Sector Detector: Technology surges to top of quant rankings

Fear has subsided enough to let loose the bulls, which in turn has sent bears running for cover to add fuel to the rally. On Wednesday, an international effort to support global liquidity, along with a host of other positive headlines, got the party started. The Dow soared nearly 500 points to close just above the 12,000 level. This put the markets back near the flat line for both the month of November and for 2011 YTD—which in retrospect is a welcome result, indeed, given the huge price swings and pervasive fears of global economic collapse.

Energy and Basic Materials have led the rally this week, but it is Technology that now sits atop Sabrient’s SectorCast rankings of the 10 U.S. sector iShares.

On Wednesday, the Federal Reserve, ECB, and other central banks stepped in to shore up global money markets and ensure that European banks have sufficient funding, as government bond yields have surged. This is essential for keeping interest on debt at a manageable level. It followed China’s unexpected reduction in bank reserve requirements, intended to boost its somewhat sluggish economy.

The ten highest-yielding Dow stocks (a.k.a., Dogs of the Dow) are now yielding over 4%, which is more than double the 10-year Treasury yield, so stock valuations are low. Earnings reports, industrial production, payrolls, and consumer confidence have all been quite promising, so the only holdup has been Europe. Any sign of a possible solution to their debt crisis is an excuse for the U.S. stock market to rally.

The market now has some positive momentum as it enters the month of December, which is historically strong. With market essentially flat for the year, there is a chance for a net gain for 2011.

Despite good overall earnings reports this season, suspect earnings quality nevertheless has been the downfall of a number of stocks. Forensic accounting firm and recent Sabrient acquisition Gradient Analytics (http://www.EarningsQuality.com) saw a number of stocks that it had red-flagged fall after their earnings reports. Abercrombie & Fitch (ANF) and j2 Global Communications (JCOM) are two of the latest stocks that have taken a fall.

The SPY closed Wednesday right at the 125 level. After pulling a big turkey last week, with one of the worst Thanksgiving weeks ever, the market found enough positive catalysts to gap up on Monday, take on breather on Tuesday, and then really get revved up on Wednesday. The symmetrical triangle formation I pointed out two weeks ago, which is very much like a coiled spring, first broke down bearishly straight through Thanksgiving. But last Friday produced a potentially bullish inverted hammer candlestick, which was indeed confirmed on Monday with the big gap up.

On Wednesday, the huge across-the-board rally cut right through potential resistance from the 50- and 100-day simple moving averages, and now the 200-day MA looms above around 127. RSI, MACD, and Slow Stochastic have reversed their bearish course and are all pointing up bullishly.

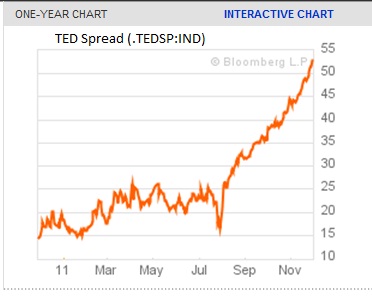

The VIX (CBOE Market Volatility Index – a.k.a. “fear gauge”) closed Wednesday at 27.80, which puts it well below the important 30 mark. With elevated levels of fear since August, VIX has had a devil of a time staying below 30. The TED spread (indicator of credit risk in the general economy, measuring the difference between the 3-month T-bill and 3-month LIBOR interest rates) just keeps on climbing, as shown in the Bloomberg chart below. It closed Wednesday at 52.89. Although not nearly so high as the extremes it hit during the 2008 financial crisis, it nevertheless is a far cry from the low-teens earlier this year, and indicates elevated investor worry about bank liquidity and a preference for the safety of Treasuries bonds over corporate bonds.

Latest rankings: The table ranks each of the ten U.S. industrial sector iShares (ETFs) by Sabrient’s proprietary Outlook Score, which employs a forward-looking, fundamentals-based, quantitative algorithm to create a bottom-up composite profile of the constituent stocks within the ETF. In addition, the table also shows Sabrient’s proprietary Bull Score and Bear Score for each ETF.

High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods. Bull and Bear are backward-looking indicators of recent sentiment trend.

As a group, these three scores can be quite helpful for positioning a portfolio for a given set of anticipated market conditions.

