Sector Detector: New Year kicks off with new fears to keep investors on edge

As widely expected, the New Year has begun with plenty of volatility on high trading volume, as investors fear more than just a mild correction to start out the year. Despite the strong fundamentals here in the U.S., there are plenty of dangers around the rest of the world, and many fear that our cozy comfort at home simply cannot remain insulated for much longer.

In this weekly update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review our weekly fundamentals-based SectorCast rankings of the ten U.S. business sectors, and then offer up some actionable trading ideas, including a sector rotation strategy using ETFs and an enhanced version using top-ranked stocks from the top-ranked sectors.

Market overview:

I would like to start by saying that I have been traveling a lot lately, speaking with and presenting to financial advisors to promote our annual Baker’s Dozen portfolio, which is packaged as a unit investment trust by our strategic partner First Trust Portfolios. Many of these advisors are readers of this weekly article, and I want to take this opportunity to say that I have been humbled and gratified by your tremendous interest, enthusiastic reception, and warm hospitality. We are doing our best to sustain your loyalty and respect, and of course, to continue our record of outstanding performance.

Anyway, just when we all had grown accustomed to the old Wall of Worry and the scary bogeymen under the bed, there are new bogeymen peeking out from the bedroom closet. The new sources of worry are really bigger and scarier versions of existing ones, including the continued slide in oil prices (far further than hardly anyone believed possible), worsening recession and deflation in the Eurozone (leading to drastic actions), and the global metastasis of radical Islam (despite our successes in foiling their plots and destroying their infrastructure). News headlines seem to getting worse for both issues.

First, radical Islam has been with us for a long time, and of course it jumped to the forefront with 9/11. Today, splintered organizational infrastructures and terrorist training facilities have suffered highly-publicized defeats by the skilled efforts of the civilized world, but each of these successes consumes an incredible amount of time and resources, while the hateful ideology continues to spread like wildfire around the world (with the helpful assistance of social media). I liken it to trying to fight a mosquito problem with a fly swatter. Sure you can swat a whole bunch of them, but the number you eradicate pales in comparison to the numbers that are proliferating in all those innumerable pools of stagnant water. Obviously, any long-term solution will need to come from education rather than police action. But in the meantime, the impact on business investment, productivity, and consumer confidence is vast.

Oil prices have fallen beneath $50/barrel, and some observers see more pain ahead before finding a bottom and settling later this year into the $50-60 range. $40 is generally considered to be the economic threshold for enhanced extraction techniques. This plunge in prices also has impacted the high-yield bond market, which has lent heavily to oil projects. Nominal yields for junk bonds have reached 6.7% versus 5.3% just six months ago, which compared with the 10-year Treasury yield of 1.8% is a wide (and enticing) credit spread.

The impact on petroleum exporting countries has been like a sledgehammer to their budgets but a boon to business and consumers everywhere else. Another bright spot from the fall in oil prices is that almost all of terrorist funding comes from oil revenues.

This sudden bear market in oil was created by a supply shock brought on by the tremendous success of enhanced extraction techniques like hydraulic fracking here in North America, coupled with the unwillingness of oil producers around the world to reduce production. The catch-22 is that as prices fall, they are compelled to make up the shortfall by producing and selling more, not less, thus worsening the situation. Scott Minerd of Guggenheim sees a lot of similarities between the current situation and the 1985-86 marketplace in which oil prices launched a recovery leading to tighter credit spreads (i.e., rising junk bond prices) and a 20% rally in stocks within a year.

Indeed, the U.S. economy seems to firing on all cylinders, with improving consumer confidence, non-existent inflation (further aided by falling oil prices), nominal GDP growth approaching 5%, job growth the strongest since the 1990s, unemployment below 6%, and corporate profits at all-time highs. As Q4 earnings reports continue, the forward P/E of the S&P 500 is back down to a modest 16x. So far this earnings season, 55% of the S&P 500 companies that have reported have beaten analyst revenue expectations, and 77% have beaten earnings expectations (although projections have been largely revised downward).

GDP growth and falling unemployment should start to bring about wage growth, which will further propel consumer buying. Beneficiaries of lower oil prices include consumers, airlines, travel, hotels and fast food producers. In addition, although oil producers will struggle with lower revenues tied to energy prices, those involved in marketing refined products should do well, as demand remains steady for lower priced products that garner higher margins at the pump.

