Sector Detector: Overdue market weakness finally hits, but sector rankings turn bullish

This seasonally weak time of the year has proven reliable once again. As I observed last week, the volatility index often hits a peak in October but has never hit a trough during this notorious month. Last week, I warned of more downside in stocks before any new highs are challenged. It was the type of week that tests investors’ bullish conviction, and it was way overdue.

This seasonally weak time of the year has proven reliable once again. As I observed last week, the volatility index often hits a peak in October but has never hit a trough during this notorious month. Last week, I warned of more downside in stocks before any new highs are challenged. It was the type of week that tests investors’ bullish conviction, and it was way overdue.

So, is that it for downside this year? Is the market ready to commence its end-of-year rally now? Well, the charts appear to be in recovery mode, and our fundamentals-based sector rankings have turned bullish. But with volatility setting in, I don’t think we have seen the last of the scary market action. Will the S&P 500 fall into the -10% correction that we haven’t seen in three years? I think it is unlikely at this time, but I expect further consolidation and testing of bullish conviction in the near term.

In this weekly update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review our weekly fundamentals-based SectorCast rankings of the ten U.S. business sectors, and then offer up some actionable trading ideas, including a sector rotation strategy using ETFs and an enhanced version using top-ranked stocks from the top-ranked sectors.

Market overview:

The fourth quarter kicked off with a new flavor -- extreme market weakness. Not only did the large caps finally shows some vulnerability, but small caps are now looking like they are in a full-blown correction from their highs reached back in July. But weakness in October is not unusual, and in fact I see it as a welcome cleansing that should validate some key support levels, wring out some excesses and overbought technical conditions, and establish a base from which to kick off the highly anticipated year-end rally.

Of course, one major signal on Friday that investors applauded was the unemployment report showing a dip to 5.9%, which is its first time below 6% since 2008. 248,000 jobs were added in September and August was revised upward from 142,000 to 180,000. Also, the ISM Services report came in at a robust 58.6.

Earnings reports for Q3 kick off this week, and according to Capital IQ, S&P 500 companies in aggregate are expected to post +7% earnings growth and +4% revenue growth. Moreover, all ten business sectors are projected to report positive earnings growth -- in spite of the strong performance of the U.S. dollar, which was up +8% during Q3 -- its best quarterly gain in six years.

The 10-year U.S. Treasury bond yield closed Friday at 2.44%, which is down significantly from the prior week and continuing to trend downward after its mid-month spike. This should be no surprise given the elevated volatility in the stock market, frightening headlines from around the world, economic malaise in much of the rest of the world, and a general flight to safety among global investors. As foreign central banks inject liquidity into their economies while the Federal Reserve concludes its QE, global investors continue to look to the U.S. for higher yields on government bonds. The spread between the 10-year U.S. Treasury and the comparable German bund reached 157 bps in September. This is the widest spread since 1999, and it has been rising steadily for the past three years. Also, the spread between 10-year U.S. Treasury and the 10-year Japanese government bond has reached 189 bps.

But there is a limit to how much more the spreads can increase, since these other government bonds can hardly go lower, and the Fed will be loathe to allow domestic rates to increase too quickly for fear of hurting the housing market and by extension the broader U.S. economic recovery.

The CBOE Market Volatility Index (VIX), a.k.a. fear gauge, spiked to near 18 last Thursday before closing Friday at 14.55, which is back below the important 15 level. Its 50-day SMA is now crossing up through the 200-day SMA, which is bullish for VIX but bearish for stocks. From a historical perspective, VIX often hits a peak in October, but it has never hit a trough during October. Nevertheless, although VIX is up substantially since July, it remains well below the 40 level that it reached in October 2011.

