Sector Detector: Confused investors are saying, “It’s all Greek to me”

When something is confusing or incomprehensible, a person might say, “It’s all Greek to me.” Well, that’s exactly what investors have been saying for the past several days—in the market’s inimitable way. Despite promising economic and corporate news in the U.S., the headline risk from Europe has been just too much to bear. It is keeping the bulls at bay, and front and center for an encore performance is Greece.

When something is confusing or incomprehensible, a person might say, “It’s all Greek to me.” Well, that’s exactly what investors have been saying for the past several days—in the market’s inimitable way. Despite promising economic and corporate news in the U.S., the headline risk from Europe has been just too much to bear. It is keeping the bulls at bay, and front and center for an encore performance is Greece.

I guess the Greeks couldn’t stand losing their global limelight to Spain and Italy. Greece is like that pesky cousin who always stops by unannounced to bum a free meal and “borrow” a few bucks (and light up a cigarette in your living room before heading out).

They have not been able to put together a political coalition to run the government, so the likelihood of them having to drop out of the euro is steadily rising. Now we must await another round of elections slated for June 17, while bond rates in Spain and Italy rise. If Greece refuses to make mandated spending cuts after the new elections, which is likely given that anti-austerity candidates are likely to gain even more support the next time around, they may lose their bailout and get kicked out of the euro club. Many experts think such an occurrence would be devastating to the EU and UK.

The resulting weakness in the euro vs. the U.S. dollar has been a negative for U.S. equities and good for bonds. Looking at the U.S. sector iShares this week, Financial (IYF) and Materials (IYM) have been the weaklings, while defensive sectors Healthcare (IYH) and Consumer Goods (IYK) have held up pretty well. The PowerShares US Dollar Fund (UUP) and iShares Barclays 20-Year Treasury Fund (TLT) are both up this week.

But this correction seems like a developing buying opportunity to me. The only question in my mind is how much pain investors will have to endure before the market rebounds.

Bonds have become wildly overvalued relative to stocks. The U.S. 10-year Treasury yield is near its all-time low as money flees Europe in favor of the relative safety of the U.S. So, there is no shortage of liquidity in this country…and the Fed has pledged to make sure it stays that way.

Despite some extremely worrisome developments last week, including European elections, Cisco’s (CSCO) weak report, and JP Morgan’s (JPM) revelation, the market has not cratered and bears have been remarkably tame. Looking ahead, corporate earnings have been strong overall, and companies are carrying strong balance sheets with plenty of cash.

The highly anticipated IPO for Facebook (FB) is nigh, and investors are jazzed. It is expected to start public trading on Friday. Notably, the firm is only paying its numerous underwriters a 1.1% commission, given that there is little in the way of press and exposure the deal needs. There have been several other Internet IPOs recently, including LinkedIn (LNKD), Groupon (GRPN), and Zynga (ZNGA), so the market’s appetite is already whetted for social media companies. Demand for FB has been so strong that the company raised the bottom end of its share price range from $28 to $31.

The biggest chink in the bull’s armor is newly elevated fear of a European meltdown. For now, Germany’s brisk economic growth has balanced the erosion in the at-risk nations to keep the eurozone out of a net recession, but still, seven of the 17 eurozone nations are in an official recession.

SPY closed Wednesday at 132.83. Last week, it lost the strong support it had been enjoying at the convergence of its 50-day simple moving average and the uptrend line. This week it has lost support at the convergence of its 100-day simple moving average and the line of prior support just below 135. Volume is still elevated during this period of weakness. RSI, MACD, and Slow Stochastic are now deeply oversold. There is little in the way of support between here and the 200-day SMA near 128, so an immediate bounce is needed. Given the weak technical conditions, any sign of promising news from across the pond could result in a very strong relief rally.

The VIX (CBOE Market Volatility Index—a.k.a. “fear gauge”) closed Wednesday at 22.27. Last fall in the heat of the Eurozone crisis, fear was elevated and 30 was acting as strong support. As fears subsided, VIX finally broke down and it quickly made its way to test support at 20 for about 4 weeks before breaking down further. It got as low as 13.66 during March, but as the market has entered this consolidation period, VIX has been testing support-turned-resistance at 20 a few times. It has now broken out, at least for the moment.

The TED spread (indicator of credit risk in the general economy, measuring the difference between the 3-month T-bill and 3-month LIBOR interest rates) closed Wednesday once again at 38 bps. After complacently sitting in the teens last year, it rose to near 60 at the height of the Eurozone crisis in December, but has since flatlined in this mid-level zone near 40 since mid-February.

As a reminder, The MacroReport is Sabrient’s newest product for the investment professional. This is a monthly co-publication of Sabrient Systems and MacroRisk Analytics, providing an in-depth analysis of the macroeconomic trends in focus territories around the world and their impact on the U.S. economy, along with actionable ideas (U.S. stocks and ETFs) intended to capitalize on a given outcome. Complimentary access is available on our web site throughMacroReport InterActive. The inaugural March issue focused on Greece. The current issue focuses on China. The next issue, slated to be released next week, will look at oil prices and the global issues that impact it.

