Sector Detector: What’s next for the post-election rally and rotation?

By Scott Martindale

President, Sabrient Systems LLC

Fear of missing out is suddenly the prevailing sentiment, overwhelming the previously dominant fear of an imminent selloff. I think this is due to a combination of: 1) uncertainty being lifted regarding the election, 2) domestic optimism about the US economy and business-friendly fiscal policies, 3) foreign investors seeing the US as the favored investment destination, 4) the expectation of rising inflation and interest rates rotating capital out of bonds and into stocks, and 5) a cautious but still accommodative Fed. Now that investors can focus on the many positive fundamentals instead of the news headlines, we are seeing healthy market breadth and diverse leadership led by value and small cap stocks rather than just the mega-cap growth stocks (e.g., “FANG”). Such sentiment has been a boon for fundamentals-based portfolios like Sabrient’s. But of course, everyone wants to know, how much further can this rally go? And what happens when it inevitably hits a wall?

In this periodic update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review Sabrient’s weekly fundamentals-based SectorCast rankings of the ten U.S. business sectors, and then offer up some actionable ETF trading ideas. Overall, our sector rankings look slightly bullish as post-election adjustments to sell-side EPS estimates are gaining traction in the model, and the sector rotation model continues to suggest a bullish stance.

Market overview:

I read somewhere that nearly $900 billion has been added to US equity values since the election. Although the very fact that the election was over, no matter who won, likely would have led to something in the way of a stock market relief rally, it is apparent that the expectation of a more business-friendly environment, fiscal stimulus, and a desirably higher level of inflation under Trump and a Republican-controlled congress, coupled with the latest solid economic reports, has really lit the market on fire. The Dow is approaching 20,000 for gosh sakes, and the NASDAQ is eyeing 5,500. Year-to-date, the Dow is +12.6%, S&P 500 +9.9%, and NASDAQ +8.2%, while the Russell 2000 small cap index is up a whopping +22%.

Money has fled some of the best performing stocks of the past couple of years (including many growth stocks with elevated PEs) and into some of the neglected market segments (including many value stocks with attractive PEs) – particularly those that had been targeted by the Democrats for new regulations. During November, money rotated out of technology, biotech, utilities, bonds, and even gold, into financials, industrials, and basic materials. Moreover, investors shunned anything considered an “equity bond equivalent” for its attractive yield, like preferred stocks, utilities, consumer staples, and many REITs. However, during December so far, there has been some renewed buying some of these market segments.

The Wall Street Journal reported that “…hedge funds entered October holding their largest collective position in the technology sector in over a decade…[but] were light on financial stocks and industrial stocks ahead of the election.” Rather than waiting to see the specifics of what our new government has in store, markets are already betting on the come that a variety of new legislation will pass quickly, perhaps leading to lower corporate and personal taxes, immediate expensing of capital investment (rather than depreciating over time), reduced regulatory burdens, and infrastructure spending programs.

Value continues to outperform Growth as the prospect of a rising discount rate lessens the present value of growth stocks’ future earnings. Since the November 8th election through Thursday’s close, the S&P 500 is +5.2%, while S&P 500 Value is +8.3% and Growth is +2.1%. Small caps continue to lead since election day, with the Russell 2000 +16.0%, and an impressive +45% since the lows on February 11 (versus +23% for the S&P 500). Meanwhile, the formerly esteemed “FANG” gang of stocks (i.e., Facebook, Amazon, Netflix, Google) are languishing, down an average of -2.4% since the election (and none are positive). ConvergEx reports that daily sector correlations to the broad index over the past month have averaged 57% versus the 80%+ levels we witnessed earlier, which is a good environment for stock-picking.

Next on the horizon for market-watchers is the FOMC rate decision next week. This used to put markets into a sideways channel in anxious anticipation. But now everyone “knows” without question that there will be a rate hike…but they don’t seem to mind. CME fed funds futures place the odds of a rate hike next week at 97%. But the odds of another 25 bps hike after that don’t eclipse 50% until June – which is the part of the story that is keeping investors happy, i.e., an accommodative Fed.

The 10-year Treasury closed Thursday at 2.39% and is showing signs of either consolidating or plateauing. This is a yield that should be attracting buyers. The 30-year hit 3.09%, while on the short end the 2-year has climbed to 1.11% and the 5-year is 1.82%. The spread between the 10-year and 2-year has steepened to 128 bps, while the spread between the 30-year and 5-year has shrunk to 127 bps.

No doubt, economic fundamentals are showing improvement, including both Global PMI Services and Manufacturing, as well as our ISM Services, which jumped to 57.2 from the prior reading of 54.8, and Existing Home Sales. Durable goods orders rose an impressive +4.8% month-over-month in October (consensus was only +1.1%). Black Friday and Cyber Monday shopping provided an eye-popping +12% year-over-year growth. After-tax corporate earnings rose +5.2% in Q3, and the final estimate for GDP growth was revised higher to +3.2% for Q3, while the Atlanta Fed's GDPNow model forecast is now predicting +2.9% for Q4. Q3 corporate profits jumped +6.6%. Also, oil prices surged +12% to more than $50/bbl after a successful OPEC meeting in Vienna (although such agreements are typically worth less than the paper they are printed on). And notably, this week the Senate passed the “21st Century Cures bill,” which intends to cut red tape at the FDA and speed the approval process for new drugs and devices.