Market breadth continues to be a concern, as over half of the S&P 500 stocks are below their 50-day SMAs. Nevertheless, although we might see more volatility and market weakness over the coming weeks, I believe a year-end rally to new highs is still in the cards. Interest rates remain low, corporate earnings reports should be strong, mid-term election years are typically bullish, and the holiday season usually engenders market rallies. True, there are many frightening things in the news each day, ranging from despicable acts of terrorism, to Ebola in the U.S., to unusually severe weather patterns, to extreme weakness in commodities, emerging markets, high-yield bonds, to wars and conflicts around the globe. But it seems to me that only a major Black Swan event can derail the bulls’ train.

SPY chart review:

From a technical (chart) standpoint, last week was quite eventful. The SPDR S&P 500 Trust (SPY) closed last Friday at 196.52, which is only slightly below the previous week’s close despite the extreme market weakness. However, the big reversal on Thursday followed by Friday’s strong rally still couldn’t bring SPY back above its 50-day simple moving average (although it came close). Notably, the bottom of the long-standing bullish rising channel came into play and passed the test (although it took a big intraday reversal on Thursday. Next support levels are (again) the bottom of the bullish rising channel and the 100-day SMA around 195, and then the 200-day SMA all the way down below 189. There is also the August 7 closing low at 191 that might provide support, if called upon. Oscillators RSI, MACD, and Slow Stochastic are all at or near oversold territory, and thanks to Friday’s recovery, they are pointing upward bullishly. So, SPY could start rallying immediately. If the market can indeed put together a rally, the 200 price level will once again serve as tough resistance, and the top of the bullish rising channel is now at 205.

Notably, if you look at the weekly chart of the SPY (not shown), the oscillators I follow (RSI, MACD, and Slow Stochastic) have remained above the neutral line ever since price bounced from its 50-week SMA back in November 2012. Also, it has consistently found support at the 20-week exponential moving average (which is the center line of the Bollinger Bands). In a strong uptrend, prices usually fluctuate between the upper band and the 20-period EMA, so a crossing below the 20-period is an indication of a trend reversal, which didn’t quite happen last week in spite of the extreme weakness in the market.

The small-cap iShares Russell 2000 ETF (IWM), which has diverged from the large caps since April, is now even more severely oversold that it was a week ago and appears to be ready to bounce more significantly. The oscillators are all pointing bullishly upward from the most oversold territory. Also, Thursday marked the fourth time this year that the Dow Jones Transportation Average reversed from that its 50-day SMA.

As a reminder, back in 1998 the S&P took three months of struggle before it finally broke through round-number psychological resistance at 1,000. Now as was the case then, the market is experiencing divergences among market segments, sharp pullbacks and recoveries, and reemergence of the doomsayers. Also worth mentioning – the S&P 400 MidCap ETF (MDY) bounced on Thursday from its year-to-date breakeven level, and the NASDAQ 100, as tracked by the PowerShares QQQ Trust (QQQ) has been showing impressive relative strength compared with all the other major indexes.

Latest sector rankings:

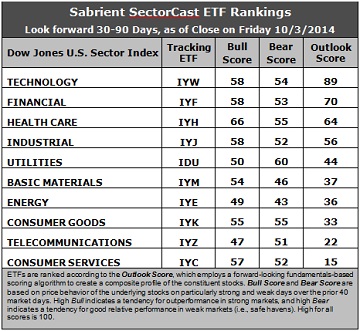

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. Technology still holds the top spot with the same Outlook score of 89. The sector displays relatively solid scores across most factors in the model, including solid Wall Street analyst sentiment (despite getting hit with net downward revisions to earnings estimates), the strongest return ratios, a good forward long-term growth rate, and a reasonable forward P/E. Financial solidifies its place in the second spot this week with a score of 70. Although most sectors saw net downward revisions, Financial stocks stayed net positive this week. Financial has the strongest analyst sentiment, the best (lowest) forward P/E and the strongest insider sentiment (open market buying). In third is Healthcare, followed by Industrial and Utilities.

