Sector Detector: Investors Watch Romney’s Hunt for Red October

With about six weeks to go until the U.S. Presidential election, we enter the critical month of October in which Romney will be using all means necessary to move the swing states like Ohio, Florida, and Colorado from blue to red. The latest polls show Obama leading in these states, but everyone—especially investors—knows that it can all change during this final stretch of debates, campaigning, interviews, and commercials. And bulls will have a difficult time reestablishing the rally without enlisting some new investors to join them.

With about six weeks to go until the U.S. Presidential election, we enter the critical month of October in which Romney will be using all means necessary to move the swing states like Ohio, Florida, and Colorado from blue to red. The latest polls show Obama leading in these states, but everyone—especially investors—knows that it can all change during this final stretch of debates, campaigning, interviews, and commercials. And bulls will have a difficult time reestablishing the rally without enlisting some new investors to join them.

We have been seeing snippets of promising news, such as rising home prices, soaring consumer confidence, and notable improvements in some manufacturing indexes. Nevertheless, cautious traders have been taking profits while bulls await the next buying opportunity. As I write this, stock futures are getting a boost after Thursday trading in Asian markets reacted quite favorably to reports that the People's Bank of China made a record injection of liquidity into its banking system.

However, one of the Fed hawks, Philly Fed President Charles Plosser, expressed his profound displeasure about the latest round of quantitative easing, in which the Fed will buy up mortgage-backed securities for as long as they see fit. He sees no benefit for the economy, but an unhealthy escalation in inflation—i.e., the dreaded stagflation. It’s good to have someone speaking the truth, even if it’s not the party line. With huge levels of excess reserves, banks don’t need or want more cash, and mortgage rates are already extraordinarily low. It reeks of desperation.

While I write this article, I am watching the X-Factor on TV with my family and some of my older daughter’s friends. It is startling how many people go on these talent shows as a last-ditch attempt to rise above the hopelessness and despair in which they live each day. This is the opportunity issue that Romney has been trying to highlight. Too many folks depend upon government entitlements for the bare necessities, but at the same time they feel they have almost no legitimate opportunity to escape their current circumstances without winning the lottery, or X-Factor, or American Idol.

Romney’s message of unleashing businesses to grow and create jobs should be resonating with these folks, but so far it has not. Unless he can convince the huddled masses that reemphasizing capitalist policies will give them hope, to replace their current state of hopelessness, they will continue to vote for whoever promises the comforting but debilitating social programs they depend upon. Yes, Romney has his work cut out for him as he takes on the difficult task of changing the color of the swing states to Republican red.

As for the trading action, NYSE short interest appears to have peaked in June and has been generally falling since then. Higher short interest tends to be a negative for the market, so the trend towards short-covering has provided extra fuel for stocks in this low-volume trading environment.

Some traders are blaming the current market pullback on the news that Germany wants to delay Spain’s formal request for aid, but technicians will tell you that it’s all in the chart pattern. So let’s examine the charts.

The S&P 500 SPDR Trust (SPY) closed Wednesday at 143.29. The market definitely needed some backing-and-filling, and that’s what we are getting. It had been trading within a bullish rising channel since the rally started at the beginning of June, and then it got a major breakout after the Fed QE3 announcement, before taking some time to retest resistance-turned-support at the top line of the 3-month bullish rising channel. But this week it was not to be, and price now finds itself back in the middle of that rising channel, below the 20-day simple moving average, but still above the 50-, 100- and 200-day SMAs. As I said last week, it had reached so far beyond the 20- and 50-day SMAs that a reversion to the mean was likely.

You can see in the chart that before the post-Fed breakout, Bollinger Bands had pinched closely together while price coiled within a tight sideways channel as it awaited a catalyst. Now price has almost come back full circle to the breakout level of 142. There is a lot of strong support below, including the previous triple-top resistance-turned-support at 142, the rising 50-day SMA, the bottom line of the rising channel, and then prior support at 140. Then there is the 100-day SMA near 137 and finally the rising 200-day SMA down around 136. Oscillators like RSI and Slow Stochastic have worked off most of their overbought characteristics, but MACD has only begun a bearish crossover.

I think the support levels will hold, but we might not see another attempt at new highs until the election results become clearer.

The VIX (CBOE Market Volatility Index—a.k.a. “fear gauge”) once again bounced from strong multi-year support around 14 and closed Wednesday at 16.81. This is still quite low and generally bullish for stocks.

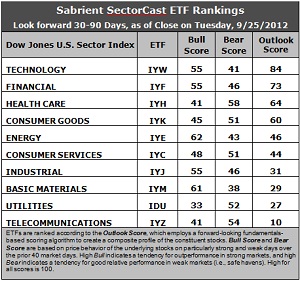

Latest rankings: The table ranks each of the ten U.S. industrial sector iShares (ETFs) by Sabrient’s proprietary Outlook Score, which employs a forward-looking, fundamentals-based, quantitative algorithm to create a bottom-up composite profile of the constituent stocks within the ETF. In addition, the table also shows Sabrient’s proprietary Bull Score and Bear Score for each ETF.

