Sector Detector: Breakout or another bluff? Bulls seeking confirmation this week

Stocks ended last week on a high note, closing a smidge above strong resistance at 1900 for the S&P 500, which set a new closing high for the large-cap index, albeit on low pre-holiday volume. With the Memorial Day holiday giving us a short week of trading, all eyes are on voting in Ukraine, where a decisive win for billionaire business tycoon Petro Poroshenko seems assured. The only question is how Russia and the breakaway eastern regions will respond this week.

Stocks ended last week on a high note, closing a smidge above strong resistance at 1900 for the S&P 500, which set a new closing high for the large-cap index, albeit on low pre-holiday volume. With the Memorial Day holiday giving us a short week of trading, all eyes are on voting in Ukraine, where a decisive win for billionaire business tycoon Petro Poroshenko seems assured. The only question is how Russia and the breakaway eastern regions will respond this week.

Meanwhile, over in Western Europe, surprising election strength from anti-EU, anti-euro, anti-austerity, anti-immigration, anti-Islam, and anti-Semitic parties from the far right and far left all won seats in countries like France, Britain, Greece, Denmark, Holland, and Hungary.

Among the ten U.S. business sectors, defensive sector Utilities is still the clear leader year-to-date, up nearly +10%, but it has pulled back significantly during the month of May. Energy and Healthcare are now in a dead heat for second place YTD, and Technology is finally making its move. Tech was quite strong last week, up about +2.5%. Consumer Services/Discretionary remains the laggard, but even it is approaching the breakeven mark YTD.

Rather than bond prices falling, the 10-year Treasury yield remains at a low 2.54% and still shows no inclination whatsoever to rise. As the Federal Reserve tapers its bond purchases, there has been no widely-expected Great Rotation out of Treasuries. In fact, PIMCO bond guru Bill Gross is actually predicting that long-term yields will fall even further, primarily because the all-time high in global debt will keep global growth quite slow over the next few years. The yield curve is already flatter than most observers expected it would be, and Bill Gross is expecting it to get even flatter. As a result, he also thinks it will be several more years before the Fed can start to raise short-term rates. And of course, low long-term interest rates support higher equity valuations because the comparative earnings yield threshold is lower.

The CBOE Market Volatility Index (VIX), a.k.a. fear gauge, closed last week at 11.36, which is a new 52-week low. It continues to creep downward, indicating investor complacency about risk in their stock holdings -- and perhaps an expectation of a low-return, low-volatility trading environment for the foreseeable future. As it continues to move lower, some observers are predicting that a single-digit VIX is in the offing, but others are saying that a sudden spike (correlating with a big fall in equities) is far overdue and imminent.

Notably, Bank of America Merrill Lynch put out their global research report about the four-year presidential cycle, and the midterm election year (which we are in right now) is typically the weakest. They observe that an intra-year decline of at least 20% has occurred 43% of the time during midterm election years, compared with a 27% likelihood in any given year since 1928.

Indeed, investor sentiment has become notably bearish, as the AAIA investor poll of bullishness is at pessimistic extremes and the 10-day Put/Call Ratio is at its highest level of bearishness since last summer. But from a contrarian perspective, both of these are historically bullish for equities. Moreover, the BAML report also observes that the midterm election year typically turns quite bullish come September.

As described below, the charts are giving a tentatively bullish appearance, and our fundamentals-based sector rankings look mostly bullish. Thus, it seems best to stay long but vigilant of a summer selloff, and continue to avoid the lower-quality, higher-volatility stocks.

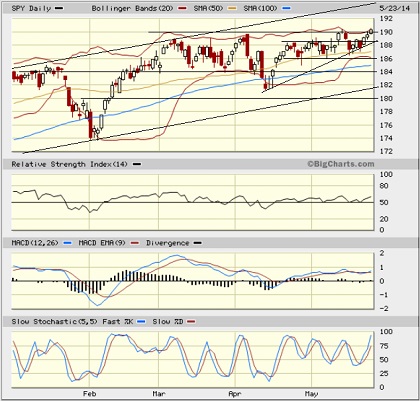

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed Friday at 190.35, barely breaking through tough resistance that has held strong since early March. In doing so, it also broke out of a narrow neutral sideways channel (between 187 and 189) and a bullish ascending triangle (a series of higher lows with resistance around 189). However, until it confirms by holding above 190 and making some higher ground, it might be just another false breakout attempt. Price still remains near the middle of the long-standing bullish rising channel, so if this fledgling breakout can hold up, there is plenty of upside, with the top of the rising channel currently above 194 (but rising). Let’s see if it can confirm during this Memorial Day Holiday-shortened week. SPY has now returned back to its neutral sideways channel between roughly 187 and 189. Oscillators RSI, MACD, and Slow Stochastic are all bullishly pointed upward now.

Notably, the broad Wilshire 5000 Total Market Index has broken through resistance at 20,000, while the iShares Russell 2000 (IWM) small cap ETF has bullishly regained its 200-day simple moving average, at least for the moment, and the iShares MSCI Emerging Markets Index Fund (EEM) continues to strengthen, with its 50-day SMA crossing bullishly through its 200-day in a golden cross. Perhaps leadership from large caps and higher quality names will allow the higher-risk market segments to ride their coattails.

