Sector Detector: Bulls need to shake off the “June gloom”

Here in Santa Barbara, we refer to the annual summer ritual of heavy marine layer engulfing the coastline for much of the day as the “June gloom.” It can be frustrating to beach-going visitors since there are otherwise no clouds, and the inland areas are brilliantly sunny. Similarly, bullish investors might be frustrated with the financial version of June gloom to start the month, given that the overall setting for equities is still relatively bright.

Here in Santa Barbara, we refer to the annual summer ritual of heavy marine layer engulfing the coastline for much of the day as the “June gloom.” It can be frustrating to beach-going visitors since there are otherwise no clouds, and the inland areas are brilliantly sunny. Similarly, bullish investors might be frustrated with the financial version of June gloom to start the month, given that the overall setting for equities is still relatively bright.

During their run of seven consecutive positive months, stocks have managed to shrug off a lot of obstacles from Greece, Italy, Cyprus, China, Japan, North Korea, Iran, and even our own Federal government. But the blame for this June gloom has been widely placed on the rumored tapering of the Federal Reserve’s bond-buying program. Treasury yields have spiked, sending bond prices down. The worry is that the bond market will get clobbered and bring equities down with it.

Some think the FOMC has been too transparent, with all their internal squabbling making investors uneasy. And yet the stock market remains on a bullish trajectory despite its recent weakness. It’s likely that money will simply flow from bonds to stocks as interest rates rise.

Low-volatility ETFs like PowerShares S&P 500 Low Volatility (SPLV) and Guggenheim Defensive Equity (DEF) have outperformed this year as the more defensive sectors that dominate their portfolios have been the leaders. Lately, however, their performance has suffered as Utilities has sold off hard as capital has rotated into cyclical and higher-beta sectors.

Of course, the appeal of dividend-paying stocks diminishes as interest rates rise, and as P/E multiples of these safe dividend-paying sectors have risen, their valuations are no longer so attractive, either. This, along with a slowly improving economy, has been the driver of the recent sector rotation into cyclicals.

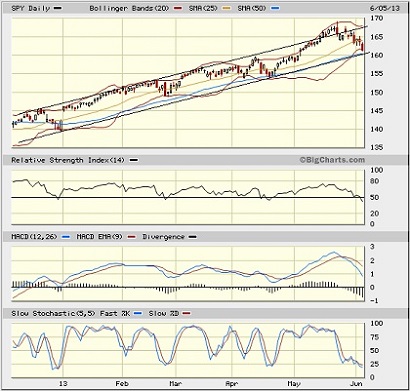

Looking at the chart of the SPDR S&P 500 Trust (SPY), it closed Wednesday at 161.27 as the technical consolidation that appeared to be starting last week continues. Bollinger Bands have pinched back together and oscillators RSI, MACD, and Slow Stochastic have all cycled back down from overbought territory. The 20-day simple moving average (SMA) failed to hold up as support. It is now approaching the bottom of the bullish rising channel that has been in place since November, which happens to converge with psychological support at 160 (corresponding with 1600 on the S&P 500 Index) and the important 50-day SMA. I expect this level to provide strong support.

The CBOE Market Volatility Index (VIX), a.k.a. “fear gauge,” closed Wednesday at 17.50, which is above recent resistance at 15, but it remains below the important 20 as it approaches the April highs. Still, VIX has not been above 20 during 2013.

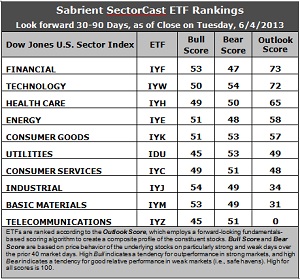

Latest rankings: The table ranks each of the ten U.S. business sector iShares ETFs by Sabrient's proprietary Outlook Score, which employs a forward-looking, fundamentals-based, quantitative algorithm to create a bottom-up composite profile of the constituent stocks within the ETF. The multi-factor model considers forward valuation, historical earnings trends, earnings growth prospects, the dynamics of Wall Street analysts' consensus estimates, accounting practices and earnings quality, and various return ratios. In addition, the table also shows Sabrient's proprietary Bull Score and Bear Score for each ETF.

High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods. Bull and Bear are backward-looking indicators of recent sentiment trend.

As a group, these three scores can be quite helpful for positioning a portfolio for a given set of anticipated market conditions.

