Sector Detector: Neutral indicators and mixed reports, but sector rotation model bullish

Volatility continues as the parade of mixed earnings and economic reports marches along amidst a backdrop of global unrest and economic uncertainties. This has led to a neutral near-term outlook for both the technical picture and fundamentals-based sector rankings. Nevertheless, the longer-term trends appear to favor further flattening of the yield curve and continued strength in the dollar, gold, volatility, and equities.

In this weekly update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review our weekly fundamentals-based SectorCast rankings of the ten U.S. business sectors, and then offer up some actionable trading ideas, including a sector rotation strategy using ETFs and an enhanced version using top-ranked stocks from the top-ranked sectors.

Market overview:

Last week, stocks finally got it together to register a +3% gain, even though it gave some back on Friday on the heels of a robust employment report that made investors worry that the Fed now has more reason to declare victory in its dual mandate (of unemployment and inflation targets) and raise the fed funds rate. With the big fall in oil prices, consumers are taking their savings from the pump directly into the stores, and retailers reported strong January sales while the ISM Services report clocked in at a robust 56.7.

There was some consternation among investors about the weaker GDP, which registered only 2.6% in Q4 versus the 5% annualized growth in Q3. However, Scott Minerd, CIO at Guggenheim, wrote that all the surprise and fuss completely misses the underlying strength hidden behind the headline number. In particular, although it was falling net exports that subtracted a full percentage point from GDP growth, net exports appeared weak only because imports were so strong, growing at an annualized rate of +8.9%. Moreover, household consumption has been the biggest driver of GDP growth, which is a big positive.

So, consumers are spending, and there are signs that wages are starting to grow, which would further support consumer spending, as would continued strengthening in the housing market. Also, federal, state, and local government spending is on the rise. In addition, global M&A totaled over $230 billion in January, which is 28% more than last January. I also find it fascinating that global semiconductor sales hit a record $336 billion during 2014, which is nearly 10% higher than 2013.

On the other hand, Jeff Gundlach, CIO of DoubleLine Capital, made a few recent public observations of his own, saying at the Inside ETFs Conference that, “The Federal Reserve seems hell-bent on raising the funds rate, but there’s no fundamental reason to do so. It’s just because they don’t want to be at zero when the next recession comes.” He also pointed out that U.S. equities have never finished positive for seven straight years (and of course, we just completed a sixth straight year of positive returns since the Great Recession ended).

Another wild card for which it is difficult to predict the eventual outcome is that 17 central banks have cut rates, which is the type of drastic action not seen since 2008. It’s hard to predict how this will impact an already strong U.S. dollar, but it has led many observers to say that the Federal Reserve can’t possibly raise rates in such a climate without worsening the situation for multinational firms trying to sell in overseas markets. My view is that we will get a token raise of a quarter point later this year, but nothing beyond that until next year.

Although many market observers are citing lower forward valuations and quant easing in Europe as reasons to look to European equities rather than U.S., I see this as just a speculative play on "mean reversion.” Although it may indeed play out for awhile, in my view QE is really about asset inflation rather than real reform and improvements in competitiveness and productivity. So, at the end of the day, the U.S. is still the engine for growth.

Last week’s strength in the equity markets led the CBOE Market Volatility Index (VIX), a.k.a. fear gauge, to close Friday at 17.29, as it continues to gyrate around the important 20 threshold that suggests real fear.

So, the trends appear to favor a flattening yield curve and continued strength in the U.S. dollar, gold, volatility, and equities (in the U.S. and elsewhere). However, we are likely in a stock-pickers market in which favored stocks will be those with higher quality -- rather than a blind adherence to the broad market indexes or big bets on speculative names.

Speaking of stock picking, the 30-day offering period is nearing an end for our annual Baker’s Dozen portfolio as packaged and distributed by our strategic partner First Trust Portfolios in a unit investment trust. So, my nationwide travel with their wholesalers is also coming to a close. I just got back from a great trip to Denver on Friday, but I have been all around the country speaking with financial advisors. I continue to be heartened by how the marketplace has embraced our “quantamental” GARP process (growth at a reasonable price, using both a quantitative prescreen and a fundamental final selection process) together with a forensic accounting “backstop” to help us avoid the landmines. (Of course, six straight years of market-beating performance is attractive, too.) Many of those investment professionals also have signed up for our web-based suite of research products. In fact, I employ the ETF Summaries section of the product suite when writing this weekly article to identify highly ranked stocks from the strongest sector ETFs when providing stock ideas for an enhanced sector rotation strategy (see below).

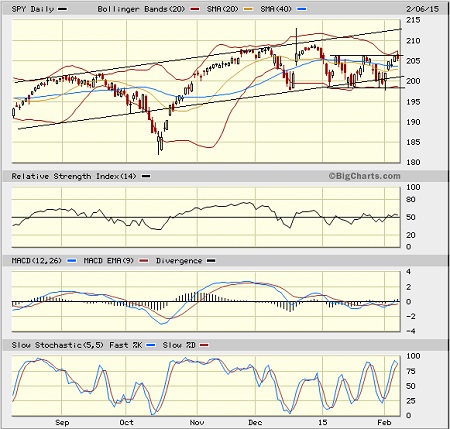

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed Friday at 205.55. After closing the prior Friday slightly below the 100-day SMA and testing support from the lower trend line of the long-standing bullish rising channel and round-number support at 200, stocks enjoyed a strong week and finished the week up about +3%. SPY price is back above both its 20-day and 50-day simple moving averages. Oscillators are showing RSI is still in neutral and MACD is flashing a buy signal, but Slow Stochastic has again cycled back up to overbought territory and is pointing toward consolidation or a slight pullback. The bearish head-and-shoulders pattern that might have been forming seems to be a distant memory, but the prior price gap down at 190 remains something of a magnet. The neutral symmetrical triangle I mentioned last week seems to have morphed into a neutral sideways channel as shown (now corresponding to the current position of the Bollinger Bands), which is still more likely to resolve as a continuation pattern (i.e., bullish). However, it’s also likely that we will get a longer period of consolidation before there is enough conviction to go higher. So, conflicting signals remain for the moment. Lower support levels reside at the 100-day SMA and the lower uptrend line, which are both near 201, and then the critical 200-day SMA near 198.

