish engulfing candle last Thursday, which gave traders the conviction to push higher, and SPY now appears ready to challenge its all-time high. Minor support can be found at the 20-day simple moving average (SMA), followed by the 50-day SMA at 277, the 100-day at 272, and the critical 200-day SMA at 270 (coinciding with prior support, as well). Oscillators RSI, MACD, and Slow Stochastic are all pointing up bullishly, while Bollinger Bands are pinching together in anticipation of a bigger move (one way or the other). All in all, despite the trade wars hanging over the market, the chart looks bullish. In addition, small caps remain strong and market breadth is good (as evidenced by the uptrend in the advance/decline line), both of which bolster the bullish outlook.

Latest Sector Rankings:

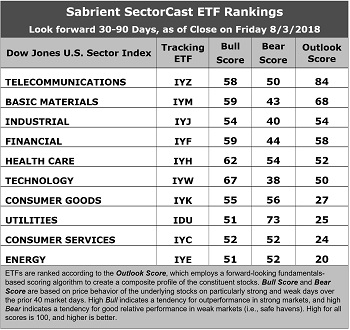

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each of over 600 equity ETFs based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings, and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. A high Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500 large cap index, I prefer the iShares for their larger universe and broader diversity.

Here are some of my observations on this week’s scores:

1. The biggest change is the ascension of Telecom to the top spot, which might be the first time we’ve seen it there. Its Outlook score of 84 is quite impressive, as second-place Basic Materials is 16 points lower at 68. Telecom displays the lowest forward P/E (14.1x), positive sell-side analyst sentiment (net positive revisions to EPS estimates), and the highest return ratios. Although its projected year-over-year EPS growth rate is on the low side (9.3%), its forward PEG (ratio of forward P/E to forward EPS growth rate) is a respectable 1.52. Basic Materials takes second with an Outlook score of 68, having good return ratios, the second lowest forward P/E (15.0x, likely due to trade war fears), and a forward PEG of 1.20. Industrial, Financial, Healthcare, and Technology round out the top six, which all score above 50, and then there is a big 23-point drop to the seventh spot.

2. Four sectors: Energy, Consumer Services (Discretionary/Cyclical), Utilities, and Consumer Goods (Staples/Noncyclical) are essentially bunched at the bottom of the Outlook rankings with scores between 20-27. Energy remains at the bottom despite having the highest projected yoy EPS growth rate (50%) and lowest (most attractive) forward PEG of 0.35 – which has grown ever more attractive as its EPS growth rate has risen while its forward P/E has fallen to 17.2x versus 24x at the beginning of 2018 and 32x at the beginning of 2017. In our Outlook model, the Energy sector in aggregate has been held back by fewer analyst upward revisions and low return ratios. Nevertheless, Sabrient continues to find individual names in the space that are sufficiently attractive to include in our monthly Baker’s Dozen portfolios.

3. Looking at the Bull scores, Technology enjoys the top score of 67, followed by Healthcare, as stocks within these sectors have displayed relative strength on strong market days. Although Utilities scores the lowest at 51, it is notable that none of these sector ETFs is scoring below 50. The top-bottom spread is 16 points, which reflects moderately low sector correlations on strong market days. It is desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the market segments and stocks they want to hold (rather than broad risk-on behavior).

4. Looking at the Bear scores, we find Utilities in the top spot with a score of 73, which means that stocks within this defensive sector have been the preferred safe havens lately on weak market days. Technology has the lowest score of 38, as investors have fled during recent market weakness. The top-bottom spread is 35 points, which reflects quite low sector correlations on weak market days. Ideally, certain sectors will hold up relatively well while others are selling off (rather than broad risk-off behavior), so it is desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points.

5. Telecom displays the best all-around combination of Outlook/Bull/Bear scores, followed by Materials, while Energy is the worst. Looking at just the Bull/Bear combination, Utilities is the best, followed by Healthcare, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish), while Materials is the worst, followed closely by Energy and Industrial, as investors have generally avoided the sectors lately.

6. This week’s fundamentals-based Outlook rankings continue to reflect a modestly bullish bias, given that five of the top six sectors are economically-sensitive or all-weather. Keep in mind, the Outlook Rank does not include timing, momentum, or relative strength factors, but rather reflects the consensus fundamental expectations at a given point in time for individual stocks, aggregated by sector.

ETF Trading Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), still displays a bullish bias and suggests holding Technology (IYW), Healthcare (IYH), and Telecom (IYZ), in that order. (Note: In this model, we consider the bias to be bullish from a rules-based trend-following standpoint when SPY is above both its 50-day and 200-day simple moving averages.)

Besides iShares’ IYW, IYH, and IYZ, other highly-ranked ETFs in our SectorCast model (which scores over 500 US-listed equity ETFs) from the Technology, Healthcare, and Telecom sectors include iShares PHLX Semiconductor (SOXX), VanEck Vectors Biotech (BBH), and First Trust NASDAQ Smartphone Index (FONE).

If you prefer a neutral bias, the Sector Rotation model suggests holding Telecom, Basic Materials, and Industrial, in that order. On the other hand, if you are more comfortable with a defensive stance on the market, the model suggests holding Utilities, Telecom, and Financial, in that order.

An assortment of other interesting ETFs that are scoring well in our latest rankings include First Trust Value Line 100 (FVL), First Trust NASDAQ Bank (FTXO), Alpha Architect US Quantitative Value (QVAL), First Trust Materials AlphaDEX (FXZ), First Trust RBA American Industrial Renaissance (AIRR), SPDR S&P Transportation (XTN), VanEck Vectors Steel (SLX), VanEck Vectors Mortgage REIT Income (MORT), First Trust NASDAQ-100 Tech Sector (QTEC), Cambria Shareholder Yield (SYLD), and FlexShares US Quality Large Cap (QLC).

IMPORTANT NOTE: I post this information periodically as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I do not update the information on a regular schedule or on technical triggers. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted, but not necessarily on the days that I happen to post this article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ideas mentioned here as a managed portfolio.

Disclosure: The author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any opinions, commentary, rankings, or stock selections provided by Sabrient Systems or its wholly-owned subsidiary Gradient Analytics. Sabrient makes no representations that the techniques used in its rankings or analysis will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.