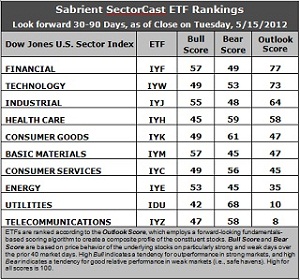

Latest rankings: The table ranks each of the ten U.S. industrial sector iShares (ETFs) by Sabrient’s proprietary Outlook Score, which employs a forward-looking, fundamentals-based, quantitative algorithm to create a bottom-up composite profile of the constituent stocks within the ETF. In addition, the table also shows Sabrient’s proprietary Bull Score and Bear Score for each ETF.

High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods. Bull and Bear are backward-looking indicators of recent sentiment trend.

As a group, these three scores can be quite helpful for positioning a portfolio for a given set of anticipated market conditions.

Observations:

1. Financial (IYF) stays at the top of the Outlook rankings with a 77, and Technology (IYW) continues in second place with a 73. Industrial (IYJ) and Healthcare (IYH) round out the top four. IYF still has one of the lowest (best) forward P/Es, and it continues to gain support among analysts as the banks re-emerge, despite their vulnerability to Europe’s turmoil. IYW remains strong in its return ratios as margins are high for tech products.

2. Energy (IYE) and Materials (IYM) continue to be hammered by analyst downgrades of earnings estimates, yet they still reflect the lowest (best) forward P/Es. Nevertheless, IYM jumped a bit back up to a fifth place tie on the strength of its current valuation vs. its projected long-term growth rate.

3. Telecom (IYZ) remains at the bottom of the rankings with a dismal Outlook score of 8. It is saddled with the worst return ratios and the highest forward P/E. It is again joined in the bottom two by Utilities (IDU) with an Outlook score of 10. IDU has low long-term growth projections and a high forward P/E, as well as more earnings downgrades.

4. Looking at the Bull scores, Financial (IYF) and Basic Materials (IYM) are the leaders on strong market days, followed by Industrial (IYJ) and Energy (IYE). Utilities (IDU) is by far the weakest on strong days, scoring 42.

5. Looking at the Bear scores, Utilities (IDU) remains the investor favorite “safe haven” on weak market days, scoring a strong 68, followed by Consumer Goods (IYK). Materials (IYM) and Energy (IYE) share the lowest Bear scores, as they have tended to sell off the most when the market is pulling back.

6. Overall, IYF still shows the best all-weather combination of Outlook/Bull/Bear scores. Adding up the three scores gives a total of 183. IYW is next at 175. IYZ is the worst at 113. IYK and IDU now reflect the best combination of Bull/Bear with a total score of 110, which is both defensive and bearish. Energy (IYE) displays by far the worst combination with a 98, as investors have avoided the sector under all market conditions.

These scores represent the view that the Financial and Technology sectors may be relatively undervalued overall, while Telecom and Utilities sectors may be relatively overvalued based on our 1-3 month forward look.

Top-ranked stocks within Financial and Technology sectors include Invesco Mortgage Capital (IVR), BancorpSouth (BXS), NetEase (NTES), and Demand Media (DMD).

Disclosure: Author has no positions in stocks or ETFs mentioned.

About SectorCast: Rankings are based on Sabrient’s SectorCast model, which builds a composite profile of each equity ETF based on bottom-up scoring of the constituent stocks. The Outlook Score employs a fundamentals-based multi-factor approach considering forward valuation, earnings growth prospects, Wall Street analysts’ consensus revisions, accounting practices, and various return ratios. It has tested to be highly predictive for identifying the best (most undervalued) and worst (most overvalued) sectors, with a one-month forward look.

Bull Score and Bear Score are based on the price behavior of the underlying stocks on particularly strong and weak days during the prior 40 market days. They reflect investor sentiment toward the stocks (on a relative basis) as either aggressive plays or safe havens. So, a high Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods.

Thus, ETFs with high Bull scores generally perform better when the market is hot, ETFs with high Bear scores generally perform better when the market is weak, and ETFs with high Outlook scores generally perform well over time in various market conditions.

Of course, each ETF has a unique set of constituent stocks, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use ten iShares ETFs representing the major U.S. business sectors.

About Trading Strategies: There are various ways to trade these rankings. First, you might run a sector rotation strategy in which you buy long the top 2-4 ETFs from SectorCast-ETF, rebalancing either on a fixed schedule (e.g., monthly or quarterly) or when the rankings change significantly. Another alternative is to enhance a position in the SPDR Trust exchange-traded fund (SPY) depending upon your market bias. If you are bullish on the broad market, you can go long the SPY and enhance it with additional long positions in the top-ranked sector ETFs. Conversely, if you are bearish and short (or buy puts on) the SPY, you could also consider shorting the two lowest-ranked sector ETFs to enhance your short bias.

However, if you prefer not to bet on market direction, you could try a market-neutral, long/short trade—that is, go long (or buy call options on) the top-ranked ETFs and short (or buy put options on) the lowest-ranked ETFs. And here’s a more aggressive strategy to consider: You might trade some of the highest and lowest ranked stocks from within those top and bottom-ranked ETFs, such as the ones I identify above.