Sector Detector: Stocks confirm tepid breakout, but on ultra-low volume and volatility

Well, it’s official. The old adage about selling in May didn’t apply this year. Instead, larger-cap, higher-quality, and value-oriented stocks continued to lead the market higher. The S&P 500 gained +2.1% during the month and confirmed its tentative technical breakout from the prior Friday with steady progress last week. However, it was tepid at best during the holiday-shortened week, and a somewhat concerning ‘double-low’ confirmation -- i.e., on extremely low (and decreasing) volume and with a backdrop of persistently low volatility.

The CBOE Market Volatility Index (VIX), a.k.a. fear gauge, closed last week at 11.40, after setting yet another new 52-week low moments earlier. Although some observers are predicting single digits for the VIX, the greater likelihood is a mean reversion in the form of a spike higher. However, the VIX is not a timing tool, so it could stay low for some time before eventually going higher.

Among the ten U.S. business sectors, defensive sector Utilities is still the clear leader year-to-date, up nearly +14% after a strong showing during last two weeks of May. Energy and Healthcare are in a virtual tie for second place YTD. So, the top three are largely defensive sectors, which doesn’t feel particularly bullish in the traditional sense. However, Technology is making an effort to join the leaders, and it was quite strong during May, up over +3.5%. Consumer Services/Discretionary remains the laggard, and Telecommunications also has been weak. Both of these sectors have consistently ranked at the bottom of our fundamentals-based SectorCast rankings.

Going hand-in-hand with the outperformance of defensive sectors is the low (and falling) yield in the 10-year Treasury bond, which indicates that global capital continues to flow into the safety of U.S. Treasuries. The 10-year yield has now dropped below 2.50% and seems destined to fall further, despite prevailing expectations of the inevitability of higher rates among most of the financial community. In fact, I have read some compelling arguments that we are stuck indefinitely in a low interest rate environment, as the Fed cannot raise short-term rates without tanking the economy. And that’s what the flattening yield curve is signaling to investors.

With forward valuations in equities somewhat elevated but not egregiously so, and with low interest rates encouraging corporations to issue debt in order to continue their stock buybacks, and with central banks around the world committed to keeping the liquidity spigots open, there is little reason to expect equities to have a massive selloff anytime soon (although periods of fear-inducing technical consolidations and short-term corrections surely will occur -- perhaps soon). On the other hand, there is also little reason to expect a big surge in GDP growth, corporate earnings, and the broader stock indexes, either. So, thoughtful stock-picking (rather than relying on all-boats-lifted-in-a-rising-tide) seems to be in order.

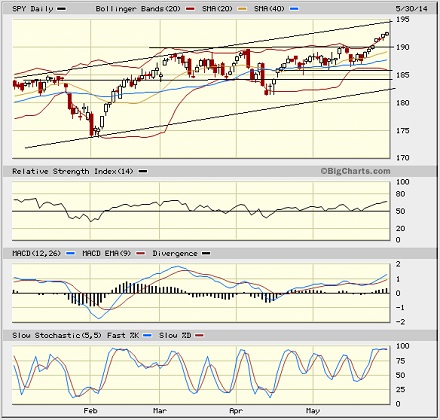

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed Friday at 192.68. The prior Friday, it had barely broken through tough resistance at 190, but last week clearly confirmed the breakout. Or did it? With such ultra-low volume in the holiday-shortened week, bullish conviction to take this market higher is still not clearly proven to me. The Bollinger Bands had become quite pinched, signaling an imminent price move in one direction or the other, and in conjunction with the upside breakout that ultimately occurred, price has been hugging a rising upper Bollinger Band. Now price is quite stretched from its moving averages, and oscillators RSI, MACD, and Slow Stochastic are all either at or approaching extreme overbought levels. With price approaching the upper line of the long-standing bullish rising channel, a pullback seems highly likely to occur soon, first testing resistance-turned-support at 190, and then perhaps the 20-day and 50-day simple moving averages. Below that, support resides at the top of the mid-April gap around 186, the bottom of the gap around 184, and then the lower line of the bullish rising channel (currently around 182.5).

I noted last week that the iShares Russell 2000 (IWM) small cap ETF had bullishly regained its 200-day simple moving average, and the iShares MSCI Emerging Markets Index Fund (EEM) saw its 50-day SMA crossing bullishly through its 200-day in a golden cross. However, the bounce in the IWM appears to be losing steam at resistance from its down-sloping 50-day simple moving average, and price action may be forming a bearish falling channel that started in mid-March. And for its part, the EEM looks as though its rally might be peaking, as well. All told, I expect a summer pullback to occur soon to allow the technicals to cycle back down to oversold conditions, from which the market can then stage a fall rally to new highs.

