Forensic accounting is not just for shorts! How to identify strong earnings quality to confirm long stock selections

by Ian Striplin

by Ian Striplin

Equity Analyst, Gradient Analytics LLC (a Sabrient Systems company)

Here at Gradient Analytics, where we specialize in forensic accounting research and consulting, it may seem to the outsider that we are just a bunch of pessimistic short researchers, sniffing out aggressive accounting practices that might soon cause a given company to miss earnings expectations and reduce forward guidance, for the benefit of our clientele of long/short hedge funds. To be honest, we are jaded in our belief that most companies will, from time to time, take liberties with their accrual accounting in order to achieve short-term reporting objectives. But most only do it sparingly and temporarily, and only those that become overly extended in employing aggressive practices – while facing fundamental headwinds that make it likely certain metrics will persist or worsen – make good short candidates. But that doesn’t automatically make all the others good long candidates.

Thus, our expertise is also useful for identifying solid earnings quality for the vetting of long candidates. Earnings quality analysis can reveal accounting benefits to future earnings potential and help ensure that a quant model or fundamental analysis that created a positive equity profile for a given company is indeed based on the underlying economics of the business rather than an aberration of accrual accounting. In other words, it can serve to add conviction or a confirmation signal to a long thesis.

In this article, we will describe several positive earnings quality factors that can act as a tailwind to sustainable future earnings growth, with four real-life examples. In forming a stock universe for this article, we screened the output file of our proprietary Earnings Quality Rank (EQR), which assigns a quintile score of 1-5 (with 5 being the “best” earnings quality relative to peers), and limited the population to companies in the top quintile and a market capitalization greater than $500 million, to avoid liquidity constraints. (Note: On the other hand, when seeking short candidates, we look to the bottom quintile of the EQR model.) Read on….

Discerning aggressive vs. conservative accounting:

The question we attempt to address is whether quality of earnings suggests the firm is more likely to have been over- or under-reporting its income in the past and, therefore, whether the forecasted earnings growth is likely to be overly optimistic or pessimistic. In our experience, aggressive earnings management tends to lead to negative earnings surprises in the future, while conservative accounting often results in positive earnings surprises.

Interestingly, conservative accounting often suppresses earnings growth and therefore does not typically benefit the firm’s share price in the short term. Therefore, conservative accounting is not necessarily a good stand-alone investment criterion. However, conservative accounting does provide investor confidence in sustainable earnings growth in the longer term. This is due to the managerial mindset, assumptions, and actions that provided historically understated earnings (i.e., easier comparable periods) as well as leaving more “cushion” on the balance sheet to support future earnings if the firm finds a reason to utilize that cushion.

Our high-level assessment of earnings quality revolves around low or negative accruals which we group into two categories: total and operating accruals. Total accruals are simply net income (GAAP or non-GAAP) less free cash flow. Operating accruals are slightly different and calculated as EBITDAS (earnings before interest, taxes, depreciation, amortization and stock-based compensation) minus cash flow from operating activities (CFOA, before tax and interest). Operating accruals places greater emphasis on working capital accounts, which often have greater management discretion. Additionally, it avoids conflating certain earnings management techniques with tax accruals, which can be difficult to isolate and time effectively. The accruals that come with poor earnings quality are subject to write-offs, untimely recognition, and even become a structural weakness on a “pristine” balance sheet (to borrow sell-side parlance) until impairment ultimately is triggered and earnings surprise to the downside. Importantly, these diagnostics only show changes over time and may not expose structural impairment risks that were acquired or produced prior to the periods examined (typically five years for much of our short research).

When we think of high-quality earnings, generally we are looking for the balance sheet to play a limited role in sales and expense recognition. As a starting point for fundamental sustainability, we would like to see the company maintaining gross margin and payment terms that indicate healthy demand for a company’s products or services. We typically assess the top-line risk by looking at the accounts receivable-to-sales ratio over time. When a company is in distress, it may loosen credit terms, which creates a lag in collection and an associated increase in receivables. This is also present in the more common days sales outstanding (DSOs), but due to the use of averages in the DSO calculation we find the former a timelier measure. When we see both top-line growth and a declining AR-to-sales ratio, not only do we view sales as more sustainable, but the cash flow statement reflects greater CFOA conversion and thus improved FCF margins.