Here are some observations about Sabrient’s latest SectorCast ETF scores.

1. Technology (IYW) and Energy (IYE) iShares have surged to the top while Healthcare (IYH) and Basic Materials (IYM) have fallen in their Outlook scores. IYW scores 86, which puts it well above second-place IYE at 58. Stocks within IYW are mostly holding onto their analyst support, while also displaying the highest return ratios. Stocks within IYE are showing some of the best projected growth rates.

2. Financial (IYF) and Industrial (IYJ) remain in third and fourth. IYF shows the lowest (best) aggregate projected P/E due to investor caution about investing in the sector.

3. Materials (IYM) continues to be held back by the most net downward revisions among analysts, although it still sports one of the best (lowest) projected P/Es.

4. Utilities (IDU) and Telecom (IYZ) are in the bottom two again. Stocks within IYC and IYZ are saddled with high projected P/Es.

5. Seeing IYW, IYE, IYF, and IYJ at the top is a relatively bullish sign. It would be even better to see IYM and IYC scoring above IYK.

6. Looking at the Bull scores, IYM has been the leaders on strong market days, scoring 61, followed by IYE with a 59. IDU is by far the weakest with a 37. It is notable that IYW is not one of the leaders on strong market days.

7. As for the Bear scores, IDU is the clear investor favorite “safe haven” on weak market days with a score of 68. IYK is second at 64. IYF carries the lowest Bear score of 39, which means that stock with this ETF sell off the most on weak market days.

Overall, IYW now displays by far the best combination of Outlook/Bull/Bear scores. Adding up the three scores gives a total score of 187. IYE displays by far the best combination of Bull/Bear with a total score of 110, while IYF has the worst combination (97).

Top ranked stocks in Technology and Energy include Netgear (NTGR), SolarWinds (SWI), HollyFrontier (HFC), and Stone Energy (SGY).

Low ranked stocks in Utilities and Telecom include Atlantic Power (AT), Crosstex Energy (XTEX), Crown Castle International (CCI), and Meru Networks (MERU).

These scores represent the view that the Technology and Energy sectors may be relatively undervalued overall, while Utilities and Telecom sectors may be relatively overvalued, based on our 1-3 month forward look.

Disclosure: Author has no positions in stocks or ETFs mentioned.

About SectorCast: Rankings are based on Sabrient’s SectorCast model, which builds a composite profile of each equity ETF based on bottom-up scoring of the constituent stocks. The Outlook Score employs a fundamentals-based multi-factor approach considering forward valuation, earnings growth prospects, Wall Street analysts’ consensus revisions, accounting practices, and various return ratios. It has tested to be highly predictive for identifying the best (most undervalued) and worst (most overvalued) sectors, with a one-month forward look.

Bull Score and Bear Score are based on the price behavior of the underlying stocks on particularly strong and weak days during the prior 40 market days. They reflect investor sentiment toward the stocks (on a relative basis) as either aggressive plays or safe havens. So, a high Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods.

Thus, ETFs with high Bull scores generally perform better when the market is hot, ETFs with high Bear scores generally perform better when the market is weak, and ETFs with high Outlook scores generally perform well over time in various market conditions.

Of course, each ETF has a unique set of constituent stocks, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use ten iShares ETFs representing the major U.S. business sectors.

About Trading Strategies: There are various ways to trade these rankings. First, you might run a sector rotation strategy in which you buy long the top 2-4 ETFs from SectorCast-ETF, rebalancing either on a fixed schedule (e.g., monthly or quarterly) or when the rankings change significantly. Another alternative is to enhance a position in the SPDR Trust exchange-traded fund (SPY) depending upon your market bias. If you are bullish on the broad market, you can go long the SPY and enhance it with additional long positions in the top-ranked sector ETFs. Conversely, if you are bearish and short (or buy puts on) the SPY, you could also consider shorting the two lowest-ranked sector ETFs to enhance your short bias.

However, if you prefer not to bet on market direction, you could try a market-neutral, long/short trade—that is, go long (or buy call options on) the top-ranked ETFs and short (or buy put options on) the lowest-ranked ETFs. And here’s a more aggressive strategy to consider: You might trade some of the highest and lowest ranked stocks from within those top and bottom-ranked ETFs, such as the ones I identify above.