Our suggestion to investors in this optimistic Trump 2.0 climate is to not chase the highflyers and instead focus on high-quality businesses at reasonable prices. “High quality” means fundamentally strong, displaying a history of consistent, reliable, and accelerating sales and earnings growth, positive revisions to Wall Street analysts’ consensus forward estimates, rising profit margins and free cash flow, solid earnings quality, and low debt burden—and we want the stock to be trading at a reasonable valuation relative to its own history and its industry peers..

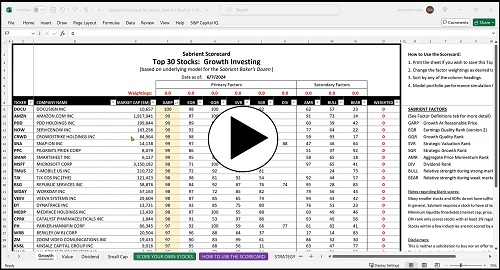

The next-generation “Sabrient Scorecards” can help with this by doing most of the stock evaluation for you. We've already done the individual factor backtests and creation/testing/validation of predictive, quantitative, multi-factor ranking models.

These are the same factors Sabrient employs in selecting our portfolios, including Baker’s Dozen, Forward Looking Value, Dividend, and Small Cap Growth, which are packaged and distributed as unit investment trusts (UITs) by First Trust Portfolios. We also use many of them in our SectorCast ETF ranking model. And notably, our proprietary Earnings Quality Rank (EQR) is a key factor in each of these models, and it is also licensed to a number of hedge funds and to the actively managed, absolute-return-oriented First Trust Long-Short ETF (FTLS).

Sabrient founder David Brown discusses these and other factors in his new book, How to Build High Performance Stock Portfolios, which is available on Amazon.com for investors of all experience levels. David describes his path from NASA engineer on the Apollo 11 moon landing project to creating quant models for ranking stocks, and how to methodically and strategically build wealth in the stock market in four distinct investing strategies—growth, value, dividend, and small cap.

Here is a 4-minute video providing a brief overview of our next-gen Scorecard for Stocks (user-friendly Excel format):

To learn more about David's book and the companion subscription to our next-gen Sabrient Scorecards for Stocks and ETFs (including a free trial offer), please visit:

https://DavidBrownInvestingBook.com

Read on....