What the Market Wants: 5 Stocks for 2010

As we close out a tumultuous year that took us from the depths of fear about the future of capitalism as we know it, to the heights of optimism, we enter 2010 with a cautious but hopeful view that the next shoe to drop—whatever it might be—will not lead to another maelstrom.

As we close out a tumultuous year that took us from the depths of fear about the future of capitalism as we know it, to the heights of optimism, we enter 2010 with a cautious but hopeful view that the next shoe to drop—whatever it might be—will not lead to another maelstrom.

From teetering at the edge of the abyss in March, brave investors rode a classic V-bottom recovery straight through year-end. And our list of 15 Top Stocks for 2009 (13 main picks plus 2 bonus picks) performed extremely well, chalking up a robust 41% gain for the year, including one speculative pick that was up 170% (T-3 Energy Services, ticker TTES).

Although many are predicting renewed turmoil during 2010 from distress in commercial & residential mortgages, others believe that the Federal government’s willingness to intervene with whatever it takes to save the banking industry has given investors the confidence to put money back into private and public equity.

Sabrient’s quantitative models are indicating that we are entering 2010 on reasonably sound footing, and with stock valuations (based on forward earnings projections) that are not out of line with historical norms. Unless the analysts’ consensus projections are wildly optimistic, or unless the World economy reverses its fledgling recovery and falls into despair, the climate seems ripe for continued investment in high-quality stocks that are particularly well positioned to success.

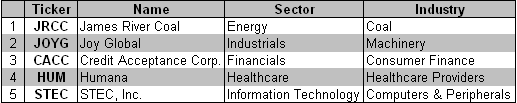

Like last year, we have compiled a diverse group of stocks that seem to fit the bill, and we are again calling them the Sabrient “Baker’s Dozen.” Today, let’s discuss five of them, which represent a cross-section of industries, score particularly well in our system, and might not all be household names that you would already know:

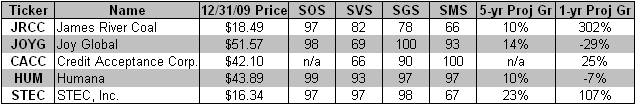

These stocks were identified based on a number of quantitative criteria, including the following:

SOS – Sabrient Company Outlook Score is a proprietary Sabrient rank that measures current valuation and the forward earnings outlook of a consensus of Wall Street analysts. It can be considered largely a GARP rank (Growth at a Reasonable Price), and also rewards conservative accounting practices.

SVS – Sabrient Value Score measures the relationship between a company's stock price and its intrinsic value, as indicated by earnings and balance sheet attributes, with an emphasis on earnings. Also considered are cash flow measures and fundamental valuation ratios. A high value score indicates that the stock may be undervalued, while a low value score indicates it is overvalued.

SGS – Sabrient Growth Score reflects a company's historical and projected earnings growth, revenue and sales growth, projected cash flow, analyst activity, and changes in earnings estimates, each over various time periods. The higher the score, the better the combined performance of these key measures.

SMS – Sabrient Momentum Score measures a company's earnings and price momentum, evenly weighted and augmented by group strength, money flow, and relative volume. Core technical factors include current price relative to periodic highs and moving averages. High scores indicate strong momentum.

5-yr Proj Gr is the consensus estimate among Wall Street analysts of the annualized projected earnings growth rate for the next five years. Of course, positive numbers are best. (An “n/a” indicates that there were not enough analysts covering the given stock to provide a reliable estimate.)

1-yr Proj Gr is the consensus estimate among Wall Street analysts of next year's projected year-over-year earnings growth rate. Again, positive numbers are best.

Here is how the five stocks scored:

JRCC engages in mining, processing, and selling bituminous, steam, and industrial-grade coal. It carries a Strong Buy rating from the Sabrient Ratings Algorithm. It looks particularly well-positioned to prosper in an energy-hungry world that likes to run on coal. Its scores are solid across the board, with a particularly strong Company Outlook Score that reflects good valuation and analyst optimism. Its projected earnings growth for 2010 is particularly strong.

JOYG manufactures and services mining equipment for the extraction minerals and ores. JOYG is the one holdover from last year’s Top Stocks list. It was one of our top performers with a fantastic 125% gain. Although it is projected to earn less this coming year than last, we believe the current price properly reflects that expectation. Moreover, its 5-year growth projections are strong, its overall scores are quite high (especially the Growth and Outlook scores), and it seems well-positioned relative to its peers to succeed in any market climate. JOYG continues to carry a Strong Buy rating from the Sabrient Ratings Algorithm.

CACC provides auto loans to consumers primarily in the United States through both a portfolio program, under which the company advances money to dealer-partners in exchange for the right to service the underlying loan, and purchase programs, under which it buys the consumer loan from the dealer-partner. CACC is rated Strong Buy in the Sabrient Ratings Algorithm. In a weak Financials sector, segments of consumer finance look strong. You’ll notice that CACC doesn’t have enough Wall Street coverage to receive a 5-yr growth rate projection or a Sabrient Outlook Score. Because it’s a bit “under the radar,” we decided to include it in the portfolio rather than its better-known peers.

HUM provides various health and supplemental benefit plans for employer groups, government benefit programs, and individuals in the United States. It carries a Strong Buy rating from the Sabrient Ratings Algorithm. It has consistently ranked among the highest of all Healthcare stocks across the board in its Outlook, Value, Growth, and Momentum scores.

STEC designs, develops, manufactures, and markets custom memory solutions based on flash memory and dynamic random access memory (DRAM) technologies. It is rated Strong Buy in the Sabrient Ratings Algorithm. This coupled with its high Outlook and Growth scores, superb forward earnings growth estimates, and a recent technical price correction giving it a terrific Value score convinced us we just had to include it.

These are five of Sabrient’s “Baker’s Dozen” Top Stocks for 2010 (full report available on the Sabrient web site). These five stocks were identified based upon a combination of robust quantitative models and selected by a committee of senior staff members. They represent a diverse group of stocks with strong business models that should hold up well no matter what the year might bring us.

Disclosure: The author holds no positions in any of the stocks discussed in this article.