Sector Detector: Fast and furious selloff provides important market cleansing

The sudden bearish turn last week in the market -- after hitting new highs the prior week -- has come fast and furious as selloffs are wont to do. And the pullback might have further still to go. But there are several reasons to expect a stabilization or bounce during this holiday-shortened week, and in any case I still expect that it eventually will turn out to be a great buying opportunity leading to higher prices later in the year. The major indexes are at or near round-number support levels, including NASDAQ at 4,000, Dow Jones Industrials at 16,000, S&P 500 at 1,800, and Russell 2000 at 1,100. And from a technical standpoint, despite violating support at the 50-day simple moving average, the S&P 500 remains well within the bounds of its long-standing bullish rising channel.

The sudden bearish turn last week in the market -- after hitting new highs the prior week -- has come fast and furious as selloffs are wont to do. And the pullback might have further still to go. But there are several reasons to expect a stabilization or bounce during this holiday-shortened week, and in any case I still expect that it eventually will turn out to be a great buying opportunity leading to higher prices later in the year. The major indexes are at or near round-number support levels, including NASDAQ at 4,000, Dow Jones Industrials at 16,000, S&P 500 at 1,800, and Russell 2000 at 1,100. And from a technical standpoint, despite violating support at the 50-day simple moving average, the S&P 500 remains well within the bounds of its long-standing bullish rising channel.

Among the ten U.S. business sectors, defensive sector Utilities stands alone as the year-to-date leader, up about +9% and hitting a new intraday high on Thursday. Healthcare had been keeping up for a while, but it has fallen back into the pack with the big selloff in biotech and biopharma.

No doubt, investors have been protecting capital, and there has been a rotation into the blue chips as the momentum darlings have been slaughtered. Experienced traders know that, although the glamour stocks can outperform value stocks over short periods of time, history shows that ultimately the tortoise beats the hare, i.e., value wins out. As such, I would not suggest jumping back into stocks like Netflix (NFLX) or 3D Systems (DDD) that have poor earnings quality and still display high forward valuations even after their massive selloffs.

So, yes, a market cleansing like this is both important and inevitable. However, as I observed last week, the market will often throw out the proverbial baby with the bathwater, which is a boon for savvy investors. For example, Sabrient favorites Jazz Pharmaceuticals (JAZZ) and Actavis plc (ACT) remain fundamentally sound, and their previously fair valuation is now even much more attractive.

Although we will likely see positive returns in the U.S. market, many market commentators are predicting those returns to be modest in the U.S. and other developed economies this year, but better for emerging markets and potentially outstanding for frontier markets. Indeed, the IMF reported at their meeting on Saturday that the global economy appeared to have turned a corner into a “strengthening phase” that can make inroads into persistently high unemployment after a disastrous 2008-2010 timeframe. Certainly the high price of crude oil suggests global demand due to economic growth.

Some of the extreme market weakness recently might be due to shorting for “delta hedging” by put sellers, and total short interest on S&P 500 stocks has risen to its highest levels since 2012. Furthermore, many traders may have been exiting positions or cashing in gains so that they can take time off this week in observance of Passover, or perhaps to pay taxes on capital gains. If so, we might not see much more downside.

Of course, in any market climate there will be a bull case and a bear case. Bears are complaining that the forward P/E valuation of the S&P 500 (about 15x) is still historically expensive, corporate profit margins are at record highs and due for a reversion to the mean, the Federal Reserve’s tightening of monetary policy (i.e., tapering of quantitative easing) will prove recessionary, and growth slowdown and credit tightening in China along with Russia’s incursion into Ukraine will spook international investor and stunt global demand. Many are expecting a weak earnings season and few expressions of optimism.

This week, 54 S&P 500 companies are scheduled to report Q1 earnings, including bellwethers like General Electric (GE), Johnson & Johnson (JNJ), Goldman Sachs (GS), Google (GOOGL) and IBM (IBM). Also, we’ll hear economic reports like retail sales on Monday, CPI on Tuesday, housing starts and industrial output on Wednesday, and the Philly Fed business activity index and initial jobless claims on Thursday, before the Good Friday holiday.

The CBOE Market Volatility Index (VIX), a.k.a. “fear gauge,” closed Friday at 17.03. So, there has been a notable jump in investor trepidation, but it is still below 20 and lower than one might expect for the prevailing conditions.

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed Friday at 181.51. After the previous Friday’s action ended with a nasty bearish engulfing candle on high volume, we saw some follow-through last Monday, a brief bounce from the 50-day simple moving average, and then the week finished with a scary selloff that stopped only briefly at the 100-day SMA. Oscillators RSI, MACD, and Slow Stochastic are all at or near oversold territory. It appears that bears might struggle to push price much lower in the near term. Remaining support levels start with round-number support at 180, the bottom of the rising channel (near 179), and finally the 200-day SMA (near 177).

Latest sector rankings:

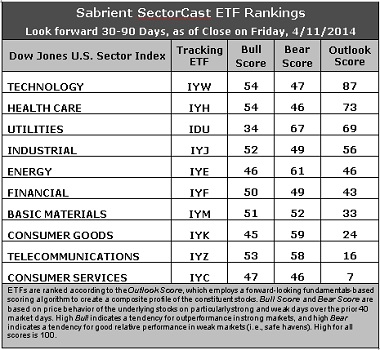

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The “Outlook Score” employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting score), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes our Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (“safe havens”) when the market is weak.