Four examples of positive earnings quality:

The recent performance of Tetra Tech, Inc. (NasdaqGS:TTEK) is a good example of improving top-line sustainability. TTEK provides consulting and engineering services to governments at local, state and federal levels domestically and abroad. During FQ1 2020 (quarter ended 12/29/19), TTEK’s receivable balance only increased 4.2% YOY, undershooting sales and earnings growth by a wide margin over the same period. Within total receivables, unbilled AR fell 1.2% YOY and contract assets fell 12.2%. Both accounts represent recognized sales that haven’t yet been billed to the client or when management asserts that project milestones have been met, making both inherently more subjective. We combined contract assets and unbilled AR due to their similar characteristics and found that these more concerning receivable accounts fell by 415 bps YOY to only 44.2% of total AR which is a five-year seasonal low. This also bled into our headline AR-to-sales metric, which improved by 896 bps YOY to 137.8% and was also a five-year low.

To take this analysis a step further, we also utilize AR netted against deferred revenue (DR) as another gauge of top-line sustainability. This metric is particularly useful as companies have shifted over time to subscription and service models that materially alter historic revenue recognition patterns. In the case of TTEK, net AR-to-12M sales declined 350 bps YOY to 26.2% (another five-year seasonal low). Finally, most companies maintain an allowance for doubtful accounts (AFDA) which is netted against gross receivables. In the case of TTEK, the AFDA increased 28.0% YOY to $55.7 million (or 6.2% of gross AR) and is the highest level recorded over the last five years. The additions to this account would otherwise be pure operating profit held back during recent quarters. Therefore, it suppresses current period operating margins while providing a cushion to absorb future shortfalls without impacting the bottom line when the future shortfalls occur.

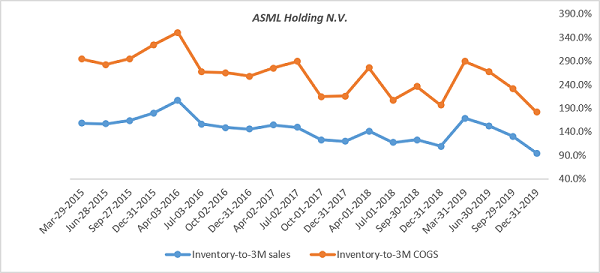

To drill down on gross margin sustainability which is often closely linked with cost of goods sold (COGS) we look for steady or declining levels of inventory relative to sales and COGS. This indicates the company is tightening its working capital relative to demand and supports durable pricing (especially along with tightening customer credit terms). As an example, ASML Holding N.V. (ENXTAM:ASML) exhibited favorable relative inventory dynamics that bode well for maintaining or improving gross margin. The company produces advanced semiconductor equipment systems for memory and logic chipmakers. Illustrated below, the company’s overall net inventory position has declined to five-year lows versus both sales and COGS. The company only provides a detailed breakout of its inventory accounts on an annual basis but recently filed its 20F, which revealed that while net inventory increased 10.7% YOY (well below the 28.4% YOY sales growth), raw material increased 30.7% YOY. This is our least concerning inventory component and may provide manufacturing and sourcing stability in times of supply chain stress. In fact, work-in-progress (WIP) and finished goods both declined modestly on a YOY basis by 2.1% and 2.7% respectively. Most importantly, the company maintains a reserve for obsolete and excess inventory, which is the contra account in net inventory. This reserve increased 12.0% YOY, with all of the provisions for this account sourced by charges to COGS in 2019.

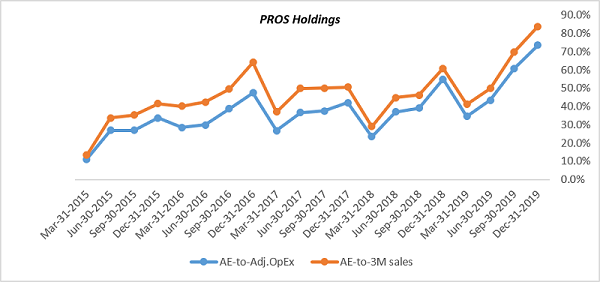

Unlike the earnings quality metrics above, the next two examples may impact operating profit more directly. The first, accrued expenses (AE), typically comprise sales commissions, warranty reserves, and other estimated future cash costs recognized in the current period. Timely recognition of accrued expenses represents some of the highest earnings quality given the level of subjectivity and the initial non-cash nature of much of these accounts. Furthermore, companies may pull forward expenses to “spring load” future earnings when current expectations may already be met. Accrued expenses are recognized on the income statement prior to any cash outflow and therefore may be recognized more opportunistically. Consequently, we view increasing levels of AE relative to both adjusted operating expense (total OpEx less D&A) and revenue as an indicator of high earnings quality.

