Sector Detector: Buy the dip sentiment gives way to preservation of capital

The intransigence continues in Washington, and it has kept stock market buyers at bay until they get the go signal from Congress. This has left the sellers in control as investor sentiment has temporarily shifted from a buy-the-dip mentality to protect-your-gains and preservation-of-capital.

The intransigence continues in Washington, and it has kept stock market buyers at bay until they get the go signal from Congress. This has left the sellers in control as investor sentiment has temporarily shifted from a buy-the-dip mentality to protect-your-gains and preservation-of-capital.

Tuesday’s extreme weakness hit momentum stocks the hardest, followed by a succession of the lowest-quality names. For example, last week I noted that the NASDAQ Internet Index (QNET) has been incredibly strong this year, but many of those names led to the downside on Tuesday. Still, many investors eagerly await the imminent Twitter IPO.

This has been a symptom of the junk rally and overall outperformance of lower quality stocks that has persisted during much of this year. I am talking about companies with weak analyst ratings, poor earnings quality, and aggressive accounting practices. As a result, many fundamentals-based quantitative models that have a general GARP and quality theme have underperformed much of the year.

We have seen it this year in some of Sabrient’s models, including our Earnings Quality Rank (EQR), which is a pure accounting-based risk assessment signal that Sabrient developed together with subsidiary Gradient Analytics, a forensic accounting research firm. Although Sabrient’s top-ranked (highest quality) stocks have performed well (including our renowned Baker’s Dozen portfolio that has more than doubled the return of the S&P 500 again this year), we also have seen many of the bottom-ranked (lowest quality) stocks perform even better as speculators have bid them up -- causing underperformance in tails-oriented long/short strategies. This has been particularly significant in the Energy, Consumer Non-cyclical, Financial, and Technology sectors (with the notable exception of Telecom). One glaring example is Tesla Motors (TSLA).

However, there are signs that this “upside down” performance is beginning to reverse. Mean reversion always happens eventually, and the “mean” is for higher quality stocks to outperform lower quality. Lack of fear breeds speculation and “irrational exuberance,” and bulls have remained unbowed during a constant barrage of worrisome external events, but perhaps the latest scares concerning fallout from QE tapering, Syria, government shutdown, and debt default are leading investors back toward rationality. At least one can hope.

Of course, all human activity is dictated by self-interest. Even charitable actions are performed out of a sense of duty, honor, or compassion, each of which makes us feel better about ourselves. And the same is true of our elected officials in Washington, who are driven mostly by their political futures and pleasing their constituents rather than compromising with “the other side” for short-term expediency and the greater good. In fact, compromising is a good way to lose the next election, so that definitely is not acting in one’s self-interest.

As for the federal government shutdown, we all should take this as an opportunity to reflect on what services we truly need from our federal government. In the private sector, mass layoffs and/or cuts in pay or benefits occur frequently, even in the largest firms. But it almost never happens in the public sector, particularly at the federal level. In the private sector, we have to justify our existence (i.e., market value) at all times. Not so in the public sector.

As for the debt ceiling, if it’s supposed to be “automatically” increased as needed, then why do we have one at all? Imagine if your credit card automatically raised your credit limit whenever you approach it. It might sound good, but in effect, it is no credit limit at all. If our federal government isn’t going to take it seriously, we might as well do away with the concept of a debt ceiling altogether. Why perpetuate the charade?

Ultimately, resolving this situation comes down to the President and his ability to lead. Rather than standing firm with his party on this and refusing discussion, he must seek a way to placate those who are simply exercising their Constitutional powers. The founding fathers never intended a pure democracy, where the minority is forced to completely knuckle-under to majority rule. Instead, minority interests have tools at their disposal. In this case, it’s known as “legislation by appropriation,” and it has been exercised routinely by both parties through the years. Indeed, on Wednesday it appears the President is finally taking some steps toward fostering discussion.