2. Telecom moves out of the cellar this week with an Outlook score of 22. Although the sector displays the highest (worst) forward P/E and the lowest forward long-term growth rate, its return ratios aren’t bad and sentiment among analysts and insiders has improved. Instead, Consumer Services/Discretionary has fallen to the bottom with a score of 15, despite the highest long-term forward growth rate and good insider sentiment.

3. Looking at the Bull scores, Healthcare again displays the highest score of 66, while Telecom is the lowest at 47. The top-bottom spread is now 19 points, reflecting lower sector correlations on particularly strong market days. It is generally desirable in a healthy market to see low correlations and a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold, rather than the all-boats-lifted-in-a-rising-tide mentality that dominated 2013. Also displaying strong Bull scores are Technology, Financial, Industrial, and Consumer Services/Discretionary, which are all economically-sensitive sectors that should have the highest Bull scores in a healthy market.

4. Looking at the Bear scores, Utilities is seeing its score rise again, this time taking back the top spot with a score of 60, as one would expect for this traditionally defensive sector. Thus, Utilities stocks have been the preferred safe havens on weak market days. Energy continues to display the lowest score of 43. The top-bottom spread is now 17 points, reflecting lower sector correlations on particularly weak market days. Again, it is generally desirable in a healthy market to see low correlations and a top-bottom spread of at least 20 points. Also displaying strong Bear scores are Consumer Goods/Staples and Healthcare, which along with Utilities are traditionally defensive (or all-weather) sectors that should have the highest Bear scores in a healthy market.

5. Technology displays the best all-around combination of Outlook/Bull/Bear scores, followed by Healthcare and Financial, while Telecom is the worst, followed by Consumer Services/Discretionary and Energy. Looking at just the Bull/Bear combination, Healthcare is the clear leader, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish), while Energy is the worst, indicating general investor avoidance during extreme conditions.

6. Overall, this week’s fundamentals-based Outlook rankings look noticeably more bullish. The top four are all economically sensitive (or in the case of Healthcare, all-weather) sectors with the highest Bull scores, and all four have Outlook scores above 50. The glimmer of bullish hope that I have been describing in the rankings over the past couple of weeks continues to grow brighter.

Stock and ETF Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or bearish), has technically moved to a neutral bias, despite the overall bullish outlook of the chart and the fundamentals-based rankings, because the SPY closed Friday just below its 50-day simple moving average. It still suggests holding Technology, Financial, and Healthcare sectors (in that order) as it would in a bullish climate, but the order of preference (or relative weightings) is different. (Note: In this model, we consider the bias to be bullish from a rules-based trend-following standpoint because SPY is above both its 50-day simple moving average and its 200-day SMA.)

Other highly-ranked ETFs from the Technology, Financial, and Healthcare sectors include PowerShares Dynamic Semiconductors Portfolios (PSI), Market Vectors Bank & Brokerage ETF (RKH), iShares and Market Vectors Biotech ETF (BBH),

For an enhanced sector portfolio that enlists top-ranked stocks (instead of ETFs) from within Technology, Financial, and Healthcare, some long ideas include KLA-Tencor (KLAC), Facebook (FB), First Republic Bank (FRC), Discover Financial Service (DFS), Amgen (AMGN), and Regeneron Pharmaceuticals (REGN). All are highly ranked in the Sabrient Ratings Algorithm and also score within the top two quintiles (lowest accounting-related risk) of our Earnings Quality Rank (a.k.a., EQR), a pure accounting-based risk assessment signal based on the forensic accounting expertise of our subsidiary Gradient Analytics. We have found EQR quite valuable for helping to avoid performance-offsetting meltdowns in our model portfolios.

However, if you think the market has begun a bullish reversal and you prefer to maintain a bullish bias, the Sector Rotation model suggests holding the same three in a different order: Healthcare, Technology, and Financial (in that order). But if you have a bearish outlook on the market, the model suggests holding Technology, Utilities, and Healthcare (in that order).

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.