As an example, PROS Holdings, Inc. (NYSE:PRO) has shown relative increases in AE that suppress current period operating margin and may be used to spring load performance once profitability milestones are reached. The company is a SAAS business services provider with sales, quoting, and pricing management solutions. While the company is still currently loss-making, PRO has recognized a 45.0% YOY increase in payroll and other benefits as well as more than doubling of accrued liabilities (+139.3% YOY). Illustrated below, combined AE accounts relative to sales and adjusted operating expense have increased consistently while simultaneously benefiting CFOA (no cash outlay) and suppressing operating margin. Going forward, the company may be more capable of improving its operating margin by less aggressively booking these expenses in future periods which could help with an expected profitability inflection. In fact, as estimates currently stand, PRO is expected to produce positive non-GAAP net income in Q4 2020 and may well be able to achieve that with the help of more normalized expense recognition.

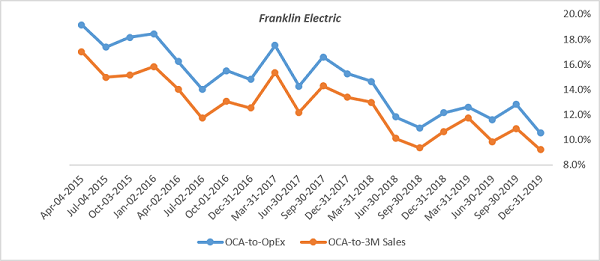

Unlike the initial non-cash impact of increases to accrued expense, with prepaid expense and other current assets (OCA), the firm expends cash to create a balance sheet account that is then recognized on the income statement over the next 12-month period. For an indication of sustainable operating margin, we would look for these accounts to maintain a relatively stable or declining relationship with adjusted operating expense. In the case of a dwindling prepaid expense and OCA-to-OpEx ratio, there may be less expense flowing from the asset account to the income statement in future periods and could indicate a tailwind to operating margin expansion. At a minimum, a declining trend in this ratio indicates a tighter expense recognition linkage and a potential indication of sustainable future earnings. This clearly differs from a situation with a rising ratio, which indicates a potential push of current operating expense to later quarters (i.e., prepaid rent for which the company receives a month of benefit in the quarter but four months of expense in the subsequent 3M period).

As an example of conservative accounting of prepaid expenses and other current assets, Franklin Electric Co., Inc. (NasdaqGS:FELE) has shown a consistently improving ratio of other current assets relative to both adjusted OpEx and revenue (as illustrated below) over the past five years. The company does not break out prepaid expenses in detail, but the current nature of these accounts merits similar treatment in regard to earnings quality analysis. FELE is a liquid pumping system manufacturer and distributor and should have very few expenses that need to be paid in advance of the benefit received.

One of the reasons we find FELE’s earnings quality improvement so compelling is the confluence of other signals that also indicate earnings sustainability. These other positive earnings quality signals include increased relative accrued expense and a declining AR-to-sales ratio. Furthermore, the company’s cash flow margins are now at multi-year highs and result in low levels of accruals.

In summary:

To be clear, earnings smoothing distorts earnings by recognizing revenue or expenses in periods in which the true economic business was not transacted. While we typically look for these benefits to be realized in current periods and rectified later (as with our short research products), in many cases we can use the same process to discern which companies are setting themselves up for outperformance later. At a minimum, we can hedge against negative earnings surprises due to aggressive accounting by looking closely at a firm’s accruals.

Let me close by saying that we believe the negative consequences of poor earnings quality make earnings quality analysis by itself more useful for short research and the prediction of negative earnings surprises (and associated share price declines), as most of these accounting treatments have a limit. For example, a company can only run off accrued expenses down to zero or grow other current assets to a level that cash becomes an issue (or warrant increased disclosure). Furthermore, a company can only pull forward sales until customers are no longer incentivized, and inventory can only store losses for so long before impairments or discounts eventually hurt gross margin.

Indeed, high-quality earnings often can go unnoticed by investors – and may actually suppress the short-term earnings performance of the firm (thereby detracting from its attractiveness) in the name of conservatism and sustainability. Nevertheless, while it may not present itself as a compelling stand-alone catalyst for investment, the extra layer of security provided by high-quality earnings and conservative accounting can add conviction (and a confirmation signal) to long candidates and present opportunities to view the underlying fundamentals of a firm more clearly.

Disclosure: At the time of this writing, the author held no positions in the securities mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any opinions, commentary, rankings, or stock selections provided by Sabrient Systems or its wholly owned subsidiary Gradient Analytics. Sabrient Systems makes no representations that the techniques used in its rankings or analysis will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.