This does not mean that he must defund his landmark healthcare program. There is no denying the fact that the Affordable Care Act is the law of the land. But it became so in a hasty power play by the dominant majority, and now a vocal minority has found a way to be heard, as the Constitution allows. Understandably, the Tea Party Republicans want to negotiate while they still hold their bargaining chips -- not after giving them up as the President has insisted. President Obama is going to have to accommodate their demands in some way, however small, or else the fallout will forever be a major blemish on his legacy and his alone. When you consider their respective self-interests, the Tea Party Republicans quite simply have much less to lose (and perhaps a lot to gain) from a protracted government shutdown and debt default than does the President.

Liz Ann Sonders of Charles Schwab has opined that the timing of a protracted shutdown would prove especially costly, as she believes the economy is now poised to move into the next phase of its recovery. She has seen signs of an imminent acceleration in capital expenditures among businesses rather than continuing to use their earnings for stock buybacks and dividend increases. In particular, she thinks the manufacturing sector has just about exhausted its ability to cut costs and implement productivity gains, so spending on new plant, equipment, and personnel is required for earnings growth to continue.

In any case, Bill Gross of PIMCO thinks interest rates likely will remain low longer than the market or most anyone else expects. A near-zero fed funds rate and some measure of quant easing is likely here to stay for the foreseeable future. It would be like trying to take away an entitlement that a large segment of the population has grown accustomed to and dependent upon -- it’s very difficult to do and rarely happens.

The SPY chart: The SPDR S&P 500 Trust (SPY) closed Wednesday at 165.60, which is just below the important 50-day simple moving average. I have drawn an uptrend line of support connecting the various lows since last November’s V-bottom, but this week’s continued weakness has pushed SPY below it. Oscillators like RSI, MACD, and Slow Stochastic are all oversold, but they are not yet at extremes and could go lower. We got a little intraday recovery on Wednesday. But if failure of support at the 100-day SMA is confirmed on Thursday-Friday, next support comes in at 165 and then 160, which also happens to coincide with the critical 200-day SMA. However, if and when bulls get the green flag to resume their rally, I doubt there will be much hesitation at any prior resistance levels above.

The CBOE Market Volatility Index (VIX), a.k.a. “fear gauge,” popped over 21 on Wednesday before closing the day at 19.60. This indicates a healthier level of investor anxiety, given the external events of the day, but it is surprisingly back below the 20 threshold.

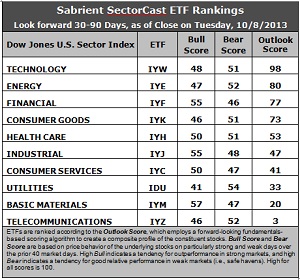

Latest rankings: The table ranks each of the ten U.S. business sector iShares ETFs by Sabrient's proprietary Outlook Score, which employs a forward-looking, fundamentals-based, quantitative algorithm to create a bottom-up composite profile of the constituent stocks within the ETF. The multi-factor model considers forward valuation, historical earnings trends, earnings growth prospects, the dynamics of Wall Street analysts' consensus estimates, accounting practices and earnings quality, and various return ratios. In addition, the table also shows Sabrient's proprietary Bull Score and Bear Score for each ETF.

High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods. Bull and Bear are backward-looking indicators of recent sentiment trend.

As a group, these three scores can be quite helpful for positioning a portfolio for a given set of anticipated market conditions.

Observations:

1. Technology (IYW) remains in the top spot with a near-perfect Outlook score of 98 once again this week. IYW displays one of the lowest forward P/Es, the best return ratios, and positive sentiment among both Wall Street analysts (i.e., upgraded earnings estimates) and company insiders (i.e., open-market buying). Energy (IYE) stays in the second spot with an 80. IYE displays a low forward P/E and solid return ratios. In third place with a score of 77 is Financial (IYF), which saw less in the way of sell-side earnings downgrades. Consumer Goods (IYK) and Healthcare (IYH) round out the top five. All are scoring above 50.

2. Telecom (IYZ) is in the cellar yet again with a dismal Outlook score of 3. IYZ remains weak in all factors across the board, including a high forward P/E, low return ratios, a modest projected long-term growth rate, and poor Wall Street sentiment. In the bottom two again this week is Basic Materials (IYM) with a score of 20.

