Sector Detector: Fundamental strength overcomes new macro worries as Tech and small caps lead

by Scott Martindale

by Scott Martindale

President, Sabrient Systems LLC

The month of May turned out to be pretty decent for stocks overall, with the S&P 500 large caps up about +2%, with growth greatly outperforming value, and June has got off to a good start, as well. But the smaller caps were the bigger stars, as I have been predicting for several months, with the S&P 600 small caps up +6% for the month. Even after a volatile April, and even though the headlines on trade wars, oil prices, Iran, North Korea, Venezuela, Italy, et al were confusing if not frightful, and even though technical signals suggested overbought conditions and a likely pullback, investors have been reluctant to sell their equities and the late-month pullback was fleeting.

Nevertheless, many commentators are offering up lots of reasons why further upside is limited and stocks likely will turn tail into a downtrend, including political contagion in the EU, the US dollar strengthening too much such that overseas corporate profits take a hit, and yields rising too quickly such that they 1) burden a heavily-leveraged economy and 2) suppress stock prices by spiking the risk-free rate used in a discounted cash flow analysis. But I think the main thing weighing on investors’ minds right now is fear that things are “as good as it gets” when it comes to synchronized global growth, monetary and fiscal stimulus, and year-over-year growth in corporate earnings. In other words, now that the hope and optimism for strong growth actually has materialized into reality, there is nothing more to look forward to, so to speak. The year-over-year EPS comparisons won’t be so eye-popping. Earnings growth inevitably will slow, higher interest rates will suppress valuations, and P/E compression will set in.

However, recall that the so-called “taper tantrum” a few years ago led to similar investor behavior, but then eventually cooler heads prevailed as investors realized that the fundamental picture was strong and in fact extraordinary monetary accommodation was no longer necessary (or even desirable). Similarly, I think there is still plenty of fuel in the tank from tax reform, deregulation, and new corporate and government spending plans, offering up the potential to drive strong growth for at least the next few years (e.g., through revived capex, onshoring of overseas capital and operations, and M&A).

In this periodic update, I provide a market commentary, offer my technical analysis of the S&P 500, review Sabrient’s latest fundamentals-based SectorCast rankings of the ten US business sectors, and serve up some actionable ETF trading ideas. In summary, our sector rankings still look bullish, while the sector rotation model takes a bullish posture as stocks try to break out.

By the way, in response to popular demand, Sabrient is launching this week our first International Opportunity portfolio comprising 30-35 stocks from non-US developed markets (e.g., Canada, Western Europe, Australasia, Far East) based on the same “quantamental” growth-at-reasonable-price (GARP) portfolio construction process used for our Baker’s Dozen portfolios, including the in-depth earnings quality review and final vetting by our wholly-owned forensic accounting subsidiary Gradient Analytics. In addition, we are nearing two years since the inception of our Sabrient Select actively-managed strategy, a 30-stock all-cap GARP portfolio that is available for investment as a separately managed account (SMA) through a dual-contract arrangement. (Please contact me directly if you would like to learn more about this.) Read on....

Market Commentary:

The month of May saw very little of the classic “sell in May and go away” behavior. In fact, May actually brought us a technical breakout to the upside, with the small-cap Russell 2000 and S&P 600 indices hitting new all-time highs and the Nasdaq Composite and Nasdaq 100 getting back near their all-time highs (and eclipsing them on Monday). Meanwhile, the CBOE Market Volatility Index (VIX), aka “fear gauge,” closed Monday at 12.74. History tells us that when small caps lead, it is very bullish for the market, and I will continue to preach my belief that we have the ideal climate for small caps.

Year to date through Monday, June 4, the S&P 500 is up about +2.3% while the S&P 400 is +2.9%, Russell 2000 +7.0%, S&P 600 +9.2%. Technology, Consumer Discretionary, and Energy have been the leading sectors among large caps, while defensive sectors Consumer Staples, Real Estate, Telecom, and Utilities have lagged. Among small caps, Healthcare has led. With robust growth, strong earnings reports and forward guidance, a great jobs report, a renewed bid for Treasury bonds putting a lid on rates, and impressive market breadth led by small caps, the bull case appears to remain intact.

Indeed, despite persistently worrisome headlines from overseas (are we really hearing about Italy collapsing the EU yet again?), there is no denying the strength in our domestic economic reports and indicators. For example, the latest S&P CoreLogic Case-Shiller Home Price Index was up 6.8%. The Dallas Fed Manufacturing Survey showed that the Production Index came in at 35.2 (a 12-year high) vs. last month's 25.3, while the General Activity Index rose to 26.8 from 21.8. Consumer Confidence remains near historic highs, while Investor Confidence remains well above the 100 threshold as institutional investors continue to accumulate equities. The unemployment rate fell to 3.8%, the lowest since 1969. Average hourly earnings were up 2.7% year-over-year, while weekly hours worked remained at 34.5.

