Sector Detector: Semiconductors get slammed as investors scramble to protect profits

Volatility continues to increase in the stock market and many of the leaders are breaking down. In particular, semiconductors took a rather big hit when one of the bellwethers warned of weakening global demand. Nevertheless, despite the significant headwinds, I do not think this spells the end of the bull market. But the technical damage to the charts is severe, particularly to the small caps, which are in full-blown correction mode. The large caps must show leadership and rally immediately -- or it will put at risk the critical and widely-anticipated year-end rally.

In this weekly update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review our weekly fundamentals-based SectorCast rankings of the ten U.S. business sectors, and then offer up some actionable trading ideas, including a sector rotation strategy using ETFs and an enhanced version using top-ranked stocks from the top-ranked sectors.

Market overview:

So far in October, the market already has seen five days with moves greater than 1%, which is as many such days as we saw in the prior five months combined. Jeff Macke observed in Yahoo! Finance that nearly one third of every trading day in the month of October since 1970 has seen 1% movements, up or down, including the infamous Black Monday of 1987. Heck, even the great Wall Street Crash of 1929 commenced in October.

No, weakness in October is not unusual, and this year in particular, because it has been so long since the broad market has pulled back in a meaningful way, I see it as a welcome cleansing that should validate some key support levels, wring out some excesses and overbought technical conditions, and establish a base from which to kick off the highly anticipated year-end rally.

Germany announced on Monday that factor orders fell -5.7%, which heightened fears among an already fearful investor community that Europe is worse off than thought. But then on Wednesday, the Dow Jones Industrial Average saw its best percentage gain of the year when the FOMC minutes expressed concern about the strong dollar and global economic weakness, which suggested that interest rate hikes are still a long ways off.

But then Thursday brought the worst daily point drop of the year, and the NASDAQ Composite endured its worst week since 2012. The NASDAQ started last week up +7.1% year-to-date, but fell -4.7% to finish the week up only +2.4% YTD, while the mighty NASDAQ 100 fell -4.2%, bringing its 2014 gain down to +7.4%. The Dow Industrials is back to breakeven for the year, and the S&P 500 is clinging to a +3.2% gain after losing -3.2% last week alone. For its part, the Russell 2000 small cap index is now in full-fledged correction mode, down -9.5% for the year and -13% from its July recovery peak.

So, what's really going on? Well, for all the flailing about and gnashing of teeth throughout the investment community, let’s keep in mind that the S&P 500 has not experienced a -10% pullback in over three years, while historically, such pullbacks tend to occur at least once every year, and -5% corrections typically occur three times a year.

I believe what we are enduring is a simple case of weak holders bailing out, of momentum riders locking in profits for fear of riding their positions back down to breakeven or losses. Nobody enjoys that, so these bearish events can become self-perpetuating. With visions of prior selloffs, no one wants to be the guy left holding the bag while others tell tales of getting out just in time.

Technology -- particularly the chip sector -- took a direct hit to the chin late last week. The Philadelphia Semiconductor Index fell -7% on Friday to a six-month low. This all resulted from a warning on Thursday afterhours by Microchip Technology (MCHP) that sales in the most recent quarter will fall shy of previous guidance and that an industry correction has commenced, largely due to weak demand in China. Juniper Networks (JNPR) also cut its third-quarter guidance citing lower-than-expected demand. MCHP is known as the proverbial canary in the coal mine because, unlike most chipmakers that report sales to distributors (many of whom may be building inventories), MCHP only reports revenue that has been sold from distributors to global customers. The bad news sent investors scrambling to protect profits in the strongest performers, including some of Sabrient’s favorites like Skyworks Solutions (SWKS), NXP Semiconductors (NXPI), Broadcom (BRCM), and RF Micro Devices (RFMD), all of which fell precipitously on Friday.

Is this it, then – i.e., the end of the bull market that has been driven by Fed liquidity, as the Fed pulls the last bit of its quant easing off the table? I still say no. I believe this economic recovery has legs on its own, and it only requires a gut check and some renewed investor confidence to rejuvenate the bullish conviction that has suddenly disappeared.

There are headwinds, to be sure. The Fed is widely expected to announce the official end to QE3 on October 29. Over the past five years since quant easing began, the correlation between growth in the Fed balance sheet and S&P 500 performance has been close to 1.0. Although some commentators are predicting that a new round of stimulus will be necessary sometime next year to support the economy, investors certainly aren’t counting on it now. With liquidity plateauing, corporate stock buybacks and IPOs that have been supportive of equities are expected to slow.

The CBOE Market Volatility Index (VIX), a.k.a. fear gauge, spiked above 20 for the first time since early February and closed Friday at 21.24. The VIX hit a low of 10.32 back on July 3, so it has more than doubled in the three months since then. In my article last week, I noted that 50-day SMA was crossing up through the 200-day SMA, which is bullish for VIX but bearish for stocks. From a historical perspective, VIX often hits a peak in October. Nevertheless, it remains well below the 40 level that it reached in October 2011, and recall that at the height of the financial crisis in 2008, VIX spiked above 80. In fact, the 19-20 level is its five-year average.

