Sector Detector: Bulls wrest back control of market direction, despite global adversity

Some weeks when I write this article there is little new to talk about from the prior week. It’s always the Fed, global QE, China growth, election chatter, oil prices, etc. And then there are times like this in which there is so much happening that I don’t know where to start. Of course, the biggest market-moving news came the weekend before last when Paris was put face-to-face with the depths of human depravity and savagery. And yet the stock market responded with its best week of the year. As a result, the key issues dominating the front page and election chatter have moved from the economy and jobs to national security and a real war (rather than police actions) against a blood-thirsty orthodoxy that, as the world now seems to universally understand, cannot be simply contained. It is suddenly better to risk being wrong but strong than to be right but weak.

In any case, the major market indexes have remained undeterred -- by either the Fed’s apparent foregone decision to raise the fed funds rate next month or the sudden wave of violence sweeping the globe -- as seasonality and a strong technical picture continue to stoke bullish conviction in U.S. stocks. Moreover, our fundamentals-based sector rankings are mostly unchanged.

In this weekly update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review our weekly fundamentals-based SectorCast rankings of the ten U.S. business sectors, and then offer up some actionable trading ideas, including a sector rotation strategy using ETFs and an enhanced version using top-ranked stocks from the top-ranked sectors.

Market overview:

First a planeload of Russian tourists is bombed out of the sky. Then Paris is attacked by suicidal murderers. Then Mali gets the same. Now Brussels is in lockdown. This is not just a containment problem any longer (not that it ever really was). The civilized world seems to be coming together in the conviction that we are at war with a blood-thirsty ideology bent on religious and ethnic cleansing that would sooner see the entire world annihilated than allow infidels to inhabit it. There can be no peaceful coexistence with this line of thinking, and yet it is spreading like a cancer around the world.

At the same time, the world is coming to realize that after seven years (since the financial crisis) of global monetary policies designed to stimulate growth and inflation, there has been very little of either. It is becoming evident that different strategies are needed, if any are really needed at all. Perhaps the best idea is to normalize interest rates and focus instead on policies that take the heavy hand of government out of the picture and allows market forces to work with greater freedom.

For its part, the Fed is trying to signal as clearly as possible that they are on track for their first rate hike, come hell or high water. The fed funds futures (which tend to be quite prescient) are now forecasting a 74% chance of a quarter-point rate hike at the December 16 meeting. The 10-year Treasury yield closed Friday at 2.26%, which is up significantly from 2.06% just two weeks ago. However, there is an interesting observation about the yield curve’s response since the low in yields on October 14. The 2-year/10-year spread has flattened from 1.43% (2.33-0.90) on November 6, to 1.34% (2.26-0.92) on Friday; while the 5-year/30-year spread has flattened from 1.56% (2.84-0.56) on October 14, to 1.35% (3.09-1.74) on November 6, to 1.33% (3.02-1.69) on Friday.

Investors seem to be becoming more comfortable in the idea that the Fed will go slow, and that a small rate hike is a sign of a strengthening US economy and consumer. Retail stocks in general have shined for the past week, although the leaders have been discounters like Walmart (WMT), Ross Stores (ROST), and TJ Maxx (TJX), while higher-end mall-based stores like Nordstrom (JWN) and Macy’s (M) and Williams-Sonoma (WSM) have faltered. Nike (NKE) announced it was raising its dividend, buying back $12 billion in stock, and splitting its stock, to boot.

Commodities across the board continue to weaken, making anything and everything in this broad space (including oil) highly correlated and difficult to diversify. Moreover, the entire Industrial sector is struggling as China growth remains uncertain and global liquidity is used more for investing in Treasuries, real estate, and stock buybacks than in capital equipment and new projects. As a result, breadth is poor, leadership is narrow, and the Street continues to reduce forward estimates on sales and earnings across all sectors. But an earnings recession does not imply an economic recession, and low energy prices and strength in the dollar has not held back an improving labor market, consumption, innovation, and productivity gains.

Indeed, this year has been a trader’s market rather than an investor’s market, which means it has been driven more by the latest headline than by attractive forward valuations. Certainly there are many smart and highly-successful investors and hedge fund managers who have been hurt by the news-driven market winds this year, including the likes of Warren Buffett and Bershire Hathaway (BRK-B), William Ackman, David Einhorn, and Carl Icahn. Perhaps the biggest example of the news-driven climate this year has been in the Healthcare sector, which until mid-year had been providing reliable leadership and outperformance for a long time.