All of this should help the US continue to attract global capital, which has contributed to the 7% surge in the dollar during November. Part of that is due to those strong economic metrics, but also anticipation of a Fed rate hike next week and the rising yields on Treasury bonds and notes. We don’t yet know how much impact there will be on corporate guidance, but with banks abundant in excess reserves and likely renewed investor interest in buying up those rising yields (which may serve to cap them), improving economic growth may not result in the same level of dollar strengthening that we have seen historically. That certainly would be appreciated by multinational corporations … and the large cap indexes. Similarly, the knee-jerk rotation out of solid dividend payers – many of whom can boast a history of strong growth in both earnings and dividends – has offered income investors attractive entry points.

So, where next for the “Trump Rally”? Is this finally the impetus needed to launch the “Great Rotation” (from bonds to stocks) that many have been predicting since the Fed first started tapering QE?

DoubleLine’s Jeffrey Gundlach, who has proven to be quite prescient in predicting such things, thinks that financial markets could reverse their momentum soon, or at the latest by Trump's January 20 inauguration. He thinks the rally is losing steam and that we will next enter “a buyer's remorse period" in which the dollar falls and gold rises while bond yields and stocks trade sideways – and he is particularly bearish on the FANG stocks. Gundlach is predicting US GDP growth to hit 6% by 2019, which he thinks would push the 10-year Treasury yield above 3% in anticipation of accelerated rate hikes from the Fed.

Riverfront Investment Group believes U.S. long-term interest rates may have hit an all-time low, and they are positioning for an inflationary climate with rising interest rates across the yield curve. They say, “Our first line of defense in our balanced portfolios is to underweight bonds vs equities. We prefer bonds that act somewhat like stocks (high yield) and investment grade bonds over Treasuries. In our Moderate Growth and Income bond portfolio, we have lowered duration from 7.3 years to 4.1 years.”

On the negative side, the total US debt to GDP ratio has reached 3.6x, whereas it was 0.9x back in the early 1980s. And the ratio of household debt to income is now 130% versus 62% back then. And then of course there are the doomsayers. David Stockman thinks that stocks are now the “shorting opportunity of a lifetime” because “financial markets are heading straight into a perfect storm of central bank failure, bond market carnage, a worldwide recession and a spectacular fiscal bloodbath in Washington.”

For my part, I see a lot of reason for optimism all the way into 2018. Of course, the high expectations that are currently getting priced into stocks will need to be fulfilled. But despite the ongoing talk about how our nation is more divided than ever, all citizens should be able to agree that a robust economy that lifts incomes rather than just asset prices has a better chance of creating opportunities across the socioeconomic spectrum and narrowing the wealth gap. Relying on central bank monetary largesse alone does little more than prop up a stagnant economy. As we have learned, it sows the seeds of wealth inequality, discontent, resentment, and class warfare. Most Americans want to earn their keep rather than live on the dole. They want to own property rather than just rent it. Broad prosperity has a way of curing a lot of societal ills. That’s my hope – and expectation – for the New Year.

By the way, as we here at Sabrient gear up for the unveiling of our ninth annual Baker’s Dozen top picks for the New Year, which will be unveiled on January 17, I am planning to spend a good bit of time on the road during January and February speaking with financial advisors across the country. In addition, I expect to set aside a couple of days to attend the Inside ETFs 2017 conference in Hollywood, FL, which takes place January 22-25. ETF.com has generously provided me with a discount code to share with advisors who might want to attend: IE17-SM.

SPY chart review:

The SPY closed Thursday at 225.15 – another new all-time closing high, of course. Other than a brief rest at the end of November to consolidate its impressive post-election launch, the market has been in a steady march higher. Former resistance at 215 fell easily, then 217 was breached after putting up a brief fight, and then the bearish gap down from 218 was filled. The previous high near 220 provided little resistance, but the market did decide to go back and test that level as resistance-turned-support – which then served as a new launch pad for December. SPY is now moving within a narrow and steep rising channel. Price could continue to track the top of the channel as it did in mid-November before stopping for a breather. However, oscillators RSI, MACD, and Slow Stochastic are all looking extended and ready to cycle back down. Likewise, the rubber band is getting a bit stretched as price is well above its 20-day and 50-day simple moving averages. We may see a consolidation over the next few days into the FOMC meeting before heading higher into year end. Overall, I continue to like the technical picture, particularly in conjunction with the healthy broadening of the market and the outperformance of small caps and value stocks.