Most of the world is struggling to get their economies on track. Global economic growth and inflation are both lower than anticipated for this stage of the recovery, given the broad focus among central banks on stimulus and liquidity, which means there is little hope for deleveraging anytime soon and the ratio of global debt to GDP continues to climb.

But overall, the bull case remains compelling for the next few years. The economic recovery continues to gain traction, with an expectation of +3% GDP growth. Mid-term election years are typically bullish, and the holiday season usually fosters bullish sentiment. Interest rates remain low, and the Fed stands ready to support the economy as needed. Remember, although the Fed is nearly done with injections of newly minted cash, maturing securities still will be reinvested rather than unwound. And corporate earnings reports are expected to be strong.

Q3 earnings season is now underway, and according to Capital IQ, S&P 500 companies are expected to post +7% earnings growth and +4% revenue growth, in aggregate. But even if Q3 earnings growth is indeed robust, all eyes will be on forward guidance and any words of caution or lack of visibility (like we heard from MCHP). After all, nearly half of S&P 500 earnings come from foreign markets. Moreover, weakness in commodities and many fixed income instruments appear to be sending out recessionary signals.

The 10-year U.S. Treasury bond yield closed Friday around 2.3%, which is once again down significantly from the prior week. It is the low for the year and its lowest close since June 2013 (which was the middle of its big spike upward). This should come as no surprise given the global flight to safety and the extremely low rates of comparable 10-year government bonds in Germany and Japan. Looking forward, there is little reason to expect a sudden spike or rapid march higher any time soon, helping provide equities with the fuel to outperform.

So, I still expect the stock market to get its act together and finish the year a good bit higher -- although I am not so confident anymore that it will be able to achieve new highs. The fundamental story for U.S. equities might be somewhat less attractive than it was a few months ago, but it is still better than the alternatives.

Nevertheless, it seems time to walk away from speculative bets and perhaps even from simple passive investing in broad indexes. Instead, the time is ripe for selective buying of high quality companies with market-dominant positions. Some of these top firms have been hit the hardest lately in the wave of fear-based profit-taking. But those with the strongest market position, solid cash flow, and lower debt levels will be back. Given the prevailing market conditions (elevated fear and volatility), investors must avoid the speculative stocks, especially those with high short interest -- rather than benefiting from short-covering, they have been the biggest underperformers during this bout of market weakness.

SPY chart review:

Another highly eventful week from a technical (chart) standpoint. Small caps are a disaster. Large caps are barely holding on. Blue chips in the Dow Industrials are back to breakeven year-to-date. And the NASDAQ 100, which had been holding up the market, finally succumbed last week. As for my weekly read of the SPDR S&P 500 Trust (SPY), it closed last Friday at 196.52, which is down over -3% from the previous Friday. Wednesday’s big bounce was encouraging, but the bears would not back down. After all, this is finally their moment in the sun. Now the critical 200-day simple moving average is being tested as SPY closed Friday right on top of it. Notably, the bottom of the minor bullish rising channel (since April) came into play again (like it did the previous week), but this time it failed, and the lower trend line of the major and long-standing rising channel from November 2012 came into play, and it, too, has failed -- at least so far, we will see if it confirms on Monday.

After this test of the 200-day SMA, next support level is all the way down at 185, which is a previous level of resistance-turned-support. Oscillators RSI and Slow Stochastic are again in oversold territory after bouncing somewhat on Wednesday, while MACD is extremely oversold and due for a bounce.

Notably, if you look at the weekly chart of the SPY (not shown), I mentioned in last week’s article that it has consistently found support at the 20-week exponential moving average (which is the center line of the Bollinger Bands), and a crossing below the 20-week is an indication of a trend reversal. This didn’t quite happen the previous Friday, but last Friday it finally closed firmly below the 20-week EMA. This is quite bearish, and bulls need to reverse it immediately. If the failure is confirmed, the next test of support is the 50-week SMA around 188.

The small-cap iShares Russell 2000 ETF (IWM) has become ridiculously oversold, which serves to illustrate that having oscillators at extremes is not a guarantee of an imminent reversal. Also, the NASDAQ 100, which is tracked by the PowerShares QQQ Trust (QQQ), has been showing impressive relative strength this year compared with all the other major indexes, but even it closed well below its 100-day SMA on Friday.