Firms in the Healthcare sector have been weak across the board since June as the formerly invincible sector has absorbed bad press and election-year populist criticism, particularly in the biopharma segment. Former powerhouses like Valeant Pharmaceuticals (VRX), Horizon Pharmaceuticals (HZNP), and Mallinckrodt (MNK) have been targeted as this segment with its strong organic growth and robust cash flow suddenly changed from a long-term investor darling into a highly-volatile trader’s paradise. In addition, health insurers like UnitedHealth Group (UNH), Anthem (ANTM), Aetna (AET), and Molina Healthcare (MOH) were at first simply caught up in the broad downdraft, but now have taken it on the chin due to difficulty working within the constraints of Obamacare in offering individual exchange-compliant plans. Nevertheless, the future is bright for the sector, and in fact it still leads the pack in our fundamentals-based sector rankings.

Furthermore, if you haven’t been in the so-called FANG stocks -- i.e., Facebook (FB), Amazon (AMZN), Netflix (NFLX), and Google aka Alphabet (GOOGL) -- then you are likely underperforming. And hedge funds that have been burned by the Healthcare sector appear to be concentrating their positions even more into a narrower group of stocks, with consumer-facing Tech companies now de rigueur. So, broad GARP models (growth at a reasonable price) that seek attractive forward valuations across a diversified portfolio are generally underperforming -- especially since the summer peaks. In this trader’s market, compelling forward valuations simply aren’t so appealing.

Moreover, the poor breadth is reflected in the relative performance of the cap-weighted indexes versus the equal-weighted, and the large caps versus the small caps. To illustrate the extremes, just look at the performance difference since June 22 of the cap-weighted SPDR S&P 500 Trust (SPY) versus the Guggenheim Russell 2000 Equal Weight ETF (EWRS). There is about 13 percentage points difference -- but all of that divergence has occurred since June, as the first half of the year displayed very similar performance across indexes.

It has been a challenging time, to say the least. But we still believe very strongly in GARP as the way to invest (as opposed to trade) in stocks. After all, that’s what investing is supposed to be about -- buying future earnings and dividend streams for an attractive price.

The CBOE Market Volatility Index (VIX), a.k.a. fear gauge, closed Friday at 15.47 after spiking to 20 (the panic threshold) on the previous Friday.

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed Monday at 209.31 and remains above its 50-day, 100-day, and 200-day simple moving averages. After breaking below the 200 and 100, it found support just above the 50-day. The bullish ascending wedge I saw forming two weeks ago instead turned into a bull flag pattern, with a bounce occurring at the 202.50 price level that should serve as strong support if it is tested again. The strong rally of the past week has created another ascending triangle pattern with solid resistance just above at around 211-212, which was the level of the August highs that stopped the October rally. Oscillators RSI, MACD, and Slow Stochastic all appear to have some room to go higher before looking overbought. I expect that one of these breakout attempts will resolve to the upside. If so, next resistance is the May (and all-time) high near 214, followed by blue skies. Support resides at the 200-day SMA (around 207) and 100-day SMA (around 204), last week’s bounce point at 202.50, and then the 50-day SMA, which is rising rapidly in an attempt to cross up bullishly through the 200-day SMA.

Friday’s spinning top candlestick pattern ostensibly implies indecision and a possible end to the rally, but given it occurred at the end of the strongest week of the year, I wouldn’t worry too much about it just yet. In case I’m not being clear enough, the picture is quite bullish for the near term.

Latest sector rankings:

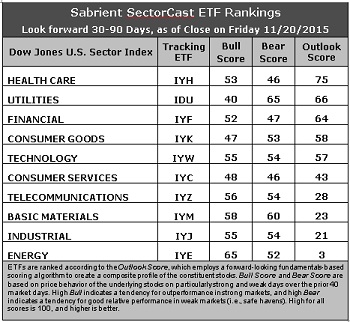

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. Healthcare remains in the top spot this week with an Outlook score of 75. Although biopharmas have taken a big hit to their prices over the past few months, their fundamentals and forward valuations are strong. None of its factor scores are particularly notable, but the sector displays a solid forward long-term growth rate and return ratios, and relatively good sentiment among Wall Street analysts (net revisions to earnings estimates), plus strengthening insider sentiment (open market buying). All sectors continue to display net reductions to forward estimates, so relatively less in this regard earns a sector a good relative score. Technology and Telecom have the least in the way of reduced estimates, but Utilities is third best and remains in second place with an Outlook score of 66, primarily boasting a relatively low forward P/E (about 15.5x). Financial takes third and displays the lowest forward P/E (about 15.2x), although analysts have been cutting estimates given that the yield curve has remained stubbornly flat. Consumer Goods (Staples/Noncyclical), Technology, and Consumer Services (Discretionary/Cyclical) round out the top six, and then there is a big drop down to the bottom four. Notably, Industrial continues to fall in the rankings -- even though the transportation segment (including airlines) has a strong Outlook score.

