Sector Detector: Headlines continue to control market direction as valuation models languish

Headlines continue to dominate the trading landscape, perpetuating a news-driven trader’s market rather than allowing a healthier valuation-driven investor’s market to return to favor. After all, that’s what stock market investing is supposed to be about. Narrow market breadth and daily stock price gyrations have been driven primarily by three headline generators -- oil price, the Fed’s monetary policy, and China growth. Sure, there were many other important news items, notably the sinister course of Islamic terrorism. But it was those three main subjects that have been the persistent drivers of the daily buffeting of investor sentiment, and by extension stock prices.

In particular, the fact that the Federal Reserve can’t seem to remove itself from the headlines has been a disappointment. In December, it tried to fade to the backdrop by clearing up some uncertainty about its intentions by making an initial rate hike and then laying out a convincing timeline (albeit data-dependent) for a path toward normalization. But alas market speculation continues given the stark divergence between the Fed monetary policy and all other central banks. Nevertheless, it is likely that all three headline-grabbers (oil, Fed, China) may resolve much of their uncertainty over the course of the year, thus enticing investors to return to a “flight to quality” strategy.

In this weekly update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review our weekly fundamentals-based SectorCast rankings of the ten U.S. business sectors, and then offer up some actionable trading ideas, including a sector rotation strategy using ETFs and an enhanced version using top-ranked stocks from the top-ranked sectors.

Market overview:

Friday was a tough day due to renewed speculation about future Federal Reserve rate hikes, after the BLS reported that the U.S. economy added 151,000 jobs in January. This was below the expected 180,000 jobs, but wage inflation continued to growth, rising by 0.5%, and the workforce participation rate ticked a bit higher (although it is still near a 40-year low). For the week, the U.S. dollar fell hard against a basket of currencies and was down 1.9%. Then the selloff in equities continued on Monday, with stocks falling hard on high volume before recovering about half their losses by the close. The S&P 500 finished down 1.4% while a flight to safety pushed the 10-year yield down to 1.76% -- a 12-month low. Two-year yields closed near 0.67%.

Last month was the worst January for stocks since 2009, and the start of February has led to more of the same, as bulls are getting an extreme test of conviction, with critical technical support lines trying to hold. Financials in particular seem to be inordinately bearing the brunt of the fear-driven selling. The sector was already displaying the lowest forward P/E as investors evidently doubt the accuracy of consensus earnings estimates, but it continues to take direct hits. Certainly rising credit spreads in Energy sector and Emerging Market debt instruments are a concern, as is the flattening yield curve, which makes lending less lucrative. Although we all recall that the V-bottom in March 2009 launched a 6-year bull market, most investors and commentators are not expecting the same thing this time around. Equity prices have been tied to headlines generated primarily by oil prices, the Fed, and China.

Oil price declined last week and has been struggling to hold the $30 level, which has been putting pressure on Energy and Financial sectors. As a result, oil analysts and market commentators have become progressively gloomier about the near term outlook for prices, with some price targets to the downside ranging as low as $7 to $20, and some are seeing no end in sight to the supply glut -- with predictions of a calamitous fallout in oil-exporting countries and in our own domestic oil patch (and by extension, the high yield debt market).

I worked in the oil industry for the first 18 years of my career, and I must admit that I was a believer in the “peak oil” theory in which global demand would soon outstrip an ever-dwindling supply of recoverable reserves, thus driving the U.S. to ultimately import 100% of its crude oil and force us into alternative energy sources, including nuclear. The theory suggested that shale oil and other tight formations wouldn’t be economically viable until prices reached at least $200/bbl.

But that was then and this is now, and the ingenuity and persistence of capitalists and entrepreneurs has made North America essentially energy independent, contributing to today’s worldwide supply glut. Nevertheless, these imbalances should begin to moderate this year as demand continues to grow while output declines from exhausted wells here at home (without further costly stimulation, like fracking) and oil-exporting countries (non-OPEC) reduce their capital budgets. This may lead oil to drift back into the $40-50 range sometime over the course of the year. Keep in mind, oil is a “Goldilocks” commodity that can’t be either too hot or too cold without disturbing oil producers on the low side or consumers on the high side.

As for the Fed’s path toward normalizing the fed funds rate, it is notable that the fed funds futures are currently pricing the probability of a March rate hike at 0%, a June hike at 13%, and December at only 26%, with only a 3% chance that we will see two rate hikes this year. This is a big difference from the four rate hikes telegraphed by the Fed after their first rate hike in December. The market seems to be speaking loud and clear about such a plan. In any case, investors will listen for clues in FOMC Chairwoman Yellen's congressional testimony on Wednesday and Thursday this week.