Latest sector rankings:

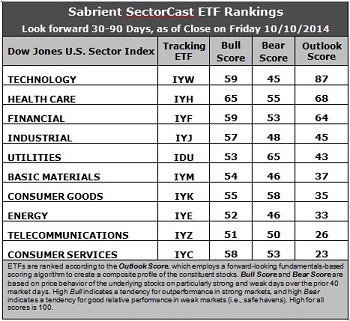

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. Technology still holds the top spot with the same Outlook score of 87. The sector displays relatively solid scores across most factors in the model, including solid Wall Street analyst sentiment (despite getting hit with more downward revisions to earnings estimates), the strongest return ratios, a good forward long-term growth rate, and a reasonable forward P/E. Healthcare is in the second spot this week with a score of 68, displaying solid analyst sentiment, a good forward long-term growth rate, decent return ratios, and good insider sentiment (open market buying). In third is Financial, followed by Industrial and Utilities.

2. Consumer Services/Discretionary stays in the cellar this week with an Outlook score of 23, despite the highest long-term forward growth rate and good insider sentiment. Telecom once again is also in the bottom two. Energy and Materials are the sectors getting hit the worst by sell-side downward earnings revisions.

3. Looking at the Bull scores, Healthcare again displays the highest score of 65, while Telecom is the lowest at 51. The top-bottom spread is now 14 points, reflecting elevated sector correlations on particularly strong market days recently. It is generally desirable in a healthy market to see low correlations and a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold, rather than the all-boats-lifted-in-a-rising-tide mentality that dominated 2013. Also displaying strong Bull scores are Technology, Financial, Industrial, and Consumer Services/Discretionary, which are all economically-sensitive sectors that should indeed have the highest Bull scores in a healthy market.

4. Looking at the Bear scores, Utilities continues to see its score rise, reaching 65 this week, as one would expect for this traditionally defensive sector. Thus, Utilities stocks have been the preferred safe havens on weak market days. Energy continues to display a low score of 45, but after such a tough week, it is Technology that scored the lowest with a 45. The top-bottom spread is now 20 points, reflecting low sector correlations on particularly weak market days. Again, it is generally desirable in a healthy market to see low correlations and a top-bottom spread of at least 20 points. Also displaying strong Bear scores are Consumer Goods/Staples and Healthcare, which along with Utilities are traditionally defensive (or all-weather) sectors that should have the highest Bear scores in a healthy market.

5. Technology still displays the best all-around combination of Outlook/Bull/Bear scores, followed closely by Healthcare, while Telecom is the worst, followed by Energy. Looking at just the Bull/Bear combination, Healthcare is the leader, followed by Utilities, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish), while Energy is the worst, indicating general investor avoidance during extreme conditions.

6. Overall, this week’s fundamentals-based Outlook rankings still appear slightly bullish to me. The top four sectors are all economically-sensitive (or in the case of Healthcare, all-weather), and also display the highest Bull scores. Keep in mind, the Outlook Rank does not include timing or momentum factors.

Stock and ETF Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or bearish), maintains its neutral bias this week, and it still suggests holding Technology, Healthcare, and Financial sectors (in that order). (Note: In this model, we consider the bias to be neutral from a rules-based trend-following standpoint because SPY is below its 50-day simple moving average while remaining above its 200-day SMA -- although just barely.)

Other highly-ranked ETFs from the Technology, Healthcare, and Financial sectors include First Trust NASDAQ Technology Dividend Index Fund (TDIV), Market Vectors Bank & Brokerage ETF (RKH), and Market Vectors Pharmaceutical ETF (PPH),

For an enhanced sector portfolio that enlists some top-ranked stocks (instead of ETFs) from within the top-ranked sectors, some long ideas from Technology, Healthcare, and Financial sectors include Computer Programs and Systems (CPSI), QUALCOMM (QCOM), Shire plc (SHPG), Allergan (AGN), Citigroup (C), and Discover Financial Service (DFS). All are highly ranked in the Sabrient Ratings Algorithm and also score within the top two quintiles (lowest accounting-related risk) of our Earnings Quality Rank (a.k.a., EQR), a pure accounting-based risk assessment signal based on the forensic accounting expertise of our subsidiary Gradient Analytics. We have found EQR quite valuable for helping to avoid performance-offsetting meltdowns in our model portfolios.

However, if you think the market has begun a bullish reversal and you prefer to maintain a bullish bias, the Sector Rotation model suggests holding the same three in a different order: Healthcare, Technology, and Financial (in that order). But if you have a bearish outlook on the market, the model suggests holding Utilities, Healthcare, and Consumer Goods/Staples (in that order).

IMPORTANT NOTE: Some readers have been asking for more specifics on how to trade our sector rotation strategy based solely on what I discuss in my weekly newsletter. Thus, I feel compelled to remind you that I post this information each week as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if the model was due for a rebalance, and I may or may not update the information each week. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/bearish bias when warranted -- but not necessarily on the days that I happen to post this weekly article. The enhanced strategy seeks higher returns by employing stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ETF and stock ideas mentioned here as a managed portfolio.

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.