Latest sector rankings:

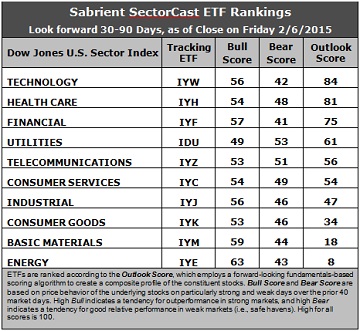

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. Wall Street’s downward revisions to forward earnings estimates continues as earnings season proceeds. Hardest hit (in order) continue to be Energy, Basic Materials, Consumer Goods/Staples, Industrial, and Financial. And the three-tier ranking continues, as well. At the top, Technology continues to rank first with an Outlook score of 84. It displays the best return ratios, a good forward long-term growth rate and forward P/E, and relatively good sell-side analyst sentiment (i.e., not as bad as most of the other sectors in downward revisions to earnings estimates). Healthcare is back in second place with a score of 81 in its weekly duel with Financial, scoring 81 to Financial’s 75. Healthcare displays relatively good sentiment among both sell-side analysts and insiders, a good forward long-term growth rate, and solid return ratios. Financial continues to display the best (lowest) forward P/E. The next tier includes defensive sector Utilities, Telecom, Consumer Services/Discretionary, and Industrial, whose scores are all bunched around 50 (ranging from 61-47). And at the bottom we still see Consumer Goods/Staples, Basic Materials, and Energy.

2. It is no surprise that Energy continues to hold the bottom spot given the weakness in oil prices. Joining Energy in the bottom two again is Basic Materials, as these two sectors continue to get the brunt of Wall Street’s downward revisions to forward earnings estimates. Energy also shows the worst forward long-term growth rate, the highest (worst) forward P/E (despite the huge drop already in share prices), and the worst insider sentiment.

3. Looking at the Bull scores, Energy now displays the top score of 63, followed by Materials at 59. Utilities scores the lowest at 49. The top-bottom spread has expanded to 14 points, which is much healthier than the recent spread and reflects lower sector correlations during particularly strong market days. It is generally desirable in a healthy market to see low correlations and a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold going forward.

4. Looking at the Bear scores, Utilities displays the highest score of 53 this week, which means that stocks within this sector have been the preferred safe havens on weak market days, although not so clearly preferred as in the past. Financial has the lowest score of 41, followed closely by Technology. The top-bottom spread is down to 12 points, reflecting only moderately low sector correlations on particularly weak market days. Ideally, certain sectors will hold up relatively well while others are sell off. Again, it is generally desirable in a healthy market to see low correlations and a top-bottom spread of at least 20 points.

5. Healthcare and Technology display the best all-around combination of Outlook/Bull/Bear scores, while Energy is the worst. Looking at just the Bull/Bear combination, Energy has suddenly jumped to the top (on the strength of its strong Bull score), indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish). Technology and Financial are the worst, due to their weak Bear scores.

6. Overall, this week’s fundamentals-based Outlook rankings have taken a neutral turn in my view, as market sentiment continues to grow more cautionary. Note that the sectors with the strongest Bull scores (Energy and Materials) are at the bottom of the Outlook rankings, while two of the top five sectors are defensive (Utilities and Telecom) with the highest Bear scores. Keep in mind, the Outlook Rank does not include timing or momentum factors, but rather is a reflection of the fundamental expectations of individual stocks aggregated by sector.

Stock and ETF Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), has moved to a bullish bias, and the model suggests holding Technology, Financial, and Energy, in that order. (Note: In this model, we consider the bias to be bullish from a rules-based trend-following standpoint when SPY is above both its 50-day and 200-day simple moving averages.)

Other highly-ranked ETFs from the Technology, Financial, and Energy sectors include SPDR S&P Semiconductor ETF (XSD), PowerShares KBW Insurance Portfolio (KBWI), and Guggenheim Invest Solar ETF (TAN).

For an enhanced sector portfolio that enlists some top-ranked stocks (instead of ETFs) from within the top-ranked sectors, some long ideas from Technology, Financial, and Energy sectors include Spansion (CODE), Microchip Technology (MCHP), The Allstate Corp (ALL), Ameriprise Financial (AMP), First Solar Inc (FSLR), and Tidewater Inc (TDW). All are highly ranked in the Sabrient Ratings Algorithm. In addition, most of them and also score within the top three quintiles (lowest accounting-related risk) of our Earnings Quality Rank (a.k.a., EQR), a pure accounting-based risk assessment signal based on the forensic accounting expertise of our subsidiary Gradient Analytics. We have found EQR quite valuable for helping to avoid performance-offsetting meltdowns in our model portfolios.

However, if you prefer to maintain a neutral bias, the Sector Rotation model suggests holding Technology, Healthcare, and Financial, in that order. And if you prefer a defensive stance on the market, the model suggests holding Utilities, Telecommunications, and Healthcare, in that order.

IMPORTANT NOTE: I post this information each week as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I may or may not update the information each week. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted -- but not necessarily on the days that I happen to post this weekly article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ETF and stock ideas mentioned here as a managed portfolio.

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.