China of course remains a big question mark -- not just because of its big and growing impact on the global economy (especially emerging markets) but also because of its veil of opacity and secrecy that confounds trading and investing models and commentators. But China is highly motivated to keep its “miracle” alive and kicking and is unlikely to permit a recession to take hold, so all tools are in play including devaluation of the yuan that has been so expensive to shore up and keep pegged to the rising dollar.

Yet despite all of this noise and paralyzing headlines, U.S. equities still look attractive, with historically reasonable forward valuations (S&P 500 forward P/E around 15x), especially given the expected persistence of low 10-year yields. And in any case, if you believe that we are not on the precipice of a recession or bear market but are simply waiting for the clouds of uncertainty to pass, then you will likely miss much of the upside before you realize that bulls finally got it together. It is quite difficult to time a market entry that avoids any portfolio drawdown.

The CBOE Market Volatility Index (VIX), a.k.a. fear gauge, closed the week at 26.0, which is well above the 20 long-term average. However, we are likely entering a period of elevated volatility that may have pushed the “panic threshold” up closer to 30, so the fact that VIX has not closed above 30 this year (it has only spiked above that level intraday a couple of times) may be an indication that the market is not on the verge of a crash but rather simply searching for a bottom.

Notably, despite the harsh market conditions, ETFGI reported that global exchange-traded products (ETFs and ETPs) gathered net inflows of $13.1 billion in January 2016, and the global ETF/ETP industry ended the month with 6,180 products totaling assets of $2.85 trillion from 277 providers on 64 exchanges. During January, 43 new ETFs/ETPs were launched by 17 different providers.

Sabrient’s eighth annual Baker’s Dozen top 13 picks for 2016 launched on January 15. It is based on our unbiased quantitative GARP (growth at reasonable price) model with a fundamental final review and selection process (i.e., a “quantamental” approach). The new portfolio comprises stocks from various sectors but with the common thread that they produce finished goods and services that can be directly consumed by individuals -- including airline, cruise line, auto maker, drug maker, discount retailer, cell phone service, banking, software, and gaming -- rather than producing components (like semiconductors) or B2B services (like industrial supplies or equipment rentals).

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed on Friday at 187.95, right near important support around 187.50, but then Monday’s selloff took it down to 182.80 intraday before a late recovery helped it close at 185.42. Price formed a bullish hammer pattern that will likely lead SPY to close the gap from Friday’s close, but we’ll have to see if bulls can take it back up inside the sideways channel between 187.50 and 200. SPY remains below all of its key moving averages, including the 20-day (at 190), 50-day (at 198), 100-day (near 201), and 200-day (near 204) simple moving averages. All are knifing downward ominously. The long-term low from October 2014 near 182 has been tested three times this year now. Oscillators RSI, MACD, and Slow Stochastic have all turned back downward after a brief rally attempt, but they are essentially in a neutral position that could turn back up at any time. If investors can shake off their fears and turn this back into a quality-driven rather than headline-driven market, the 200 level will be a challenge, but the bearish gap down from 204 at the beginning of the year should act as a magnet (long-time technicians have observed that gaps generally get filled about 80% of the time). Jeff Saut, chief investment strategist at Raymond James, has commented that the cluster of high-volume selling followed by higher-than-average buying volume indicates to him that a major bottom is trying to form.

Latest sector rankings:

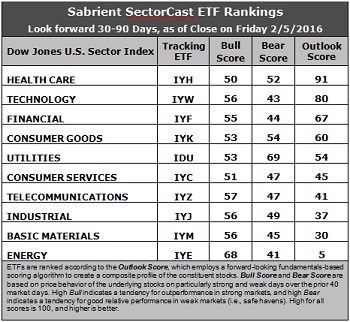

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. Healthcare has regained the top spot with an Outlook score of 91, primarily due to the best (relatively speaking) Wall Street analyst sentiment, as all sectors are again being hit with net reductions to forward earnings estimates during this earnings reporting season. Healthcare displays solid factor scores across the board. Technology comes in second with an Outlook score of 80, and the sector also displays solid factor scores, including the highest forward long-term growth rate. Financial takes the third spot this week with an Outlook score of 67 as the sector displays the lowest aggregate forward P/E (12.7x). Rounding out the top six are Consumer Goods (Staples/Noncyclical), Utilities, and Consumer Services (Discretionary/Cyclical).