So, U.S. equities appear to be a likely beneficiary. Nevertheless, volatility is likely to remain with us (as well demonstrated so far this year), so thoughtful stock selection is paramount rather than simply relying on a risk-on, all-boats-lifted mentality of years past. Of course, stock selection becomes more critical as a bull market matures.

A continued flight to quality will favor companies generating strong free cash flow, increasing U.S.-sourced sales, displaying operational excellence and innovation, making shrewd capital investments, and using conservative accounting with solid earnings quality. This generally should favor Technology, Healthcare, and Consumer sectors, as well as larger, more established companies versus smaller companies with narrow business models. In other words, it looks a lot like 2014 -- with the exception that bond-like Utilities will likely not be a top performer this time around.

The CBOE Market Volatility Index (VIX), a.k.a. fear gauge, closed Friday at 20.95, which is above the important 20 threshold that suggests real fear. However from a technical perspective, it is displaying a series of lower highs in its series of spikes in mid-October, mid-December, and now mid-January.

Also notable last week was the move by the Swiss National Bank to end its 3-year currency cap, which has sent the Swiss franc soaring versus the euro, while the dollar rose to an 11-year high against the euro. This week, the ECB is widely expected to announce a massive bond-purchase (quant easing) program this week in a desperate attempt to steer the Eurozone away from deflation. With oil prices falling so far, Europe’s inflation rate has officially fallen below zero. Moreover, with the exception of Greece, sovereign debt yields are collapsing throughout the Eurozone. For example, 10-year bond yields in Italy and Spain have declined below 1.9% and 1.7%, respectively, and the mighty German bund is at 0.41%. Thus, global capital continues to pour into the U.S., making a strong dollar even stronger and further flattening the yield curve.

Despite the fact that only a small percentage of active managers beat their benchmarks last year, Sabrient’s annual Baker’s Dozen portfolio of 13 top picks finished its sixth straight strong year (since 2009 inception). It was up about +22% from its January 13 launch through year-end, while the S&P 500 was up about +15% over the same timeframe. The new portfolio officially launched last week as a unit investment trust (UIT) issued through First Trust Portfolios, and it looks very similar to last year’s portfolio in its sector and industry composition (although only two stocks from the prior portfolio repeated into the 2015 portfolio). Stocks from airlines, semiconductors, and biopharma continue to score among the top, along with a number of consumer names. Notably, few financial stocks (e.g., banks, brokers, insurance, REITs) score near the top of our rankings, and so this sector is not represented in the portfolio this year. Baker’s Dozen represents a sector-diversified group of 13 stocks based on our Growth at a Reasonable Price (GARP) quant model and confirmed by a rigorous forensic accounting review by our subsidiary Gradient Analytics to help us avoid stocks at higher risk of issues that could result in a underperformance.

Also, many of the investment professionals who have embraced the Baker’s Dozen have asked for access to some of our institutional-level research but at a more affordable price. In response, we have launched a web-based suite of research products geared to investment professionals.

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed last Friday at 201.63, which is down about -3.5% from its recent high in December. I had been hopeful that the December technical pullback down to the lower trend line of the long-standing bullish rising channel was all the market needed in the way of a correction to avoid a more dramatic downside event in January, like the one we saw in Jan-Feb last year. We still haven’t had an official 10% correction in three years (although the October pullback came close on an intraday basis). Oscillators RSI, MACD, and Slow Stochastic are all in a slightly oversold position and could either cycle a bit further down to oversold territory or turn upward from here. The 50-day simple moving average gave up support, but price is now desperately clinging to the 100-day SMA and lower trend line (both have provided reliable support levels over the past year). Shown on the chart is the possible formation of a bearish head-and-shoulders pattern, with a head around 209 and a neckline at the lower trend line, which would project downside potential to 190, which would fill a previous upside gap in October. If current support fails, the next notable support level comes from the important 200-day SMA near 195, followed by the gap fill at 190. If instead price rallies from here, overhead resistance will come from the 50-day SMA around 204, the highs near 209, and then the upper trend line that is now near 212.

