Sector Detector: Jaded public needs a new hero

An inordinately contentious and dispiriting election season left virtually everyone who was paying attention with a bitter taste in their mouth about the say-whatever-it-takes politicians that so desperately seek the honor of representing us. But never fear, at least we can still look to the top brass in our military for leaders with the utmost in discipline and integrity, right? Guys like Colin Powell, Wesley Clark, Tommy Franks, and David Petraeus, are all beyond reproach, right? Oh, wait, maybe not that last guy.

An inordinately contentious and dispiriting election season left virtually everyone who was paying attention with a bitter taste in their mouth about the say-whatever-it-takes politicians that so desperately seek the honor of representing us. But never fear, at least we can still look to the top brass in our military for leaders with the utmost in discipline and integrity, right? Guys like Colin Powell, Wesley Clark, Tommy Franks, and David Petraeus, are all beyond reproach, right? Oh, wait, maybe not that last guy.

Even Jimmy Carter admitted to lusting in his heart, but at least he had the self-discipline to refrain from acting on it. Good people can be seduced to the dark side—when power and adulation corrupts one into thinking one can do whatever one wants. Petraeus was supposed to be the one to actually become a presidential nominee someday. But no longer.

So, the public needs a new hero. Someone who talks straight about what medicine this country and economy really need without lowering himself/herself to slinging mud at the other candidates. Someone with the diplomacy to bring warring factions to compromise, the integrity and leadership to gain trust and commitment from all parties—including those who vehemently disagree. Someone who won’t fall on their own sword. Sorry, but I have no suggestions….

It almost makes me want to take a break from the same old daily news barrage and go visit another country. Maybe it would make me better appreciate our American brand of craziness. In fact, I think I will head out for awhile…specifically to Tokyo, Hong Kong, and Singapore for Bloomberg’s Changing the Game: The Financial App Forums. I will be demonstrating Sabrient’s new Equity Valuation and Ranking (EVR) application, an advanced stock and ETF screening, evaluation, and risk assessment tool, within the new Bloomberg App Store. If you have access to a Bloomberg terminal, take a free trial of EVR (APPS SABRIENT) and let us know what you think.

With the election behind us, the Fiscal Cliff is now the proverbial Job One, unless Congress decides that the Petraeus case is more “important” to focus on. Actually, I think they would choose to use it as an excuse to defer a new budget deal if it weren’t for the hard deadlines that they imposed the last time it was deferred.

Of course, these are just a couple of the negative headlines with which investors are dealing. We also still have riots in Greece and recession in Europe that is now impacting Germany, a slowdown in China, contraction in Japan, negative year-over-year quarterly earnings growth here at home, and a typically weak first year of a new presidential cycle.

But all is not lost. Obama’s reelection guarantees the same ultra-low interest-rate policy of the FOMC for the foreseeable future. Although aging Baby Boomers are not expected to be so swayed to buy stuff with low interest rates, and although interest rates on revolving consumer credit are still high, the net effect still should stimulate business borrowing. And this same low-interest monetary policy is in place in nearly all the big economies around the world. Also, the risk-free rate for income investors will stay near zero. So, the expectation is a continued rise in hard assets…and stocks.

Looking at the charts, we saw some high-volume weakness in stocks at the end of last week. The psychologically important resistant-turned-support levels at Dow 13,000, S&P 500 1,400 and Nasdaq 3,000 all broke down. The S&P 500 SPDR Trust (SPY) closed Tuesday at 137.79, as it drops further below 140 after confirming the breakdown of support. SPY made only a brief hesitation at its 100-day SMA, and it’s now threatening to confirm a breakdown through its critical 200-day SMA around 138. The 200-day provided support back in June after a false breakdown then, so let’s see if the cavalry comes to save the day again as SPY continues to slide along the bottom of the bearish falling channel that started in mid-October. It still might turn out to be a bull flag (continuation) pattern. Oscillators like RSI, MACD, and Slow Stochastic are all oversold and in a position where they could easily turn back up.

If price rallies from here, it faces some daunting resistance at 140, the 100- and 50-day SMAs, and the top of the falling channel, as well as prior resistance at 143. Investors definitely need a new hero to get sentiment to turn around.

The CBOE Market Volatility Index (VIX), a.k.a. “fear gauge,” closed Tuesday at 16.65, which is below the important 20 level, and still quite low in its historical range, theoretically reflecting a lack of investor fear.

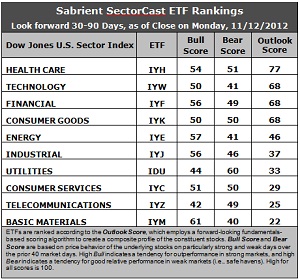

Latest rankings: The table ranks each of the ten U.S. industrial sector iShares (ETFs) by Sabrient’s proprietary Outlook Score, which employs a forward-looking, fundamentals-based, quantitative algorithm to create a bottom-up composite profile of the constituent stocks within the ETF. In addition, the table also shows Sabrient’s proprietary Bull Score and Bear Score for each ETF.