Observations:

1. Little change this week. Financial (IYF) stays in the top spot with an Outlook score of 73. Stocks within IYF display strong sentiment among insiders and Wall Street analysts (net upgrades to earnings estimates), as well as a low forward P/E. Technology (IYW) is a close second with a score of 72. Stocks within IYW display a low forward P/E, a solid long-term projected growth rate, and the best return ratios.

2. Telecom (IYZ) stays in the cellar with an Outlook score of 0. It is weak across the board with a high forward P/E, poor long-term projected growth, low return ratios, and negative sentiment among insiders and sell-side analysts. It is joined in the bottom two again this week by Basic Materials (IYM) at 31.

3. I would say that this week’s fundamentals-based rankings are still mostly bullish, with Financial (IYF), Technology (IYW), and Energy (IYE) in the top five. But it would be more encouraging to see improving scores in Consumer Services (IYC), Industrial (IYJ) and Materials (IYM).

4. Looking at the Bull scores, IYJ has been the leader on particularly strong market days, scoring 54, followed closely by IYF and IYM, while defensive sectors have been the laggards. IYZ and IYM score the lowest at 45. This is normal market behavior and further evidence of the rotation into traditional leaders of market rallies. However, the narrow top-bottom spread of 9 points continues to indicate high sector correlation on strongly bullish days.

5. Looking at the Bear scores, Technology (IYW) has become the favorite “safe haven” on weak market days, scoring 54, followed closely by traditional safe havens Utilities (IDU) and Consumer Goods (IYK). Financial (IYF) remains the weakling during extreme market weakness as reflected in its low Bear score of 47. The top-bottom spread has dropped even further to only 7 points, which indicates much lower correlation on weak market days than we were seeing during most of the year so far.

6. Overall, Technology (IYW) shows the best all-weather combination of Outlook/Bull/Bear scores. Adding up the three scores gives a total of 176. Telecom (IYM) is the worst at 96. Looking at just the Bull/Bear combination, Consumer Goods (IYK) and Technology (IYW) display the highest score of 104. Telecom (IYZ) scores the lowest at 96.

These Outlook scores represent the view that Financial and Technology sectors may be relatively undervalued, while Telecom and Basic Materials sectors may be relatively overvalued based on our 1-3 month forward look.

Some top-ranked stocks within IYF and IYW include Mastercard (MA), Berkshire Hathaway (BRK.B), Cree Inc (CREE), and SanDisk (SNDK).

Disclosure: Author has no positions in stocks or ETFs mentioned.

About SectorCast: Rankings are based on Sabrient’s SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a fundamentals-based multi-factor approach considering forward valuation, earnings growth prospects, Wall Street analysts’ consensus revisions, accounting practices, and various return ratios. It has tested to be highly predictive for identifying the best (most undervalued) and worst (most overvalued) sectors, with a 1-3 month forward look.

Bull Score and Bear Score are based on the price behavior of the underlying stocks on particularly strong and weak days during the prior 40 market days. They reflect investor sentiment toward the stocks (on a relative basis) as either aggressive plays or safe havens. So, a high Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods.

Thus, ETFs with high Bull scores generally perform better when the market is hot, ETFs with high Bear scores generally perform better when the market is weak, and ETFs with high Outlook scores generally perform well over time in various market conditions.

Of course, each ETF has a unique set of constituent stocks, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use ten iShares ETFs representing the major U.S. business sectors.

About Trading Strategies: There are various ways to trade these rankings. First, you might run a sector rotation strategy in which you buy long the top 2-4 ETFs from SectorCast-ETF, rebalancing either on a fixed schedule (e.g., monthly or quarterly) or when the rankings change significantly. Another alternative is to enhance a position in the SPDR Trust exchange-traded fund (SPY) depending upon your market bias. If you are bullish on the broad market, you can go long the SPY and enhance it with additional long positions in the top-ranked sector ETFs. Conversely, if you are bearish and short (or buy puts on) the SPY, you could also consider shorting the two lowest-ranked sector ETFs to enhance your short bias.

However, if you prefer not to bet on market direction, you could try a market-neutral, long/short trade—that is, go long (or buy call options on) the top-ranked ETFs and short (or buy put options on) the lowest-ranked ETFs. And here’s a more aggressive strategy to consider: You might trade some of the highest and lowest ranked stocks from within those top and bottom-ranked ETFs.