Latest sector rankings:

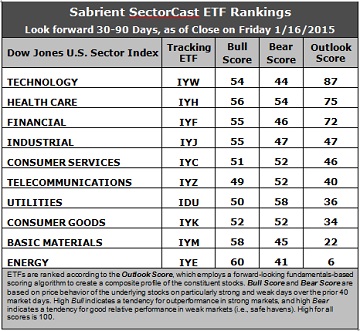

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. Notably, all sectors recently have endured net downward revisions to Wall Street’s earnings estimates. Technology ranks first with an Outlook score of 87. It displays the best return ratios, a good forward long-term growth rate and forward P/E, and relatively good sell-side analyst sentiment (only slight downward revisions to earnings estimates). Healthcare is back in second place with a score of 75, displaying a strong forward long-term growth rate, relatively good sell-side analyst sentiment (slight downward revisions), solid insider sentiment (buying activity), and good return ratios. Financial is close behind in third place with a 72, followed by Industrial and Consumer Services/Discretionary. This remains a bullish top five.

2. Energy continues to hold the bottom spot after the plunge in oil prices. Joining Energy in the bottom two is Basic Materials, as these two sectors have taken the brunt of Wall Street’s downward revision to forward earnings estimates, and also display the lowest insider buying activity. Notably, Telecom has moved up to sixth place primarily on improving sentiment among both Wall Street analysts and insiders.

3. Looking at the Bull scores, Energy displays the top score of 60, followed by Basic Materials. Telecom scores the lowest at 49. The top-bottom spread is only 11 points, which still reflects fairly high sector correlations during particularly strong market days, i.e., highly-correlated risk-on action. It is generally desirable in a healthy market to see low correlations and a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold, rather than the all-boats-lifted-in-a-rising-tide (risk-on) mentality.

4. Looking at the Bear scores, Utilities displays the highest score of 58 this week, which means that stocks within this sector have been the preferred safe havens on weak market days. Energy has the lowest score of 41. The top-bottom spread is 17 points, reflecting fairly low sector correlations on particularly weak market days. In other words, certain sectors are holding up relatively well while others are selling off. Again, it is generally desirable in a healthy market to see low correlations and a top-bottom spread of at least 20 points.

5. Technology and Healthcare share the best all-around combination of Outlook/Bull/Bear scores, while Energy is clearly the worst. Looking at just the Bull/Bear combination, Healthcare is the leader, followed by Utilities, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish). Technology is the worst, somewhat surprisingly, indicating general investor avoidance (at least for the moment).

6. Overall, this week’s fundamentals-based Outlook rankings look bullish to me, with the top five sectors all economically-sensitive and growth-oriented (or in the case of Healthcare, all-weather). Keep in mind, the Outlook Rank does not include timing or momentum factors, but rather is a reflection of the fundamental expectations of individual stocks aggregated by sector.

Stock and ETF Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), moved to a neutral bias earlier in the year when the SPY confirmed a loss of support from its 50-day simple moving average, and it suggests holding Technology, Healthcare, and Financial, in that order. (Note: In this model, we consider the bias to be neutral from a rules-based trend-following standpoint because on Friday, SPY remained between its 50-day and 200-day simple moving averages.)

Other highly-ranked ETFs from the Technology, Healthcare, and Financial sectors include Market Vectors Semiconductor ETF (SMH), Market Vectors Pharmaceuticals ETF (PPH), and iShares Mortgage Real Estate Capped (REM).

For an enhanced sector portfolio that enlists some top-ranked stocks (instead of ETFs) from within the top-ranked sectors, some long ideas from Technology, Healthcare, and Financial sectors include Tyler Technologies (TYL), Gartner Inc (IT), IDEXX Laboratories (IDXX), UnitedHealth Group (UNH), Jones Lang LaSalle (JLL), and Public Storage (PSA). All are highly ranked in the Sabrient Ratings Algorithm and also score within the top two quintiles (lowest accounting-related risk) of our Earnings Quality Rank (a.k.a., EQR), a pure accounting-based risk assessment signal based on the forensic accounting expertise of our subsidiary Gradient Analytics. We have found EQR quite valuable for helping to avoid performance-offsetting meltdowns in our model portfolios.

However, if you prefer to maintain a bullish bias, the Sector Rotation model suggests holding Healthcare, Technology, and Financial, in that order. And if you prefer a defensive stance on the market, the model suggests holding Healthcare, Utilities, and Consumer Services/Discretionary, in that order.

IMPORTANT NOTE: I post this information each week as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I may or may not update the information each week. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted -- but not necessarily on the days that I happen to post this weekly article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ETF and stock ideas mentioned here as a managed portfolio.

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.