High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods. Bull and Bear are backward-looking indicators of recent sentiment trend.

As a group, these three scores can be quite helpful for positioning a portfolio for a given set of anticipated market conditions.

Observations:

1. Technology (IYW) remains in the top spot with a strengthening Outlook score of 84. Stocks within IYW are displaying relatively low forward P/Es, strong projected long-term growth, and solid return ratios. However, the analysts have been reducing forward earnings estimates overall. They also have been reducing estimates within the Industrial and Materials sectors. Healthcare (IYH) falls to the third spot with a 64, as Financial (IYF) takes second place with a 73. Consumer Goods (IYK) retakes fourth as Energy (IYE) seems to have lost some of its mojo.

2. Telecom (IYZ) stays at the bottom of the Outlook rankings this week with an Outlook score of 10. Stocks within the sector are burdened by the highest forward P/Es and the worst return ratios, plus net downgrades from Wall Street. Utilities (IDU) falls back into the bottom two, mainly due to its anemic long-term projected growth rate.

3. Overall, I still categorize the rankings as mostly neutral, with conservative sectors like Consumer Goods and Healthcare in the top five, and economically-sensitive sectors like Industrial, Consumer Services, and Basic Materials in the bottom five.

4. Looking at the Bull scores, Energy (IYE) is the leader on strong market days, scoring 62, followed closely by Basic Materials (IYM). Utilities (IDU) is still by far the weakest on strong days, scoring 33. In other words, Energy stocks have tended to perform the best when the market is rallying, while Utilities stocks have lagged.

5. Looking at the Bear scores, Healthcare (IYH) is the investor safe haven on weak market days, scoring 58. Basic Materials (IYM) has been abandoned the most by investors during market weakness, as reflected by its low Bear score of 38. In other words, Materials stocks have tended to sell off the most when the market is pulling back, while Healthcare stocks have held up the best.

6. Overall, Technology (IYW) again shows the best all-weather combination of Outlook/Bull/Bear scores. Adding up the three scores gives a total of 180. Telecom (IYZ) is the worst at 105. As for Bull/Bear combination, Energy (IYE) remains the best at 105, while Utilities (IDU) is by far the worst with a dismal 85.

These scores represent the view that the Technology and Financial sectors may be relatively undervalued overall, while Telecom and Utilities sectors may be relatively overvalued based on our 1-3 month forward look.

Top-ranked stocks within IYW and IYF include Google (GOOG), Rackspace Hosting (RAX), Goldman Sachs (GS), and RenaissanceRe Holdings (RNR).

Disclosure: Author has no positions in stocks or ETFs mentioned.

About SectorCast: Rankings are based on Sabrient’s SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a fundamentals-based multi-factor approach considering forward valuation, earnings growth prospects, Wall Street analysts’ consensus revisions, accounting practices, and various return ratios. It has tested to be highly predictive for identifying the best (most undervalued) and worst (most overvalued) sectors, with a 1-3 month forward look.

Bull Score and Bear Score are based on the price behavior of the underlying stocks on particularly strong and weak days during the prior 40 market days. They reflect investor sentiment toward the stocks (on a relative basis) as either aggressive plays or safe havens. So, a high Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods.

Thus, ETFs with high Bull scores generally perform better when the market is hot, ETFs with high Bear scores generally perform better when the market is weak, and ETFs with high Outlook scores generally perform well over time in various market conditions.

Of course, each ETF has a unique set of constituent stocks, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use ten iShares ETFs representing the major U.S. business sectors.

About Trading Strategies: There are various ways to trade these rankings. First, you might run a sector rotation strategy in which you buy long the top 2-4 ETFs from SectorCast-ETF, rebalancing either on a fixed schedule (e.g., monthly or quarterly) or when the rankings change significantly. Another alternative is to enhance a position in the SPDR Trust exchange-traded fund (SPY) depending upon your market bias. If you are bullish on the broad market, you can go long the SPY and enhance it with additional long positions in the top-ranked sector ETFs. Conversely, if you are bearish and short (or buy puts on) the SPY, you could also consider shorting the two lowest-ranked sector ETFs to enhance your short bias.

However, if you prefer not to bet on market direction, you could try a market-neutral, long/short trade—that is, go long (or buy call options on) the top-ranked ETFs and short (or buy put options on) the lowest-ranked ETFs. And here’s a more aggressive strategy to consider: You might trade some of the highest and lowest ranked stocks from within those top and bottom-ranked ETFs.