Kraft Heinz: A Case Study of Soft Asset Write-Downs

by Rachel Bradley

by Rachel Bradley

Equity Analyst, Gradient Analytics LLC (a Sabrient Systems company)

While the accrual method of accounting has its usefulness, it also opens the door for companies to “manage” and even overstate earnings through various tactics – some merely aggressive, others more nefarious. There are a variety of levers that management can pull to either book expected revenue sooner than normal or push current expenses farther out into the future. However, earnings growth sourced this way is unsustainable. Unless the firm expects a massive boost in sales in the near future (such as from the rollout of a highly anticipated new product), sustaining the growth story would require not only continuing to pull revenue forward but to do so at an accelerating rate.

Pulling sales forward or pushing expenses farther down the road both overstate the firm’s sustainable earnings power and result in a presentation of financials that obfuscate reality. There is also a myriad of other tools available to dress up financial statements to present a firm that appears financially healthier than it truly is. A common way to pad the balance sheet is through so-called “soft assets,” i.e., goodwill and other intangibles like brands, logos, trademarks, corporate reputation, client lists, and contracts.

At Gradient Analytics we have a saying, “With soft assets, come soft profits.” Put another way, when a firm has material intangible assets and most of its valuation is tied to the terminal value dependent on a set of unrealistic assumptions, then earnings have a higher risk of write-downs. As an example, we take a deeper look at the financials of The Kraft Heinz Company (KHC), specifically examining some overly optimistic assumptions management used in valuing its soft assets. Read on….

Chronologically, this story begins on 7/2/15 (Q3 2015) when Kraft merged with Heinz to become The Kraft Heinz Company (KHC). This was a highly material transaction as the total consideration exchanged was $52.6 billion, of which KHC paid $9.5 billion in cash. In connection with the merger, KHC recorded $86.4 billion in purchased assets in the final purchase price allocation. However, the majority ($78.2 billion or 90.6%) was in soft assets. Of that, goodwill represented $30.5 billion and intangible assets represented $47.8 billion. From this perspective, we see that KHC invested a considerable amount to acquire prominent brands and trademarks.

Skipping ahead to just three years later, in 2018, KHC wrote down $15.9 billion in soft assets, both goodwill and intangibles, across five brands but primarily in Kraft and Oscar Mayer. Two questions initially come to mind. How could the value of these assets decline so precipitously (20.3%) in just three years? And more importantly, were there any leading indicators that signaled a major write-down could be coming? We believe there were three specific red flags that supplied evidence that the underlying businesses were deteriorating: 1) declining pro forma sales and earnings, 2) a divergence between reported earnings and cash flow performance, and 3) a falling premium on soft assets.

Just one quarter following the merger (Q4 2015), trailing twelve month (TTM) pro forma sales declined 5.8% YOY to $27.4 billion (based on the assumption that Kraft had been acquired as of 12/30/13). Similarly, 2015 pro forma net income from continuing operations declined 12.1% YOY to $1.8 billion. Sales continued to decline the following two years, down 3.5% YOY in 2016 and down 0.8% YOY in 2017. It is likely that during the acquisition process, analysts valued these intangible assets based on the key assumption that earnings and cash flow would grow in the future. But the question that comes to mind when considering this is, how will the firm sustainably grow earnings and cash flow in a declining sales environment?

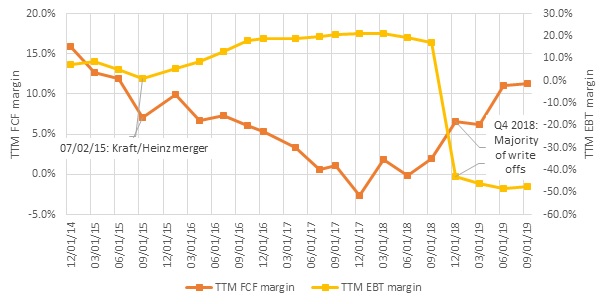

Like declining pro forma sales, another key sign that the underlying businesses were deteriorating was lackluster cash flow performance. While earnings are subject to the vagaries of GAAP and can be easily managed, cash is impossible to fake. As shown in the chart below, in the three years immediately preceding the 2018 write-down, KHC’s TTM EBT margin was expanding. However, this growth was not supported by similar growth in the TTM FCF margin. In fact, FCF margin was declining over this period. The divergence between these two measures indicates that management may have sourced prior earnings growth from low-quality or unsustainable sources.

Moreover, if sales, earnings, and cash flows are all declining, then most of the firm’s valuation is likely tied to a high terminal value (i.e., what the firm could be worth in the future). The problem occurs when there is a significant divergence between what this terminal value firm must look like and what the firm currently looks like. There is a plethora of real-world factors outside the scope of business valuation that will impact the firm’s operations between now and the time the terminal value is projected. Therefore, a valuation with a higher proportion of value tied to the terminal value is much more speculative than a valuation with a higher proportion of value associated with the current value of the firm’s assets. The problem here, is that the assets KHC acquired were primarily trademarks with little pricing information to go by. Moreover, the trademark value was dependent on the underlying businesses growing on a sustainable long-term basis, in contrast to the structural decline they actually appear to be in.