Latest sector rankings:

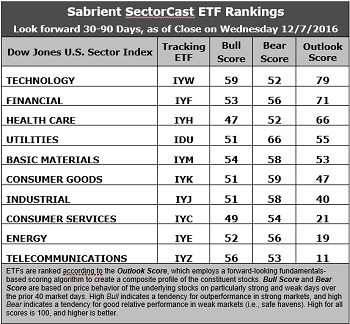

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each of over 600 equity ETFs based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity.

Here are some of my observations on this week’s scores:

1. Adjustments to sell-side forward estimates based on post-election expectations are more noticeable now. Financial, Basic Materials, Energy, Technology, and Industrial have received most of the positive revisions to EPS estimates from the Wall Street analyst community. As for Outlook score, Technology retains the top spot with a score of 79. In aggregate, stocks within the sector display solid Wall Street sell-side analyst sentiment, strong return ratios, a reasonable forward P/E of about 16.5x, the highest forward long-term EPS growth rate of 14.3%/yr, and the lowest forward PEG of 1.2 (ratio of forward P/E to forward EPS growth rate). Financial comes in second this week with an Outlook score of 71. It displays the best sentiment among both Wall Street analysts and insiders, and a reasonable forward P/E of 17.1x. Rounding out the top five are Healthcare, Utilities, and Basic Materials.

2. Telecom and Energy take the bottom two with Outlook scores of 19 and 11. Telecom displays weak analyst sentiment (net negative earnings revisions) and an elevated forward P/E (27.6x) and forward PEG (3.3), while Energy has a high forward P/E (34.0x) and forward PEG (3.6) and poor return ratios. Year-over-year growth comps are starting to get tougher for oil stocks.

3. Looking at the Bull scores, Technology has the top score of 59 as it has recently displayed relative strength on strong market days, while Healthcare is the lowest at 47. The top-bottom spread is 12 points, which reflects fairly high sector correlations on strong market days, which is not as favorable for stock picking. It is desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the market segments and stocks they want to hold (rather than broad risk-on behavior).

4. Looking at the Bear scores, we find Utilities with the top score of 66, followed by Consumer Goods (Staples/Noncyclical), which means that stocks within these sectors have been the preferred safe havens lately on weak market days. Technology and Healthcare score the lowest at 52, as investors have fled during market weakness. The top-bottom spread is 14 points, which reflects fairly high sector correlations on weak market days. Ideally, certain sectors will hold up relatively well while others are selling off (rather than broad risk-off behavior), so it is desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points.

5. Technology displays the best all-around combination of Outlook/Bull/Bear scores, while Telecom is the worst. However, looking at just the Bull/Bear combination, Utilities is by far the best, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish), while Healthcare is the worst.

6. This week’s fundamentals-based Outlook rankings look slightly bullish to me, given that the top of the rankings comprises mostly economically-sensitive sectors, led by Technology and Financial. As I expected, the bullish sentiment pervading the Street is showing up in the rankings. Keep in mind, the Outlook Rank does not include timing, momentum, or relative strength factors, but rather reflects the consensus fundamental expectations at a given point in time for individual stocks, aggregated by sector.

ETF Trading Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), now displays a bullish bias and suggests holding Technology (IYW), Financial (IYF), and Basic Materials (IYM), in that order. (Note: In this model, we consider the bias to be bullish from a rules-based trend-following standpoint when SPY is above both its 50-day and 200-day simple moving averages on the rebalance day.)

Besides iShares’ IYW, IYF, and IYM, other highly-ranked ETFs in our SectorCast model (which scores over 600 US-listed equity ETFs) from the Technology, Financial, and Basic Materials sectors include iShares PHLX Semiconductor ETF (SOXX), Oppenheimer Financials Sector Revenue ETF (RWW), and VanEck Vectors Steel ETF (SLX).

An assortment of other ETFs that are scoring well in our rankings include SPDR S&P Health Care Services (XHS), VanEck Vectors Mortgage REIT Income (MORT), First Trust NASDAQ Rising Dividend Achievers (RDVY), Guggenheim Invest S&P 500 Equal Weight Financials (RYF), WBI Tactical LCV Shares (WBIF), ProShares Ultra Semiconductors (USD), First Trust Dow Jones Select MicroCap Index Fund (FDM), SPDR MFS Systematic Value Equity (SYV), VanEck Vectors Biotech (BBH), and PowerShares KBW Bank Portfolio (KBWB).

However, if you prefer a neutral bias, the Sector Rotation model suggests holding Technology, Financial, and Healthcare, in that order. On the other hand, if you are more comfortable with a defensive stance on the market, the model suggests holding Utilities, Consumer Goods (Staples/Noncyclical), and Basic Materials, in that order.

IMPORTANT NOTE: I post this information periodically as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I may or may not update the information on a regular schedule. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted -- but not necessarily on the days that I happen to post this article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ideas mentioned here as a managed portfolio.

Disclosure: The author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.