As for GDP growth, the IMF projects real GDP global growth of 3.9% in both 2018 and 2019. Moody’s sees 2018 Chinese GDP at +6.6% for full-year 2018, and then gradually slowing to +5.5% by 2023. Here at home, the US Bureau of Economic Analysis (BEA) published its second estimate of real GDP growth in 1Q2018 at 2.2%, following 2.9% for 4Q2017. The Atlanta Fed’s GDPNow model as of June 1 raised its 2Q2018 GDP forecast to 4.8%, while the New York Fed’s Nowcast model projects 3.3% for 2Q2018.

Corporate earnings have been en fuego, with roughly 18% year-over-year EPS growth expected for full-year 2018. For 1Q2018 alone, S&P 500 EPS was up 20%. 77% of S&P 500 companies have reported upside surprises (along with the strongest forward guidance in 17 years). Given the tax holiday, record amounts of cash are being brought back home from overseas, dividends are being hiked by double digits, and share buyback programs are surging once again, as are IPOs and M&A activity. M&A is on track for its biggest year on record, with nearly 4,000 deals globally.

However, the market is forward-looking, and forward PEGs won’t be quite as enticing when we enter 2019. Consensus earnings growth estimates for the S&P 500 large caps have been about 18% in 2018 and 10% in 2019, and for the S&P 600 small caps 32% in 2018 and 18% in 2019. Entering 2018, the S&P 500 traded around 18.5x forward P/E for about 18% EPS growth. This equates to a forward PEG of about 1.03. However, a good chunk of that earnings growth was due to the corporate tax cut, and the forward year-over-year EPS growth rate for 2019 is expected to be more like 10%. So, even if the forward P/E finishes the year at its current level of about 16.5x, going into 2019 the forward PEG would be over 1.65, which is not nearly so attractive. Thus, we get the “as good as it gets” argument. And according to a Wall Street Journal study of the past seven years, stock markets have tended to perform poorly after great earnings seasons with lots of beats.

Furthermore, the Lending Tree Consumer Debt Outlook for May revealed that while incomes have been rising, household debt has been rising faster. Student loans continue to grow as a share of total consumer debt, now at a record high of nearly 11%, while auto loan delinquencies are also rising. On the other hand, mortgage debt has remained near record lows around 67%, and mortgage delinquencies also remain near record lows. And then another notable development is that freight costs for businesses have been skyrocketing due to supply/demand dynamics. For example, Coca-Cola (KO) recently reported a 20% year-over-year increase in freight expense.

In addition, JP Morgan thinks that relative performance among asset classes is becoming indicative of late-cycle behavior. They point out that, for the first time since 2008, the 3-month T-bill yield has achieved the same level as the dividend yield of the S&P 500 at about 1.9%, and that such a convergence of rates is a warning sign of recession. However, when you add in the yield from share buybacks, the composite yield is closer to 5%.

Not to be outdone, legendary investor George Soros thinks that the world is headed for another major financial crisis, this time having its epicenter in the EU, in a blast from the past (2011). He thinks it will be caused by “the refugee crisis, territorial disintegration exemplified by Brexit and an austerity policy, prompted by the financial crisis.” Is the political crisis in Italy the start of this crisis? After all, the parties vying for power have talked about exiting the EU and eschewing austerity by cutting taxes and boosting spending, which led the Italian 2-year yield to rise an incredible 150 bp in one day, from 0.9% to 2.4%, before settling back the next day to 1.7% as their anti-EU rhetoric toned down. And would Spain be next, with both countries exiting the EU and redenominating their bonds in their old currencies (lira and peseta)? The fearmongers would have us believe so. But in any case, I would expect that the destination for any capital flight is likely the US.

As for all the hostile rhetoric around trade tariffs, keep in mind that the US sits in a very strong negotiating position with the world’s largest economy and military. Moreover, it is the greatest importer with the largest trade deficit, highest debt, the most important central bank, the world’s reserve currency, and the most important global payment system. It seems likely that capital flow will slow down into emerging markets, with the US the likely destination – for both debt and equity investors. Trump knows this, of course, and I think his bluster is part of his negotiating approach to all things, which is to call out perceived inequities for all to hear and let it be known he will not tolerate it any longer. He doesn’t like to leave things to the professional (“deep state”) negotiators, particularly since it was those folks who got us into our current circumstances. If you show a willingness to talk about his grievances, he strokes your ego and treats you like a good friend, but if you resist, he treats you like an unrepentant cheater. After decades of ineffectuality, he has surely provided a new approach. He knows that everyone wants (and needs) to trade with the US. Yes, we have a lot to lose if things go awry, but everyone else has a lot more to lose, so I do not fear a messy trade war that sinks the global economy into recession. There is simply too much at stake for everyone involved. And even if the unthinkable transpired, to where would investors flee? Why, the US, of course.