2. Energy remains at the bottom with an Outlook score of 3 as the sector scores among the worst in most factors of the GARP model. In particular, the sector still shows an increasingly negative forward long-term growth rate and low return ratios, as well as the highest forward P/E (around 24.5x). Industrial and Basic Materials are nearly tied for the other spot in the bottom two with Outlook scores of 21 and 23 as commodity prices and global industrial production continue to fall.

3. Looking at the Bull scores, Energy tops the list with a 65, while Utilities is the lowest at 40. The top-bottom spread is 25 points, which reflects low sector correlations on particularly strong market days, which is good. It is generally desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold (rather than broad risk-on behavior).

4. Looking at the Bear scores, Utilities displays the top score of 65, which means that stocks within this sector have been the preferred safe havens (relatively speaking) on weak market days. Healthcare and Consumer Services (Discretionary/Cyclical) score the lowest at 46, followed closely by Financial, as investors flee these sectors during market weakness. The top-bottom spread is 19 points, which reflects low sector correlations on weak market days, which is good. Ideally, certain sectors will hold up relatively well while others are selling off (rather than broad risk-off behavior), so it is generally desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points.

5. Healthcare displays the best all-around combination of Outlook/Bull/Bear scores, while Energy is the worst. However, looking at just the Bull/Bear combination, Basic Materials is the best, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish), while Consumer Services (Discretionary/Cyclical) is the worst, probably due to the mixed earnings reports from retailers (discounters doing well while mall-oriented stores not so much).

6. This week’s fundamentals-based Outlook rankings remain neutral, with defensive sectors Utilities and Consumer Goods (Staples/Noncyclical) in the top four, all-weather Healthcare on top, and economically-sensitive sectors Technology and Financial still scoring pretty well, but Industrial falling into oblivion. Also, the constant flow of negative earnings revisions from Wall Street is unsettling. Keep in mind, the Outlook Rank does not include timing, momentum, or relative strength factors, but rather is a reflection of the fundamental expectations of individual stocks aggregated by sector.

Stock and ETF Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), maintains a bullish bias and suggests holding Healthcare, Energy, and Technology, in that order. (Note: In this model, we consider the bias to be bullish from a rules-based trend-following standpoint when SPY is above both its 50-day and 200-day simple moving averages.)

Other highly-ranked ETFs in SectorCast from the Healthcare, Energy, and Technology sectors include Market Vectors Pharmaceutical ETF (PPH), PowerShares Dynamic Oil & Gas Services Portfolio (PXJ), and Technology Select Sector SPDR Fund (XLK). Other notable ETFs that are highly ranked in our quant model include US Global Jets ETF (JETS), which is mostly airlines, plus the Direxion All Cap Insider Sentiment Shares (KNOW), which tracks a Sabrient index, and the First Trust LongShort Equity ETF (FTLS), which employs an absolute return strategy that licenses our Earnings Quality Rank (a quant model we developed together with our forensic accounting subsidiary Gradient Analytics).

For an enhanced sector portfolio that enlists some top-ranked stocks (instead of ETFs) from within the top-ranked sectors, some long ideas from Healthcare, Energy, and Technology sectors include AmerisourceBergen (ABC), Mylan NV (MYL), Diamond Offshore Drilling (DO), Tesoro Petroleum (TSO), Accenture plc (ACN), and Adobe Systems (ADBE). All are highly ranked in the Sabrient Ratings Algorithm and also score among the top two quintiles (lowest accounting-related risk) of our Earnings Quality Rank (a.k.a., EQR), a pure accounting-based risk assessment signal based on the forensic accounting expertise of Sabrient subsidiary Gradient Analytics.

If you prefer to take a neutral bias, the Sector Rotation model suggests holding Healthcare, Utilities, and Financial, in that order. But if you prefer a defensive stance on the market, the model suggests holding Utilities, Basic Materials, and Technology, in that order.

Speaking of ETFs, I am excited to be attending the Inside ETFs 2016 conference in Hollywood, FL in late January. I haven’t attended this event in several years and from what I can tell, it has grown into one of the premier ETF events of the year. If you go, be sure to look for me. In fact, ETF.com has provided me with a discount code to share with advisors who might want to attend: IE16-SM.

IMPORTANT NOTE: I post this information each week as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I may or may not update the information each week. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted -- but not necessarily on the days that I happen to post this weekly article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ETF and stock ideas mentioned here as a managed portfolio.

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.