Sector Detector: Flight to safety may serve as prelude to flight to quality stocks

Stocks continued last week to seek some firmer footing, as prices found some support and volatility hit some resistance, and a flight to safety of global capital benefited long-term Treasury bonds -- the very assets that are supposed to be selling off in a secular “Great Rotation” into equities. There is a lot of investor fear that Fed tapering combined with tightening credit conditions in China (potentially bursting a perceived credit bubble) are already having a harsh impact on emerging markets and will eventually impact the developed markets, as well. Indeed, the iShares MSCI Emerging Markets (EEM) is down over -8.6% YTD.

Stocks continued last week to seek some firmer footing, as prices found some support and volatility hit some resistance, and a flight to safety of global capital benefited long-term Treasury bonds -- the very assets that are supposed to be selling off in a secular “Great Rotation” into equities. There is a lot of investor fear that Fed tapering combined with tightening credit conditions in China (potentially bursting a perceived credit bubble) are already having a harsh impact on emerging markets and will eventually impact the developed markets, as well. Indeed, the iShares MSCI Emerging Markets (EEM) is down over -8.6% YTD.

However, I continue to see this pullback as a healthy correction creating a buyable entry point. In fact, if you follow the Super Bowl indicator, the Seahawks just made a resounding statement that the bulls will be back in 2014.

Many signs still point to global economic expansion and higher prices for U.S. and global equities, although I expect that the higher quality companies with sound business models and sustainable earnings growth should emerge as the leaders, ahead of the more speculative names that enjoyed so much attention last year.

Among the ten U.S. business sectors, only Utilities and Healthcare are positive for 2014, while Technology made a late-week attempt to gain some ground, with help from a well-received earnings report from Facebook (FB). Utilities are up +2.7% and Healthcare +1.5%. Energy was the worst performer during January, down -6.2% YTD, followed by Consumer Discretionary.

Certainly the fall in longer-term interest rates, with the 10-year Treasury now yielding 2.67% and the 30-year at 3.62%, is the opposite outcome to what everyone expected from Fed tapering. Much like we saw when S&P downgraded U.S. debt a few years ago and yields fell instead of rose, a flight to safety among global investors always pushes capital into U.S. Treasuries.

However, the biggest threat is not so much Fed tapering but an insidious move toward more and more government intervention in the marketplace in an effort to mitigate “income inequality,” broaden the public safety net, and generally protect public interest from the impacts of private and corporate initiatives. Witness President Obama’s promise to solve the nation’s problems “with or without Congress,” i.e., by executive order, which is basically the same as a third-world autocrat governing by decree.

All of this will likely result in higher volatilities in most asset classes going forward. Nevertheless, with revenue growth the new mandate for sustained earnings growth, businesses will need to hire and invest in PP&E, rather than simply cut costs and buy back stock. Undoubtedly, the unshakeable determination of corporation leaders, entrepreneurs, and motivated workers to find a way to move their businesses forward, despite the obstacles, will pull the economy and the standard of living of working Americans along with it.

Among the positive signs, Bloomberg reports that nearly 80% of S&P 500 companies have beaten earnings expectations so far this reporting season. On Thursday, the U.S. Dept of Commerce reported that the U.S. economy grew at a +3.2% annual rate during Q4, which comes on the heels of the +4.1% rate logged in Q3. Exports also grew, and consumer spending rose at its fastest rate since 2010. GDP hit a new all-time high of $16.2 trillion. Before the recent stock market pullback, the total market cap of all U.S. publicly traded companies had reached nearly $20 trillion.

It’s interesting to note that with the strong outperformance of Google (GOOG) so far this year, the stock is approaching a $400 billion market cap that would put it in league with Apple (AAPL) and Exxon Mobil (XOM) as the largest companies in the world. By the way, $400 billion also happens to be entire GDP of Argentina, so don’t get too much in a dither when you hear about currency devaluations and the 25% fall in the Argentinean stock market. In fact, much of the pain in emerging markets has been concentrated in the natural resource exporting countries -- meaning that the developed economies benefit from lower raw materials and commodities prices.

The International Energy Agency has predicted that the U.S. will surpass Saudi Arabia in oil production by 2020, and we are already considered to be the Saudi Arabia of natural gas, which is now priced 80% lower than it was just four years ago. Lower energy costs coupled with rising standards of living around the world are making the U.S. look attractive once again for manufacturing. General Electric (GE), Whirlpool Corp (WHR), and Caterpillar (CAT) have led the way in bringing back factories, as have many foreign-based firms.

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed Friday at 178.18, which is just slightly lower than where is finished the previous Friday. So the past week provided further technical consolidation. There is plenty of speculation as to whether we are in the midst of “the” long-overdue market correction, which might bring it down as much as 10%. So far, it has only fallen about 3%. Oscillators RSI, MACD, and Slow Stochastic are all in oversold territory and could be foretelling a market bounce this week. Bollinger Banks are spread wide, after being so closely pinched just several days ago, which further supports a bounce. The 100-day simple moving average is providing support, as is 177.50, which was a prior level of resistance-turned-support. The long-standing bullish rising channel is still intact, and next levels of support are the lower line of the rising channel (around 176), followed by prior support at 175. Notably, a similar bullish rising channel in the Russell 2000 small caps is still intact, as well.