2. Energy remains mired at the bottom with an Outlook score of 5 as the sector scores among the worst in all factors of the GARP model, including an increasingly negative forward long-term growth rate (as oil prices hit lower lows) and the highest forward P/E (23.7x). Basic Materials takes the other spot in the bottom two with an Outlook score of 30 as commodity prices in general continue to languish along with oil prices.

3. Looking at the Bull scores, Energy tops the list with a robust 68, as investors do some bottom fishing on strong market days, while Healthcare is suddenly the lowest at 50, likely due to the congressional hearings on drug repricing practices. Even though all sectors display Bull scores of 50 or above, the top-bottom spread is 18 points, which reflects relatively low sector correlations on strong market days, which is good for stock picking. It is generally desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold (rather than broad risk-on behavior).

4. Looking at the Bear scores, Utilities (as usual) displays the top score of 64, which means that stocks within this sector have been the preferred safe havens (relatively speaking) on weak market days. Energy scores the lowest at 41, followed closely by Financial, as investors flee during market weakness. The top-bottom spread is 23 points, which reflects low sector correlations on weak market days, which is good for stock picking. Ideally, certain sectors will hold up relatively well while others are selling off (rather than broad risk-off behavior), so it is generally desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points.

5. Healthcare displays the best all-around combination of Outlook/Bull/Bear scores, while Energy is by far the worst. However, looking at just the Bull/Bear combination, Utilities is by far the best (perhaps due to a renewed investor appetite for dividends), indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish), while Consumer Services (Discretionary/Cyclical) is the worst, followed closely by Tech and Financial.

6. This week’s fundamentals-based Outlook rankings still look mostly neutral, but signs of growing bullishness continue to reveal themselves. Healthcare at the top is somewhat all-weather (so it’s not a strong indicator either way of bullish or defensive sentiment), but economically sensitive Technology and Financial at two and three is bullish, while defensive sectors Consumer Goods (Staples/Noncyclical) and Utilities in the top five is typically less bullish. The rankings seem to be indicating some fundamental reasons for optimism in our future. Keep in mind, the Outlook Rank does not include timing, momentum, or relative strength factors, but rather is a reflection of the fundamental expectations of individual stocks aggregated by sector.

Stock and ETF Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), continues to reflect a defensive bias and suggests holding Utilities, Healthcare, and Consumer Goods (Staples/Noncyclical), in that order. (Note: In this model, we consider the bias to be defensive from a rules-based trend-following standpoint when SPY is below both its 50-day and 200-day simple moving averages.)

Other highly-ranked ETFs in SectorCast from the Utilities, Healthcare, and Consumer Goods (Staples/Noncyclical) sectors include Utilities Select Sector SPDR Fund (XLU), Market Vectors Pharmaceutical ETF (PPH), and PowerShares DWA Consumer Staples Momentum Portfolio (PSL).

Other notable ETFs that are highly ranked in our quant model include US Global Jets ETF (JETS), which mostly comprises airlines and has been consistently top-ranked. The forward P/E among airlines is extraordinarily low for solid expected growth. Other top-ranked ETFs include PowerShares Dynamic Leisure & Entertainment Portfolio (PEJ), and Market Vectors Mortgage REIT Income ETF (MORT), as well as the Guggenheim Invest Insider Sentiment ETF (NFO), which tracks a Sabrient index based on insider buying activity and sell-side analysts’ upward revisions to earnings estimates.

For an enhanced sector portfolio that enlists some top-ranked stocks (instead of ETFs) from within the top-ranked sectors, some long ideas from Utilities, Healthcare, and Consumer Goods (Staples/Noncyclical) sectors include American Duke Energy (DUK), American Water Works (AWK), Intuitive Surgical (ISRG), AbbVie Inc (ABBV), Tyson Foods (TSN), and WD-40 Company (WDFC). All are highly ranked in the Sabrient Ratings Algorithm.

If you prefer to take a neutral bias, the Sector Rotation model suggests holding Healthcare, Technology, and Financial, in that order. On the other hand, if you prefer a bullish stance on the market, the model suggests holding Energy, Technology, and Financial, in that order.

IMPORTANT NOTE: I post this information periodically as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I may or may not update the information each week. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted -- but not necessarily on the days that I happen to post this weekly article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ETF and stock ideas mentioned here as a managed portfolio.

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.