Sector Detector: Focus returns to corporate earnings and Europe

U.S. stocks rallied on Election Day Tuesday, ostensibly in anticipation of a “surprise” Romney win. But on Wednesday, after huge dollars were spent on rancorous campaigns and attack ads that only further deepened the divide in our country, we woke up to find ourselves with the same President and divided Congress that previously failed to address the looming Fiscal Cliff. That realization was coupled with negative comments by ECB President Draghi about the European debt crisis hurting Germany's GDP, which returned the nearly-forgotten Europe problem to front-and-center. As if on cue following the U.S. elections, Greek parliamentary workers walked off the job and riots erupted over austerity measures (which the government narrowly passed, by the way).

U.S. stocks rallied on Election Day Tuesday, ostensibly in anticipation of a “surprise” Romney win. But on Wednesday, after huge dollars were spent on rancorous campaigns and attack ads that only further deepened the divide in our country, we woke up to find ourselves with the same President and divided Congress that previously failed to address the looming Fiscal Cliff. That realization was coupled with negative comments by ECB President Draghi about the European debt crisis hurting Germany's GDP, which returned the nearly-forgotten Europe problem to front-and-center. As if on cue following the U.S. elections, Greek parliamentary workers walked off the job and riots erupted over austerity measures (which the government narrowly passed, by the way).

This all simply piled on to investors’ concerns about President Obama’s vision for taxation, especially with regard to capital gains and dividends. Investors made their displeasure clear with a defensive “risk-off” turn. Nevertheless, dividend-paying stocks should remain preferable to low-yielding bonds for income investors.

The Financial sector got smacked, with the exception of REITs. And because Romney was the big supporter of clean coal as an important fuel source, coal stocks got hit particularly hard, including Market Vectors Coal ETF (KOL), Arch Coal (ACI), Peabody Energy (BTU), and Walter Energy (WLT), along with most of the rest of the Energy sector. On the other hand, some Healthcare stocks that stand to benefit from Obamacare moved strongly against the negative sentiment, including hospital operators like Community Health Services (CYH), Health Management Associates (HMA), and Tenet Healthcare (THC).

In any case, the election results are clear…without the need to examine “hanging chads.” I have some key takeaways. First, a populist message can prevail anywhere when the huddled masses are worried about the basic necessities. They would rather rely on the certainty of their safety net (some would call it “shackles”) of entitlements than the uncertain potential for a more robust economy and enhanced job opportunities.

Second, the ‘50s-era “Father Knows Best” social platform of the Republican Party is their ball-and-chain that must be overhauled if they are ever to win another national election. Even regionally, evolving demographics are rendering the basic conservative social platform as extreme and out of touch. No matter how much a moderate or independent voter wanted to try Romney’s ideas for stimulating the economy through tax cuts and regulatory reform, many (particularly women) simply could not get past the harsh social policies (on abortion, immigration, gay marriage, etc.) demanded by the party’s vocal fringe.

Nevertheless, even Obama’s most ardent supporters are unhappy with the pace of economic recovery, which has been fueled almost entirely by FOMC monetary policy. He very nearly lost this race solely because of his inability to effect meaningful jobs growth. Hopefully, the President recognizes this and will be willing to truly “reach across the aisle” to incorporate at least some of the fiscal policies put forth by Romney that were so appealing to so many. In any case, it is imperative to our nation’s long-term health that the President reverses the alarming entitlement mentality in favor of America’s traditional “can-do” mentality.

Unfortunately, corporate earnings have been shrinking while companies continue to either store cash or buy back shares to boost reported EPS (if you can’t increase the numerator then reduce the denominator). It’s not a healthy situation when stocks rise due to the flood of unlimited liquidity rather than good old fashioned earnings growth. New jobs are not created. On the plus side, some companies are doing their best to lead the way, such as Qualcomm (QCOM), which came out with a stellar report afterhours on Wednesday, including raised guidance on both earnings and revenues. Note that QCOM is one of Sabrient’s top ranked stocks within the iShares Dow Jones US Technology Sector Fund (IYW).

With the contentious rhetoric and vitriolic sound bites of election season behind us, now the real work begins. As I have said before, in a business, failure is all but assured if half the company is trying to undermine the strategies and initiatives of the leadership. Cooperation is essential for survival. But in our representative democracy, cooperation can come back to haunt you at election time, so obstructionism is the norm. My hope is that our elected representatives will find it within themselves to recognize the seriousness of our predicament, put dogma aside, show a modicum of respect for differing views, and help our economy move forward.

Looking at the charts, psychologically important support levels at Dow 13,000, S&P 500 1,400 and Nasdaq 3,000 all gave way on Wednesday. The S&P 500 SPDR Trust (SPY) closed at 139.72, below the important 140 level, but let’s see if it confirms on Thursday. SPY is now struggling at its 100-day SMA, with the critical 200-day SMA just below around 138. The 200-day provided support back in June. If it can manage to do so again, the bearish falling channel shown might turn out to be a bull flag (continuation) pattern. However, oscillators like RSI, MACD, and Slow Stochastic are all now pointing down bearishly—at least for the moment—but they are each in a position where they could turn back up on a dime. Last week I suggested that a rally into the election was quite possible, but breaking back up through prior-support-turned-resistance at 143 wouldn’t be easy. And it wasn’t; SPY was turned back twice from that level.