Once sales, earnings and cash flows had declined three years in a row, the business had violated some critical growth assumptions, and it became apparent that this terminal value was no longer realistic and impairment recognition was required. As a write-down is a charge to earnings, it is no surprise that KHC underperformed earnings expectations that year. In 2018, KHC’s GAAP EPS was $11.30 lower than the consensus estimate. However, even after excluding the impairment, KHC underperformed expectations as non-GAAP EPS was still $0.06 lower than the consensus estimate. On the Q4 2018 Conference Call (on 2/21/19), former CEO Bernardo Hees attributed the underperformance to assumptions that were overly optimistic and said, “The core cause of our shortfall in 2018 was forecasting the pace and magnitude of our savings curve in 2018, not merger-related synergies.” To that point, KHC also initially anticipated significant synergy potentials in connection with the merger. KHC estimated $1.5 billion in annual cost savings by the end of 2017 and that the transaction would be EPS accretive by 2017. Note that these synergies do not fully compensate for the structural decline of these brands or assets. The materiality of the 2018 write-down effectively wiped out any synergies that KHC was able to realize. We believe that an increasing proportion of intangible assets that had a declining fair value premium from 2015 to 2018 also signaled that the valuation of these businesses may have been based on assumptions that were not coming to fruition.

In its Annual Reports from 2015 to 2018, KHC disclosed that an increasing amount of soft assets saw a compression in their fair market value premiums. Put another way, from the time of acquisition in 2015 to the write-down in 2018, KHC consistently reported that more and more intangible assets had a declining excess fair value over carrying value. For instance, in its 2015 Annual Report (dated 3/3/16), KHC disclosed that 21 brands having intangible assets with excess fair values over their carrying values of less than 10% had an aggregate carrying value of $2.5 billion. In addition to this, the historical Heinz North America Consumer Products segment had goodwill assets with a premium under 10% but KHC did not disclose the carrying value. Then, intangible assets with thin premiums tripled the following year (2016). In its Annual Report (dated 2/23/17), KHC disclosed that intangible assets with an excess fair value over the carrying value of less than 10% had an aggregate value of $6.1 billion. In addition, one segment in Europe had a thin premium with a goodwill carrying value significantly less, $48.0 million.

The following year (2017), the intangible asset disclosure increased to encompass almost 10x as many intangible assets ($53.7 billion), but each goodwill reporting unit had an excess fair value over carrying value of at least 10%. In its Annual Report (dated 2/16/18), KHC disclosed, “We have a risk of future impairment to the extent individual brand performance does not meet our projections.” It went on to state that, because it recorded the majority of intangible assets in connection with 2015 Merger discussed above as well as a merger in 2013, “there was not a significant excess of fair values over carrying values as of April 2, 2017.”

The asset value on the date the merger closed represents the fair value. However, in a healthy company that is growing, the premium should increase over time, not decline. From this perspective, it is not surprising that KHC wrote down a sizeable amount of assets just three years following the merger. In 2018, KHC impaired $15.9 billion in both goodwill and intangible assets across five brands. Of the five, KHC had previously disclosed that Velveeta and Kraft had thin premiums. So, the impairments were a result of lowering the prior unrealistic assumptions about sales and earnings growth.

Furthermore, there are signs that KHC could record additional material impairments in the near-term. In 2018, KHC changed its disclosure to include assets that had excess fair value over the carrying value of less than 20%, rather than the prior 10%. As of 12/29/18, intangible assets with a heightened risk of future impairments had an aggregate carrying amount of $29.3 billion. These included the previously mentioned Kraft, Oscar Mayer, Velveeta and eight others. Of that, $24.0 billion (or 81.9%) is attributable to brands with 0% excess fair value over carrying amount. In addition to that, reporting units with a heightened risk of future impairments had an aggregate goodwill carrying amount of $29.0 billion. Of that, $9.3 billion (or 32.1%) is attributable to reporting units with 0% excess fair value over carrying amount. These businesses will need to stop shrinking and start growing to prevent violating more critical growth assumptions that would trigger associated impairments. Moreover, since 2015 KHC has continued to acquire several more companies. While it has not made a transaction as material as the Kraft Heinz merger, it has purchased five bolt-on acquisitions. There is a chance that the same overly optimistic assumptions could pervade these transactions as well.

Interestingly, during the process of finalizing the purchase price allocation for the 2015 merger, the actual value of intangible assets came in lower than anticipated. This is key because if the purchase price does not change, and in this case it did not, then the balance is added to the premium paid for the acquisition as goodwill. Despite declining pro forma sales and earnings, goodwill on the purchase price allocation increased 4.9% from the first merger projections publicly disclosed. The final purchase price allocation disclosed that identifiable intangible assets declined $2.0 billion. Offsetting this, goodwill increased $1.4 billion and deferred income tax liabilities increased $564.0 million. While in a vacuum this data point alone is not necessarily a red flag, it does provide interesting context to the situation.

We have presented the impact on earnings of the assumptions KHC used to value assets, observing in hindsight (i.e., forensic accounting) that they were overly optimistic and leading indicators of business underperformance. Declining pro forma sales, earnings, cash flows, and the market premium of the related assets all showed that the underlying business was deteriorating. In fact, we believe that a good indication that a firm is sourcing earnings growth from low quality sources is when cash flow growth does not support earnings growth. Moreover, the materiality of earnings quality concerns rises as the divergence between earnings and cash flow growth increases. To help our clients avoid investing in companies that are valued based on a set of unrealistic assumptions, Gradient Analytics continues to vigilantly scrutinize the financial statements (and importantly, the footnotes), sniffing out unsustainable sources of growth.

Disclosure: At the time of this writing, the author held no positions in the securities mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any opinions, commentary, rankings, or stock selections provided by Sabrient Systems or its wholly-owned subsidiary Gradient Analytics. Sabrient Systems makes no representations that the techniques used in its rankings or analysis will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.