High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods. Bull and Bear are backward-looking indicators of recent sentiment trend.

As a group, these three scores can be quite helpful for positioning a portfolio for a given set of anticipated market conditions.

Observations:

1. Healthcare (IYH) returns to the top spot with an Outlook score of 78, and there is now a three-way tie for second place with a score of 68, shared by Technology (IYW), Financial (IYF), and Consumer Goods (IYK). (Tech gets the honor of being in the top two before rounding the scores.) Stocks within IYH continue to get decent support from Wall Street analysts raising earnings estimates, and they have strong return on sales. Technology (IYW) has stabilized a bit, even though the analysts continue to downgrade earnings expectations. Stocks with IYW still show some of the best long-term growth rates and return ratios.

2. Telecom (IYZ) stays in the cellar with an Outlook score of 25, but the new one in last place is Basic Materials (IYM), scoring 22. Wall Street continues to hammer away at future earnings expectations, and in fact the long-term earnings growth rate is second worst to staid Utilities (IDU).

3. Overall, I would continue to characterize the Outlook rankings as neutral, with the more aggressive and defensive sectors mixed about in the rankings. The range from the top to the bottom Outlook scores remains historically small at only 55, and there are three diverse sectors tied for second place. All of this indicates uncertainty about economic growth.

4. Looking at the Bull scores, Materials (IYM) is the clear leader on strong market days, scoring 61. Telecom (IYZ) is now the weakest on strong market days, scoring 42. In other words, Materials stocks have tended to perform the best when the market is rallying, while Telecom stocks have lagged.

5. Looking at the Bear scores, Utilities (IDU) is the clear investor safe haven on weak market days, scoring 60, which remains far ahead of second-place Healthcare (IYH) at 51. Materials (IYM) is the weakest during market weakness, as reflected in its low Bear score of 40, followed by Technology (IYW) and Energy (IYE) at 41. In other words, Materials stocks have been selling off the most lately when the market is pulling back, while Utilities stocks have held up the best.

6. Overall, Healthcare (IYH) now shows the best all-weather combination of Outlook/Bull/Bear scores. Adding up the three scores gives a total of 182. Telecom (IYZ) is by far the worst at 116. As for Bull/Bear combination, Financial (IYF) and IYH share the best at 105, while Technology (IYW) and Telecom (IYZ) share the worst at 91.

These scores represent the view that the Healthcare and Technology sectors may be relatively undervalued overall, while Telecom and Materials sectors may be relatively overvalued based on our 1-3 month forward look.

Top-ranked stocks within IYH and IYW include Regeneron Pharmaceuticals (REGN), MEDNAX Inc (MD), SolarWinds (SWI), and QUALCOMM Inc (QCOM).

Disclosure: Author has no positions in stocks or ETFs mentioned.

About SectorCast: Rankings are based on Sabrient’s SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a fundamentals-based multi-factor approach considering forward valuation, earnings growth prospects, Wall Street analysts’ consensus revisions, accounting practices, and various return ratios. It has tested to be highly predictive for identifying the best (most undervalued) and worst (most overvalued) sectors, with a 1-3 month forward look.

Bull Score and Bear Score are based on the price behavior of the underlying stocks on particularly strong and weak days during the prior 40 market days. They reflect investor sentiment toward the stocks (on a relative basis) as either aggressive plays or safe havens. So, a high Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods.

Thus, ETFs with high Bull scores generally perform better when the market is hot, ETFs with high Bear scores generally perform better when the market is weak, and ETFs with high Outlook scores generally perform well over time in various market conditions.

Of course, each ETF has a unique set of constituent stocks, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use ten iShares ETFs representing the major U.S. business sectors.

About Trading Strategies: There are various ways to trade these rankings. First, you might run a sector rotation strategy in which you buy long the top 2-4 ETFs from SectorCast-ETF, rebalancing either on a fixed schedule (e.g., monthly or quarterly) or when the rankings change significantly. Another alternative is to enhance a position in the SPDR Trust exchange-traded fund (SPY) depending upon your market bias. If you are bullish on the broad market, you can go long the SPY and enhance it with additional long positions in the top-ranked sector ETFs. Conversely, if you are bearish and short (or buy puts on) the SPY, you could also consider shorting the two lowest-ranked sector ETFs to enhance your short bias.

However, if you prefer not to bet on market direction, you could try a market-neutral, long/short trade—that is, go long (or buy call options on) the top-ranked ETFs and short (or buy put options on) the lowest-ranked ETFs. And here’s a more aggressive strategy to consider: You might trade some of the highest and lowest ranked stocks from within those top and bottom-ranked ETFs.