Sector Detector: Bulls revel in new highs and blue skies, but oil introduces a dark cloud

As everyone knows, stocks do not go up in a straight line, not even during the holidays. So although the future looks bright for U.S. equities as the major indexes continue to hit or challenge new highs, the market has been gasping for a breather to gather bullish conviction. My fear has been that we might not see it until January, which likely would have resulted in a more severe correction at that time. But falling oil prices and a weak Energy sector seems to have introduced a reason to sell this week. Correspondingly, the Energy sector is now ranked at the bottom of our fundamentals-based, forward-looking sector rankings.

In this weekly update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review our weekly fundamentals-based SectorCast rankings of the ten U.S. business sectors, and then offer up some actionable trading ideas, including a sector rotation strategy using ETFs and an enhanced version using top-ranked stocks from the top-ranked sectors.

Market overview:

In the fall of 1999, my older daughter was in kindergarten, and I met another father at her school who had moved his family to Santa Barbara from Puerto Rico. He had enjoyed success with real estate and construction there and owned free-and-clear a large house in downtown San Juan. As his kids were ready to start attending school, he decided to monetize his big house by leasing it out. But rather than using the lease payments as income to live on, he took out a large mortgage on his house and gave it to his financial advisor back home to invest for him. After all, stocks were raging and his broker was enamored with the performance of the NASDAQ Composite Index. All his money was invested in NASDAQ stocks, particularly the Technology sector.

The following spring of 2000, as the index approached its incredible closing high of 5,048 (or 5,132 intraday), he was getting more and more anxious about the meteoric rise. And as the market began its fateful decline, his broker kept telling him not to worry because new technologies were the engine for all future of global economic growth. But fears of Y2K doom-and-gloom proved unfounded, and instead budgets were slashed for further capital upgrades. Software company valuations based solely on projected revenues rather than earnings were chopped off at the knees. Dot-com valuations that were based solely on web site visits (a.k.a., eyeballs) became dot-bombs. Ultimately, my friend’s investment account was decimated and his brief retirement (in his 30’s) had to end. He returned to the construction business back in Puerto Rico.

Today, the NASDAQ is once again approaching the 5,000 level for the first time in nearly 15 years. Over the past two years as U.S. economic recovery has taken shape, the index is up almost 2,000 points (70%). So the logical question is whether there is more validity to this valuation level (beyond the impact of inflation, of course).

Well, some things are quite different this time. With a trailing P/E around 20, NASDAQ stocks display an average P/E that is actually about the same as the S&P MidCap 400 Index. But many market observers still believe that Fed’s easy money policy has inflated the valuations for many speculative stocks.

Not to be outdone, the Dow Industrials blue chip average is knocking on the door at 18,000. The S&P 500 large caps are eyeing 2,100. The combination of economic weakness outside the U.S. and increasing U.S. oil production continues to push down the price of oil, which on the surface should create a wealth effect among consumers. Hiring is on pace to make 2014 the strongest for job growth since 1999. And of course, we are in a seasonally strong time of year, which has been bolstered by recent short covering among hedge funds and share buyback activity among corporations. And despite worries about a slowdown in China’s growth, the Shanghai index is up about 40% this year.

Another bright spot in the bulls’ court is falling asset price correlations, which ConvergEx reported has fallen in November to five-year lows, with average correlations among the ten business sectors of the S&P 500 at 58%, and with other asset classes, displaying similar trends. ConvergEx believes that the end of QE3 is allowing asset classes to perform according to their fundamentals rather than enabling highly-correlated risk-on/risk-off behavior. In other words, stock picking and asset allocation strategies matter again. Moreover, ETFGI reports that the U.S. ETF/ETP industry reached a new record of $1.98 trillion in AUM at the end of November, while global ETF/ETPs set a new record of $2.76 trillion.

However, the oil price collapse is proceeding far deeper than imagined and might be shaping up as a dreaded Black Swan-type event in many ways -- not only for the energy sector and oil-producing nations directly but also indirectly for banking sector through the junk bond market. Those countries that depend upon oil revenues are in deep trouble, since there seems to be little in the way of near-term catalysts to drive oil prices higher. And high-yield bonds have been showing a technical divergence from equities for well over a year, which has been worrisome for the economy. Energy high-yield debt represents 16% of the $1.3 trillion market, which leaves many banks holding that debt seriously exposed.

The 10-year U.S. Treasury bond yield closed Friday at 2.33% and seems unwilling to move higher, while the 2-year Treasury bond yield is up significantly. In other words, the yield curve is getting flatter, even without the new injections of bond-buying from the Federal Reserve.

The CBOE Market Volatility Index (VIX), a.k.a. fear gauge, fell even further to close Friday at 11.82. In this bullish climate, VIX remains well below the important 15 level.

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed Friday at 208.00, and in the process set new intraday and closing highs. Two weeks ago it closed at 206.68, so not much has changed. As the month began, the market flirted with the idea of a pullback that it very much needs, closing the gap from November 20, but the bulls just wouldn’t let it happen -- at least not yet. Price is creeping higher beneath the strong resistance line from the long-standing rising bullish channel, but not even attempting to break through. The 20-day simple moving average seems to be offering temporary support. The overbought technical condition has not abated, as oscillators RSI, MACD, and Slow Stochastic all quickly returned to overbought but really need to cycle back down if a concerted breakout attempt is to have any chance of success.

Notably, the Russell 2000 small cap index, which hit 1213 during the summer, is struggling mightily at 1182 and will be hard-pressed to eclipse strong resistance at the 1200 level. NASDAQ and the mid-caps hit their new highs during Thanksgiving week. So, although a sustained breakout of the SPY is still possible at this level, I would greatly prefer to see a retest of support levels, some back-and-filling, and a working off of the overbought conditions. Sorry, but last week’s mild pullback to start the month wasn’t nearly enough. So, this is the week that we should see something happen in this regard or else we will likely have to wait until early January -- which could be a more dramatic event.