The CBOE Market Volatility Index (VIX), a.k.a. “fear gauge,” closed Wednesday at 19.08, which is elevated but still below the important 20 level … and still quite low in its historical range.

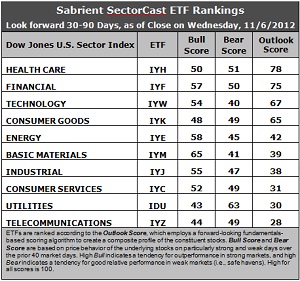

Latest rankings: The table ranks each of the ten U.S. industrial sector iShares (ETFs) by Sabrient’s proprietary Outlook Score, which employs a forward-looking, fundamentals-based, quantitative algorithm to create a bottom-up composite profile of the constituent stocks within the ETF. In addition, the table also shows Sabrient’s proprietary Bull Score and Bear Score for each ETF.

High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods. Bull and Bear are backward-looking indicators of recent sentiment trend.

As a group, these three scores can be quite helpful for positioning a portfolio for a given set of anticipated market conditions.

Observations:

1. Financial (IYF) has relinquished the top spot to Healthcare (IYH). IYH comes in this week with an Outlook score of 77, while IYF scores a close 75. Stocks within both sectors continue to get decent support from Wall Street analysts raising earnings estimates, and both have strong return on sales. Technology (IYW) holds on to third place with an Outlook score of 67, but it has been gradually dropping, and now defensive sector Consumer Goods (IYK) is nipping at its heels.

2. Telecom (IYZ) fell back down into the cellar with an Outlook score of 28, despite continued support from Wall Street. Utilities (IDU) stays in the bottom two with a score of 30.

3. Overall, I would continue to characterize the Outlook rankings as neutral, with the more aggressive and defensive sectors mixed about in the rankings. On the bullish side, Energy (IYE) and Materials (IYM) have risen about 10 points each, but on the other hand, Industrial (IYJ) fell further down the rankings. Also, the range from the top to the bottom Outlook scores remains tight, reflecting a lot of uncertainty as to which sectors will emerge as the strongest. This week the top-bottom range has further tightened to 50.

4. Looking at the Bull scores, Materials (IYM) is the clear leader on strong market days, scoring 65. Utilities (IDU) is now the weakest on strong market days, scoring 43. In other words, Materials stocks have tended to perform the best when the market is rallying, while Utilities stocks have lagged.

5. Looking at the Bear scores, Utilities (IDU) is the clear investor safe haven on weak market days, scoring 63, which remains far ahead of second-place IYH at 51. Technology (IYW) is still the weakling during market weakness, as reflected in its low Bear score of 40, followed by IYM at 41. In other words, Tech and Materials stocks have been selling off the most lately when the market is pulling back, while Utilities stocks have held up the best.

6. Overall, Financial (IYF) still shows the best all-weather combination of Outlook/Bull/Bear scores. Adding up the three scores gives a total of 182. Telecom (IYZ) is by far the worst at 121. As for Bull/Bear combination, IYF is the best at 107, while Technology (IYW) and Telecom (IYZ) have the worst combined scores of 94 and 93, respectively.

These scores represent the view that the Healthcare and Financial sectors may be relatively undervalued overall, while Telecom and Utilities sectors may be relatively overvalued based on our 1-3 month forward look.

Top-ranked stocks within IYH and IYF include DaVita HealthCare Partners (DVA), Watson Pharmaceuticals (WPI), Signature Bank New York (SBNY), and Visa (V).

Disclosure: Author has no positions in stocks or ETFs mentioned.

About SectorCast: Rankings are based on Sabrient’s SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a fundamentals-based multi-factor approach considering forward valuation, earnings growth prospects, Wall Street analysts’ consensus revisions, accounting practices, and various return ratios. It has tested to be highly predictive for identifying the best (most undervalued) and worst (most overvalued) sectors, with a 1-3 month forward look.

Bull Score and Bear Score are based on the price behavior of the underlying stocks on particularly strong and weak days during the prior 40 market days. They reflect investor sentiment toward the stocks (on a relative basis) as either aggressive plays or safe havens. So, a high Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods.

Thus, ETFs with high Bull scores generally perform better when the market is hot, ETFs with high Bear scores generally perform better when the market is weak, and ETFs with high Outlook scores generally perform well over time in various market conditions.

Of course, each ETF has a unique set of constituent stocks, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use ten iShares ETFs representing the major U.S. business sectors.

About Trading Strategies: There are various ways to trade these rankings. First, you might run a sector rotation strategy in which you buy long the top 2-4 ETFs from SectorCast-ETF, rebalancing either on a fixed schedule (e.g., monthly or quarterly) or when the rankings change significantly. Another alternative is to enhance a position in the SPDR Trust exchange-traded fund (SPY) depending upon your market bias. If you are bullish on the broad market, you can go long the SPY and enhance it with additional long positions in the top-ranked sector ETFs. Conversely, if you are bearish and short (or buy puts on) the SPY, you could also consider shorting the two lowest-ranked sector ETFs to enhance your short bias.

However, if you prefer not to bet on market direction, you could try a market-neutral, long/short trade—that is, go long (or buy call options on) the top-ranked ETFs and short (or buy put options on) the lowest-ranked ETFs. And here’s a more aggressive strategy to consider: You might trade some of the highest and lowest ranked stocks from within those top and bottom-ranked ETFs.