Speaking of the US trade deficit, it is notable that our deficit in industrial supplies (including energy, steel, and chemicals) has declined over the past few years, thanks to rising domestic production and lesser petroleum imports. Sounds good. But more recently, the capital goods deficit has progressively increased, which might sound bad. However, this implies rising equipment investment on the part of businesses, which represents the important and long-sought capex spending that helps the economy grow, including onshoring of operations, updating old equipment, and hiring personnel.

But for now, the 10-year Treasury seems to catch a bid whenever it exceeds the 3.0% level, as global structural issues, demographics, relative yields, and political turmoil have created an appetite for the relative safety and higher yields offered here compared with other developed market rates – and in fact emerging markets debt seems to have lost its steam, with those capital outflows likely destined for the US. The 10-year Treasury closed Monday at 2.94%, while the 2-year closed at 2.51%. The closely-watched 2-10 spread sits at only 43 bps in the wake of the turmoil in Italy (and the resulting flight to safety of the good old USA) and remains well under the 100 bps “normalcy threshold.”

While the rise in short-term U.S. rates and flattening of the yield curve have created concerns about a possible recession, it largely reflects greater confidence in the growth and inflation outlook. It appears to me that the rapid rise in rates have finally caught a bid (as I expected they would) as markets have priced in higher growth and inflation and additional Fed rate increases. Note that when political turmoil flared up in Italy, demand for safe-haven assets (like the US) surged.

The FOMC has indicated it is comfortable with a modest overshoot of its 2% inflation target given the “symmetric” nature of the target. Thus, CME fed funds futures have changed from forecasting three additional rates hikes in 2018 to just two (or even one). After the March 25 bp hike, the current target fed funds rate is 1.50%-1.75% (which with inflation subtracted is still a negative real rate). Fed funds futures currently place the odds of rate hike #2 for 2018 coming at the June meeting at 94%, and by September there is a 70% chance of a third rate hike but only a negligible chance of a fourth hike. By the December meeting, there is an 86% chance of a third hike, a 41% probability of a fourth quarter-point rate hike, and a remote 3.6% chance of a fifth hike, while the odds are only 14% that the fed funds rate remains at 1.75%-2.00% (i.e., a total of only two rate hikes this year).

Nevertheless, with the trend in interest rates being upward (albeit gradually), stocks that tend to thrive in a rising rate environment would be expected to outperform the broad market. Indeed, Sabrient’s Rising Rate portfolios (2-year trusts holding 50 stocks each) all have been outperforming. In such an environment, economically-sensitive sectors like Industrials and Financials tend to score well in our GARP model, as well as sectors that benefit from commodity inflation like Materials and Energy. Also, Technology is typically favored as an all-weather sector given its lower financial leverage (i.e., lower debt-to-equity ratio) and its synergies throughout the broad economy as a driver of productivity.

Although some summer trading doldrums may set in, and the runup into the mid-term elections might bring some elevated volatility, I think the 2H2018 should see a resurgence in bullish sentiment as markets resume their upside breakout. Some are suggesting that commodities are on track to be the best performing asset class this year, and that might be so, but I still think equities will end up the year with a reasonable return, with the S&P 500 north of 3,000.

Finally, I want to reiterate what I said at the outset regarding Sabrient’s new International Opportunity portfolio and our SMA option. In addition, we continue to have conversations with ETF issuers about bringing our GARP-based strategies to market through an ETF wrapper (passive or active),.

SPY Chart Review:

The SPDR S&P 500 ETF (SPY) closed Monday June 4 at 263.20. It broke out from a descending triangle pattern in early May and is now testing resistance at the top of its new sideways consolidation channel, supported by the 20-day simple moving average (SMA). As I suggested last month, descending triangles sometimes turn out to be quite bullish, fueled by both dip buying and short covering, and that is exactly what happened. Now that it has remained in a sideways pattern for a few weeks, a breakout would likely lead to a test of resistance at the first “lower high” of the previous downtrend line near 280. The bullish move has been supported by greater market breadth, with five cyclical sectors outperforming, led by Tech, Consumer Discretionary, and Energy. In addition, the small caps are especially strong, which is bullish. Oscillators RSI, MACD, and Slow Stochastic have all moved out of neutral territory and have each made a series of higher lows, which is bullish.

Latest Sector Rankings:

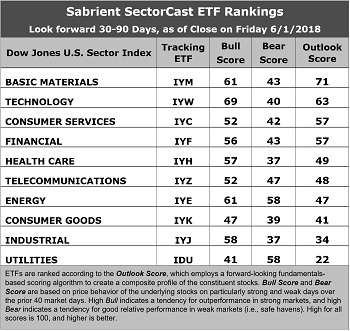

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each of over 600 equity ETFs based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings, and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. A high Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500 large cap index, I prefer the iShares for their larger universe and broader diversity.