Latest sector rankings:

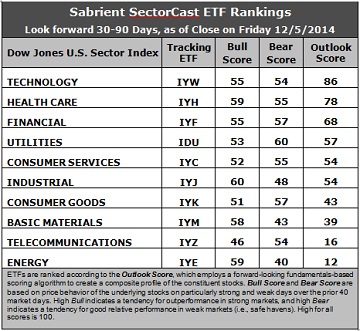

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. The rankings continue to remain mostly stable -- and perhaps a bit more bullish. Technology and Healthcare continue to rein supreme, although they have switched places again. Technology is back in the top spot with an Outlook score of 86. Tech stocks are no longer getting hit with downward earnings revisions from sell-side analysts, and they display the best return ratios, a good forward long-term growth rate, and a reasonably good forward P/E. Healthcare scores a 78 and displays good sell-side analyst support, a strong forward long-term growth rate, solid insider sentiment (buying activity), and good return ratios, although its forward P/E is on the high side. Financial remains in third with a score of 68, and it continues to display the lowest (most attractive) forward P/E. Next in the rankings are Utilities, followed by Consumer Services/Discretionary (a.k.a., Cyclicals) and Industrial. The latter two continue to see their scores improve (which is bullish for the market), and in fact Consumer Services received the strongest analyst score this week (net positive earnings revisions).

2. Basic Materials got a reprieve from the onslaught of downward earnings revisions while insider sentiment also improved, so its score has strengthened. But Energy continues to be pounded by Wall Street analysts (as oil prices fall beyond all expectations), with cuts to forward earnings estimates and a lower forward long-term growth rate. Even with the big fall in prices already for stocks within the sector, the overall forward P/E is a bit higher (worse) this week due to the downgrades. As a result, Energy is in the bottom position, although its one glimmer of hope is a slight uptick in insider sentiment (buying activity). Joining Energy in the bottom two is Telecom, which generally scores poorly across the board in most factors in the Outlook model.

3. Looking at the Bull scores, Industrial displays the highest score of 60, followed by Healthcare and Energy. Telecom scores the lowest at 46. The top-bottom spread is 14 points, reflecting relatively high sector correlations during particularly strong market days, i.e., correlated risk-on behavior. It is generally desirable in a healthy market to see low correlations and a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold, rather than the all-boats-lifted-in-a-rising-tide (risk-on) mentality that dominated 2013.

4. Looking at the Bear scores, Utilities again displays the highest score of 60 this week, as one would expect for this traditionally defensive sector, but its score is actually falling. Utilities stocks have been the preferred safe havens on weak market days. Energy displays the lowest score of 40, followed by Basic Materials. The top-bottom spread is 20 points, which continues to reflect low sector correlations on particularly weak market days. Again, it is generally desirable in a healthy market to see low correlations and a top-bottom spread of at least 20 points.

5. Technology now displays the best all-around combination of Outlook/Bull/Bear scores, followed closely by Healthcare, while Energy is the worst. Looking at just the Bull/Bear combination, Healthcare is the leader, followed closely by Utilities and Financial, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish). Energy is still the worst, followed closely by Telecom and Basic Materials, indicating general investor avoidance.

6. Overall, this week’s fundamentals-based Outlook rankings look more bullish to me. The onslaught of downward earnings revisions has subsided (with the exception of Energy sector), although it hasn’t turned greatly positive either (thus allowing the stable Utilities sector to hold up in the rankings). Five of the top six sectors are economically-sensitive (or in the case of Healthcare, all-weather), and they also display some of the highest Bull scores. Keep in mind, the Outlook Rank does not include timing or momentum factors, but rather is a reflection of the fundamental expectations of individual stocks aggregated by sector.

Stock and ETF Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), continues to indicate a bullish bias this week, and it suggests holding Healthcare, Industrial, and Technology (in that order, for those portfolios that might be due for rebalance). (Note: In this model, we consider the bias to be bullish from a rules-based trend-following standpoint because SPY is above both its 50-day and 200-day simple moving averages.)

Other highly-ranked ETFs from the Healthcare, Industrial, and Technology sectors include iShares US HealthCare Providers ETF (IHF), SPDR S&P Transportation ETF Trust (XTN), and Technology Select Sector SPDR Fund (XLK).

For an enhanced sector portfolio that enlists some top-ranked stocks (instead of ETFs) from within the top-ranked sectors, some long ideas from Healthcare, Industrial, and Technology sectors include Centene (CNC), Health Net (HNT), FedEx (FDX), Spirit Airlines (SAVE), SolarWinds (SWI), and SanDisk (SNDK). All are highly ranked in the Sabrient Ratings Algorithm and also score within the top two quintiles (lowest accounting-related risk) of our Earnings Quality Rank (a.k.a., EQR), a pure accounting-based risk assessment signal based on the forensic accounting expertise of our subsidiary Gradient Analytics. We have found EQR quite valuable for helping to avoid performance-offsetting meltdowns in our model portfolios.

However, if you prefer to maintain a neutral bias, the Sector Rotation model suggests holding Technology, Healthcare, and Financial (in that order). And if you prefer a defensive stance on the market, the model suggests holding Utilities, Technology, and Healthcare (in that order).

IMPORTANT NOTE: Some readers have been asking for more specifics on how to trade our sector rotation strategy based solely on what I discuss in my weekly newsletter. Thus, I feel compelled to remind you that I post this information each week as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I may or may not update the information each week. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted -- but not necessarily on the days that I happen to post this weekly article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ETF and stock ideas mentioned here as a managed portfolio.

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.