Investing proverbs to live by (or at least take under advisement)

by Scott Martindale

by Scott Martindale

President & CEO, Sabrient Systems LLC

With stocks holding up near their all-time highs in the face of a towering Wall of Worry, it is apparent that investors have been reluctant to sell for fear of missing out (FOMO) on continued upside.

However, at the same time, there has been something of a lid on further upside as valuations are at lofty levels, with the S&P 500 and Nasdaq 100 at forward P/Es of 22.4x and 27.0x, respectively, while the 10-year yield has been on the rise (recently eclipsing 4.30%), which tends to hold down valuation multiples. Indeed, many of the most prominent investors are wary, including the likes of Warren Buffett, Jamie Dimon, and Jeff Bezos, while corporate insider buying has slowed.

So, bulls and bears appear to be at a standoff, perhaps awaiting a catalyst from earnings season and the election outcome. And depending on how things transpire, markets are likely to experience some volatility (like today!). I have been anticipating a market pullback followed by higher prices by year end and well into 2025, buoyed by the combination of a dovish Fed and rising global liquidity—and potentially from reduced taxes and red tape in the New Year. In any case, any surprise that leads to a selloff—other than a cataclysmic “Black Swan” event—would likely be a buying opportunity, in my view.

But with the momentous election just a few days away (I can’t wait for it to be over!), I thought it might be a good time to share some timeless market wisdom, insights, and levity by compiling a list of 55 investing proverbs to live by. The first several have no particular author that I can discern, but for the rest I show a byline. Here we go: Click HERE to continue reading

“Price leads fundamentals.”

“Don’t fight the Fed.”

"Don't fight the [ticker] tape."

“There is always a bull market somewhere.”

“You never go broke taking a profit.”

“Buy low, sell high.”

“Don’t sell new highs.”

“Markets like to climb a Wall of Worry.”

“The trend is your friend.”

“Nothing goes up in straight line forever.”

“Stocks take the stairs up and the elevator down.”

“Never catch a falling knife.”

“Buy the rumor, sell the news.”

“The three pillars of diversification are: capital allocation, asset allocation, and security selection.”

“The stock market rewards patience and punishes greed.”

“Don’t put all your eggs in one basket.”

“Put all your eggs in one basket, and then watch that basket…It is trying to carry too many baskets that breaks the most eggs.” – Andrew Carnegie

“Investors should own a concentrated portfolio of high-quality businesses that can deliver strong organic growth even if the economy falters.” – Michael Burry

“Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.” – Sir John Templeton

“Buying’s easier, selling’s hard – it’s hard to know when to get out.” – Seth Klarman

“Time in the market beats timing the market.” – Ken Fisher

“Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.” – Peter Lynch

“The market can stay irrational longer than you can stay solvent.” – John Maynard Keynes

“Be fearful when others are greedy and greedy only when others are fearful." – Warren Buffett

"The time to buy is when there’s blood in the streets.” – Baron Nathan Rothschild

“The stock market is a device to transfer money from the impatient to the patient.” – Warren Buffett

“The four most dangerous words in investing are: ‘This time it’s different.'” – Sir John Templeton

“Minimizing downside risk while maximizing the upside is a powerful concept.” – Mohnish Pabrai

"It's not whether you're right or wrong that's important, but how much money you make when you're right and how much you lose when you're wrong." – George Soros

"In investing, what is comfortable is rarely profitable." – Robert Arnott

"The biggest risk of all is not taking one." – Mellody Hobson

"Know what you own and know why you own it." – Peter Lynch

“If you can’t take a small loss, sooner or later you will take the mother of all losses.” – Ed Seykota

"The most contrarian thing of all is not to oppose the crowd but to think for yourself." – Peter Thiel

“Never bend your rules to accommodate your guts.” – Naved Abdali

“An investor without investment objectives is like a traveler without a destination.” – Ralph Seger

“The stock market clearly values companies that can deliver disruptive innovation.” – Steve Blank

“The main function of economic forecasting is to make astrology look respectable.” – John Kenneth Galbraith

“In the short run, the market is a voting machine. In the long run, it is a weighing machine.” – Benjamin Graham

“When the tide goes out, you can see who's swimming naked.” – Warren Buffett

“A market downturn…is an opportunity to increase our ownership of great companies with great management at good prices.” – Warren Buffett

“You make most of your money in a bear market, you just don’t realize it at the time.” – Shelby Cullom Davis

“Luck is what happens when preparation meets opportunity.” – Lucius Annaeus Seneca

“Successful investing is about managing risk, not avoiding it.” – Ben Bernanke

“Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.” – John D. Rockefeller

“Investing is something where you have to be purely rational and not let emotion affect your decision making — just the facts.” – Bill Ackman