On Friday, the CBOE Market Volatility Index (VIX), a.k.a. “fear gauge,” closed at 18.41, which is just slightly higher than where it closed the previous Friday. Despite elevated volatility compared with the sub-12 levels it has enjoyed recently, VIX remains below the important 20 threshold and still low on an historical basis. The technicals are getting somewhat overbought and due to cycle back down, which would be supportive of a bounce in stock prices.

Latest rankings:

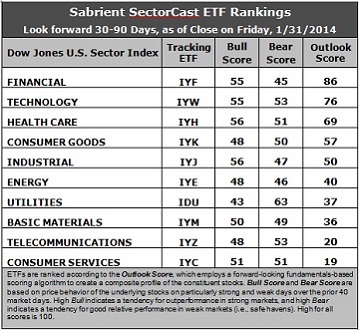

Relative rankings are based on Sabrient’s proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The “Outlook Score” employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting score), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes Sabrient's Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (“safe havens”) when the market is weak.

Outlook Score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use the ten iShares that represent the ten major U.S. business sectors: Financial, Technology, Industrial, Healthcare, Consumer Goods, Consumer Services, Energy, Basic Materials, Telecom, and Utilities. Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity.

Observations:

1. Financial (IYF) retains the top spot with an Outlook score of 86, while Technology (IYW) scores 76 to stay in second place. The Financial sector displays one of the lowest forward P/Es and strong sentiment among both Wall Street analysts (upward revisions to earnings estimates) and company insiders (buying activity). Technology still displays strong factor scores across the board, with a relatively low forward P/E, a strong forward long-term growth rate, the best return ratios, and excellent sentiment among both sell-side analysts and company insiders. In third place again this week is Healthcare (IYH), which continues to gradually gain ground on the top two, scoring 69. Rounding out the top five are Consumer Goods (IYK) and Industrial (IYJ), both of which are scoring 50 or above.

2. Telecom (IYZ) and Consumer Services (IYC) remain in a virtual tie for the bottom spot, although technically IYC gets the indignity this week with a score of 19. Consumer Services, a.k.a., consumer cyclicals or consumer discretionary, continues to enjoy the best forward long-term growth rate, but this is more than offset by weakening sentiment among both Wall Street analysts (negative revisions to earnings estimates) and company insiders (low buying activity). Telecom scores among the lowest on most of the factors in the model, including the highest (worst) forward P/E, lowest return ratios, and a low projected long-term growth rate, but sentiment among sell-side analysts and insiders continues to improve, which has given the sector a slight boost.

3. Although these fundamentals-based rankings still reflect a mostly bullish bias, with economically-sensitive sectors at the top, the weakening Outlook scores in Basic Materials (IYM) and Consumer Services are a concern.

4. Looking at the Bull scores, Industrial and Healthcare have been the leaders on strong market days, scoring 56, while Utilities (IDU) is the notable laggard with a score of 43. The top-bottom spread is now 13 points, reflecting gradually lower sector correlations on particularly strong market days.

5. Looking at the Bear scores, Utilities has been holding up the best (“safe haven”) on recent weak market days, scoring a robust 63, while Financial scores the lowest at 45. The top-bottom spread widened considerably more this week to 18 points, which reflects a continued trend towards lower sector correlations on weak market days. The strength in Technology late last week helped the sector boost its Bear score a bit to 53.

6. Overall, Financial holds a slim lead with the best all-weather combination of Outlook/Bull/Bear scores, while Telecom and Consumer Services are tied for the worst. Looking at just the Bull/Bear combination, Technology holds a slim lead, indicating excellent relative performance in extreme market conditions (whether bullish or bearish). Energy now scores by far the lowest, indicating investor avoidance (relatively speaking) during extreme conditions, as investors have avoided the sector after disappointing reports from bellwethers like Chevron (CVX), Exxon Mobil (XOM), Conoco (COP), and Royal Dutch Shell (RDS.A).

These Outlook scores represent the view once again that Financial and Technology sectors are still relatively undervalued, while Telecom and Consumer Services may be relatively overvalued based on our 1-3 month forward look.

Stock and ETF Ideas:

Our Sector Rotation Model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or bearish), suggests holding Technology, Financial, and Healthcare ETFs in the current neutral climate. (The trend moved to neutral when the SPY lost support at its 50-day simple moving average.)

Other ETFs highly-ranked by Sabrient from the Financial, Technology, and Healthcare sectors include the SPDR S&P Regional Banking ETF (KRE), the iShares PHLX Semiconductor ETF (SOXX), and the Market Vectors Pharmaceutical ETF (PPH).

For an “enhanced” sector portfolio that employs top-ranked stocks (or options) from within the top-ranked sectors (instead of ETFs), some long ideas from Financial, Technology, and Healthcare sectors include SVB Financial Group (SIVB), Credit Acceptance Corp (CACC), FleetCor Technologies (FLT), Cognizant Technology Solutions (CTSH), Actavis plc (ACT), and MWI Veterinary Supply (MWIV), all of which are ranked highly in the Sabrient Ratings Algorithm.

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.