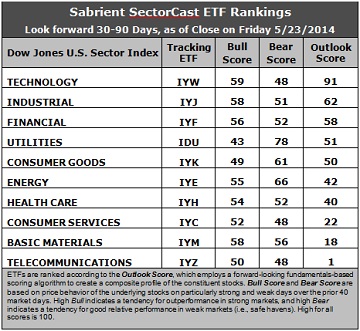

Latest sector rankings:

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. Technology remains in first place with a robust Outlook score of 91 -- anything above 90 is quite strong, especially given its big 29-point gap above second place Industrial. Technology displays generally solid factor scores across the board, with a strong forward long-term growth rate, a reasonable forward P/E, the highest return ratios, and the strongest sentiment among Wall Street analysts (upward revisions to earnings estimates), along with steadily improving insider sentiment (buying activity). Industrial displays a good forward long-term growth rate, solid return ratios, and strong sentiment among both sell-side analysts and insiders. Financial moves into third place this week ahead of Utilities, primarily because of improving sell-side analyst sentiment. Consumer Goods holds fifth place.

2. Telecommunications stay in the cellar with an Outlook score of 1, as it scores at or near the bottom in every factor in the model. It is joined in the bottom two this week by Basic Materials with a score of 18.

3. Looking at the Bull scores, Technology holds the lead with a 59, followed closely by Industrial and Basic Materials at 58, while Utilities is the laggard with a 43. The top-bottom spread has expanded to 16 points, reflecting falling sector correlations on particularly strong market days. It is generally desirable in a healthy market to see a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold, rather than the all-boats-lifted-in-a-rising-tide mentality that dominated 2013.

4. Looking at the Bear scores, Utilities continues hold up well, scoring 78, which means that stocks within this defensive sector have been the preferred safe havens on weak market days. No surprise here. Energy is second at 66. Consumer Services, Technology, and Telecom all share the lowest score at 48. The top-bottom spread is a highly robust 30 points, reflecting extremely low sector correlations on particularly weak market days. Again, it is generally desirable in a healthy market to see a top-bottom spread of at least 20 points.

5. Technology displays by far the best all-weather combination of Outlook/Bull/Bear scores, followed by Utilities and Industrial. Telecom is by far the worst, followed by Consumer Services. Looking at just the Bull/Bear combination, Utilities and Energy share the lead, but it is Energy that displays the best balance between its Bull and Bear scores, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish). Telecom scores the lowest, followed by Consumer Services, indicating general investor avoidance during extreme conditions.

6. Overall, I would still interpret this week’s fundamentals-based Outlook rankings as mostly bullish, mainly because the top three are all economically-sensitive sectors displaying high Bull scores (Technology, Industrial, Financial). Tempering the bullishness somewhat is that the next three are all mostly defensive sectors (Utilities, Consumer Goods, Energy).

These Outlook scores represent the view that Technology and Industrial sectors are relatively undervalued, while Consumer Services and Telecom may be relatively overvalued based on our 1-3 month forward look.

Stock and ETF Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or bearish), suggests holding Technology, Industrial, and Financial in the prevailing bullish climate. (In this particular model, we consider the bias to be bullish from a rules-based standpoint because SPY is still above its 50-day simple moving average while also remaining above its 200-day SMA.)

Other ETFs that are ranked high by our algorithm from the Technology, Industrial, and Financial sectors include First Trust NASDAQ Technology Dividend Index Fund (TDIV), First Trust Industrials/Producer Durables AlphaDEX Fund (FXR), and First Trust NASDAQ ABA Community Bank Index Fund (QABA).

For an enhanced sector portfolio that enlists top-ranked stocks (instead of ETFs) from within Technology, Industrial, and Financial, some long ideas include RF Micro Devices (RFMD), Facebook (FB), United Rentals (URI), General Dynamics (GD), KeyCorp (KEY), and Signature Bank (SBNY). All are ranked highly in the Sabrient Ratings Algorithm and also score within the top two quintiles of our Earnings Quality Rank (EQR), a pure accounting-based risk assessment signal based on the forensic accounting expertise of our subsidiary Gradient Analytics. We have found it quite valuable for helping to avoid performance-offsetting meltdowns in our model portfolios.

However, if you are more comfortable with a neutral bias, the model still suggests holding Technology, Industrial, and Financial. On the other hand, if you have a bearish outlook on the market, the model suggests holding Utilities, Energy, and Consumer Goods/Staples.

Also, I should mention that Sabrient's sixth annual Baker's Dozen portfolio is leading the market averages yet again this year, led by NXP Semiconductors NV (NXPI), Southwest Airlines (LUV), Arris Enterprises (ARRS), and Actavis plc (ACT), and our mid-year Forward Looking Value portfolio will launch in mid-June (last year's has nearly doubled the S&P 500 return).

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.