“There are two hedges I know of; one is cash and the other is knowledge.” – Bruce Berkowitz

“The secret recipe for success in the stock market is simple: 30% market analysis skills, 30% risk management, 30% emotion control, and 10% luck.” – Benjamin Lee

“To achieve satisfactory investment results is easier than most people realize; to achieve superior results is harder than it looks.” – Benjamin Graham

“The stock market is like a roller coaster, and it’s important to have a strong stomach.” – Jim Cramer

“In trading you have to be defensive and aggressive at the same time. If you are not aggressive, you are not going to make any money, and if you are not defensive, you are not going to keep it.” – Ray Dalio

“In life and business, there are two cardinal sins. The first is to act precipitously without thought, and the second is to not act at all.” – Carl Icahn

"The individual investor should act consistently as an investor and not as a speculator." – Benjamin Graham

“Investing puts money to work. The only reason to save money is to invest it.” – Grant Cardone

“An investment in knowledge pays the best interest.” – Benjamin Franklin

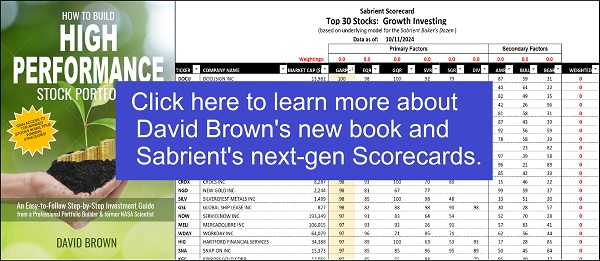

David Brown’s new book on investing, and Sabrient’s next-gen Scorecards:

We continue to recommend high-quality, fundamentally strong stocks across all market caps that display consistent, reliable, and accelerating sales and earnings growth, positive revisions to Wall Street analysts’ consensus estimates, rising profit margins and free cash flow, solid earnings quality, and low debt burden. Indeed, these are some of the factors Sabrient employs in selecting our growth-oriented Baker’s Dozen portfolio (our “Top 13” stocks), value-oriented Forward Looking Value portfolio, growth & income-oriented Dividend portfolio, and our Small Cap Growth portfolio, which is an alpha-seeking alternative to a passive position in the Russell 2000 Index.

We also use many of those same factors in our SectorCast ETF ranking model. And notably, our Earnings Quality Rank (EQR) is not only a key factor used in building each of our stock portfolios, but it is also licensed to the actively managed, absolute-return-oriented First Trust Long-Short ETF (FTLS).

If you are interested in learning the key financial factors and portfolio construction process Sabrient employs, Sabrient founder David Brown unveils it all in his new book, How to Build High Performance Stock Portfolios, which is now available in paperback and eBook formats on Amazon.com. David has written a number of books through the years. In this one, he describes his path from NASA engineer on the Apollo 11 moon landing project to building quant models for ranking stocks and creating stock portfolios in his 4 main investing styles—Growth, Value, Dividend, and Small Cap.

The book also reveals how readers can access the next generation of our “Sabrient Scorecard for Stocks,” which provides a weekly Top 30 stocks list for each of those 4 key investing strategies (using their underlying quant models) and displays each stock’s scores for 9 of our proprietary alpha factors (i.e., our “secret sauce”)—including our Earnings Quality Rank (EQR). You can also paste your own list of tickers on the Score Your Own Stocks tab to monitor their alpha-factor scores.

And as a bonus, we provide a “Sabrient Scorecard for ETFs,” which displays the Top 30 ETFs based on our proprietary Outlook Score (plus 2 other proprietary alpha factors). It also provides access to our full universe of roughly 1,400 equity ETFs.

Both scorecards are quite user friendly and allow you to weight and sort the lists based on Sabrient's key alpha factors in accordance with your personal preferences. You can learn more about both the book and how to access the next-gen Scorecards at:

http://DavidBrownInvestingBook.com.

I invite you to take advantage of the complimentary scorecard download and free trial offer … and please provide us your feedback!

Disclaimer: This document is for informational purposes only. It is neither a solicitation to buy nor an offer to sell securities. It is not intended as investment advice and should not be used as the basis for any investment decision. Individuals should consider their personal financial circumstances in acting on any opinions, commentary, rankings, or stock selections provided by Sabrient Systems. Sabrient makes no representations that the techniques used in its rankings or analyses will result in profits. Trading involves risk, including possible loss of principal and other losses, and past performance is no guarantee of future results. Investment returns will fluctuate, and principal value may either rise or fall. Sabrient disclaims liability for damages of any sort (including lost profits) arising from the use of or inability to use its rankings or analyses. Information contained herein reflects our judgment or interpretation at the time of publication and is subject to change without notice.

Copyright © 2024 Sabrient Systems, LLC. All rights reserved