Here are some of my observations on this week’s scores:

1. The rankings have shuffled quite a bit since last month, once again, and look even more bullish overall. Basic Materials has returned to the top with an Outlook score of 71, followed by old friend Technology at 63. Materials has good sell-side analyst sentiment (net positive revisions to EPS estimates), a reasonable forward P/E (16.1x), strong return ratios, and good insider sentiment (net open market buying). Technology has strong sell-side analyst sentiment, a high projected year-over-year EPS growth rate (15.7%), a forward PEG (ratio of forward P/E to forward EPS growth rate) of 1.2, and the highest return ratios. Consumer Goods (Discretionary/Cyclical), Financial, and Healthcare round out the top five, followed by Telecom and Energy. Energy saw the best sell-side analyst sentiment.

2. Utilities now sits at the bottom of the Outlook rankings with a score of 22 as it generally displays poor factor scores across the board, including a low forward P/E (5.1x) and the highest forward PEG of 3.2. Industrial has fallen into the bottom two with a score of 34, mainly due to average factor scores across the board.

3. Looking at the Bull scores, Technology enjoys the top score of 69, followed by Materials and Energy, as stocks within these sectors have displayed relative strength on strong market days, while Utilities scores the lowest at 41. The top-bottom spread is 28 points, which reflects quite low sector correlations on strong market days. It is desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the market segments and stocks they want to hold (rather than broad risk-on behavior).

4. Looking at the Bear scores, we find Utilities and Energy sharing the top spot with a score of 58, which means that stocks within these sectors have been the preferred safe havens lately on weak market days. Industrial and Healthcare share the lowest score of 37, as investors have fled during recent market weakness. The top-bottom spread is 21 points, which reflects low sector correlations on weak market days. Ideally, certain sectors will hold up relatively well while others are selling off (rather than broad risk-off behavior), so it is desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points.

5. Materials displays the best all-around combination of Outlook/Bull/Bear scores, followed closely by Technology, while Utilities is the worst. Looking at just the Bull/Bear combination, Energy is by far the best, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish), while Consumer Goods (Staples/Noncyclical) is by far the worst, as investors have generally avoided the sector.

6. This week’s fundamentals-based Outlook rankings continue to reflect a bullish bias, given that the top five sectors are economically-sensitive or all-weather. Keep in mind, the Outlook Rank does not include timing, momentum, or relative strength factors, but rather reflects the consensus fundamental expectations at a given point in time for individual stocks, aggregated by sector.

ETF Trading Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), displays a bullish bias and suggests holding Technology (IYW), Materials (IYM), and Energy (IYE), in that order. (Note: In this model, we consider the bias to be bullish from a rules-based trend-following standpoint when SPY is above both its 50-day and 200-day simple moving averages.)

Besides iShares’ IYW, IYM, and IYE, other highly-ranked ETFs in our SectorCast model (which scores nearly 650 US-listed equity ETFs) from the Technology, Materials, and Energy sectors include PowerShares Dynamic Semiconductors (PSI), PowerShares DWA Basic Materials Momentum (PYZ), and PowerShares Dynamic Energy Exploration & Production (PXE).

If you prefer a neutral bias, the Sector Rotation model suggests holding Basic Materials, Technology, and Consumer Services (Discretionary/Cyclical), in that order. On the other hand, if you are more comfortable with a defensive stance on the market, the model suggests holding Energy, Utilities, and Telecom, in that order.

An assortment of other interesting ETFs that are scoring well in our latest rankings include VanEck Vectors Mortgage REIT Income (MORT), Alpha Architect US Quantitative Value (QVAL), Global X MSCI Argentina (ARGT), Deep Value ETF (DVP), First Trust Value Line 100 (FVL), Pacer US Cash Cows 100 (COWZ), iShares PHLX Semiconductor (SOXX), SPDR MFS Systematic Value Equity (SYV), First Trust NASDAQ ABA Community Bank (QABA), SPDR S&P Homebuilders (XHB), iShares Edge MSCI USA Value Factor (VLUE), and WBI BullBear Yield 2000 (WBIC).

IMPORTANT NOTE: I post this information periodically as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I do not update the information on a regular schedule or on technical triggers. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted, but not necessarily on the days that I happen to post this article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ideas mentioned here as a managed portfolio.

Disclosure: The author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any opinions, commentary, rankings, or stock selections provided by Sabrient Systems or its wholly-owned subsidiary Gradient Analytics. Sabrient makes no representations that the techniques used in its rankings or analysis will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.