Latest sector rankings:

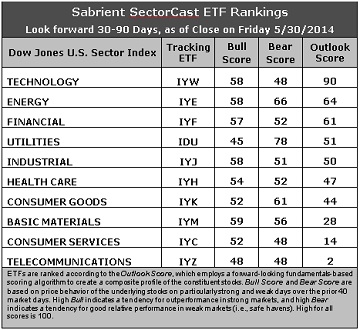

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. Technology remains in first place with a strong Outlook score of 90, which is quite impressive especially given its big 26-point gap above second place Energy at 64. Technology displays generally solid factor scores across the board, with a strong forward long-term growth rate, a reasonable forward P/E, the highest return ratios, and the strongest sentiment among Wall Street analysts (upward revisions to earnings estimates). Energy displays a low forward P/E and suddenly got a burst of upward earnings revisions from the sell side, as well as insider buying activity. Financial solidifies its hold on third place over Utilities, and Industrial rounds out the top five after falling 12 points from second place -- there were relatively fewer Wall Street upward revisions and less insider buying.

2. Telecommunications stays in the cellar once again with an Outlook score of 2, as it scores among the lowest in every factor in the model. It is joined in the bottom two this week by Consumer Services/Discretionary with a score of 14, as companies within the sector endured more downward earnings revisions from Wall Street.

3. Looking at the Bull scores, Basic Materials holds the lead with a 59, followed closely by Technology, Energy, and Industrial at 58, while Utilities is the laggard with a 45. The top-bottom spread narrowed slightly to 14 points, reflecting somewhat higher sector correlations on particularly strong market days. It is generally desirable in a healthy market to see a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold, rather than the all-boats-lifted-in-a-rising-tide mentality that dominated 2013.

4. Looking at the Bear scores, Utilities continues hold up well, scoring 78, which means that stocks within this defensive sector have been the preferred safe havens on weak market days. No surprise here. Energy is second at 66. Consumer Services, Technology, and Telecom all share the lowest score at 48. The top-bottom spread remains a highly robust 30 points, reflecting extremely low sector correlations on particularly weak market days. Again, it is generally desirable in a healthy market to see a top-bottom spread of at least 20 points.

5. Technology displays by far the best all-weather combination of Outlook/Bull/Bear scores, followed by Energy. Telecom is by far the worst, followed by Consumer Services. Looking at just the Bull/Bear combination, Energy is the leader, followed by Utilities, but it is Energy that displays the best balance between its Bull and Bear scores, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish). Telecom scores the lowest, followed by Consumer Services, indicating general investor avoidance of these sectors during extreme conditions.

6. Overall, I would still interpret this week’s fundamentals-based Outlook rankings as mostly bullish, given that four of the top five also display high Bull scores (Technology, Energy, Financial, Industrial). Although Utilities remains surprisingly strong, note that Energy is displaying both bullish and defensive properties these days.

These Outlook scores represent the view that Technology and Energy sectors are relatively undervalued, while Consumer Services and Telecom may be relatively overvalued based on our 1-3 month forward look.

Stock and ETF Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or bearish), suggests holding Technology, Energy, and Financial in the prevailing bullish climate. (In this particular model, we consider the bias to be bullish from a rules-based standpoint because SPY is still above its 50-day simple moving average while also remaining above its 200-day SMA.)

Other ETFs that are ranked high by our algorithm from the Technology, Energy, and Financial sectors include First Trust NASDAQ Technology Dividend Index Fund (TDIV), PowerShares Dynamic Energy Exploration & Production Portfolio (PXE), and PowerShares KBW High Dividend Yield Financial Portfolio (KBWD).

For an enhanced sector portfolio that enlists top-ranked stocks (instead of ETFs) from within Technology, Energy, and Financial, some long ideas include Skyworks Solutions (SWKS), OmniVision Technologies (OVTI), Bonanza Creek Energy (BCEI), Phillips 66 (PSX), Zions Bancorp (ZION), Fifth Third Bancorp (FITB). All are ranked highly in the Sabrient Ratings Algorithm and also score within the top two quintiles of our Earnings Quality Rank (EQR), a pure accounting-based risk assessment signal based on the forensic accounting expertise of our subsidiary Gradient Analytics. We have found it quite valuable for helping to avoid performance-offsetting meltdowns in our model portfolios.

However, if you are more comfortable with a neutral bias, the model still suggests holding Technology, Energy, and Financial. On the other hand, if you have a bearish outlook on the market, the model suggests holding Utilities, Energy, and Consumer Goods/Staples.

Lastly, Sabrient's mid-year Forward Looking Value portfolio will launch in mid-June, and much like our renowned Baker’s Dozen annual portfolio that comes out each January, last year's has nearly doubled the S&P 500 return. Top performers include Delta Air Lines (DAL), Jazz Pharmaceuticals (JAZZ), and Pilgrim’s Pride (PPC).

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.