3. This week’s fundamentals-based rankings retain their bullish bias as Tech, Energy, and Financial are the top three. Also, Industrial (IYJ) and Consumer Services (IYC) are hanging in there, just below the 50 midpoint.

4. Looking at the Bull scores, Basic Materials (IYM) has become the leader on particularly strong market days, scoring 57, which is just ahead of IYF and IYJ. Utilities (IDU) is the lowest at 41. The top-bottom spread is now a relatively robust 16 points, which continues to indicate falling sector correlations on particularly strong market days, which is a sign of a healthy (and rational) market.

5. Looking at the Bear scores, Utilities (IDU) has finally returned to the top spot as favorite “safe haven” on weak market days, scoring 54. Financial (IYF) is the lowest at 46. The top-bottom spread is only 8 points, which indicates high sector correlations on particularly weak market days. That is, we are seeing mostly across-the-board selling during extreme market weakness.

6. Overall, IYW shows the best all-weather combination of Outlook/Bull/Bear scores. Adding up the three scores gives a total of 197. IYZ is the by far the worst at 101. Looking at just the Bull/Bear combination, IYM displays the highest score of 104 this week, which indicates good relative performance in extreme market conditions (whether bullish or bearish), while IDU is the lowest at 95, which indicates investor avoidance (relatively speaking) during extreme conditions (particularly bullish conditions, in this case).

These Outlook scores represent the view that Technology and Energy sectors are still relatively undervalued, while Telecom and Materials may be relatively overvalued based on our 1-3 month forward look.

Some top-ranked stocks within IYW and IYE that look good to me this week include CACI International (CACI), QUALCOMM (QCOM), Marathon Petroleum (MPC), and EOG Resources (EOG). Each of these companies also scores well in Gradient Analytics’ Earnings Quality Rank (EQR), which is a pure accounting-based risk assessment signal that has proven quite valuable for avoiding meltdowns that can ruin overall portfolio performance.

Keep in mind, our new “Earnings Busters” portfolio for Q4 launched on October 1, and given the market weakness since then, it’s not too late to check it out. Sabrient analyst Walter Gault and I appear on the video to introduce the quarterly portfolio of 20 stocks, and there is a companion report, as well.

Disclosure: Author has no positions in stocks or ETFs mentioned.

About SectorCast: Rankings are based on Sabrient’s SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a fundamentals-based multi-factor approach considering forward valuation, earnings growth prospects, Wall Street analysts’ consensus revisions, accounting practices, and various return ratios. It has tested to be highly predictive for identifying the best (most undervalued) and worst (most overvalued) sectors, with a 1-3 month forward look.

Bull Score and Bear Score are based on the price behavior of the underlying stocks on particularly strong and weak days during the prior 40 market days. They reflect investor sentiment toward the stocks (on a relative basis) as either aggressive plays or safe havens. So, a high Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods.

Thus, ETFs with high Bull scores generally perform better when the market is hot, ETFs with high Bear scores generally perform better when the market is weak, and ETFs with high Outlook scores generally perform well over time in various market conditions.

Of course, each ETF has a unique set of constituent stocks, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use ten iShares ETFs representing the major U.S. business sectors.

About Trading Strategies: There are various ways to trade these rankings. First, you might run a sector rotation strategy in which you buy long the top 2-4 ETFs from SectorCast-ETF, rebalancing either on a fixed schedule (e.g., monthly or quarterly) or when the rankings change significantly. Another alternative is to enhance a position in the SPDR Trust exchange-traded fund (SPY) depending upon your market bias. If you are bullish on the broad market, you can go long the SPY and enhance it with additional long positions in the top-ranked sector ETFs. Conversely, if you are bearish and short (or buy puts on) the SPY, you could also consider shorting the two lowest-ranked sector ETFs to enhance your short bias.

However, if you prefer not to bet on market direction, you could try a market-neutral, long/short trade—that is, go long (or buy call options on) the top-ranked ETFs and short (or buy put options on) the lowest-ranked ETFs. And here’s a more aggressive strategy to consider: You might trade some of the highest and lowest ranked stocks from within those top and bottom-ranked ETFs.