Outlook Score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use the iShares that represent the ten major U.S. business sectors: Financial, Technology, Industrial, Healthcare, Consumer Goods, Consumer Services, Energy, Basic Materials, Telecom, and Utilities. Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. After last week saw Utilities (IDU) suddenly reach the top of the rankings, which was a bearish development that has certainly played over the past week, we now see a quick “normalization” in which Technology (IYW) is back on top with an Outlook score of 87, and Utilities drops to third with a 69. Healthcare (IYH) has risen back to second place with a score of 73. Technology generally displays solid factor scores across the board, with a strong forward long-term growth rate, a reasonable forward P/E, and the highest return ratios. In addition, the Wall Street analysts are starting to show support again after sentiment had slipped a bit recently with some downward earnings revisions. The recent Tech selloff helped improve the sector’s forward valuation, while the strength in Utilities has hurt its forward valuation. Rounding out the top five are (IYJ) and Energy (IYE).

2. Consumer Services (IYC) stays in the cellar with an Outlook score of 7, even though it has the highest forward long-term growth rate. Telecommunications (IYZ) is back in the bottom two with a score of 16. Basic Materials (IYM) has risen significantly this week to 33. Consumer Goods (IYK) has fallen down to the third worst with an Outlook score of 24. The two Consumer sectors and Financial have been bearing the brunt of the sell-side’s downward earnings revisions, as we enter earnings reporting season.

3. Looking at the Bull scores, Technology and Healthcare share the lead with a score of 54, while Utilities is by far the laggard with a low score of 34. The top-bottom spread has jumped to 20 points, reflecting low sector correlations on particularly strong market days. It is generally desirable in a healthy market to see a top-bottom spread of at least 20 points. This indicates that investors have clear preferences in the stocks they want to hold, rather than an “all boats lifted in a rising tide” mentality that we saw during 2013.

4. Looking at the Bear scores, Utilities is the clear leader with a 67, which means that stocks within this defensive sector have been the preferred “safe havens” on weak market days. Notably, Energy also scores above 60 this week. Healthcare and Consumer Services score the lowest at 46. The top-bottom spread is a robust 21 points, reflecting low sector correlations on particularly weak market days (and we’ve certainly seen a number of those lately). It is generally desirable in a healthy market to see a top-bottom spread of at least 20 points. As corroboration, ConvergEx reported last week that among the 10 sectors of the S&P 500, the average industry correlation to the broad index was 77.5% over the past month versus 80-87% over the prior two months.

5. Technology displays the best all-weather combination of Outlook/Bull/Bear scores, while Consumer Services is the worst. Looking at just the Bull/Bear combination, Telecom is the clear leader, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish), while Consumer Services scores the lowest, indicating general investor avoidance during extreme conditions.

6. Overall, I would say that this week’s rankings have returned to a neutral bias. Technology and Healthcare are displaying solid Bull scores, and they are ranked as the top two Outlook scores, so that is bullish. However, defensive sector Utilities remains inordinately strong, while Financial, Basic Materials, and the two Consumer sectors are showing marked weakness in their Outlook scores. Moreover, given that Energy is showing a weakening Bull score and a very solid Bear score, I would have to categorize this sector as mostly defensive these days, and it is scoring among the top five Outlook scores.

These Outlook scores represent the view that Technology and Healthcare sectors are relatively undervalued, while Consumer Services and Telecom may be relatively overvalued based on our 1-3 month forward look.

Stock and ETF Ideas:

Our Sector Rotation Model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or bearish), suggests holding Technology (IYW), Healthcare (IYH), and Utilities (IDU) in the prevailing neutral climate. (We consider the bias to be neutral from a rules-based standpoint because the SPY has fallen below its 50-day simple moving average but is still above its 200-day.)

Also, Fidelity offers its own line of U.S. sector ETFs, including Fidelity MSCI Information Technology Index ETF (FTEC), Fidelity MSCI Health Care Index ETF (FHLC), and Fidelity MSCI Utilities Index ETF (FUTY).

Other ETFs that are ranked high by our algorithm from the Technology, Healthcare, and Utilities sectors include iShares PHLX Semiconductor ETF (SOXX), Market Vectors Biotech ETF (BBH), and First Trust Utilities AlphaDex Fund (FXU).

For an “enhanced” sector portfolio that employs top-ranked stocks (instead of ETFs) from within Tech, Healthcare, and Utilities, some long ideas include Anixter International (AXE), VMware (VMW), Celgene Corp (CELG), Teleflex Inc (TFX), Edison International (EIX), and AGL Resources (GAS). All are ranked highly in the Sabrient Ratings Algorithm and most also score within the top two quintiles of our Earnings Quality Rank (EQR), which is a pure accounting-based risk assessment signal based on the forensic accounting expertise of our subsidiary Gradient Analytics (note: Utilities stocks are not included in EQR). We have found EQR quite valuable for helping to avoid performance-offsetting meltdowns in our model portfolios.

On the other hand, if you have a bearish outlook on the market, our Sector Rotation Model would suggest holding Utilities (IDU), Energy (IYE), and Consumer Goods (IYK). Using Fidelity ETFs, these would be the Fidelity MSCI Utilities Index ETF (FUTY), Fidelity MSCI Energy Index (FENY), and Fidelity MSCI Consumer Staples Index ETF (FSTA).

If you want to get bullish to position yourself for a reversal from the market’s extreme weakness, our Sector Rotation Model would suggest holding Technology (IYW), Healthcare (IYH), and Industrial (IYJ). Using Fidelity ETFs, these would be the Fidelity MSCI Information Technology Index ETF (FTEC), Fidelity MSCI Health Care Index ETF (FHLC), and Fidelity MSCI Industrials ETF (FIDU).

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.