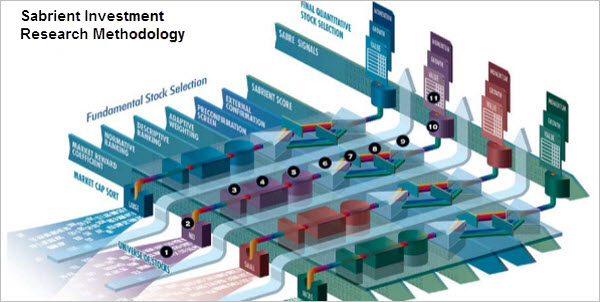

The Sabrient Methodology

Sabrient’s proprietary, fundamentals-based, quantitative methodology underlies all Sabrient products including the Sabrient indices, unit investment trusts (UITs), and other structured products.

Our strategies and rankings are used by investment professionals for hedging, position weighting, indexing, and sector rotation.

Four important features distinguish Sabrient’s quantitative methodology.

- Multi-factor Scoring Algorithms. We use multi-factor scoring algorithms to create a variety of strategies and thematic models. These algorithms, each composed of dozens of fundamentals-based factors, are used to identify stocks that we believe exhibit desirable attributes, yet appear to be undervalued.

- Scientific Hypothesis Testing. We rely on scientific hypothesis testing, rather than regression, data-mining, or curve-fitting, to test our scoring algorithms. Algorithms are tested on a regular basis on our FSYS platform, using an adaptive process to help us ensure that our scoring algorithms remain effective in a dynamic market.

- Relevance Scoring. Our strategies and rankings are based on relevance scoring, rather than filtering or sequential elimination, which allows us to identify our top-ranked or bottom-ranked stocks for any strategy. Each stock in a 5,000-plus universe is measured against other stocks in dozens of categories, verified with external sources, and ranked in order of best opportunities for the current market based on our scoring methodology.